What to expect from the Industrials sector in Asia – Interview with Simon Kavanagh

Simon Kavanagh, Partner and Head of Industrials at BDA, shares his views on where we will see the most M&A activity within Industrials in Asia, in terms of sub-sectors, markets and key players in 2021 and beyond.

– Which are the most active sub-sectors in Industrials in Asia in terms of M&A activity since 2020?

There are two sub-sectors within Industrials where we’re certainly seeing a lot of activity. One is general component manufacturing, both metal components and plastic components. The automotive sector in particular has rebounded from a low in 2020, and we are seeing several deals in the marketplace currently. Component manufacturing then extends up into EMS and assembly, and there’s quite a lot of focus on electronic components, especially where there’s a technology angle.

The general trend for 2021 onwards is that technology is key. The R&D capabilities of target companies are scrutinized very closely by investors and the extent of their technology expertise has a meaningful impact on valuation. For pure play component manufacturing companies, with less of a technology angle, there is less demand, and appetite and valuations are lower.

Another sub-sector where we are starting to see increased activity is in waste recycling. This ties into the general mega theme towards ESG, which is becoming an attractive investment sector and one which funds and LPs are actively looking for opportunities.

– At the end of 2020, BDA closed a milestone transaction in the semiconductor sector with the sale of Compart to Shanghai Wanye. Compart is a leading global supplier of semiconductor components and assemblies, headquartered in Singapore with manufacturing plants in China and Malaysia. Do you see more opportunities in this subsector? Who are the most active investors?

The sale of Compart was a very successful transaction, for both buyer and seller. The investment environment is strong and there are several additional semiconductor related transactions coming to the market. BDA is currently working on a number of these, each in a different stage of the semiconductor manufacturing supply chain.

China has made it a priority to strengthen its domestic semiconductor capability and Chinese companies are keen acquirers. There is a strong willingness for Chinese corporates to borrow money and for private equity firms to commit capital to semiconductor related targets.

We expect the Chinese pace of investment in the semiconductor sector to continue for the next few years. It is an industry where most of the manufacturing and the technology is outside of China, either in Taiwan, Korea or the US. So there is a strategic value to the companies they are buying, even if valuation is relatively high. Private equity firms specialising in the semiconductor sector have sprung up. Wise Road Capital is one of the better-known ones: earlier this year it acquired MagnaChip in Korea for US$1bn. It was unusual for a Chinese company to buy something in Korea of that size, but it followed their 2020 acquisition of United Test and Assembly Center.

– How do you view the acquisition appetite of financial sponsors versus strategic investors for the Asian Industrials sector?

Financial sponsors have the upper hand at the moment and that will continue throughout 2021, until the macroeconomic environment stabilises and travel restrictions are lifted. The investor universe for industrial companies is weighted quite heavily towards Asian financial sponsors, with some activity and interest from Asian strategics. However, financial sponsors are much more flexible in terms of considering cross border M&A in the Covid-19 environment and being able to complete due diligence virtually.

Sponsor investors across the board are looking to increase their exposure to the region. Several international private equity firms have raised large Asia-only focused funds since 2020, including KKR, Blackstone and Carlyle. China-focused private equity firms (Boyu, Primavera, Fountainvest, BPEA, Hillhouse and PAG) are also investing or raising billion-dollar funds.

Strategic investors tend to be a little more conservative. It has not been a priority for US or European corporates to make significant investments in Asia these past couple of years: they have tended to focus on their home markets. The difficulty of doing site visits under the current Covid-19 travel restrictions has more of an impact on them, than on financial investors. However, while it is early stages, BDA is starting to see a change in the trend with a noticeable increase in the number of corporate clients calling us in 2021 to discuss buyside roles in Asia.

– China outbound M&A in 2020 was the lowest level in the last decade. Do you still see Chinese investors having a conservative view in outbound industrial deals in 2021?

The volume of China outbound M&A has come back from the low of 2020. Outbound volume in Q1 2021 was up 15.9% YoY. But in general, yes, the heyday of Chinese outbound diversification has gone. US assets are still out of favor due to geopolitical tensions. Europe is attractive, but acquirers are far more cautious, both in terms of what they buy and how much they pay for it.

When they do make acquisitions it’s the technology that is most critical. China’s next stage of development is very much towards being at the forefront of technological leadership and R&D capabilities. They are looking at what this target can bring to them in the industry. Does it have something that is not essentially in China already? What can a new Chinese owner do to win Chinese customers for this foreign company? Does the target company have some special intellectual property or is it the leading expert in a particular niche? Technology will remain the key driver for outbound M&A for many more years.

– SPACs have been a hot topic recently. What impact do you think SPACs will have on the industrial sector in Asia?

Not much of an impact. SPACs tend to focus on high growth companies that are looking at raising capital and want to do an IPO, but are less suited to the more traditional routes for public listing. There are not many industrial companies that fall into that category. Local Asian SPACs are still not regulated or available / approved by regulators in either Hong Kong or Singapore, although that will change in due course. In order to pursue the SPAC route in either the US or Europe, the business needs to be big, like Grab. But if you’re a US$1 billion valuation Industrials company, you won’t need to sell new shares to raise capital, and if you’re looking for liquidity you will probably just go and do a normal route IPO or sell to a financial sponsor.

– Is the shift of manufacturing capacity to Vietnam, at the expense of China, continuing?

Yes, the trend will continue for the foreseeable future. Vietnam still has a significant cost advantage over China, particularly for labor-intensive industries. Companies are not necessarily moving their entire supply chain from China to Vietnam, but if they are adding capacity, it’s less likely that they will be making that capital expenditure in China. Vietnam, as well as Malaysia to some extent, are continuing to benefit because of their well-qualified workforce of engineers and a friendly FDI regulatory environment.

With our strong BDA Partners team on the ground in Vietnam, we are seeing and working on a lot of founder-owned sellside transactions where the target companies are very attractive bolt-on acquisitions for strategic investors. We’re witnessing the start of a shift, where a generation of founders of some very successful Vietnamese companies are looking for liquidity, and they need access to an international investor universe and an advisor to help guide them through an M&A process.

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes. BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese government-owned bank with US$150bn of assets.

US securities transactions are performed by BDA Partners’ affiliate, BDA Advisors Inc., a broker-dealer registered with the Securities and Exchange Commission (SEC). BDA Advisors Inc. is a member of the Financial Industry Regulatory Authority (FINRA) and SIPC. In the UK, BDA Partners is authorised and regulated by the Financial Conduct Authority (FCA). In Hong Kong, BDA Partners (HK) Ltd. is licensed and regulated by the Securities & Futures Commission (SFC) to conduct Type 1 and Type 4 regulated activities to professional investors. www.bdapartners.com

BDA Partners合伙人、中国业务联席主管兼私募基金客户负责人萧寅康(Anthony Siu)就中国的并购、私募股权退出和境外并购活动前景分享了看法

1. 2020年是中国境内并购创纪录的一年。您认为2021年这种情况还会继续吗?

我认为中国的境内并购趋势还在继续,甚至在2021年及以后会加速。2021年迄今,境内并购交易一直处于创纪录水平,已经公布了800亿美元的交易,开年交易额为史上最高。这一时期的并购交易额是2020年同期的三倍。

2020年上半年,新冠疫情对中国并购市场产生了重大影响,但从下半年开始,市场大幅反弹。中国买家重点关注境内并购,这主要是由于欧洲和美国的地缘政治紧张局势、旅行限制、新冠疫情的严重影响,以及重心向中国国内需求转移。我们看到越来越多的国内企业加快了在中国扩张的计划。各企业纷纷利用这次机会巩固国内市场,加快增长,并从自己所在的地区扩展到全国。在某些行业,一些全国范围内的领军企业正崭露头角。鉴于中国致力于提高自力更生能力,而且经济仍在不断增长,我预计将出现进一步的国内并购整合。

就行业而言,国内买家最青睐消费品和医疗保健行业。中国可支配收入增长正在推动消费升级,因此消费市场将继续增长。大型企业希望通过收购来加速渠道网络和市场份额的扩张。我们预计医疗保健领域也将出现更多的境内收购活动。战略参与者正在想办法在快速增长而分散的市场中扩大市场份额。例如,在医疗保健服务领域,出现了许多与医院、专科诊所和康复中心相关的并购活动。

2. 您认为2021年中国家族企业主/创始人是会偏向于通过IPO,还是通过出售股权退出?

我认为两者皆有。过去一年里,IPO市场持续火爆。科创板市场使规模较小、增长快速的公司能够以有吸引力的估值上市。对于短期没有计划退休或退出的创始人,或者拥有高增长业务但在早期难以售出的创始人,他们会偏向于IPO途径。但对于传统行业(如工业制造和消费及零售)企业的创始人来说,出售股权对他们来说可能是一条非常有吸引力的退出途径。战略和私募股权买家青睐现金流强劲的市场领导者,而具有这些特征的目标企业也能吸引众多买家。

3. 您认为新冠疫情会如何影响私募股权所有者退出投资的时机和计划?去年,由于不利的商业环境,一些私募股权卖家推迟了他们的投资组合公司退出时间。未来应该会有更多的私募股权退出投资,以清理项目积压。今年上半年,一些私募股权公司在等候目标公司确立清晰的财务和经营业绩的回复路径。我们预计今年下半年,通过卖出股权的退出将会增加。

4. 您认为2021年会有不良资产投资/重组并购机会吗?是境内还是境外资产?中国市场机会不太多,因为新冠疫情的影响比较短暂。一些企业杠杆过高的情况发生在新冠疫情之前,而且已被迫采取一些减低债务的行动。在过去的1-2年里,我们看到了许多这样的剥离活动。

在中国境外,一些危困企业急需流动性,因此可能有更多不良资产投资和重组机会。随着中国买家在境外投资中变得更加活跃,我们可能会看到更多的海外资产重组交易。

5. 2020年的中国境外并购交易额是过去十年中最低的。您认为2021年会出现反弹吗?如果会,哪些行业或国家会比较有吸引力?

自今年年初以来,我们已经看到了海外并购复苏的早期迹象。中国企业在境外交易中越来越活跃,不断向欧洲、其他亚洲国家(如新加坡)及快速增长的国家(如越南)扩张;但在美国的交易较少,因为中美的紧张关系造成了重大的交易不确定性。随着疫情的缓解和边境的重新开放,今年剩余时间内境外交易量应该会有所增加。我认为对外投资者将继续青睐工业和医疗保健等行业。由于电子商务的繁荣,另一个受益于疫情的行业是运输和物流。

6. 您如何看待拜登政府时期的中美地缘政治关系?

在特朗普政府时期,中美关系可能已触及最低点。我认为拜登政府明白中美关系是美国最重要的战略关系之一,因此将对中国采取强硬但务实的态度。美国企业在中国有大量投资,它们需要得到保护。在许多方面,中国都是世界上最大的市场,美国不能忽视这个机会。另一方面,中国将继续开放国内市场。政府已经取消了对外国直接投资的许多限制。展望未来,我预计美国企业在中国投资的兴趣将会回暖。

7. 新达成的中欧协定会促进2021年的跨境并购吗?

中欧协定主要关注中国市场对欧盟的开放。它对各个行业都有帮助,例如,新能源、医疗保健服务、金融服务;以及传统上受政府保护的领域。欧盟公司将从这一协定中受益,因为中国将对欧盟投资开放这些行业。就并购而言,我们预计将有更多的欧盟公司会通过直接收购或战略投资增加在中国的投资。然而,最近欧盟和中国之间的制裁争端使该协定的批准成疑。我相信,如果该协定被取消,双方利益均会受损,所以希望双方能找到避免事态升级的方法,使协定重回正轨。

SPACs are the hottest story in financial markets globally, today.

Special Purpose Acquisition Companies (“SPACs”) have been around for 30 years, but they blossomed in 2020, in the US market. 248 SPACs launched last year, raising a total $83bn in proceeds.

And the craze keeps getting hotter: in January and February 2021 alone, 188 SPACs raised $58bn, just in the US.

This rising tide shows that the SPAC approach is, for now, seen as a legitimate and quicker alternative to a traditional US IPO. And yet SPACs are in favour and controversial for the same reason: highly favourable economic returns to SPAC IPO sponsors, market challenges caused by the pandemic, and the apparent execution, pricing and liquidity certainty offered by SPACs, for both investors and target companies.

Today, 300 SPACs are searching for acquisition targets to de-SPAC within a limited timetable, typically two years. As the US becomes saturated, SPACs are increasingly looking for opportunities in South East Asia and Greater China, where companies backed by private equity and venture capital are demonstrating compelling growth and value prospects.

Total deal value of Asia-focused SPACs (US$bn)

This year, we’re beginning to see Asian sponsors listing SPACs in the US.

And yet only two Asian countries, South Korea and Malaysia, allow SPACs to list today.

SE Asia is arguably the most fertile ground for acquisitions by SPACs, due to the vibrant technology startup scene and smaller domestic IPO markets. This raises the question of whether financial hubs like Hong Kong and Singapore should themselves consider becoming more SPAC-friendly.

But for now, Asian companies are mostly looking to SPACs in the US.

Here are some of the ways Asian markets are engaging with SPACs – or resisting them.

1. CHINA

China is the go-to model for the South- and SE-Asian technology unicorns. Alibaba and JD.com are Chinese giants with dual US-China listings. Political pressure and rampant local multiples have encouraged Asian companies to explore regional markets, not just NASDAQ.

Notwithstanding the trade war, NYSE and NASDAQ have expressed willingness to continue to entertain China-related SPACs.

US billionaire Dan Och and his family office, Willoughby Capital, own 5.6% of Primavera Capital Acquisition Corp, a SPAC led by Fred Hu, formerly of Goldman Sachs China, hunting for a consumer target with a significant presence and potential in China. Primavera raised $350m in an NYSE IPO.

Fang Fenglei, founder of HOPU, is active via HH&L, a SPAC, now chasing a China healthcare target.

CITIC Capital raised $240m for a SPAC targeted on the energy efficiency, clean technology and sustainability sectors, in China and beyond.

The Shanghai Stock Exchange’s Sci-Tech Innovation Board (STAR Market), has attracted many high-growth startups. The popularity of these platforms offers issuers potentially stratospheric valuations, without going down the SPAC route.

New Frontier Group, an asset manager run by Anthony Leung, Hong Kong’s former financial secretary, merged Chinese private hospital United Family Healthcare with its SPAC on the NYSE in 2019. New Frontier Health is still trading below its $10 IPO price, and is soon set to be taken private by a consortium, again led by Leung, valued at only $12 a share.

Octillion Energy, a privately-held US and China headquartered electric vehicle powertrain solutions provider recently hired Bank of America to explore a potential acquisition by a NASDAQ listed SPAC instead of a trade sale.

2. HONG KONG

Hong Kong and Singapore are taking divergent approaches to the SPAC boom, as they watch Asian unicorns explore future listing structures.

The Hong Kong Exchange prefers traditional IPOs and is treading a more cautious path.

Hong Kong has long been one of the world’s top IPO destinations alongside New York and Shanghai, and it has been skeptical about non-IPO listings. In recent years, HKEX has been tightening rules on backdoor listings and shell activities. Regulators in Hong Kong and mainland China have been working hard to streamline and simplify conventional IPO listing procedures and requirements, reducing the appeal of the SPAC route. Hong Kong already allows pre-revenue biotech companies to list on its main board.

Model Performance Acquisition, a Hong Kong-based blank check company led by ex-Templeton Asset Management North Asia PE co-head Claudius Tsang, has filed with the US Securities and Exchange Commission (SEC) to raise up to $50m in an IPO.

Ace Global Business Acquisition is a Hong Kong blank check company targeting gaming and e-commerce in China, Japan and SE Asia, launching a US IPO. The company is led by Eugene Wong of Whiz Partners Asia and the China Hero PJ Fund.

HKEX’s CEO Calvin Tai said the bourse “will open our eyes and ears, listen to the market, and watch other markets” when it comes to future IPO regulations.

In 2020, 154 companies raised a combined US$52bn in IPO proceeds in Hong Kong.

3. INDIA

An array of Indian companies, valued at $30bn or so in total, are considering SPAC deals in the US. For example, Indian ecommerce pioneer Flipkart, owned by Walmart Inc, is mulling merging with a blank-cheque company in the US, potentially at a $35bn valuation.

SPACs are scouring India’s more mature targets. Last week, ReNew Power, one of India’s largest renewable energy groups, unveiled plans to go public in New York through an $8bn deal with a SPAC. ReNew Power is an Indian renewable energy company, with an asset base of 8 GW, of which 5 GW is operational. It is now exploring a dual listing in Mumbai.

Baring Private Equity Asia is considering listing US-Indian health tech company, Citiustech Healthcare Technology Pvt., in the US through a SPAC merger. Baring is hoping for a valuation of US$1bn for Citiustech. Baring only acquired its majority stake in Citiustech in 2019 for US$750m.

4. INDONESIA

Indonesia is a less mature market, but with a huge consumer population and a growing online economy. This has created four unicorns to date. Naturally they have considered the merits of listing via SPAC.

The Indonesia Stock Exchange is the third Asian market, after Hong Kong and Singapore, to consider allowing SPACs to list. Last year, there was only one SPAC deal involving an Asian company. Only five Asian start-ups have listed via SPAC since 2016.

Ecommerce leaders Tokopedia and Bakalapak, and airline ticketing and hotel booking services player, Traveloka are all considering SPAC mergers today. SPAC deals may be just one step along the way: a proposed $18bn merger between Tokopedia and ride-share giant Gojek could lead to a dual listing in New York and Jakarta.

The biggest SPAC focused on SE Asia is Bridgetown Holdings, backed by Richard Li and VC Peter Thiel. Bridgetown raised $595m, and is exploring a potential merger with Tokopedia that could value the unicorn at $8bn-$10bn.

Provident Acquisition is a $200m SPAC launched by SE Asian fund Provident Growth. Provident backed Gojek, Indonesia’s biggest start-up, and Traveloka.

5. JAPAN

Japan doesn’t allow SPACs on its domestic markets. The Japanese authorities don’t consider SPACs to be sufficiently transparent or safe in regulatory terms, as a path to IPO, or as an investment vehicle.

SoftBank is listing two new SPACs on NASDAQ. The Japanese conglomerate will raise $480m to acquire businesses in the AI sector. SoftBank’s SPACs are funded primarily by its Vision Fund. SoftBank listed its first SPAC in the US in January 2021, raising $525m.

6. SINGAPORE

The Stock Exchange of Singapore is likely to approve the formation of SPACs in Singapore.

Singapore’s IPO ranking is far behind Hong Kong, while it has suffered a slow-burning delisting trend in recent years – making it more receptive to SPACs as a growth engine.

The Singapore Stock Exchange is home to more old economy companies and REITs. SPACs would be a natural step for Singapore to attract new economy listings.

The spectacular rise of Sea, the Singapore gaming and ecommerce company listed on NYSE, was one of the world’s best-performing stocks in 2020.

Grab, backed by SoftBank and Shinsegae, is exploring going public in the US through a merger with a SPAC to speed up its listing process. Grab is a “super app” that offers multiple conveniences, including ride-hailing, financial services and food delivery. The platform has traction in eight countries — including Singapore, Indonesia, Vietnam and Thailand. Its mobile app has been downloaded more than 14 million times. This comes after talks to combine with Indonesian rival Gojek collapsed. See above.

Singapore’s on-demand bus service provider Swat Mobility is contemplating a Japan IPO to fund its expansion, or else a merger with a US SPAC to gain a listing there.

COVA Acquisition, Crescent Cove’s $300m SPAC, listed in February, is now scouting for targets across SE Asia.

L Catterton Asia Acquisition Corp launched this week as a consumer tech-focused $250m IPO on NASDAQ.

SPACs formed in 2021, searching for targets in Asia

Source: Dealogic, Mergermarket

Investors have already poured almost $3bn into SPACs focused on acquiring Asian companies this year, nearly doubling the amount committed during all of 2020, according to Dealogic. While modest by the standard of American companies, BDA understands that several Asian private equity firms are hoping to join the stampede.

The gold-rush mentality is causing concern from sponsors looking to invest, about inflated valuations for young businesses. Asian management teams at fast-growing companies are typically unprepared for the regulatory requirements of a US listing. Asian markets are simultaneously tightening restrictions on backdoor listings which avoid the independent due diligence process on a traditional IPO.

As described above, many of Asia’s most high-profile entrepreneurs and CEOs are playing in the SPAC pool. In addition to Fred Hu, Ken Hitchner, ex-head of Goldman Sachs Asia Pacific, Li Ka-shing’s son Richard Li, and Peter Thiel, the US tech investor, have all backed significant SPACs focusing their aim on SE Asia.

Most of SE Asia’s burgeoning unicorns are still valued below $3bn, which was the traditional minimum value for an IPO in the US.

As a result, Asia-focused SPACs are chasing a limited pool of viable targets.

However, Asia’s limited history of companies successfully going public via SPAC could weigh on the region’s prospects.

Sponsors have also come under scrutiny for their own lucrative compensation, typically a 20% stake in the company.

They have flocked to the US, where investors show apparently limitless appetite for blank check firms, while the larger exchanges in Asia still do not allow SPACs to list.

SPACs feel like a reflection of the mature bull market. The exuberance has sparked debate among investors and bankers about how long the trend will continue, and whether there will be enough suitable targets to be merged, if the frenzied pace of fundraising continues.

Many observers expect the SPAC mania to end badly – but not before more investors, CEO, bankers and sponsors have ridden the wave for a while longer.

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes. BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese government-owned bank with US$150bn of assets.

US securities transactions are performed by BDA Partners’ affiliate, BDA Advisors Inc., a broker-dealer registered with the Securities and Exchange Commission (SEC). BDA Advisors Inc. is a member of the Financial Industry Regulatory Authority (FINRA) and SIPC. In the UK, BDA Partners is authorised and regulated by the Financial Conduct Authority (FCA). In Hong Kong, BDA Partners (HK) Ltd. is licensed and regulated by the Securities & Futures Commission (SFC) to conduct Type 1 and Type 4 regulated activities to professional investors. www.bdapartners.com

The new Suga government has already been bold.

Japan’s fiscal response to the pandemic dwarfs the measures taken after the global financial crisis, and the earthquake and tsunami of 2011.

Now standing at more than 250% of GDP, Japan’s national debt is among the highest in the world, twice the average of other advanced economies. But it seems to be working.

Japan may finally be emerging from a prolonged slump, effectively a recession lasting three decades.

Japan’s population may be shrinking at a worrying pace, more than 1% per annum, but investors are thoroughly bullish, as if for the first time in living memory.

Private equity firms Bain, Carlyle and KKR are lining up to put serious capital to work in Japan. Interest rates remain low, which is helping to drive investor enthusiasm.

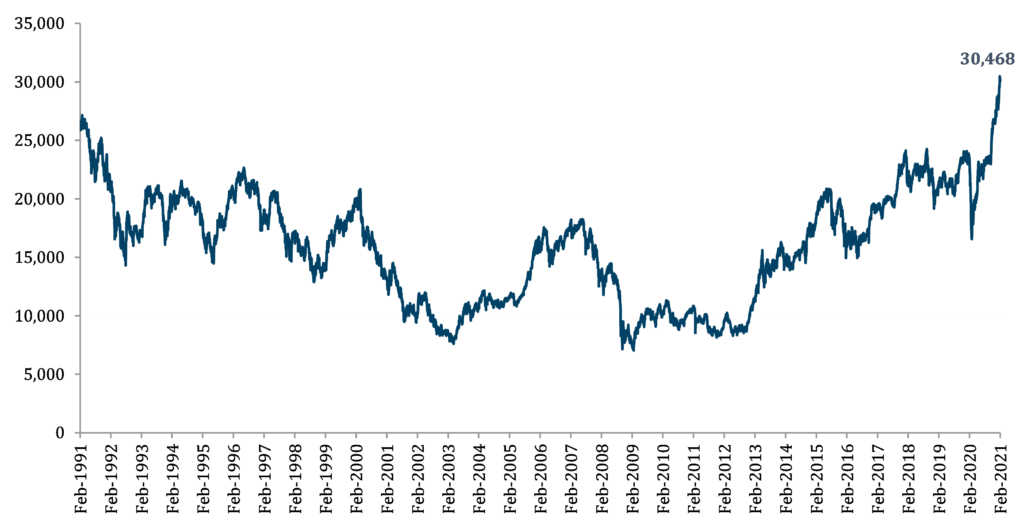

Last week, the Nikkei 225 rose above 30,000, a psychologically significant level last seen in 1991. Energy, Healthcare and Industrials have led the gains.

The Nikkei has risen 30% since November 2020, 9% since the beginning of the year, and 7% in the last two weeks. It is outperforming the US and European markets.

Nikkei 225 index 1991-2021

The TOPIX, which reflects a broader set of Japanese companies, also hit a 30-year high.

Japan’s Ministry of Health, Labour and Welfare has finally approved a Covid vaccine, months behind other major economies.

Still, signs that the pandemic is abating globally have caused optimism among Japanese analysts. Japanese companies are poised to rebound. Industrial customers and end consumers are both demonstrating renewed confidence.

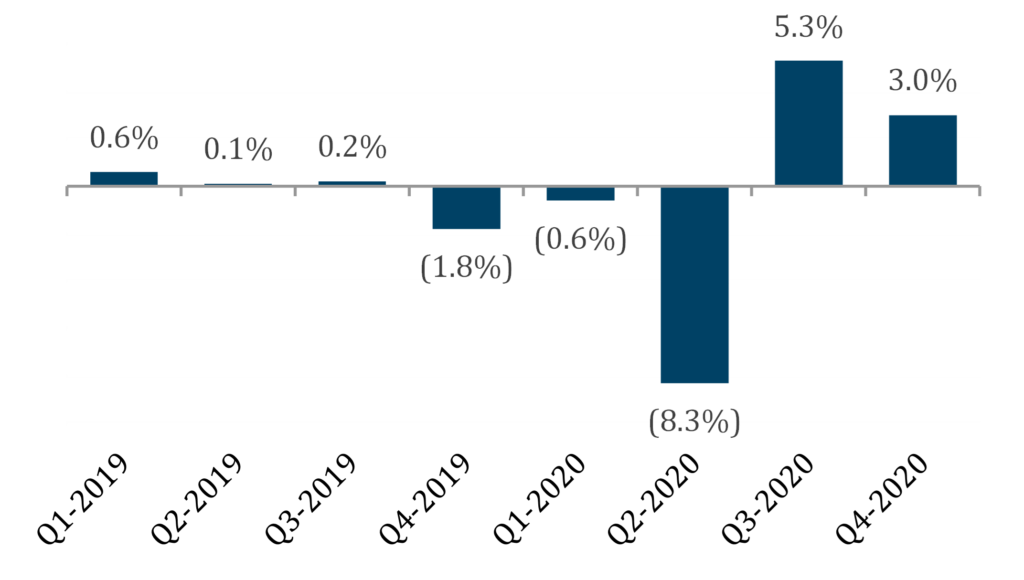

Japan’s economy performed surprisingly strongly in Q4 2020, recovering markedly from the slowdown earlier in the year. But this growth is still fragile and might be easily disrupted, analysts warn.

The second state of emergency, declared in January 2021 and extended in February, will dampen economic activity in Q1 2021, and tourism remains severely subdued.

Japan is the world’s third-largest economy behind the US and China. GDP rose 3.0% in Q4 2020, for a 12.7% annualized growth rate. The economy had also recovered by 5.3% in Q3 2020.

2019-2020 Japan Quarterly GDP growth

Exports and consumer spending have both surprised on the upside. Analysts say that consumers are demonstrating pent-up demand for Japanese goods which they did not buy in H1 2020.

Exports have been booming, especially capital goods and technology-sector goods and services.

Even before the pandemic, 2020 had begun inauspiciously, with a disastrous hike in the national consumption tax, a steep drop in trade with China, and an unusually damaging typhoon. The pandemic then arrived to cause the biggest drop in GDP since records began in 1955.

But the Government has managed the pandemic relatively well, allowing Japan to avoid the more profound economic damage that beset the US and Europe.

The Japanese population spent most of 2020 still able to travel domestically, eat out, and visit leisure facilities. The Government quickly brought in subsidies for domestic tourism, Covid notwithstanding.

Shinzo Abe resigned in August 2020, to manage his ulcerative colitis. Yoshihide Suga assumed office in September. Suga said his premiership will focus on continuing the goals of the Abe administration, including notably the Abenomics suite of economic policies.

Suga’s “third extra budget” in December 2020 supplements two earlier packages worth 11% of GDP. The year-end shot of fiscal caffeine was worth $708bn, including $385bn in direct fiscal spending and initiatives targeted at reducing carbon emissions, and boosting the adoption of digital technology.

The stimulus helped keep employment high, and companies in business. Bankruptcies actually dropped 6.5% in 2020, according to credit research company, Teikoku Databank.

Japan has been lamentably slow to start vaccinations. Regulators have finally approved the Pfizer-BioNTech vaccine. Frontline healthcare workers will receive their first doses this week, but it will be months before most citizens get shots.

And yet the pandemic’s effects have been much less severe in Japan, with fewer than 7,000 deaths to date.

The Government has begun encouraging activist investors to search for undervalued stocks, previously a taboo exercise. The weaker yen-dollar exchange rate, too, boosts the value of overseas holdings and makes exports more competitive.

The last time the Nikkei scaled these heights, Japan was in the throes of the bubble economy. The Bank of Japan throttled that speculative fever, which led to the infamous lost decade at the end of the twentieth century. Momentum has been stalled ever since.

Japan still has many hurdles to overcome. The economy relies on “old” companies. Productivity is stunted. Efforts to promote tourism died with the pandemic. Women remain undervalued in the economy, which becomes a more significant issue as the population shrinks – but also an opportunity, of course. As in other markets, inequality is growing in worrying ways, and the recovery looks K-shaped for now: steep for some, non-existent for others.

And yet: Japan is reforming, and reviving, and becoming fashionable among fund managers.

Prime Minister Suga has reasons to be cheerful. A month from now, Tokyo’s cherry trees will blossom. The symbolism should be potent this year: a chance to contemplate renewal and future happiness.

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes. BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese government-owned bank with US$150bn of assets.

US securities transactions are performed by BDA Partners’ affiliate, BDA Advisors Inc., a broker-dealer registered with the Securities and Exchange Commission (SEC). BDA Advisors Inc. is a member of the Financial Industry Regulatory Authority (FINRA) and SIPC. In the UK, BDA Partners is authorised and regulated by the Financial Conduct Authority (FCA). In Hong Kong, BDA Partners (HK) Ltd. is licensed and regulated by the Securities & Futures Commission (SFC) to conduct Type 1 and Type 4 regulated activities to professional investors. www.bdapartners.com

We spoke with Howard Lee, Partner and Head of Seoul at BDA Partners, who discussed the outlook of the M&A activities in South Korea, the impressive growth of the Korean private equity market and the role of a great financial advisor.

- What are the latest trends in the M&A inbound and outbound market in South Korea?

Inbound acquisitions of Korean assets by foreign investors have been inactive over the past year. It is largely related to the impact of Covid-19 on overseas buyers. For example, when I talked to potential buyers in the US or China about Korean assets, the general feedback was, under the Covid situation, we were unable to organize ourselves to seriously look at the asset. The Korean inbound market will be more active when the Covid situation improves globally during 2021.

Also, overseas acquisitions by Korean companies in the US and European market have not been particularly active over the last decade. Only few top conglomerates in Korea, like Samsung, LG and SK, tend to execute such M&A transactions. In general, most Korean companies tend to take a conservative stance when it comes to allocating considerable resources for cross-border M&A transactions. The problem resides in their limited exposure to cross-border M&A as well as in post transaction steps such as PMI (Post-Merger Integration). Thus, in order to penetrate overseas market through M&A strategy, it is important that they approach and confront the deal confidently but with proper preparation. Secondly, out of those major conglomerates, their hands are tied up by regulations. So, even though they would intend to go out looking at M&A opportunities, there are sometimes issues at the corporate level or sometimes at the level of key individuals.

- What are the key factors to the rising presence of financial sponsors in the Korean market?

Korean financial sponsors are quite capable, in terms of sourcing capital and executing transactions. Most Korean financial sponsors are supported by large limited partners such as the National Pension Service, the largest public pension fund in South Korea. As private equity funds continue growing in Korea, they are pressured to invest capital and make investments. Moreover, the Korean private equity market is relatively mature compared to other Asian countries and the private equity professionals are very capable and intelligent, exerting high level of professionalism in sourcing high quality assets and undertaking extensive due diligence.

The growth of Korean private equity has quite a unique story. In Korea, conglomerates divest certain affiliates every year. However, for various cultural reasons, transaction between corporates in Korea is very rare. For example, if Samsung sells one of its affiliates to LG, it would be considered exactly a kind of betrayal to employees. So, rather than directly selling the affiliate to another corporate, they would likely have an indirect discussion and sell it first to a private equity fund. A few years later under private equity ownership, the fund would then sell the asset to another conglomerate. This is a pretty typical process in Korea, and that is why financial sponsors are very active in acquiring assets, without many challenges divesting to corporates a few years later.

- Korean M&A market is expected to face an unprecedented boom in 2021. What are your views for the Korea M&A market in 2021?

The expected booming M&A activities in 2021 will be largely driven by the pent-up in transactions. Many private equity funds had good assets ready to be divested in 2020 but the M&A process was disrupted by Covid-19. These funds are now looking to resume these M&A processes in 2021. We will likely see a number of large assets come to the market in 2021. In the case of corporates, their outbound investments in the US, Japan and European markets have also been put on hold because of Covid. As we were seeing the light at the end of the tunnel by the end of 2020, these activities are also likely to resume during 2021.

As far as my knowledge goes, the market has already begun its process to rejuvenate M&A activities. A number of advisors/bankers are already in the process of developing deals and we can soon expect the market to be flooded with deals.

- How have chaebols (large local conglomerates) changed over the last few years and what do you expect going forward?

In my perspective, each chaebol has been focusing on building up their internal taskforce in 2020 looking to identify and resolve potential in-house issues related to liquidity, financial performance, etc. As a result, there were no significant transactions in 2020, other than SK Hynix’s acquisition of Intel’s NAND memory business for US$10bn.

For the past few years, chaebols were not active about overseas M&A. However, they now realize the future depends on their capabilities in AI, semiconductor, data, platform business, etc. As evidenced by Hyundai Motors’ recent investment in a global robotics company in the US, I think that these kinds of investment and acquisition by chaebols will be flourishing going forward.

- What are the most attractive sectors in Korea for M&A over the next five years and why?

One of the most attractive sectors in M&A over the next five years will be the industrials sector as it needs to be consolidated or restructured. Large industrials companies in Korea such as Samsung, LG and SK will need to complete some consolidation or restructuring, whether it is acquiring a competitor or exiting this sector soon in preparation for the ESG era. Based on the expected market dynamics as mentioned above, there will be a myriad of acquisition opportunities of legacy business under the consolidation or ESG preparation.

In addition, other attractive sector to look out for is the tech-driven industry which Korean chaebols and conglomerates are focusing on at the moment. Businesses related to AI, data, cloud computing, semiconductor are the ones that the conglomerates not only have strong fundamental on but also heavily investing in as well.

- How do you think the role of M&A financial advisory will evolve under such fierce competition?

Over the past decade, I think the top five or six conglomerates in Korea accounted for more than 80% of the fees paid to M&A financial advisors. That is because those conglomerates have sizable revenues and there are many M&A deals being sourced from them. In recent years, the private equity sector has been growing fast, contributing more and more to the financial advisory business across Korea.

Therefore, an advisor needs to focus on these two client types, and be able to deliver what they require. Corporate clients value the advisory firm’s network in both domestic and global markets. Private equity clients tend to look at each individual banker, their capabilities and track record for instance. So, I think M&A financial advisory needs to be built up in these two ways. Any advisory firm that is successful in building extensive local and global networks, and continuing to hire great professionals, will end up in a better position compared to the competition.

Another perspective here is the M&A financial advisory firms need to act like a bridge between corporates and private equity funds. If we build up a private pipeline between the two, we can arrange the one-on-one deal between private fund and corporate.

BDA has an edge in our unparalleled local Korean and global networks, extended experience in sell-side process, and seamless execution by the global team of professional bankers. Going forward, BDA Seoul will keep hiring highly competent people and delivering bigger transactions.

In this light, BDA Seoul is currently in discussion with a U.S. law firm to help Korean corporates elevate their knowledge of rules and practices to be considered when acquiring U.S. publicly-listed companies and will hold a session in March where all M&A staffs from most of major corporates in Korea will be invited. I believe this will greatly improve our reputation in the Korean market and strengthen our relationship with the potential clients.

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes. BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese government-owned bank with US$150bn of assets.

US securities transactions are performed by BDA Partners’ affiliate, BDA Advisors Inc., a broker-dealer registered with the Securities and Exchange Commission (SEC). BDA Advisors Inc. is a member of the Financial Industry Regulatory Authority (FINRA) and SIPC. In the UK, BDA Partners is authorised and regulated by the Financial Conduct Authority (FCA). In Hong Kong, BDA Partners (HK) Ltd. is licensed and regulated by the Securities & Futures Commission (SFC) to conduct Type 1 and Type 4 regulated activities to professional investors. www.bdapartners.com

1. Pandemic? What Pandemic?

China’s Communist Party will mark its 100th birthday in July 2021 with typical pomp and ceremony. Celebrations will be cheered by an economy which shrugged off the effects of the Covid-19 pandemic remarkably quickly.

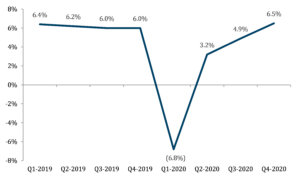

China recorded a sharp slowdown in Q1 2020, as the first country to be hit by Covid. China’s GDP dropped more in those three months than during the 2009 global financial crisis.

Beijing took the unprecedented step of locking down Wuhan a year ago, on 23rd January 2020. Economic activity and travel across the country ground to a virtual halt in the following months until the virus was stamped out. The Government tested repeatedly and widely for Covid, and on a scale other countries can only dream of: For example, in Qingdao, 12 cases in October 2020 resulted in nine million residents being tested in just five days. Unlike Western countries like the US, which focused stimulus efforts on lowering borrowing rates and handing out money to consumers, Beijing focused on restarting factories while keeping interest rates relatively high.

China’s factories came back online from April 2020, as the world’s manufacturing capacity was sputtering to a halt in the face of the devastating pandemic. China actually benefitted from the global slowdown, producing and exporting huge quantities of medical equipment, face masks and work-from-home electronics, such as laptops and monitors.

The Chinese economy roared back to life in Q2: year-on-year GDP went up by 3.2%.

China avoided consecutive quarters of negative growth, escaping the technical definition of recession. China was the only major country recording positive growth in Q2 2020.

China GDP continued to grow in Q3 2020, with year-on-year growth of 4.9%.

The pace has since accelerated. The Chinese economy grew 6.5% in Q4 2020, compared to a year ago. This was notably higher than pre-pandemic growth rates.

Chart 1 – China actual quarterly GDP growth % 2019 to 2020

Source: OECD

2. Thirty five years of growth

China’s economic miracle has lasted more than three decades. After recording 10% growth in 1987-88, China slowed in 1989-90, following violent repression of the pro-democracy protests in Tiananmen Square, Beijing, in June 1989. That led to a stark interruption of steady liberalization of the Chinese economy.

High growth rates returned quickly by 1991, and ran unabated until 2019. GDP grew by more than 9% per annum over those thirty years.

Of course, there have been significant hiccoughs along the way. The Chinese economy was already slowing dramatically before the outbreak of Covid, recording GDP growth of only 6% in 2019.

Going into 2020, The World Bank forecast 1%-2% growth for China; the IMF forecast 2%.

China’s eventual 2.3% growth in 2020 bucked the global trend. Other nations are still weighed down in the throes of the pandemic. All major global players except China, will record negative annual growth in 2020, according to IMF and the World Bank. And yet, the pandemic is apparently receding in the rearview mirror for China.

The World Bank estimates the US economy shrank by 3.6% in 2020, Japan shrank by 5.3%, and the Euro area shrank by a depressing 7.4%.

Chinese GDP per capita now exceeds US$10,000 for the first time in history, with almost no population growth at all.

Chart 2 – China actual GDP growth % 1985 to 2020 and forecast to 2025

Source: IMF

3. An aggressive President Xi

President Xi Jinping this week restated the importance of economic growth, highlighting “balance” in the Chinese economy, with strength in agriculture, more investment in infrastructure, and innovation in the tech sector.

President Xi reported reliable harvests and grain production for 17 years in a row, as well as breakthroughs in scientific explorations including the Tianwen-1 (Mars mission), Chang’e-5 (lunar probe), and Fendouzhe (manned deep-sea submersible). Development of the entire Hainan island, which is comparable in size to Taiwan, into the Hainan Free Trade Port, is proceeding at pace.

2021 will also mark the start of China’s 14th five-year plan, a closely watched road map covering 2021–25.

The World Bank is optimistic about China, predicting 2021 GDP growth of 7.9%, almost double the global growth projection of 4%.

Of course, outside observers are sceptical about the accuracy China’s reported figures, which are presented as part of President Xi’s nakedly political PR efforts. Nonetheless, BDA sees clear evidence of confidence and momentum, as Chinese private equity and IPO markets remain positive. It will be harder to achieve double digit growth, given the bigger base today, but there’s every reason to see that China will keep growing well.

Ignoring wide criticism of China’s maritime expansion, iron fisted rule over Hong Kong, and repression over the Uighurs in the northwest, Xi Jinping is asserting himself as aggressively as ever: “China will keep striving, marching ahead with courage, to create brighter glory”, he stated in his New Year’s address.

China’s ability to expand, even as the world fights to control Covid that has killed two million people, underscores the country’s success in taming Covid within its borders, and cements its unchallenged role as the dominant economy in Asia.

For now, the economic data reveal an economy still driven primarily by industrial production and investment rather than consumption. And yet, China consumer confidence is also recovering well.

4. China is unique

China’s growth makes it an outlier even among the greatest global economies. The World Bank expects the US economy to have contracted by 3.6% in 2020, and the Eurozone’s to have shrunk by 7.4%, reflected in global economic contraction of 4.3%.

This good momentum means that further recovery in China will likely have to take place without significant stimulus from the Government.

Provincial and local governments in China have some US$300bn in unspent stimulus money left over from 2020.

The export bonanza saw China ship 224 billion masks around the world from March to December 2020: 40 masks for every man, woman and child on the planet outside of China.

Domestic consumer demand may be sluggish in 2021, as wage growth is not yet back to pre-pandemic levels. That may explain Xi’s efforts to sound bullish, but the CCP under Xi tends to avoid sharp turns in policy.

China’s increasingly tense relationship with the US has caused China to pivot towards the EU, which was supported by both sides reaching an agreement on the EU-China Comprehensive Agreement on Investment in late 2020. Contrast this to the US, where in his final weeks in office, President Trump tightened restrictions on Chinese companies, to curb China’s tech sector dominance. This tension is worrying to financial markets. Wall Street is watching to see whether the incoming administration under President Biden will soften this stance at all.

Meanwhile, life continues relatively undimmed across China. People are going to restaurants again, particularly in affluent cities like Shanghai and Beijing. Service businesses like hotels and restaurants are performing well in the big coastal cities, but have not yet recovered in the inland provinces.

After its staggering success in taming the coronavirus, China has suffered renewed smaller outbreaks in the last month or so. The government mobilized quickly, building hospitals, imposing mass testing and putting 30 million people back under lockdown. The intrusive health checks will discourage consumers in the northeast from spending. Chinese families remain wary of big-ticket expenditures, new cars, or extensive home remodeling.

Retail sales growth stuttered in December, slowing to 4.6% from 5.0% the month before. The “Made in China” label has gained popularity, as people stuck in their homes cautiously redirect their spending. The consumer electronics sector has been especially resilient.

Beijing has ramped up its infrastructure spending. Every major city in China is now connected with high-speed rail, enough to span the continental US seven times. New lines were rapidly added last year to smaller cities. New expressways crisscrossed remote Western provinces. Construction companies turned on floodlights at many sites so that work could continue around the clock.

Despite reports to the contrary, China remains the workshop of the world. China’s exports grew 18.1% in December compared with the same month a year earlier, and 21.1% in November.

IPOs are booming as entrepreneurial companies go public at breakneck pace, across China. At BDA, we see M&A markets which are robust, and booming.

This explains why private equity and institutional investors are betting that China, which seemed like it might fall out of fashion in 2020, will continue to shine, and outperform the rest of the world.

Miraculously, China is approaching the Lunar New Year in rude health. 2021 will be the Year of the Ox, a fitting image for the Chinese economy.

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes. BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese government-owned bank with US$150bn of assets.

US securities transactions are performed by BDA Partners’ affiliate, BDA Advisors Inc., a broker-dealer registered with the Securities and Exchange Commission (SEC). BDA Advisors Inc. is a member of the Financial Industry Regulatory Authority (FINRA) and SIPC. In the UK, BDA Partners is authorised and regulated by the Financial Conduct Authority (FCA). In Hong Kong, BDA Partners (HK) Ltd. is licensed and regulated by the Securities & Futures Commission (SFC) to conduct Type 1 and Type 4 regulated activities to professional investors. www.bdapartners.com

Euan Rellie, Co-Founder and Senior Managing Director of BDA, in New York, recently joined a webinar International Business Briefing: What is the Future of the China Market, hosted by the US-China Business Council and Faegre Drinker.

Euan shared insights on M&A trends in China and Asia:

- China M&A Overview

- In 2019, China-related M&A transactions slumped significantly, reaching the lowest transaction value since 2013

- Major drivers were: Drop in outbound M&A (dropped 37% in value) and Drop in Private equity deals (dropped 22%)

- Outbound deals have been discouraged by increased scrutiny of CFIUS review in the US; national security review in Europe; Beijing’s controls on outbound capital flows

- Inbound transactions reached US$20bn in 2019, representing a 5.6% growth YoY

- China as a market for US companies: Large inbound acquisitions in China have always been rare; acquisitions by US companies have mostly been small/medium sized

- Impact of the trade war: Punitive actions against China will continue. Even if Trump loses in November, investors don’t expect a significant change in the US approach to China. The tone and tactics will change

- Developments during the pandemic: China becomes a refuge for US companies after overcoming COVID-19. China’s economy is slowly recovering, growing by 3.2% in Q2 2020 as retail and luxury sales experience a strong rebound. The recovery is unbalanced, which has widened the wealth gap

- Hong Kong isn’t over for foreign investors, despite the National Security Law: Hong Kong will remain the hub for inbound and outbound mainland investments

- China M&A going forward:

- In the short term, Chinese investors will be focused on domestic consolidation and less active in outbound M&A. Growth in inbound deals is expected, but a red-hot IPO market and high valuations in China could prevent this from growing fast

- In the medium/long term, we expect frequent sales of family-owned businesses. As China faces rising tension with the US, the PRC Government work to ease regulations on inbound M&A

If you want a copy of the slides, or would like to discuss any of these topics, please contact us.

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 24 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese government-owned bank with US$150bn of assets.

US securities transactions are performed by BDA Partners’ affiliate, BDA Advisors Inc., a broker-dealer registered with the Securities and Exchange Commission (SEC). BDA Advisors Inc. is a member of the Financial Industry Regulatory Authority (FINRA) and SIPC. In the UK, BDA Partners is authorised and regulated by the Financial Conduct Authority (FCA). In Hong Kong, BDA Partners (HK) Ltd. is licensed and regulated by the Securities & Futures Commission (SFC) to conduct Type 1 and Type 4 regulated activities to professional investors. www.bdapartners.com

We spoke to Huong Trinh, Managing Director and Head of the BDA Partners Ho Chi Minh City office, about the latest exciting developments in M&A in Vietnam.

You worked on the largest inbound private sector industrial transaction in Vietnam in the last three years, the sale of Thipha & Dovina to Stark Corporation, for US$240m. Why were Thipha & Dovina such an attractive investment opportunity for an international buyer?

Thipha & Dovina are a leading electric cable and non-ferrous metal group with a 30-year history. The companies grew revenues at an average 20% per annum for the period 2015-2019, and revenue exceeded US$500m.

This asset offers direct exposure to Vietnam’s economic growth. Vietnam has been emerging as a manufacturing hub in the region given its relatively low labor cost and strategic location. In 2019, Vietnam recorded GDP growth of ~7%, and is expected to remain a regional outperformer. Significant investment in infrastructure is underway. The government and business led spending will drive demand for cable and wiring for the foreseeable future.

Thai buyers are consistently interested in Vietnamese assets, and have made several significant investments in Vietnam over the last few years.[1]

Do you think there will continue to be inbound interest in Vietnamese companies from the rest of Asia and further afield in the future? If so, what are the key reasons?

Obviously yes, as we have received lots of indications of interest for high-quality industrial assets, as well as other sectors, from both global and regional buyers. We believe the strong inbound interest is mostly driven by the following factors:

- Vietnam’s economy is driven by consumer spending, which accounts for close to 70% of its GDP. With the third largest population in ASEAN, and the expansion of upper and middle-income earners, the economy is expected to grow further. Despite the disruption from COVID-19, Vietnam is expected to still enjoy ~3% economic growth this year and is expected to bounce back to 6% growth in 2021[2]

- Vietnam will benefit from recently signed Free Trade Agreements (CPTPP & EVFTA), which encourage more foreign direct investment into the country and put in place lower tariff structures. This is also an indicator of strong EU-Vietnam relations

- Vietnam has been emerging as a manufacturing hub in the region given its relatively low labor cost, but with increasing quality and a strategic location with many seaports nationwide. Global companies started shifting operation to Vietnam in 2010, and this trend has been accelerated by the ongoing US-China trade tensions

Are there opportunities in Vietnam for BDA to sell founder owned businesses in the future?

We believe there are still many more opportunities in Vietnam to advise founders on the sale of their businesses in the short term. There are still a lot of sizable and high-quality assets in the market that have grown into market leaders over the course of several decades and which have undergone different phases of development. They may need a new “growth engine” or investment to remain competitive and in some cases the founders are simply looking to exit and step back from the company they founded.

In addition, improved legal framework and corporate governance are making it easier and more transparent for foreign investors, giving them greater confidence to acquire majority stakes.

We are currently mandated on a number of projects thanks to: (i) a combination of our strong relationship with both strategic and financial sponsor buyers because of our global network; (ii) a senior team on the ground in Vietnam (especially important during COVID-19); and (iii) excellent execution capabilities which are laser-focused on delivering the best outcome for our clients.

Which will be the most attractive sectors in Vietnam for M&A in the post COVID-19 environment and why?

Internet-related businesses have been growing rapidly during COVID-19. Online, or online-to-offline, products and services have seen significant growth. This is not just a short-term effect; consumer behaviour is changing, and this is a long-term sustainable shift in consumer dynamics. Average order value on e-commerce sites rose by over 35 percent year-on-year in the first half of this year.

People are still spending money on shopping, a good sign given the fears that demand would fall during the COVID-19. The best performer was the groceries and fresh food, following by household supplies, homecare and healthcare products. Shopping malls are now packed with people like COVID-19 was never here.

For the industrials sector, COVID-19 has been certainly a catalyst for business owners to consider a transaction. The underlying reason was the fundamental change in the economic outlook domestically and globally, which has urged a number of investors to look for a more stable and “safer” destination whilst business owners see the benefits of having a “big brother” who is financially strong together with them to grow the business, especially during the unstable periods.

Healthcare is another attractive sector for investors. Some of the healthcare sub-sectors are performing well during COVID-19, while some are not. The sector will likely see lower cash flow in 2020 compared to 2019. Hospitals face a huge negative impact on revenue as they have had to cancel many profitable surgeries and procedures, while spending more on staffing and getting extra protection equipment for work. In contrast, personal protective equipment companies are seeing significant revenue growth, and the pharmaceutical sector will continue to grow strongly post pandemic.

Industrial real estate and logistics will also grow, thanks to multinational companies shifting their manufacturing base from China, and the requirement for logistics and supply chains to keep up.

Sectors that have been temporarily hit by COVID-19, such as food & beverage, hospitality and discretionary retailing, present opportunities at attractive valuations for buyers who are confident of a strong bounce back after COVID-19.

Do you see any changes in perception towards M&A processes in Vietnam? Have handshake deals been completely replaced by more structured processes?

Compared to a decade ago, the perception towards M&A has been changed drastically among business owners, government agencies and investors/buyers in a positive way. As Vietnam’s economy has opened up, we have witnessed more and more large deals that have brought positive growth to the target companies and benefits to all stakeholders. As awareness of the positive benefits of M&A has grown, shareholders are now more open to adding M&A as a strategic option in their growth trajectory and strategy. Sellers are becoming more educated in terms of an M&A process and key concepts. I still remember 15 years ago, it took me a lot of time to explain to the business owners how investors would value a business, which was not only based on how many land use rights the company held or how famous their company was.

For small deals, or deals between two domestic parties, handshake deals are still common, with all the decisions being made quickly, top down. However, we see people are taking a much more structured approach for medium and large domestic deals or cross-border deals. These deals will involve a variety of advisors as shareholders see the benefits of having an official process and professional advice: (i) better positioning the company; (ii) consistent and organised approach; (iii) a more competitive process will result in better equity valuation and terms; and (iv) increase the certainty of the deal completing and reduce the associate deal risks.

As BDA has a local team in Vietnam, we are happy to be trusted by local business owners to give them advice and help them to run a structured M&A process.

How do you see international investors completing transactions with Vietnam’s borders still shut?

BDA has signed and/or completed three transactions so far in 2020 without the buyers coming into Vietnam for the closing/signing.

This was a key concern when COVID-19 started, but as things have progressed, it is really a matter of how much both sides like the deal and how we, as the advisor, add value. We have been very creative with our sale processes. For example, helping the investor hire a local advisor to do the site visit/management meeting on the ground in Vietnam; arranging for the seller to take high-quality videos of the factories and assets, and so on. These creative approaches help to get deals done.

According to the AVCJ, 2019 was a record year for the number of PE / VC investments in Vietnam. Do you expect to see a rise in domestic and international private equity investment in Vietnam continuing in 2020 and 2021?

From a macro level value creation process perspective, Vietnam will continue to enjoy: (i) stable, unparalleled economic growth compared to other Southeast Asia countries, especially amid the COVID-19 situation; (ii) an influx of advantages from the recent free trade agreements; and (iii) strong government push to privatize state-owned enterprises. From a micro-level perspective, Vietnamese companies are getting more professional with stronger management teams and better corporate governance. They are more open to foreign investors as they see the different values that both strategic and financial investors can bring to the companies.

There is increasing demand for growth capital in 2020-2021. The private sector in Vietnam, with its strong momentum, will need more capital to pursue transformational changes and achieve further growth. The start-up ecosystem is seeing robust expansion, with internet related companies as the most attractive sector.

We, at the BDA Partners Ho Chi Minh City office, are seeing strong demand for growth capital and exits from both founder-backed and private equity owned companies. This is visible from our numerous live deals and strong pipeline/opportunities for 2021.

Contact us for more details on the insights

[1] In 2014, Berli Jucker Pcl announced a US$879m transaction to acquire Metro Cash & Carry Vietnam. In 2015, Central Group through its subsidiaries, Power Buy, bought 49% stake in Nguyen Kim Trading Company. In 2016, Central Group acquired Big C Vietnam, a supermarket chain, with a transaction value of US$1.0bn. In 2017, ThaiBev Group, through its subsidiary Vietnam Beverage, has acquired majority stake in Sabeco, Vietnam’s largest brewery company, with a deal size of US$4.8bn. SCG, a Thailand conglomerate, has done a number of transactions in construction materials and packaging in Vietnam.

[2] HSBC research shows Vietnam enjoying very strong internal domestic demand even during COVID-19. Nielsen research indicated that Vietnamese consumers remain 2nd in ASEAN in terms of being positive.

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 24 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese government-owned bank with US$150bn of assets.

US securities transactions are performed by BDA Partners’ affiliate, BDA Advisors Inc., a broker-dealer registered with the Securities and Exchange Commission (SEC). BDA Advisors Inc. is a member of the Financial Industry Regulatory Authority (FINRA) and SIPC. In the UK, BDA Partners is authorised and regulated by the Financial Conduct Authority (FCA). In Hong Kong, BDA Partners (HK) Ltd. is licensed and regulated by the Securities & Futures Commission (SFC) to conduct Type 1 and Type 4 regulated activities to professional investors. www.bdapartners.com

Unparalleled economic disruption, a resurgence in COVID-19 cases and heightened trade tensions are stealing newspaper headlines but also mask fundamental developments in trade and investment. In this piece, we examine some of the latest market trends that are taking place in Asia and globally against a backdrop of increased economic uncertainty and geopolitical tension.

The Asian Century

The rise of Asia remains undisputed and will continue to power global GDP growth going forward. A brief glance shows unparalleled milestones:

– 50% of world GDP is expected to be Asian by 2024, and drive 40% of the world’s consumption

– 21 of the top 30 largest cities are now in Asia

– From 2000 to 2019, China increased its GDP from just over US$1trillion to US$14trillion

While 2021 will see some rebound in western economies as they emerge from COVID, this economic growth is likely to be lacklustre compared with mid and long-term growth rates in Asia.

In our latest piece, Shifting sands: changes in trade and investment in an uncertain world, the BDA team examined some of the latest market trends that are taking place in Asia and globally against a backdrop of increased economic uncertainty and geopolitical tension. We look forward to helping you make sense of these changes and navigate through uncharted waters.

We hope you find it helpful. If you would like to discuss, please contact us:

Jonathan Aiken, Managing Director, London: jaiken@bdapartners.com

Simon Kavanagh, Managing Director, Hong Kong: skavanagh@bdapartners.com

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 24 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese government-owned bank with US$150bn of assets.

US securities transactions are performed by BDA Partners’ affiliate, BDA Advisors Inc., a broker-dealer registered with the Securities and Exchange Commission (SEC). BDA Advisors Inc. is a member of the Financial Industry Regulatory Authority (FINRA) and SIPC. In the UK, BDA Partners is authorised and regulated by the Financial Conduct Authority (FCA). In Hong Kong, BDA Partners (HK) Ltd. is licensed and regulated by the Securities & Futures Commission (SFC) to conduct Type 1 and Type 4 regulated activities to professional investors. www.bdapartners.com

Originally published as an op-ed in the Barron’s

In the 1990s, financiers used to mock “the FILTH”: British bankers or business people who “fail in London, try Hong Kong.” If you couldn’t make it anywhere else, you could still make it om the shores of the fragrant harbor whose ever-rising tide floated all boats. Hong Kong was the Manhattan, Las Vegas, and Los Angeles of Asia, all rolled into one—money, nightclubs, fast cars, world-class restaurants, stock-market booms, beaches, yachts, and dodgy go-go bars. It was a boomtown because it was the gateway to China. This was the staging post for the greatest gold rush of the 20th century: the reawakening of the Chinese dragon. Despite the recent crackdown on civil liberties, Hong Kong is far from turning into a financial backwater. As long as opportunity still exists, it will continue to attract foreign investors who feel more at home there than on the mainland.

Expats have long preferred Hong Kong to Shanghai or Beijing. The city boasts better schools, hospitals, and espresso bars. Google still works. Unlike on the mainland, business and society has felt free. While the British had never granted Hong Kong true democracy, the rule of law was clear. Private-equity firms enjoyed a fairly level playing field, taxes were low, the press was free, and the judiciary was independent. That’s why Britain fought so hard for the principle of “one country, two systems,” which was enshrined into law, for 50 years, when Hong Kong reverted to Chinese rule. China promised to give Hong Kong the democracy that Britain had denied its colony. Of course, the truth has emerged rather differently.

Suddenly, Hong Kong is out of fashion. Riots, the Covid-19 pandemic, and Chinese government repression have combined to scare away those same expats who made it their home. Six weeks ago, China imposed a broad national-security law on Hong Kong banning secession, subversion, and collusion with foreign countries. It’s already having a dramatic effect on the city’s media and politics. The new law eliminates civil rights that local residents have long exercised, and raises the specter of foreign business people being arrested for vaguely defined offenses and being deported to stand trial in China.

Beijing, far from liberalizing, is cracking down on dissent inside and outside its borders. The new security law explicitly applies beyond Hong Kong and covers non-Hong Kong residents, making this once freewheeling city dangerous for anyone viewed unfavorably by Beijing. Growing economic tensions between the U.S. and China have also led to tariff and nontariff barriers.

Last week, more than 200 police officers raided the head office of Apple Daily, the city’s most-read pro-democracy newspaper. Several managers were arrested, including the paper’s high-profile, millionaire owner, Jimmy Lai. Lai faces an array of charges, notably collusion with foreign countries, under the new law. He has a good relationship with the Trump administration and has testified before Congress in the past.

At the same time, China is trying to reassure the world that it should still do business with Hong Kong. For the foreseeable future, the city will still be the hub for inbound and outbound mainland investment. While Singapore has gained traction with private-equity professionals, boasting a transparent legal framework and increasingly broad tax treaty, Hong Kong is countering with incentives of its own. A new Limited Partnership Fund Bill hopes to establish Hong Kong as a prime Asian destination for private-equity and venture-capital funds. The legislation proposes Hong Kong as a domicile for private equity, venture capital, and real-estate funds and will attract private funds and family offices to Hong Kong. Domiciling in Hong Kong would give these firms direct access to the region and to Hong Kong’s robust capital markets. It will be a catalyst for growth in tech and financial services.

Officials have also announced plans to introduce a new carried-interest tax scheme, expected to be one of the world’s most liberal, intended to make the city a viable alternative to the Cayman Islands, especially for Asia-focused funds. The Hong Kong government is also planning to provide extensive tax concessions for private-equity funds’ “carried interest” performance fees. Singapore offers similar advantages, but Hong Kong is aiming to be even more generous to investors.

All of this will be attractive to investors as Hong Kong is still swimming in wealth. Tycoons have outperformed almost everyone else. With a population of only 7.5 million, the territory ranks seventh in the world with 96 billionaires and a combined wealth of $280 billion, according to Wealth-X’s Billionaire Census 2020. Of all world cities, only New York can boast more billionaires.

Hong Kong is clearly now part of the People’s Republic of China and, prompted by the government, mainland money is pouring in,but there’s little sign of foreign capital fleeing. Foreign investors who want to share in China’s economic growth have little choice but to use Hong Kong’s capital markets as their main vehicle. The Hong Kong dollar has held its trading band against the U.S. dollar. The stock market has seen heavy inflows from mainland institutions, and there are more and more “red-chip” companies, based in mainland China, but listed on the Hong Kong Stock Exchange. The Hang Seng Index fell sharply in the first quarter but has recovered 14% from its March low. The index is still 9% off its peak from two years ago, yet rumors of Hong Kong’s demise may be exaggerated, or just plain wrong.

Even though China has put a harness around the neck of its golden goose, Hong Kong’s economy is too precious to kill. Vietnam and Singapore are certainly benefiting from Hong Kong’s recent woes as expats move in and fund managers direct more money into those markets. Still, as long as Hong Kong’s financial advantages remain, Western professionals and investors may find themselves back in the gleaming office towers of Hong Kong Central quicker than they expect.

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 24 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese government-owned bank with US$150bn of assets.

US securities transactions are performed by BDA Partners’ affiliate, BDA Advisors Inc., a broker-dealer registered with the Securities and Exchange Commission (SEC). BDA Advisors Inc. is a member of the Financial Industry Regulatory Authority (FINRA) and SIPC. In the UK, BDA Partners is authorised and regulated by the Financial Conduct Authority (FCA). In Hong Kong, BDA Partners (HK) Ltd. is licensed and regulated by the Securities & Futures Commission (SFC) to conduct Type 1 and Type 4 regulated activities to professional investors. www.bdapartners.com