24 February 2021

Is Japan’s 30-year slowdown finally coming to an end?

The new Suga government has already been bold.

Japan’s fiscal response to the pandemic dwarfs the measures taken after the global financial crisis, and the earthquake and tsunami of 2011.

Now standing at more than 250% of GDP, Japan’s national debt is among the highest in the world, twice the average of other advanced economies. But it seems to be working.

Japan may finally be emerging from a prolonged slump, effectively a recession lasting three decades.

Japan’s population may be shrinking at a worrying pace, more than 1% per annum, but investors are thoroughly bullish, as if for the first time in living memory.

Private equity firms Bain, Carlyle and KKR are lining up to put serious capital to work in Japan. Interest rates remain low, which is helping to drive investor enthusiasm.

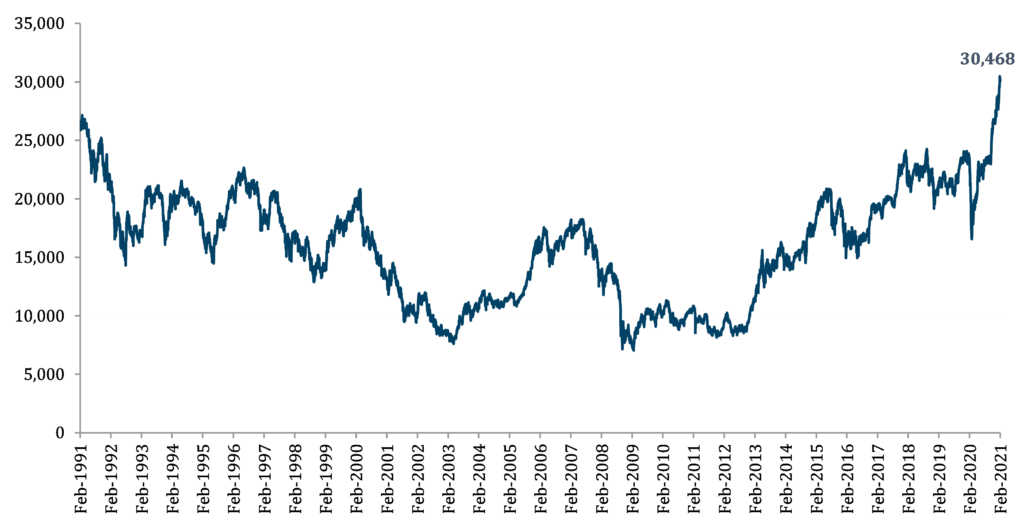

Last week, the Nikkei 225 rose above 30,000, a psychologically significant level last seen in 1991. Energy, Healthcare and Industrials have led the gains.

The Nikkei has risen 30% since November 2020, 9% since the beginning of the year, and 7% in the last two weeks. It is outperforming the US and European markets.

Nikkei 225 index 1991-2021

The TOPIX, which reflects a broader set of Japanese companies, also hit a 30-year high.

Japan’s Ministry of Health, Labour and Welfare has finally approved a Covid vaccine, months behind other major economies.

Still, signs that the pandemic is abating globally have caused optimism among Japanese analysts. Japanese companies are poised to rebound. Industrial customers and end consumers are both demonstrating renewed confidence.

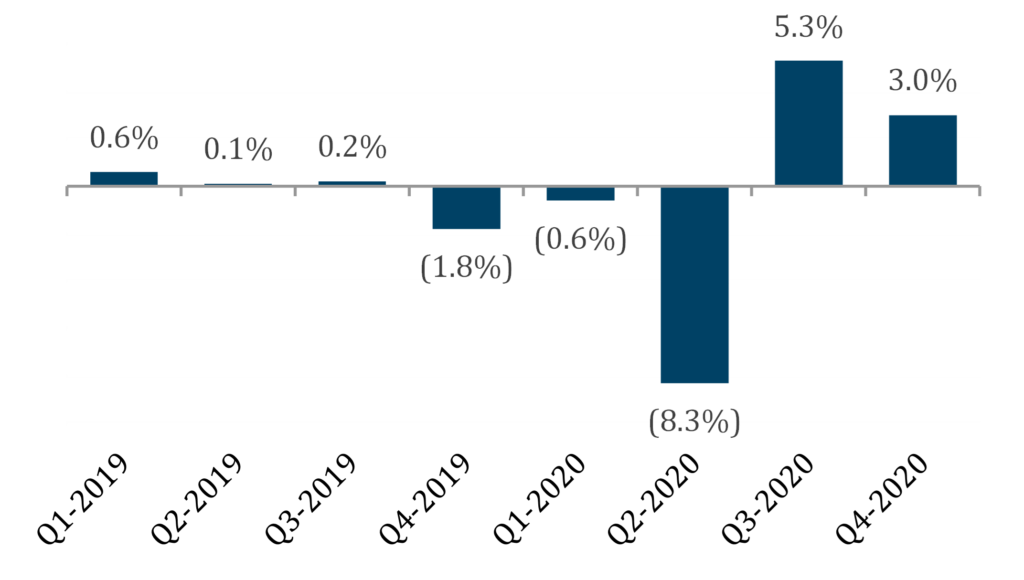

Japan’s economy performed surprisingly strongly in Q4 2020, recovering markedly from the slowdown earlier in the year. But this growth is still fragile and might be easily disrupted, analysts warn.

The second state of emergency, declared in January 2021 and extended in February, will dampen economic activity in Q1 2021, and tourism remains severely subdued.

Japan is the world’s third-largest economy behind the US and China. GDP rose 3.0% in Q4 2020, for a 12.7% annualized growth rate. The economy had also recovered by 5.3% in Q3 2020.

2019-2020 Japan Quarterly GDP growth

Exports and consumer spending have both surprised on the upside. Analysts say that consumers are demonstrating pent-up demand for Japanese goods which they did not buy in H1 2020.

Exports have been booming, especially capital goods and technology-sector goods and services.

Even before the pandemic, 2020 had begun inauspiciously, with a disastrous hike in the national consumption tax, a steep drop in trade with China, and an unusually damaging typhoon. The pandemic then arrived to cause the biggest drop in GDP since records began in 1955.

But the Government has managed the pandemic relatively well, allowing Japan to avoid the more profound economic damage that beset the US and Europe.

The Japanese population spent most of 2020 still able to travel domestically, eat out, and visit leisure facilities. The Government quickly brought in subsidies for domestic tourism, Covid notwithstanding.

Shinzo Abe resigned in August 2020, to manage his ulcerative colitis. Yoshihide Suga assumed office in September. Suga said his premiership will focus on continuing the goals of the Abe administration, including notably the Abenomics suite of economic policies.

Suga’s “third extra budget” in December 2020 supplements two earlier packages worth 11% of GDP. The year-end shot of fiscal caffeine was worth $708bn, including $385bn in direct fiscal spending and initiatives targeted at reducing carbon emissions, and boosting the adoption of digital technology.

The stimulus helped keep employment high, and companies in business. Bankruptcies actually dropped 6.5% in 2020, according to credit research company, Teikoku Databank.

Japan has been lamentably slow to start vaccinations. Regulators have finally approved the Pfizer-BioNTech vaccine. Frontline healthcare workers will receive their first doses this week, but it will be months before most citizens get shots.

And yet the pandemic’s effects have been much less severe in Japan, with fewer than 7,000 deaths to date.

The Government has begun encouraging activist investors to search for undervalued stocks, previously a taboo exercise. The weaker yen-dollar exchange rate, too, boosts the value of overseas holdings and makes exports more competitive.

The last time the Nikkei scaled these heights, Japan was in the throes of the bubble economy. The Bank of Japan throttled that speculative fever, which led to the infamous lost decade at the end of the twentieth century. Momentum has been stalled ever since.

Japan still has many hurdles to overcome. The economy relies on “old” companies. Productivity is stunted. Efforts to promote tourism died with the pandemic. Women remain undervalued in the economy, which becomes a more significant issue as the population shrinks – but also an opportunity, of course. As in other markets, inequality is growing in worrying ways, and the recovery looks K-shaped for now: steep for some, non-existent for others.

And yet: Japan is reforming, and reviving, and becoming fashionable among fund managers.

Prime Minister Suga has reasons to be cheerful. A month from now, Tokyo’s cherry trees will blossom. The symbolism should be potent this year: a chance to contemplate renewal and future happiness.

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes. BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese government-owned bank with US$150bn of assets.

US securities transactions are performed by BDA Partners’ affiliate, BDA Advisors Inc., a broker-dealer registered with the Securities and Exchange Commission (SEC). BDA Advisors Inc. is a member of the Financial Industry Regulatory Authority (FINRA) and SIPC. In the UK, BDA Partners is authorised and regulated by the Financial Conduct Authority (FCA). In Hong Kong, BDA Partners (HK) Ltd. is licensed and regulated by the Securities & Futures Commission (SFC) to conduct Type 1 and Type 4 regulated activities to professional investors. www.bdapartners.com

Latest insights

13 March 2024

HealthTech sector landscape

The HealthTech industry has seen substantial expansion in recent years,...

13 December 2023

M&A trends and outlook for 2024

Jonathan Aiken, Partner and Head of London, discussed how a challenging...

16 November 2023

Cooling-as-a-Service: Decarbonisation by Servitisation

One of the most promising shifts for decarbonisation is the introduction...

13 November 2023

The connection between ESG and value creation

Ruari Sinclair, Director, BDA Partners, shares his insights with Morrison...