2022/04/04

BDA in the news: Lanvin Group IPO not yet in the bag

April 4, 2022

By Astrid Wendlandt

Shanghai-based Lanvin Group, the fashion arm of Chinese conglomerate Fosun International, is aiming high. It wants to build “the new luxury” and obtain a valuation of more than $1.9 billion by listing in New York and merging with a special purpose acquisition company (SPAC). It is seeking to raise up to $544 million to fund its global expansion ambitions. Good luck!

Lanvin Group, which owns brands Lanvin, Sergio Rossi, Wolford, St. John Knits, and Caruso, has merged with a U.S.-listed SPAC, an “easy listing” option also known as a “blank check company.” The SPAC is affiliated to Primavera Capital Group, a Chinese investment firm founded by former Goldman Sachs Greater China Chairman Fred Hu. The proposed transaction, due to take place in the second half of this year, has raised eyebrows among investors for a number of reasons.

First, the valuation it is aiming to get is nearly four times Lanvin Group’s revenue forecast for this year, or €473 million. SPAC valuations tend to be much higher than traditional IPOs and such valuation multiples usually apply to tech or bio-tech companies with impressive growth forecasts. Lanvin Group may be tapping China’s huge appetite for luxury. But it operates in the fashion and luxury market, which is not forecast to grow massively. Consumers are buying less and buying better to preserve the environment.

Nearly all of Lanvin Group’s brands, including its flagship Lanvin, lose money. The group as a whole is not expecting to become profitable before 2024, according to its presentation to investors published on March 23. That document is peppered with superlatives and aggressive growth forecasts.

Lanvin Group, which operates more than 300 stores, wants to open over 200 new stores by 2025 to “capture growth opportunities in North America and Asia.” This is quite an aggressive plan, as it would mean opening a very large number of shops every month. Best practice in luxury recommends taking your time to open a new boutique. Finding the right location, retail partner and concept can be a long process, but it is crucial for success and image. Luxury requires patience and time. Fosun seems to refuse to accept and understand that. The group has declined several interview requests from Miss Tweed.

“If they don’t have the management and brand building skills to grow globally, it will fail,” said Scott Kerr, a luxury industry specialist who runs the New York- based Silvertone Consulting. “I am not very optimistic,” he said about Lanvin Group’s SPAC project.

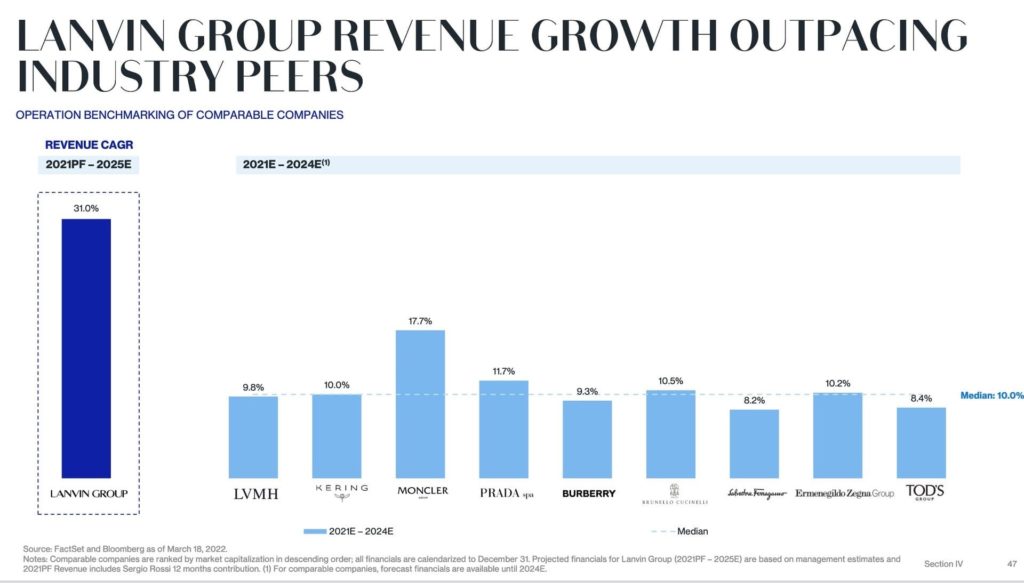

Lanvin Group said it aimed to achieve a cumulative average sales growth rate of 31 percent between 2021 and 2025, beating the industry average of eight percent estimated by the Bain & Co. consultancy. “In order to achieve this high growth forecast, they might need to pursue aggressive global M&A opportunities in future,” said Shanghai-based Vivian Ren, managing director at the global investment banking firm BDA Partners.

Apart from these points of concern, going down the SPAC route is also questionable. SPACs are shell firms that raise money from institutional and retail investors via market listings. They put it in a trust for the purpose of merging with a private company and taking it public. The problem with that model, financial analysts say, is that firms tend to overpay the acquisitions they make. Since they absolutely need to do a deal – otherwise they have to give the money back to investors – they are ready to pay hefty sums to secure the asset they want. This is not a recipe for creating value over the long term. “We do see investors become more and more cautious than before,” Ren said with regard to SPACs.

Industry sources say Lanvin Group is currently looking at several targets including Parisian brand Isabel Marant, which Miss Tweed reported last week being for sale. Last year, Lanvin Group tried to acquire the Belgian leather goods maker Delvaux but got beaten by Cartier owner Richemont. “Fosun are looking at everything right now,” one London-based investment banker said. “And that is not necessarily a good thing because it suggests they are more motivated by doing deals than by pursuing a clearly defined asset selection strategy.”

“We are seeing the Lanvin group showing interest in some of the assets we are advising in the market, and they seem aggressive,” according to Karen Cheung, managing director at BDA Partners in Hong Kong and head of the investment bank’s consumer and retail in Asia. “They have a strong interest in acquiring brands with heritage, strong DNA, from fashion brands to accessories. They love DTC brands,” she said, referring to direct-to-customer sales, “and I think it will help them tap into the younger generation (which is a change from Lanvin, St. John, Wolford, Caruso).”

OUTPERFORMING OR TIRED?

Lanvin Group claims in its investor presentation to have a “market outperforming track record” and that all its brands are “iconic.” The reality is that most of its brands are tired by most accounts.

Let’s start with St. John Knits in the United States. It lost its soul when the Grays, the founding family, sold the company to a private equity firm in 2005. It has changed hands many times since and it has never been a success story in America or elsewhere. Then there is Sergio Rossi. The Italian shoemaker has been struggling for years and Kering, its former owner, never turned it into a profitable business. It threw in the towel and sold it in 2015. Today, Sergio Rossi, which owns a reputable factory, survives partly by producing shoes for the popular designer Amina Muaddi.

Then there is the Italian tailor Caruso, which Lanvin Group describes as “the premier European menswear manufacturer in Europe.” Its main business is supplying other brands with menswear. It is not regarded as a top-tier menswear brand in its own right, at least in its home country of Italy. And there is the high-end bodywear and tights provider Wolford. The Austrian company has been steadily growing over the years and is around break-even in terms of profitability, industry sources said.

In 2021, all of Lanvin Group’s brands rebounded like the rest of the sector. That alone does not make them “outperforming” and “iconic” to investors. In the fiscal year 2021, Wolford made revenue of €116 million, while St. John Knits made €74.5 million, Sergio Rossi some €57 million and Caruso €24 million.

And then there is Lanvin. Founded by French milliner Jeanne Lanvin in 1889, it is France’s oldest fashion brand in operation. Its numbers today are a shadow of what they once were.

If in 2013, Lanvin made sales of €236 million and an operating margin of 10-12 percent, its sales were only €66 million in 2021. That was up from €32 million in 2020. Losses reached €80 million in 2020 and some €60 million in 2021. This year, Lanvin’s sales are expected to climb to around €120 million and the brand should get closer to breaking even, according to a source close to Lanvin Group.

From a creative point of view, Lanvin has been in a downward spiral since its former controlling shareholder, the Taiwanese Wang Shaw-Lan, sacked designer Alber Elbaz in 2015 for having invited Qataris to invest in the company when she had no more money to fund its expansion.

Lanvin should be the size of rivals Valentino or Saint Laurent, making more than a one billion euros in annual sales and employing hundreds of people. Lanvin is endowed with one the richest histories in the fashion industry. But that is not enough. The brand lacks the right creative and management leadership to take it to stardom where it belongs. The current designer Bruno Sialelli is doing his best. He is a nice guy, cultivated and talented, but his designs are not the most talked-about in Paris.

Sialelli’s “pencil cat” bag with an arched cat on the handle, has been somewhat popular. And the sales of his “Sugar” flap bag and “Curb” sneakers with wide laces have also had some success. He also recently launched a series of capsule collections in honor of the late Elbaz who passed away in April last year.

But over the years, Lanvin has not really managed to build huge relevance on Planet Fashion, eclipsed by stronger rivals such as Bottega Veneta and Balenciaga and new names such as Simon Porte Jacquemus and Ami. Sialelli has explored many venues for Lanvin from a style point of view – which shows he was not properly briefed by Fosun. As a result, it is not clear what the brand stands for today and its ready-to-wear has not exactly been flying off the shelves. “Lanvin is having trouble recruiting,” a head-hunter said on condition of anonymity, adding that several key people have recently left the company. Fosun denied this was the case.

In 2019, Lanvin recruited Sialelli from Loewe where he was designing menswear. The Chinese group did not respect his non-compete contract meant to prevent him from starting work for Lanvin for a number of months. Loewe’s parent LVMH sued Fosun and won, forcing Fosun to dish out millions of euros. Fosun also was forbidden from hiring anyone from LVMH for a year.

Since Fosun acquired Lanvin in 2018, the brand has been through three CEOs. In March 2020, the Chinese group pushed out Lanvin’s CEO Jean-Philippe Hecquet after recruiting him in August 2018 from French fashion brand Sandro. In September 2020, Fosun appointed two new heads, one for Europe and one for Asia. Arnaud Bazin, who previously worked for Dior, Versace and Chanel became Lanvin’s deputy general director based in Paris.

Grace Zhao, who had gained experience at Dolce & Gabbana and Louis Vuitton, became Lanvin’s new Asian boss in Shanghai. Zhao has a reputation for being temperamental and difficult to work with. Luxury industry sources in Shanghai say there is a high turnover in her team and no one in Paris ever sees her. However, she is good friends with the wife of Fosun’s chairman Guo Guangchang. “Grace Zhao wants to turn Lanvin into a mass market brand,” one person close to the company said. Lanvin regularly puts out collections in China that include prints with pandas, hearts and other cute images that the Chinese appreciate but have little to do with the brand’s more sophisticated looks designed by Sialelli.

Lanvin last year recruited Chinese designer Calvin Luo to work on collections for the Chinese market. Fosun does not seem to understand that splitting a brand’s image, as it is doing right now between China and the rest of the world, risks causing more damage to Lanvin’s brand equity globally.

In December, Fosun did not renew Bazin’s contract because it wanted to have someone with good contacts with journalists in America to push through its SPAC IPO. That transaction is a priority, it appears. To replace Bazin, Lanvin appointed Siddhartha Shukla, a man who has never managed a luxury brand before and who spent most of his career in marketing and communications in the United States. Before joining Lanvin in December, Shukla was chief brand officer for U.S. fashion brand Theory. Prior to that, he was in charge of communications at Reed Krakoff and earlier at Gucci in America.

Shukla joined Lanvin at a difficult time. The brand has been quietly shedding more than 80 staff in the past year, several industry sources have said. If in 2018, Lanvin employed more than 300 staff, the company now employs just over 100 people, several sources close to the company said.

Last year, Fosun gave its fashion arm the name Lanvin Group. It is ironic considering that Lanvin is becoming a Chinese company. Only its name now is French. Fosun signed a license agreement with Jeanne Lanvin SA, the parent company of the brand. As part of the agreement, if Fosun acquires a brand, it needs to have the same upmarket positioning as Lanvin, otherwise minority shareholders in Lanvin can ask Fosun to give the name back.

Lanvin’s minority shareholders include Wang, her associate Nicolas Druz and the entrepreneur Ralph Bartel, who started investing in Lanvin in 2008. Together, they own just under 20 percent of Lanvin. “They are furious about this SPAC deal and about the use of the name Lanvin,” one person close to Bartel said. Potential investors may want to give them a call before putting money in Lanvin Group’s SPAC.