Jeff Acton speaks to Worldfolio on how BDA became the leading cross-border M&A advisor to Private Equity in Japan

Jeff Acton, Partner and Head of BDA’s Tokyo office, was recently interviewed by Worldfolio on how BDA Partners has established itself as the leading cross-border M&A advisor to private equity clients in Japan.

In the interview, Jeff discusses the firm’s long-standing presence in Japan, its track record advising on complex international transactions, and the role BDA plays in bridging Japanese sellers with global buyers. He also highlights the growing activity and opportunities within Japan’s private equity market, as well as the cultural and strategic nuances that define successful cross-border deals.

“We have been in Japan for a long time. We understand the domestic environment, the expectations and the needs of local clients. At the same time, we’re a global firm – so we can translate those needs into an international context and connect Japanese sellers with the right global buyers,” Jeff explains.

With 30 years of experience globally, BDA continues to deliver trusted, independent advice to clients navigating Japan-related cross-border M&A.

Read the full interview on Worldfolio here.

Bloomberg has featured commentary from BDA Partners in its latest article on Japan’s rising outbound M&A activity, spotlighting Nomura’s $1.8 billion acquisition of Macquarie assets as part of a broader trend.

Jeff Acton, Partner at BDA Partners Tokyo, noted:

“We are seeing an increasing level of interest in assets that could help move part of their supply chain to the US”

highlighting how geopolitical uncertainty and trade tensions are reshaping Japanese corporate strategy abroad.

According to Bloomberg, Japanese firms have announced nearly $28 billion in outbound deals so far in 2025—up nearly 70% from the same period last year. Despite global volatility, long-term investment strategies continue to drive Japanese companies to pursue strategic overseas growth.

Read the full article on Bloomberg

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with 30 years of experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services, Sustainability and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets.

US securities transactions are performed by BDA Partners’ affiliate, BDA Advisors Inc, a broker-dealer registered with the Securities and Exchange Commission (SEC). BDA Advisors Inc is a member of the Financial Industry Regulatory Authority (FINRA) and SIPC. In the UK, BDA Partners is authorized and regulated by the Financial Conduct Authority (FCA). In Hong Kong, BDA Partners (HK) Ltd is licensed and regulated by the Securities & Futures Commission (SFC) to conduct Type 1 and Type 4 regulated activities to professional investors. www.bdapartners.com

In 2023, the global women’s health market was valued at US$250-300 billion and is forecasted to reach US$500 billion by 2030, demonstrating a compound annual growth rate (CAGR) of approximately 10%. The market encompasses not only reproductive health but also cardiovascular diseases, osteoporosis, endocrine disorders, and mental health. Fueled by unmet medical needs and rapid innovation, the sector is primed for substantial expansion. This report provides a comprehensive analysis of the market’s current landscape, including its definition, key therapeutic areas, investment rationale, and notable transactions.

Key Observations from Recent Transactions:

- Enhanced Awareness Boosting Market Growth: Increasing awareness of women’s health issues is amplifying the market’s potential. This growing consciousness spans a comprehensive array of health conditions impacting women, not just limited to reproductive health, but significantly broadening the market’s scope

- Strategic Expansion and Investment by Major Corporations and Venture Capitals: Major corporations are solidifying their foothold in the women’s health arena through strategic mergers, acquisitions, and partnerships, particularly focusing on cutting-edge technologies. Simultaneously, venture capital firms are actively supporting startups with convertible bonds and growth equity. Additionally, the investment focus has expanded from traditional sectors like reproductive health, contraception, and fertility treatments to include broader areas. This shift signifies a deeper appreciation of the varied healthcare needs of women throughout their life cycle

- Innovation-Driven Growth: The market is characterized by continual innovation, with the introduction of new FDA-approved medical devices for treating conditions like uterine fibroids, and cervical and breast cancers. Developments in FemTech, telemedicine, wearable technology, and AI-driven diagnostics are transforming the sector, creating new avenues for growth

The women’s health sector is experiencing a profound transformation, characterized by market expansion and significant economic potential. Strategic partnerships and technological innovations remain the primary catalysts for growth. Despite facing historical underfunding and other challenges, the industry is set to make substantial progress by capitalizing on global opportunities to enhance comprehensive healthcare for women worldwide.

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with 30 years of experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services, Sustainability and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets.

US securities transactions are performed by BDA Partners’ affiliate, BDA Advisors Inc, a broker-dealer registered with the Securities and Exchange Commission (SEC). BDA Advisors Inc is a member of the Financial Industry Regulatory Authority (FINRA) and SIPC. In the UK, BDA Partners is authorized and regulated by the Financial Conduct Authority (FCA). In Hong Kong, BDA Partners (HK) Ltd is licensed and regulated by the Securities & Futures Commission (SFC) to conduct Type 1 and Type 4 regulated activities to professional investors. www.bdapartners.com

We assessed both the medical devices (Medtech) and pharmaceutical (Pharma) distribution markets as part of the overall healthcare distribution market, which is collectively expected to grow at a combined CAGR of 7% from US$18bn in 2023 to US$26bn in 2029.

While historically underinvested, the healthcare industry in Southeast Asia (SEA) is becoming a key focal point for public and private investment, driven by growing demand from an increasingly aging population. Healthcare distributors in SEA have been entering the spotlight in recent years, driven by:

- Distributors moving up the value chain, offering a breadth of services to global manufacturers including handling regulatory & compliance affairs, commercialization / demand generation, managing public tenders, logistics, technical support / training, financial management, and after-sales services

- Competitive moats built via (i) understanding of local markets, regulatory environment, and customers, (ii) commercialization and logistical capabilities which translate to economies of scale, and (iii) entrenched supplier and customer relationships supported by their installed base of equipment

- The fragmented nature of SEA, which results in many manufacturers lacking scale to build a local commercial presence in each market, vis-à-vis large homogenous markets such as China and India

Investors are turning their attention to healthcare distribution in SEA, leveraging M&A as a means to diversify geographical or end market exposures, as well as to consolidate the highly fragmented regional market. Many financial sponsors have recognized the huge market potential, building regional healthcare distribution platforms via buy-and-build strategies to achieve scale in SEA.

The distribution sector is resilient, trading at long-term median levels. The sector in SEA is significantly insulated from the impact of trade wars, due to steady demand for health products, and diversified manufacturing source locations.

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with 30 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services, Sustainability and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

The global wind industry is entering a new era of growth. The need to triple annual installation by 2030 net-zero goals and minimize divergence from a global 1.5 C temperature increase, remains. In this piece, we represent BDA’s insight into the following:

- Onshore wind’s relative cost – or levelized cost of energy (LCOE) – dropped by 70% from 2010 to 2023. Onshore wind is now the most competitive global energy solution ahead of solar, hydro, and fossil fuel base-load solutions

- Whilst onshore and offshore wind have structural similarities, these differ materially in delivery – given complexities such as size, logistics, supply chain, installation and energy grid connectivity

- The wind industry continues on its long-term historical double digit annual growth journey, with onshore wind expected to grow 10% per annum and offshore wind at 22% (2024-2030)

- A large portion of the broader wind supply chain sits in China, with Western OEMs manufacturing in the country only to fulfil export / non-Chinese wind turbine demand. Geopolitical tensions are now resulting in increased geographical diversification – with India deemed a winner

- Rare Earth Permanent Magnets, made of those scarce elements often used in the e-Mobility industry, may soon blow by as a thing of the past in wind turbines – with new technologies potentially reducing the industry need to 1/10th, given the complete obsolescence of gearboxes in direct drive turbines

- We also exclusively interview the Global Wind Energy Council, a leading representative body for the wind industry with over 1,500 member companies, for their independent expert views

Please feel free to contact any of the BDA contacts below.

Download the full report here.

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with 30 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services, Sustainability and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets.

US securities transactions are performed by BDA Partners’ affiliate, BDA Advisors Inc, a broker-dealer registered with the Securities and Exchange Commission (SEC). BDA Advisors Inc is a member of the Financial Industry Regulatory Authority (FINRA) and SIPC. In the UK, BDA Partners is authorized and regulated by the Financial Conduct Authority (FCA). In Hong Kong, BDA Partners (HK) Ltd is licensed and regulated by the Securities & Futures Commission (SFC) to conduct Type 1 and Type 4 regulated activities to professional investors. www.bdapartners.com

2022年,中国私募股权基金(“PE”)市场发展面临众多不利因素,包括:经济增长放缓、新冠肺炎疫情严格防控、监管审批趋严以及由全球加息对股票市场估值带来的压力等。在过去一年中,私募股权基金的退出和募资均承受一定考验。

随着中国政府疫情清零政策的结束和边境的重新开放,中国市场经历着巨大的转变。中国政府采取多项举措以刺激经济发展并促进投资。在本报告中,我们将就这些变化对财务投资者以及2023年中国并购市场所产生的影响进行分析和论述。

本报告重点内容如下:

- 新冠肺炎动态清零政策的放开将会迅速促进消费、旅游和房地产等行业的复苏。中国经济发展和“中国故事”将再次成为全球焦点,投资者对中国经济的信心或将恢复。展望未来,消费和零售、制造、新能源、生命科学和医疗以及物流和供应链等行业将受到更多投资人的青睐。

- 2023年由财务投资者参与并主导的并购交易仍将以境内交易为主。同时,我们预计由财务投资者牵头的跨境并购交易数量将较2022年有所提高,以实现中国境外投资组合多元化。

- 财务投资者将以审慎的态度将更多的关注放在目标公司的盈利能力和现金流稳定性上,收入增长将不再作为单一的重要考量指标。

- 2023年将有更多的被投企业退出,诸多优质资产或将进入交易市场。受经济复苏带来的积极影响,在疫情期间仍稳健发展并具备一定韧性的被投企业将在2023年成为私募股权基金争相争取的并购目标。

- 另一方面,股权转让和IPO在2022年的疲软表现,使得私募股权基金不得不延长其项目退出计划和资金募集计划。考虑到部分行业相关上市政策的收紧以及长期积压的待上市企业,被投企业通过IPO退出将进一步受阻。并购交易或将在2023年成为财务投资者更重要的退出路径。

- 环境、社会与治理(“ESG”)已从边缘角色上升为投资过程中的核心议题。ESG逐步成为重要的投资方向及考核标准。全球性私募股权基金在中国市场投资时,通过设定与其全球ESG目标一致的投资策略或设立影响力基金(“Impact Fund”)来逐步提高ESG标准。

- 2022年,私募股权基金的资金募集受宏观政策的不确定性影响而有所放缓。随着市场升温,私募股权基金或将在2023年重点关注被投企业的退出。我们预计募资活动在2023年仍将相对疲软,但随着更多被投企业的成功退出,2024年起私募股权基金募资活动将大幅上升。

总体而言,我们相信中国宏观经济仍将保持稳定且持续增长。财务投资者们应积极做好与全球第二大经济体重启业务往来的准备,2023年中国私募股权市场将迎来强劲复苏。

Although COVID-19 did not completely hamper M&A deal flow in Vietnam, travel restrictions and a strict lockdown in the second half of 2021 posed major challenges for buyers and sellers alike. With the gradual unwinding of COVID-related restrictions and the resumption of international flights in October 2021, M&A activity has accelerated. The economy has recovered quickly and the outlook for dealmaking is positive.

Top 10 M&A transactions in Vietnam (October 2021 – August 2022)

| Date | Investor | Target | Deal size (US$m) | Stake |

| Oct-21 | SMBC Consumer Finance | FE Credit | 1,400 | 49% |

| Jul-22 | Swire Pacific | Coca-Cola Indochina | 1,015 | 100% |

| Dec-21 | TPG, Temasek, ADIA | The CrownX | 350 | 4% |

| Nov-21 | SK Holdings | The CrownX | 345 | 5% |

| Dec-21 | Mizuho | Momo | 200 | Undisclosed |

| Feb-22 | AC Energy | Super Energy’s nine solar plants | 165 | 49% |

| Oct-21 | UBS, Mirae, STIC | Tiki | 136 | Undisclosed |

| Apr-22 | Hana Financial Group | BIDV Securities | 118 | 35% |

| Aug-22 | Masan | Phuc Long | 155 | 34% |

| Apr-22 | Indorama Ventures | Ngoc Nghia Industry | 94 | 98% |

Source: Mergermarket

Key drivers propelling post-pandemic deal flow

Vietnam’s economic recovery has proven appealing to investors – it was one of the few countries that recorded two consecutive years of GDP growth in 2020 and 2021 during the height of COVID. According to the General Statistics Office, Vietnam achieved 2.58% GDP growth in 2021[1], despite experiencing one of the strictest lockdowns in the world during the second half of that year. Looking ahead, the Asian Development Bank is forecasting that Vietnam’s economic growth will recover to 6.5% in 2022[2]. In fact, GDP growth in Q2 2022 was 7.7%, the highest quarterly growth in the last ten years.[3]

Pent-up dealmaking demand is a key driver. Both strategic investors and financial sponsors have a large amount of capital to invest and are keen to identify new opportunities or revive discussions that were on hold. Industry leaders are actively looking for acquisitions to consolidate market share within their verticals, taking advantage perhaps of competitors weakened by COVID and slower to rebound. In addition, many companies are looking to position themselves for recovery in the post-pandemic economy and need new capital injections for internal transformation and further growth in order to remain competitive.

The resumption of international travel is also significant. In-person due diligence and site visits have facilitated many deals that were previously put on hold, especially for asset-heavy industries such as industrials, logistics, and healthcare. Since October 2021, BDA has met with numerous foreign investors who have expressed a strong interest in Vietnam. After a two-year hiatus, BDA organised its annual networking event in Ho Chi Minh City in May 2022 with over 200 participants – mainly investors and corporate shareholders – and all appreciated the opportunity to reconnect in person and discuss the future.

Trends expected to persist post COVID

Domestic investors had an advantage over their foreign counterparts during COVID given their local presence, and this led to an increase in domestic deal flow and volume. Although COVID-related border restrictions have now been lifted, BDA has seen local conglomerates continuing their acquisition spree in a market that has historically been dominated by foreign buyers. For example, in addition to its investment in Phuc Long, Masan also acquired a 25% stake in Trusting Social, a company engaged with credit scoring based on social data, for US$65m in April 2022. This was another transaction in which BDA acted as the exclusive advisor to the target company. Nova Group has been on an acquisition spree, expanding its ecosystem with a focus on Consumer businesses, having acquired and taken over the operations of major F&B establishments such as Jumbo Seafood, Sushi Tei, Crystal Jade, and PhinDeli.

From a deal negotiation perspective, BDA has observed several points that have become particularly important during deal negotiations. With material adverse change (“MAC”) clauses, buyers and sellers now need to acknowledge the risk of a significant downturn in the business as a result of COVID. MAC provisions typically exclude market-wide macroeconomic impact, but since COVID has different effects on different industries, the negotiation of specific triggers in MAC clauses needs to be scrutinised. Earn-outs have become more common by bridging valuation gaps under scenarios of temporary uncertainty, while also enabling sellers to share in the upside of long-term growth. Warranty and indemnity (“W&I”) insurance, a rare option in Vietnam deals in the past, is also being used more frequently, as both buyers and sellers appreciate the benefit of a smoother and faster signing and closing process.

During the height of domestic lockdown and border restrictions in 2021, virtual interaction was the only option in most cases for M&A transactions in Vietnam. We expect that for non-key discussions, virtual meetings will continue to be a common option in the future. However, for other key parts of the transaction process such as site visits and due diligence, which were supported by on-the-ground advisors and virtual tours during COVID, and especially for negotiations, in-person participation will still be preferred going forward.

Global slowdown in M&A in 2022 and beyond

Global M&A in H1 2022 is down 21% by value and 17% by volume compared H1 2021[4], partly due to the cooldown in SPAC-related transactions. Inflationary pressure across the supply chain, geopolitical tensions, and a rising interest rate environment have also contributed to the volatility that could become a recurring theme in the M&A market over the next year or so.

Inasmuch as businesses in Vietnam are not immune to these factors, we still believe that 2022 will remain another busy year for Vietnam’s M&A market. Investors have not shown any reduced appetite in dealmaking in Vietnam, as evidenced in their interest in BDA’s ongoing mandates. We believe that there are a lot of high-quality assets that have proven resilient against turbulence brought about by COVID that are now well-positioned for robust growth, and we look forward to a busy period ahead with a long list of current live deals and ongoing opportunities.

Tailwinds for future growth in M&A in Vietnam include:

- Strong socio-economic backbone: Vietnam will still benefit from steady economic growth, political stability, and a bourgeoning middle class population. Participation in multiple free trade agreements and open-market policies make Vietnam an attractive destination for foreign investment

- Rising importance as a manufacturing hub: More global corporations are expected to relocate to Vietnam, as the country has made significant progress in infrastructure development to catch up with international standards, with major investments from both public and private sectors. The US-China trade war and prolonged COVID restrictions in China have also led to more manufacturers moving operations to Vietnam

- Improving regulatory landscape: It is worth noting that with regards to M&A regulation and processes, local authorities have continuously been improving their turn-around time, while working towards clearer guidelines. For example, Decree 155/ND-CP guiding the implementation of the Law on Securities, which took effect in 2021, has provided additional clarification and detailed guidance with regard to the public tender offer process and foreign ownership limits

- Growing familiarity with M&A: Local businesses are becoming more professional with strong management teams and better corporate governance. Vietnamese companies are now more familiar with M&A concepts and are open to consider strategic partnerships with foreign investors, who can provide support through best practices in business operations and have extensive experience from global markets

Most attractive sectors in Vietnam for M&A

Consumer

- The Consumer sector will continue to be one of the main drivers of transaction volume

- Investors will target Vietnam as one of the fastest growing economies in the region, with its growing middle class and a young population with increasing income and propensity to spend

Healthcare

- In response to the lack of capacity within the national healthcare system, there has been an ongoing shift in demand towards private care

- Private hospitals will continue to attract interest from both strategic and financial investors, especially as patient volumes and occupancy rates are recovering to pre-COVID levels, while more profitable surgeries and procedures are reintroduced

Education

- Within private education, both local and international schools received significant interest from investors before COVID emerged

- We expect discussions regarding education assets will be restarted in the near future, as the businesses’ performance recover now that students of all levels have returned to the classrooms

Logistics

- Tailwinds from high growth in exports, a booming Internet economy, and supply chain shift from China will continue to propel growth in Vietnam’s logistics industry

- Assets in warehousing (especially smart logistics) and cold chain will generate strong interest from global investors

Financial Services

- An underbanked population with a shortage of financing and credit solutions will spur further investments in financial services

- The focus will be on consumer finance / fintech companies that provide solutions to enable access to non-bank credit for both individuals and micro, small, and medium businesses

Renewable Energy

- With a rapidly growing economy, Vietnam has been at risk of power shortages due to a lack of power infrastructure.

- Capital injections into the development of renewable energy could provide a suitable solution. Attractive feed-in-tariffs and untapped potential in solar and wind power capacity will make Vietnam an attractive destination for investors

[1] https://e.vnexpress.net/news/business/data-speaks/vietnam-finishes-2021-with-2-58-pct-gdp-growth-4409596.html

[2] https://www.adb.org/countries/viet-nam/economy

[3] https://baochinhphu.vn/gdp-quy-ii-2022-tang-truong-772-102220629090231152.htm

[4] https://www.allenovery.com/en-gb/global/news-and-insights/publications/global-ma-transactions-drop-over-20-percent-but-bright-spots-remain

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

BDA Partners 于 4 月 26 日至 28 日主办了首届中国成长型基金投资者会议。来自消费与零售、医疗健康、服务和科技领域的 20 家参会公司通过 200 多次线上一对一会议向成长型基金投资者进行了路演。

BDA合伙人兼上海办公室联席主管萧寅康表示:“为期3天的线上会议取得了巨大成功。这是BDA举办的首届成长型基金投资者会议,吸引了来自150家私募基金的300多名资深投资者参加,这些私募基金包括全球知名美元基金、国内美元基金和人民币基金。我们也得到了国内高成长公司创始人和CEO们的大力支持和积极参与。参会公司代表了中国经济发展前沿的众多赛道,包括数字健康、体外诊断、高端医疗服务、生活方式和健康、金融科技等领域。本次活动中投资机构的热情高涨,体现了私募基金对于中国快速向发达经济体转型大环境下的涌现出的优质公司的浓厚兴趣。这也显示出在资本市场中有大量流动资金正在寻求中后期投资机会。我们很高兴成为客户的首选合作伙伴,将私募基金和令人兴奋的增长机会聚集在一起。”

我们期待 2023 年的第二届BDA中国成长型基金投资者会议,以及今年年底的BDA年度私募股权大会。如果您想了解更多关于会议的信息及参会详情,请通过 gcc@bdapartners.com或者pe-conference@bdapartners.com联系我们。

Since 2020 BDA has successfully advised on nearly 60 transactions, making us one of the most active M&A advisors in Asia. This level of experience underpins our ability to deliver successful outcomes for our clients under dynamic market conditions.

For over 20 years, our Hong Kong team has advised multinationals on strategic carve-outs and bolt-ons, guided entrepreneurs on divestments and capital raises, and supported financial sponsors on investments and portfolio company exits.

We continue to leverage this experience and insight to deliver value-optimising results for our clients who entrust us with their business.

The enclosed flyer provides a snapshot of our capabilities and our recent track record globally and in the Greater China region. Our experienced and dedicated team of Hong Kong-based bankers is ready to support your M&A ambitions. Should you wish to learn more about BDA, our expertise and how we can assist you, please reach out to one of our contacts below:

- Paul DiGiacomo, Managing Partner: pdigiacomo@bdapartners.com

- Simon Kavanagh, Partner: skavanagh@bdapartners.com

- Karen Cheung, Managing Director: kcheung@bdapartners.com

- Mireille Chan, Director: mchan@bdapartners.com

- Jakub Widzyk, Director: jwidzyk@bdapartners.com

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

The article was originally published on April 2022 issue of Vietnam Economic Times

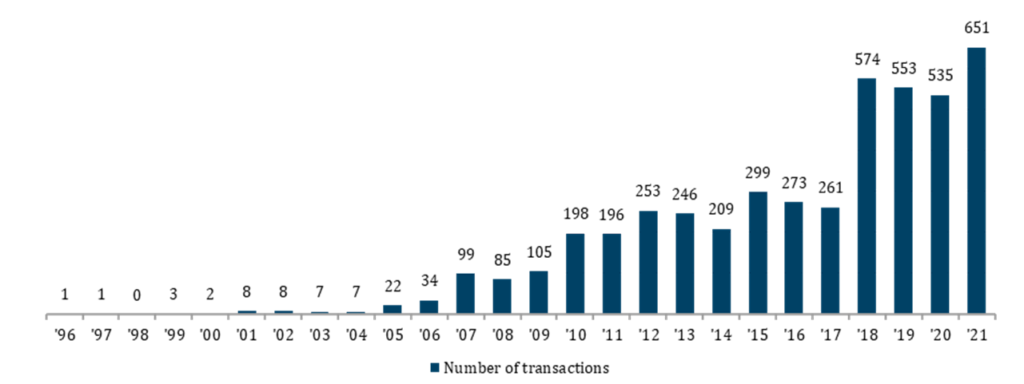

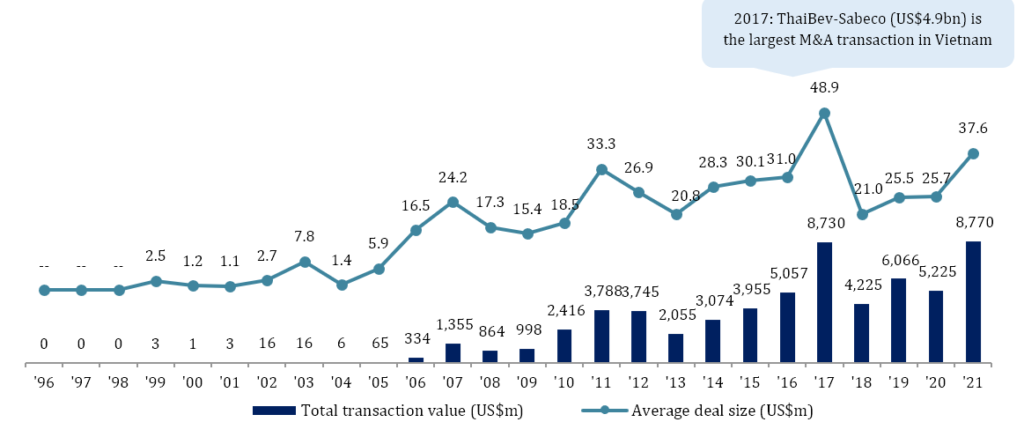

Over the last 25 years, Vietnam has transformed from a low-income country into one of the fastest-growing economies in the world, with GDP per capita increasing nearly ten-fold from 1996 to 2021[1], supported by a strong socio-economic backbone of a young population and a rapidly-growing middle class. Along with economic growth, merger and acquisition (M&A) activities in Vietnam have also soared, driven by progress in equitization and market liberalization, as evidenced by supportive market regulations for foreign investors. From the quiet days of a handful of small value deals in the late 1990s, Vietnam’s M&A market has been recording over 500 deals each year recently. Larger deals have become more common, with 62 valued at $100 million or more over the last five years. Although challenges remain, the outlook for M&A activities in Vietnam is bright, especially as border restrictions have been relaxed and the country is heading towards post-pandemic recovery.

Source: Capital IQ

Source: Capital IQ

The emergence of a new M&A market (1996-2004)

Vietnam’s new market economy was gradually developing in the 1990s, after extensive socio-economic reforms brought about by “Doi Moi” policies since 1986. In 1995, Vietnam became a member of ASEAN as part of efforts to rejoin the global economy and attract foreign investment. The early days of M&A activities in Vietnam in the late 1990s to early 2000s were relatively quiet, with no apparent trend, as its economy was still largely dominated by State-owned enterprises (SOEs). There were fewer than ten transactions each year in this period, more than 90% of which were under $5 million.

Top buyer countries: In addition to domestic investors, investors from Denmark and the US were most active, followed by those from developed countries in Asia such as Japan and South Korea. The top position held by Denmark was primarily driven by Carlsberg’s acquisition of Hue Brewery in 2003, with the addition of several small-scale projects in Industrials and Information Technology backed by IFU, the Denmark-based development fund.

Top sectors: Consumer and Financial Services dominated in deal value, driven by (i) Vietnam’s gradual emergence from low-income status at the turn of the 21st century, and (ii) the Vietnamese Government’s plan to revamp its nascent banking system with foreign investment.

Booming M&A activities due to market liberalization (2005-2013)

From only a handful of deals a year from 1996 to 2004, M&A activities in Vietnam skyrocketed to over 150 deals on average a year in the 2005-2013 period. Deal value and number of deals fell briefly from 2007 to 2009 due to the impact of the global financial recession, before rebounding in later years and peaking in 2011 and 2012 with a number of high-value deals. Transaction size significantly improved, with 90 transactions having over $50 million in value.

M&A activities in Vietnam increased significantly in this period due to:

- An influx of foreign capital into SOEs: Major examples are investments by major Japanese banks such as Mizuho and Sumitomo in Vietcombank and Eximbank

- A strengthened regulatory framework, as the 2005 Enterprise Law came into effect

- Open market access for foreign investors: Vietnam became a member of the WTO in 2007, committing to one of the world’s most progressive market access programs

Top buyer countries: Domestic investors took the top spot with a number of sizeable transactions and many smaller ones (90% of domestic deals were under $10 million). The largest deals from domestic investors had two notable trends:

- M&As in Financial Services, with top deals such as SHB’s $168 million acquisition of Habubank and Eximbank’s acquisition of a 9.6% stake in Sacombank for $100 million in 2012

- Local conglomerates’ expansion strategies, with top deals such as Masan’s acquisition of (i) an 85% stake in Nui Phao Mining for $100 million in 2010, and (ii) a 40% stake in Vietnamese-French Cattle Feed (Proconco) for $96 million in 2012

Among foreign investors, buyers from Japan, France, the US, and Singapore were among the most active, with eleven transactions surpassing the $100 million mark.

Top sectors: Financial Services overtook Consumer to be the top area of focus for M&As and foreign investments, driven by market consolidation and the restructuring of Vietnam’s banking system. Industrials remained in the top 3, attracting M&A activities from foreign investors due to Vietnam’s potential in natural resources and low labor costs.

Record-breaking deal flow (2014-2021)

In the 2014-2021 period, annual average deal count increased more than three-fold to over 450. Transaction size also significantly improved, with 196 transactions having over $50 million in value; more than double the figure in the 2005-2013 period. 2017 was a record-breaking year in terms of transaction value, driven by ThaiBev’s acquisition of a 53.6% stake in Sabeco in 2017 for $4.9 billion; the largest deal in Vietnam to date. Overall, transaction value was on an upwards trend, peaking at $8.7 billion in 2017 before declining to $6 billion in 2019 as the US-China trade war sparked recession concerns, and $5.2 billion in 2020 due to the impact of Covid-19. However, M&A activities recovered strongly in 2021, with a record year seen in deal volume (651) and value ($8.8 billion), in line with global M&A trends and due to the unleashing of accumulated capital and pent-up deal-making demand. With economic optimism remaining high, especially given new open border policies, 2021 set a solid background for supercharged growth in M&As in 2022 and beyond.

Key drivers for record-breaking deal flows in this period include:

- Favorable regulation and market access for foreign investors:

- The 2015 Law on Enterprises and Law on Investment allows foreign investors to own up to 100% of equity in listed companies in Vietnam, except for ones constrained by:

- Foreign ownership restrictions, as set out in commitments to international treaties

- Conditional lines of business

- Voluntary limits imposed by shareholders

- The 2015 Law on Enterprises and Law on Investment allows foreign investors to own up to 100% of equity in listed companies in Vietnam, except for ones constrained by:

- Vietnam’s participation in major free trade agreements such as the EU-Vietnam Free Trade Agreement and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership

Top buyer countries:

- Thai and South Korean buyers showed an appetite for large-sized deals, as evidenced by ThaiBev’s acquisition of a 53.6% stake in Sabeco for $4.9 billion in 2017 and the SK Group’s acquisition of a 6.1% stake in Vingroup for $1 billion in 2019

- Singaporean and Japanese investors were more attracted to small and medium-sized transactions, with only 5% of transactions having over $100 million in value

- Deal flow involving domestic buyers, though no longer remaining at the top position, was still significant in volume, although 90% of transactions were under $10 million in value. Major deals with domestic buyers included Vingroup’s acquisition of a 96.5% stake in the Bao Lai JSC, a white marble mining company, for $119.8 million, and Masan’s acquisition of a majority stake in Phuc Long for over $100 million

Top sectors:

- Information Technology emerged among the top 5, driven by private equity and venture capital investors betting on Vietnam’s dynamic internet economy, with the internet penetration rate doubling from 35% in 2011 to 70% in 2021 (according to the World Bank)

- Deal flow and volume in Infrastructure, Government & Utilities was driven by transactions involving renewable energy. The largest deals included Chaleun Sekong’s $99 million acquisition of the Hoang Anh Gia Lai Hydropower Plant JSC and Banpu’s $66 million acquisition of the Mui Dinh Wind Farm

Although Real Estate M&A transactions (asset / project / land bank transfer) were not considered for M&A statistics here, it is worth noting that Real Estate also saw a boom in transaction numbers and value in the period, driven by rapid urbanization in Vietnam. There were 79 deals totaling $1.7 billion from domestic buyers and 178 deals totaling $4.4 billion from foreign investors.

Future outlook

Recent outbreaks of Covid-19 might put a temporary halt on progress in economic growth but will not reverse ongoing progress in socio-political changes in Vietnam, which will set a solid foundation for the next 25 years. Vietnam will continue to enjoy (i) a bourgeoning middle class with increasing spending power, (ii) a young population with a high urbanization rate, and (iii) stable political standing. As Covid-related restrictions have been relaxed, Vietnam’s economy is expected to strongly recover as the fastest-growing economy in ASEAN, with 6.6% growth in 2022, followed by the Philippines (6.3%) and Malaysia (6.0%). Since 2019, factory relocations from China or other parts of Southeast Asia have been driving an influx of foreign capital; a trend expected to persist in the next 25 years as Vietnam cements its strategic importance as a manufacturing hub in the region. Market liberalization will also continue to serve as the backbone for Vietnam’s economy, with government policies focusing on free trade agreements.

Expected trends

Environmental, social, and governance (ESG) criteria will become more deeply integrated into Vietnam’s M&A market.

Private equity investors have become more active in Vietnam in recent years. Recent examples of large deals involving private equity investors include KKR’s $650 million investment in Vinhomes in 2020, $400 million investment led by Alibaba Group and Baring Private Equity Asia (BPEA) and $350 million investment by a consortium of TPG, Temasek, and the Abu Dhabi Investment Authority in The CrownXin 2021. More and more global and regional private equity firms have established a local presence in Vietnam, with dedicated investment teams and networks of advisors on the ground.

Asia-Pacific investors will continue to rank higher in deal volume compared to their European and North American counterparts.

Buyout transactions have become more common, especially due to the impact of the pandemic, which led to the consolidation of small and medium-sized players into respective market leaders. Local conglomerates such as Vingroup, Masan, and the Nova Group have all been active in acquiring targets across different industries both within and beyond their core capabilities, such as education, technology, and F&B, etc., and are expected to accelerate their expansion strategies through acquisitions in the future. Foreign investors, on the other hand, have been increasingly active in pursuing buyout transactions in Vietnamese businesses, as seen in the Stark Corporation’s acquisition of ThiPha Cable and Dovina in 2020 and SCG Packaging’s acquisition of Duy Tan Plastics in 2021, for both of which BDA served as sellside advisor. Financial sponsors have also been active in buyouts of Vietnamese companies, as evidenced in acquisitions of majority stakes in Vietnam USA Society English Centers (VUS) and Vietnam Australia International School by BPEA and TPG, respectively.

Sectors of focus include consumer, healthcare, industrials, IT/technology, and renewableeEnergy.

In conclusion, we remain confident in the availability of opportunities in Vietnam’s M&A market going forward, especially now that social distancing restrictions have been lifted and borders are expected to be fully open this year. We at BDA in Ho Chi Minh City have seen strong interest from investors looking for sizable transactions, as foreign investors interested in Vietnam have accumulated a lot of dry powder since 2020 and are ready to revive deals that were put on hold or cancelled. Meanwhile, we are also observing strong demand for growth capital and exits from both founder-backed and private equity-owned companies, as evidenced by current live deals and strong pipelines of opportunities for 2022 and beyond.

[1] Source: International Monetary Fund

[2] Excluding transactions with undisclosed value

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com