BDA celebrates 30 years of global investment banking

BDA Partners will celebrate its 30th year of doing business in 2026.

BDA is a premier global investment banking firm, specializing in cross-border M&A, capital raising, and financial restructuring.

BDA is exceptionally well-positioned for 2026.

BDA’s 2025 performance featured 20+ announced deals, including the landmark $2.35bn Coforge-Encora acquisition. BDA worked on transactions involving Advantage Partners, Advent, Bose, CDIB Capital, DAOL Private Equity, Flipspaces, Frasers, Marunouchi Capital, Multiples, Northstar, Oji Paper, Warburg Pincus, Wartsila and Woori Private Equity.

This underscores BDA’s robust momentum and leadership in global and Asia-focused transactions. With nine offices (New York, London, Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, Tokyo) and strategic partnerships with William Blair and the Development Bank of Japan, BDA is primed to capitalize on the Asia-Pacific M&A revival, falling interest rates, and strong demand in the Tech Services, Consumer, Health, and Industrials sectors.

We’re grateful, always, to our clients, our counterparties, our shareholders, our families – and to our talented and hard-working colleagues. We’re excited for the coming year.

At the recent Vietnam M&A Forum in Ho Chi Minh City, BDA was recognised as The Outstanding M&A Advisor for 2024–2025.

Organized by Vietnam Investment Review (VIR) under the auspices of the Ministry of Finance, the Vietnam M&A Forum has become a prestigious annual event for M&A and investment networking.

This marks BDA’s sixth win in a row, underscoring the strength, agility, and resilience of our Vietnam platform, and the trust of our valued clients.

The 2025 Forum, themed “New Position – New Momentum”, brought together leading domestic and international businesses to celebrate excellence in M&A.

Huong Trinh, Partner and Head of Ho Chi Minh City at BDA Partners, accepted the award on behalf at the ceremony held on December 9th at the JW Marriott Saigon.

Huong Trinh said: “We’re thrilled to share the news that BDA has been named VIR’s Outstanding M&A Advisor for 2024–2025. It’s a remarkable sixth consecutive win. As the market moves forward with renewed vigor, this recognition shines a spotlight on the strength, agility, and resilience of our Vietnam platform. We’re grateful for the unwavering support of our blue chip and fast growing clients. We’re appreciative of our hard working, highly effective team members. We look forward to creating new growth opportunities, and delivering exceptional results, in the year ahead”.

About BDA

BDA Partners is the global investment banking advisor. We are a premium provider of Asia-related advice to sophisticated clients globally, with 30 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services, Sustainability and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes. BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese government-owned bank with US$150bn of assets.

US securities transactions are performed by BDA Partners’ affiliate, BDA Advisors Inc, a broker-dealer registered with the Securities and Exchange Commission (SEC). BDA Advisors Inc. is a member of the Financial Industry Regulatory Authority (FINRA) and SIPC. In the UK, BDA Partners is authorized and regulated by the Financial Conduct Authority (FCA). In Hong Kong, BDA Partners (HK) Ltd is licensed and regulated by the Securities & Futures Commission (SFC) to conduct Type 1 and Type 4 regulated activities to professional investors. bdapartners.com

BDA Partners Ho Chi Minh City office is active in the healthcare sector. Huong Trinh, Partner and Yen Pham, VP at BDA Partners wrote an article for Vietnam Investment Review.

Vietnam’s healthcare sector closed 2025 with robust M&A momentum. Transactions from institutional investors demonstrated the market’s depth, while established platforms backed by private equity pursued add-ons and expansion. The year demonstrated that Vietnam is achieving multiple growth vectors simultaneously.

Notably, Livzon Group acquired 65% in Imexpharm from SK for $221m. Through this deal, Livzon secured access to Imexpharm’s four EU-GMP certified plants and its 10% share of the domestic antibiotics market.

This acquisition underscores a market reality: given strict restrictions on foreign pharm distribution, buying established manufacturers remains the most efficient path to market access.

The rationale extends beyond domestic access. Vietnamese manufacturers with international certification serve as contract manufacturing platforms for ASEAN, offering regional cost-effective production bases with preferential trade access through Vietnam’s free trade network.

Healthcare services dominated deal activity, attracting institutional investors and funds. Two platform investments captured attention. Ares’s Medlatec investment was the global investment manager’s first healthcare bet in Vietnam. Quadria Capital’s Tam Tri Medical acquisition brought Quadria back into Vietnam’s hospital sector after it exited FV Hospital in 2023.

Next year, PE-backed platforms such as Xuyen A (Warburg Pincus), Phuong Chau (CVC), and Mat Sai Gon (KKR) will pursue bolt-ons for geographic expansion or speciality capabilities.

Exit opportunities will also emerge, as PE investments from 2020-2022 are approaching their natural hold periods. Successful exits will establish new valuation benchmarks for Vietnam. Exits demonstrating good returns will validate the investment thesis and trigger increased capital allocation.

Success in 2026 will come to different players: new investors looking to make their first acquisition, existing healthcare operators expanding through add-ons, and healthcare companies preparing for M&A. Vietnam’s healthcare sector is sure to be one of SE Asia’s most active markets.

Read the full article on VIR here.

About BDA

BDA Partners is the global investment banking advisor. We are a premium provider of Asia-related advice to sophisticated clients globally, with 30 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services, Sustainability and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes. BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese government-owned bank with US$150bn of assets.

US securities transactions are performed by BDA Partners’ affiliate, BDA Advisors Inc, a broker-dealer registered with the Securities and Exchange Commission (SEC). BDA Advisors Inc. is a member of the Financial Industry Regulatory Authority (FINRA) and SIPC. In the UK, BDA Partners is authorized and regulated by the Financial Conduct Authority (FCA). In Hong Kong, BDA Partners (HK) Ltd is licensed and regulated by the Securities & Futures Commission (SFC) to conduct Type 1 and Type 4 regulated activities to professional investors. bdapartners.com

At BDA Partners, we believe in making a positive impact beyond business. Each year, we empower our employees to dedicate a day to volunteer with local organizations—leaving behind laptops, conference calls, and emails; they make a difference in the communities we serve.

In 2025, all our offices participated in BDA CSR Day, illustrating the power of collective action and meaningful change.

Hong Kong

The Hong Kong team volunteered at Crossroads Foundation, a charity dedicated to serving global and local needs. Our team was divided into groups to assist across multiple departments, including processing donated items, maintaining warehouse operations, and assembling furniture for distribution. Tasks ranged from sorting, packing, and refurbishing goods to moving furniture and preparing event spaces. We enjoyed the opportunity to support the community through hands-on involvement.

Ho Chi Minh City

The Ho Chi Minh City team volunteered at TSC Church, which has been providing 400 meal boxes daily to the needy for over 20 years. Our day began in the kitchen, preparing fresh ingredients and cooking meals under the guidance of senior volunteers. By midday, we packaged hundreds of meals and distributed them to families, children, and elderly individuals in the community. The activity showcased the importance of collaboration and efficiency in supporting large-scale food programs. We are grateful to TSC Church for the opportunity to contribute and to our team members for their generous support of the charity fund.

Seoul

The Seoul team volunteered at Wongaksa Free Meal Center, an organization that has provided daily lunches to low-income seniors and homeless individuals since 1993. We donated KRW 1.5 million to support the purchase of food ingredients and assisted with meal service throughout the day. Our team helped distribute, serve, and wash dishes, ensuring 300 people received warm meals. The activity highlighted the operational commitment required to sustain such programs and the impact they have on vulnerable communities. Our Seoul team was happy to assist Wongaksa’s mission and support its long-standing efforts.

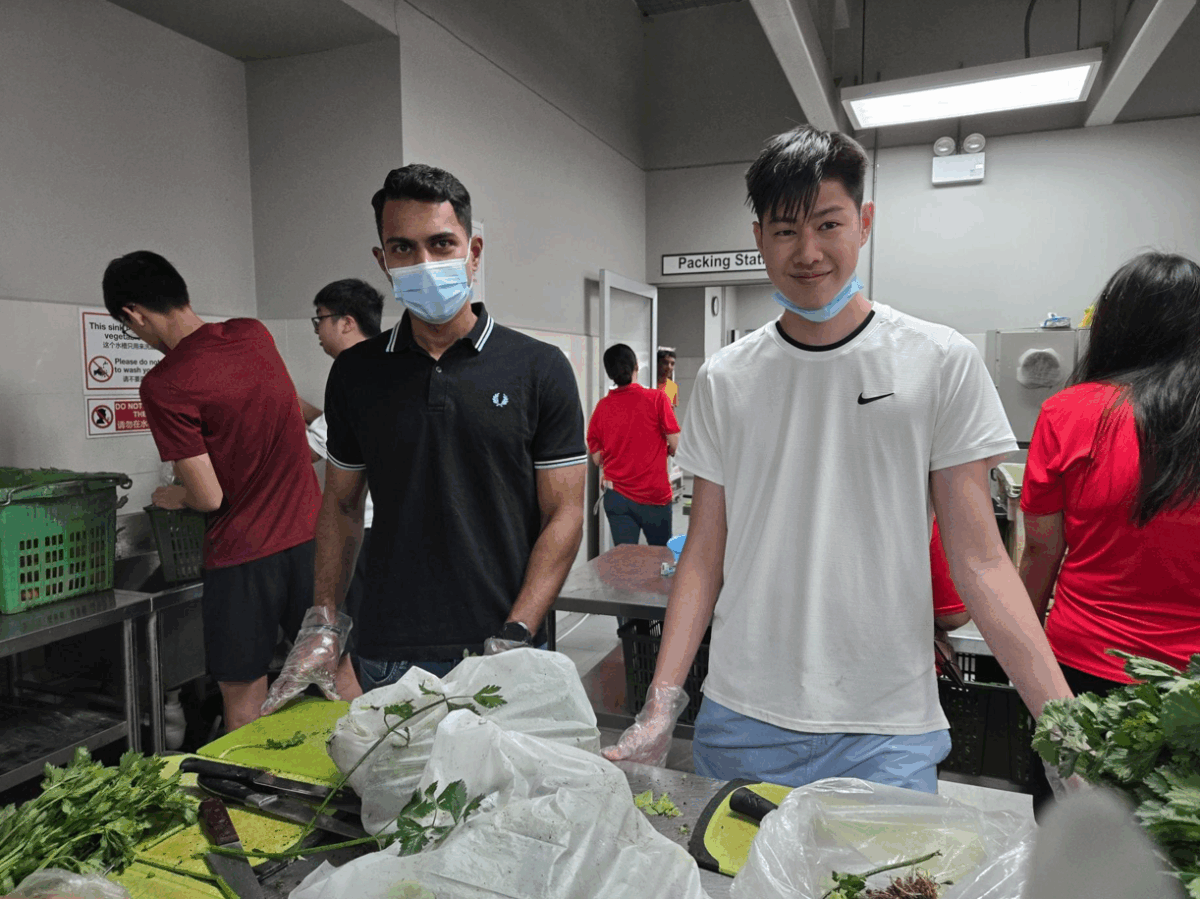

Singapore

The Singapore team volunteered at Willing Hearts, a non-profit operating one of the largest soup kitchens in Singapore. The organization prepares and delivers thousands of meals daily to beneficiaries, including the elderly, disabled, low-income families, and migrant workers. Our team assisted with food preparation tasks such as washing, peeling, and cutting vegetables, as well as sorting bulk ingredients for distribution. The visit offered insight into the scale and efficiency required to sustain such an operation and the critical role volunteers play in its success.

Tokyo

The Tokyo team participated in a community cleanup organized by the local residents’ association near our office. Alongside more than 100 participants, we collected litter around the neighborhood, including cans, bottles, and cigarette butts. After the cleanup, participants enjoyed complimentary coffee from Starbucks, reinforcing the sense of community and shared responsibility.

London

The London office participated in a year-long mentoring program with Envision, a charity focused on helping young people build confidence and essential skills. Running from September 2024 to June 2025. The project centered on fundraising for women’s safety, with our team guiding students in planning, presenting, and executing their ideas. Additionally, the office joined Shelter’s “Walk for the Homeless,” a charity walk supporting individuals facing housing challenges.

New York

The New York team volunteered at Housing Works Bookstore in Soho, supporting their mission to help individuals affected by homelessness and HIV/AIDS. Our team assisted with sorting donated books, identifying ISBN numbers, and categorizing items for online sales. We also audited bookshelves to ensure accurate inventory and removed titles scheduled for de-listing. We appreciate the opportunity to contribute to their impactful work and support the local community.

About BDA Partners

BDA Partners is the global investment banking advisor. We are a premium provider of Asia-related advice to sophisticated clients globally, with 30 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services, Sustainability and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes. BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese government-owned bank with US$150bn of assets.

US securities transactions are performed by BDA Partners’ affiliate, BDA Advisors Inc, a broker-dealer registered with the Securities and Exchange Commission (SEC). BDA Advisors Inc. is a member of the Financial Industry Regulatory Authority (FINRA) and SIPC. In the UK, BDA Partners is authorized and regulated by the Financial Conduct Authority (FCA). In Hong Kong, BDA Partners (HK) Ltd is licensed and regulated by the Securities & Futures Commission (SFC) to conduct Type 1 and Type 4 regulated activities to professional investors. bdapartners.com

The global streetwear narrative has shifted irrevocably. Globally, the category is stabilizing, but across Asia, momentum is accelerating. The region has become the creative, cultural, and commercial engine driving the next chapter of streetwear.

Japan is the blueprint. Japan remains the creative foundation of modern streetwear. Harajuku and Ura-Hara transformed global skate and hip-hop influences into a uniquely Japanese aesthetic defined by craftsmanship, scarcity, and subcultural authenticity. Human Made’s IPO on the Tokyo Stock Exchange, slated for November 27, 2025, underscores how Japanese streetwear has evolved from niche subculture to institutional-grade business. The offering, priced at the top of its range, highlights how premium Japanese brands, rooted in heritage and authenticity, are attracting global capital and investor confidence.

Korea is the amplifier. K-pop and K-hip-hop turn niche labels into global names overnight, and stylists often drive more influence than designers. Airport fashion, social media, and MV styling act as real-time runways, powering brands like thisisneverthat, ADER Error, We11Done, and rising star Thug Club. In Korea, speed and visibility define success.

China is the commercial engine. China’s streetwear boom is powered by guochao—movement blending youth identity, cultural confidence, and modern design. Combined with the world’s most advanced digital commerce ecosystem, trends move from discovery to nationwide adoption in hours.

The convergence of Asian creativity, culture, and trends is crating the most compelling investment opportunity in a generation. The question is no longer if Asian streetwear will lead, but which brands will define the next decade.

BDA is at the nexus of this transformation. With deep regional expertise and a global M&A track record, BDA supports clients across the streetwear value chain—from identifying emerging brands to structuring cross-border partnerships and acquisitions. Asia is shaping the future of global streetwear, and BDA is ready to help investors and corporates capture this next wave of growth.

Read the full article here.

About BDA

BDA Partners is the global investment banking advisor. We are a premium provider of Asia-related advice to sophisticated clients globally, with 30 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services, Sustainability and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes. BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese government-owned bank with US$150bn of assets.

US securities transactions are performed by BDA Partners’ affiliate, BDA Advisors Inc, a broker-dealer registered with the Securities and Exchange Commission (SEC). BDA Advisors Inc. is a member of the Financial Industry Regulatory Authority (FINRA) and SIPC. In the UK, BDA Partners is authorized and regulated by the Financial Conduct Authority (FCA). In Hong Kong, BDA Partners (HK) Ltd is licensed and regulated by the Securities & Futures Commission (SFC) to conduct Type 1 and Type 4 regulated activities to professional investors. www.bdapartners.com

BDA Partners’ Ho Chi Minh City team spoke with DealStreetAsia about healthcare investing in Vietnam. The interview examines why venture-backed healthtech platforms have struggled post-pandemic and why private equity interest in traditional healthcare assets remains strong.

Key perspectives from BDA Partners:

- “The shift is towards hybrid models where digital serves as an access point but must be integrated with physical infrastructure to deliver sustainable value. Pure-play telemedicine has not found a strong product market fit in Vietnam’s context,” said Huong Trinh, Partner and Head of Ho Chi Minh City at BDA Partners

- “In contrast to venture-backed startups, PE investors are targeting operators with real assets and recurring revenue. They see value in consolidation and operational improvement plays rather than in subsidising user acquisition for unproven digital models,” Trinh explained

- “These ambiguities create a regulatory risk premium. As such, investors might apply a discount on valuations to account for compliance uncertainty,” added Trinh

- “Financial sustainability has become a central investment criterion. Investors look for startups with a clear path to profitability and proven unit economics at their current scale,” said Yen Pham, Vice President of BDA Vietnam

- “The unifying theme across these opportunities is the appeal of healthcare models that combine a physical footprint, insurance reimbursement, and solid unit economics. In contrast, pure-play digital health ventures are expected to remain niche in the near term, pending greater regulatory clarity and more mature payment infrastructure,” Trinh concluded

Read the full article on DealStreetAsia here.

About BDA

BDA Partners is the global investment banking advisor. We are a premium provider of Asia-related advice to sophisticated clients globally, with 30 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services, Sustainability and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes. BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese government-owned bank with US$150bn of assets.

US securities transactions are performed by BDA Partners’ affiliate, BDA Advisors Inc, a broker-dealer registered with the Securities and Exchange Commission (SEC). BDA Advisors Inc. is a member of the Financial Industry Regulatory Authority (FINRA) and SIPC. In the UK, BDA Partners is authorized and regulated by the Financial Conduct Authority (FCA). In Hong Kong, BDA Partners (HK) Ltd is licensed and regulated by the Securities & Futures Commission (SFC) to conduct Type 1 and Type 4 regulated activities to professional investors. www.bdapartners.com

Demand across Southeast Asia is moving rapidly up the value chain—from basic liquid milk toward yogurt, cheese, and functional dairy—driven by urbanization, a rising middle class, and growing preference for premium and health-oriented products.

The region’s dairy market is valued at approximately US$34bn in 2025 and is projected to reach US$46bn by 2030, growing at ~6% CAGR. Consumption remains relatively low—20–30 liters per capita in markets such as Indonesia and Vietnam versus 100+ liters in more mature economies—leaving significant room for growth.

The industry continues to move up the value curve as consumers shift beyond liquid milk into yogurt, cheese, and functional dairy. Investors are backing brands with strong local relevance, integrated supply chains, and clear premiumization potential. Since 2023, both strategic players and private equity funds have accelerated investment—supporting domestic champions, upgrading processing technology, and building regional platforms. Value-added categories are expanding the fastest and delivering stronger margins, setting the stage for sustained deal momentum.

Looking ahead, investors should monitor opportunities that balance growth with supply-chain resilience. Emerging local leaders are scaling quickly—and are becoming increasingly attractive acquisition targets.

Please read our full report here.

BDA is here to help.

About BDA

BDA Partners is the global investment banking advisor. We are a premium provider of Asia-related advice to sophisticated clients globally, with 30 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services, Sustainability and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes. BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese government-owned bank with US$150bn of assets.

US securities transactions are performed by BDA Partners’ affiliate, BDA Advisors Inc, a broker-dealer registered with the Securities and Exchange Commission (SEC). BDA Advisors Inc. is a member of the Financial Industry Regulatory Authority (FINRA) and SIPC. In the UK, BDA Partners is authorized and regulated by the Financial Conduct Authority (FCA). In Hong Kong, BDA Partners (HK) Ltd is licensed and regulated by the Securities & Futures Commission (SFC) to conduct Type 1 and Type 4 regulated activities to professional investors. www.bdapartners.com

One billion people worldwide will celebrate Diwali next week.

Diwali, also known as Deepavali and the Hindu “Festival of Lights,” is one of India’s most widely celebrated holidays. It overlaps with other harvest rituals and festivals. The dates for the holiday vary each year; they follow the lunar calendar. Diwali originated in India, 2,500 years ago. The festival, which expands to the Indian diaspora, is observed for up to five days.

Different religious traditions in India each fit their religious themes and narratives into Diwali. Some Hindus, for example, believe Diwali to be the return of Lord Rama, an avatar of Vishnu, from 14 years of exile. Other Hindus believe it to be the celebration of the killing of the asura (demon) Narakasura by Lord Krishna, another avatar of Vishnu.

Some Hindus see Diwali as a chance to worship and celebrate the Hindu goddess of wealth, Lakshmi. For others, Diwali is the victory of knowledge over ignorance.

Diwali celebrations for Sikhs commemorate the release of Guru Hargobind, imprisoned in 1617 and released in 1619.

Jains also celebrate Diwali. They do it in remembrance of the day Lord Mahavira, revered as one of the great teachers of the religion, who attained Nirvana or enlightenment.

In each of these Indic traditions, we find that Diwali holds some sort of significance and a reason for celebration, often a representation of hope and the victory of goodness.

To honor someone, you may place a garland of flowers around them, such as the statues of deities in the temples.

Diwali occurs on the night of a new moon, adding to the importance of lights during Diwali. In the darkness of night, roads and paths in India are lined with oil lamps illuminating the way to temples where gods and goddesses are honored among lights.

People will also clean their homes and ensure every room is lit with lamps the night of Diwali. Believers report that the goddess Lakshmi visits well-lit homes.

BDA Partners hosted a panel discussion and networking reception for senior energy sector executives, in New York on 10th September, alongside Development Bank of Japan, and Norton Rose Fulbright.

We connected leading Japanese corporates across the value chain, from oil and gas energy, energy services, and renewables, with counterparts in the US. We’re focused on the surge of outbound investment interest from Japan.

We convened the most ambitious investors and US industry players. The agenda focused on the impact of the ‘One Big Beautiful Bill Act’ (OBBBA) on energy investment in the US.

The conference featured a welcome address by Shingo Kobayashi, Managing Executive Officer of DBJ, and a keynote speech by Todd Alexander, Partner at NRF, on the implications of OBBBA for the US energy sector. We followed with panel discussions, moderated by Euan Rellie of BDA and Paul Sankey of Sankey Research, addressing renewable energy and oil & gas investment trends.

Senior representatives attended from: Aggreko, AIP, Captona, CFS Energy, Chevron, Chugoku Electric, Eneos Power, Excelsior Energy Capital, Fuyo General Lease, Generate Capital, Gevo, Harbert, Hess Corp, HOG Resources, Idemitsu Kosan, Invenergy, JAPEX, Jetro, Kansai Electric, KDB, Kingston Capital, Kyuden International, Marubeni, MicroEra Power, Mitsubishi, MOL Americas, NRG Transition, Nano Nuclear, Nishimatsu, Northern Star Generation, Osaka Gas, Primergy Solar, RWE Clean Energy, Sankey Research, Shizuoka Gas, Sionic Energy, Silverpeak, TEPCO, and Tokyo Electric.

Key takeaways include:

- The future of energy will not be defined by renewables or oil & gas alone, but by a pragmatic mix of both, highlighting the need for flexible investment strategies to balance sustainability with energy security and economic viability

- Japanese appetite for US energy is driven by confidence in US demand and market resilience, rather than short-term policy catalysts like OBBBA, signalling a long-term commitment to the sector

- Japan’s energy companies are looking abroad, reflecting demographics, limited domestic growth, and the need to secure stable, diversified energy supplies

- Japanese investors are highly sought-after partners, valued for their patience, flexibility, and reliability. They are increasingly aligning with US deal timelines and valuations, while offering long term capital and a collaborative strategic approach

Euan Rellie, Managing Partner, BDA Partners, said: “This event was a big success. BDA, DBJ and Norton Rose have resolved to make it an annual conference, going forward. We’re already working on multiple potential transactions as a result of these conversations in New York. I’m grateful to everyone who participated, and excited for what’s to come”.

About BDA

BDA Partners is the global investment banking advisor. We are a premium provider of Asia-related advice to sophisticated clients globally, with 30 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services, Sustainability and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes. BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese government-owned bank with US$150bn of assets.

US securities transactions are performed by BDA Partners’ affiliate, BDA Advisors Inc, a broker-dealer registered with the Securities and Exchange Commission (SEC). BDA Advisors Inc. is a member of the Financial Industry Regulatory Authority (FINRA) and SIPC. In the UK, BDA Partners is authorized and regulated by the Financial Conduct Authority (FCA). In Hong Kong, BDA Partners (HK) Ltd is licensed and regulated by the Securities & Futures Commission (SFC) to conduct Type 1 and Type 4 regulated activities to professional investors. www.bdapartners.com

Asian food has exploded from niche to mainstream, transforming North America’s dining and grocery landscape.

Once confined to small “ethnic aisles” or family-run eateries, the category is now a US$37bn market growing at over 5% annually, outpacing the broader food sector. Immigration, cultural influence, and Gen Z’s appetite for global flavors are fueling the shift—turning dumplings, ramen, and kimchi into everyday staples.

North America’s retail shelves and restaurants are proof of this momentum. H Mart has become a US$2bn powerhouse, Jollibee has crossed 100 locations, and mochi ice cream has gone from novelty to freezer-aisle must-have. Asian corporates like CJ, Ajinomoto, and Pulmuone are planting factories on US soil, while private equity has piled in—reshaping family-run businesses into billion-dollar platforms through modernization, consolidation, and brand building.

What was once “ethnic” is now essential. Underrepresented cuisines—Filipino, Vietnamese, Indian—are set to drive the next wave, with health, wellness, and fusion formats pushing boundaries. For strategics and sponsors alike, Asian food has moved from novelty to necessity, cementing itself as the next strategic growth engine.

BDA is actively tracking the best investment and acquisition targets in this fast-growing sector. Our cross-border expertise and track record in food and beverage M&A position us to help clients capture this transformation.