Highlights from the BDA CSR day 2025

At BDA Partners, we believe in making a positive impact beyond business. Each year, we empower our employees to dedicate a day to volunteer with local organizations—leaving behind laptops, conference calls, and emails; they make a difference in the communities we serve.

In 2025, all our offices participated in BDA CSR Day, illustrating the power of collective action and meaningful change.

Hong Kong

The Hong Kong team volunteered at Crossroads Foundation, a charity dedicated to serving global and local needs. Our team was divided into groups to assist across multiple departments, including processing donated items, maintaining warehouse operations, and assembling furniture for distribution. Tasks ranged from sorting, packing, and refurbishing goods to moving furniture and preparing event spaces. We enjoyed the opportunity to support the community through hands-on involvement.

Ho Chi Minh City

The Ho Chi Minh City team volunteered at TSC Church, which has been providing 400 meal boxes daily to the needy for over 20 years. Our day began in the kitchen, preparing fresh ingredients and cooking meals under the guidance of senior volunteers. By midday, we packaged hundreds of meals and distributed them to families, children, and elderly individuals in the community. The activity showcased the importance of collaboration and efficiency in supporting large-scale food programs. We are grateful to TSC Church for the opportunity to contribute and to our team members for their generous support of the charity fund.

Seoul

The Seoul team volunteered at Wongaksa Free Meal Center, an organization that has provided daily lunches to low-income seniors and homeless individuals since 1993. We donated KRW 1.5 million to support the purchase of food ingredients and assisted with meal service throughout the day. Our team helped distribute, serve, and wash dishes, ensuring 300 people received warm meals. The activity highlighted the operational commitment required to sustain such programs and the impact they have on vulnerable communities. Our Seoul team was happy to assist Wongaksa’s mission and support its long-standing efforts.

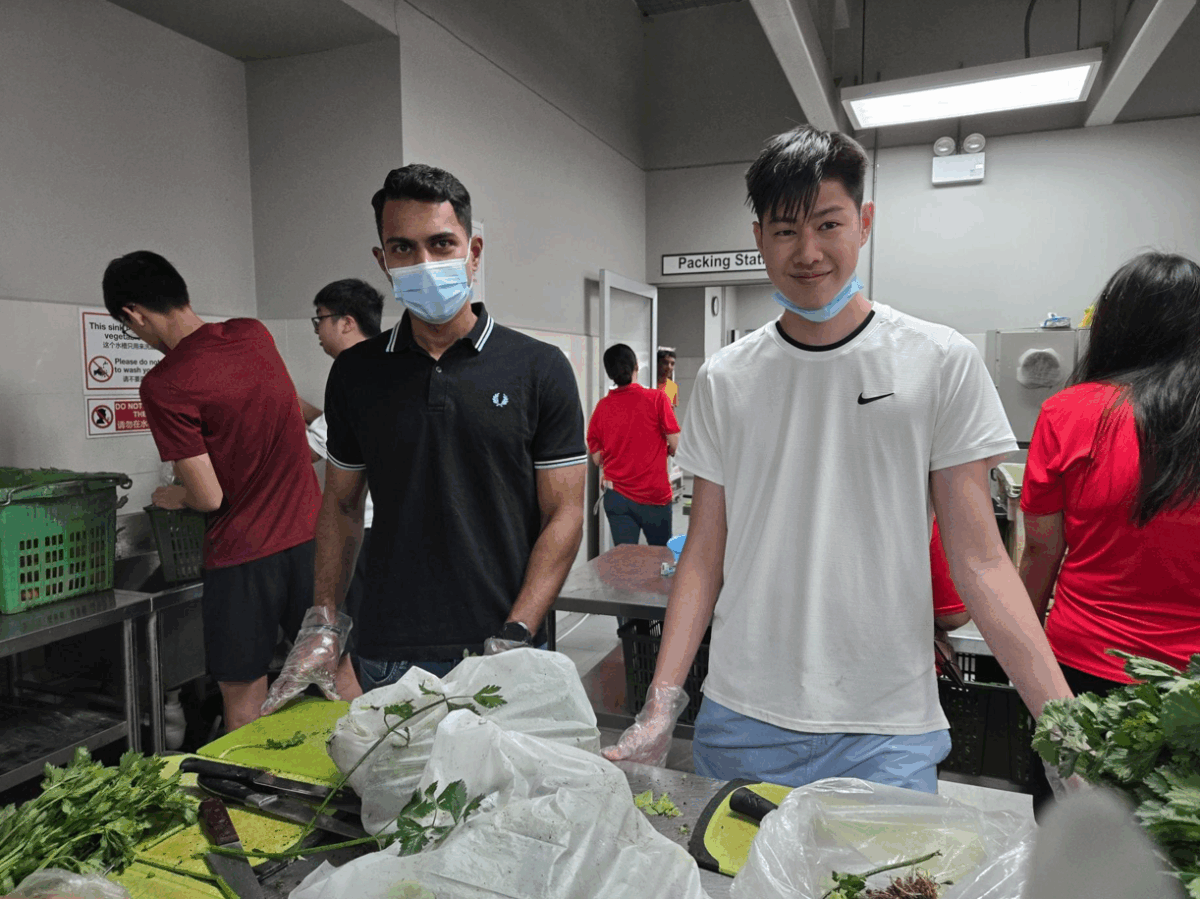

Singapore

The Singapore team volunteered at Willing Hearts, a non-profit operating one of the largest soup kitchens in Singapore. The organization prepares and delivers thousands of meals daily to beneficiaries, including the elderly, disabled, low-income families, and migrant workers. Our team assisted with food preparation tasks such as washing, peeling, and cutting vegetables, as well as sorting bulk ingredients for distribution. The visit offered insight into the scale and efficiency required to sustain such an operation and the critical role volunteers play in its success.

Tokyo

The Tokyo team participated in a community cleanup organized by the local residents’ association near our office. Alongside more than 100 participants, we collected litter around the neighborhood, including cans, bottles, and cigarette butts. After the cleanup, participants enjoyed complimentary coffee from Starbucks, reinforcing the sense of community and shared responsibility.

London

The London office participated in a year-long mentoring program with Envision, a charity focused on helping young people build confidence and essential skills. Running from September 2024 to June 2025. The project centered on fundraising for women’s safety, with our team guiding students in planning, presenting, and executing their ideas. Additionally, the office joined Shelter’s “Walk for the Homeless,” a charity walk supporting individuals facing housing challenges.

New York

The New York team volunteered at Housing Works Bookstore in Soho, supporting their mission to help individuals affected by homelessness and HIV/AIDS. Our team assisted with sorting donated books, identifying ISBN numbers, and categorizing items for online sales. We also audited bookshelves to ensure accurate inventory and removed titles scheduled for de-listing. We appreciate the opportunity to contribute to their impactful work and support the local community.

About BDA Partners

BDA Partners is the global investment banking advisor. We are a premium provider of Asia-related advice to sophisticated clients globally, with 30 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services, Sustainability and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes. BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese government-owned bank with US$150bn of assets.

US securities transactions are performed by BDA Partners’ affiliate, BDA Advisors Inc, a broker-dealer registered with the Securities and Exchange Commission (SEC). BDA Advisors Inc. is a member of the Financial Industry Regulatory Authority (FINRA) and SIPC. In the UK, BDA Partners is authorized and regulated by the Financial Conduct Authority (FCA). In Hong Kong, BDA Partners (HK) Ltd is licensed and regulated by the Securities & Futures Commission (SFC) to conduct Type 1 and Type 4 regulated activities to professional investors. bdapartners.com

The global streetwear narrative has shifted irrevocably. Globally, the category is stabilizing, but across Asia, momentum is accelerating. The region has become the creative, cultural, and commercial engine driving the next chapter of streetwear.

Japan is the blueprint. Japan remains the creative foundation of modern streetwear. Harajuku and Ura-Hara transformed global skate and hip-hop influences into a uniquely Japanese aesthetic defined by craftsmanship, scarcity, and subcultural authenticity. Human Made’s IPO on the Tokyo Stock Exchange, slated for November 27, 2025, underscores how Japanese streetwear has evolved from niche subculture to institutional-grade business. The offering, priced at the top of its range, highlights how premium Japanese brands, rooted in heritage and authenticity, are attracting global capital and investor confidence.

Korea is the amplifier. K-pop and K-hip-hop turn niche labels into global names overnight, and stylists often drive more influence than designers. Airport fashion, social media, and MV styling act as real-time runways, powering brands like thisisneverthat, ADER Error, We11Done, and rising star Thug Club. In Korea, speed and visibility define success.

China is the commercial engine. China’s streetwear boom is powered by guochao—movement blending youth identity, cultural confidence, and modern design. Combined with the world’s most advanced digital commerce ecosystem, trends move from discovery to nationwide adoption in hours.

The convergence of Asian creativity, culture, and trends is crating the most compelling investment opportunity in a generation. The question is no longer if Asian streetwear will lead, but which brands will define the next decade.

BDA is at the nexus of this transformation. With deep regional expertise and a global M&A track record, BDA supports clients across the streetwear value chain—from identifying emerging brands to structuring cross-border partnerships and acquisitions. Asia is shaping the future of global streetwear, and BDA is ready to help investors and corporates capture this next wave of growth.

Read the full article here.

About BDA

BDA Partners is the global investment banking advisor. We are a premium provider of Asia-related advice to sophisticated clients globally, with 30 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services, Sustainability and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes. BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese government-owned bank with US$150bn of assets.

US securities transactions are performed by BDA Partners’ affiliate, BDA Advisors Inc, a broker-dealer registered with the Securities and Exchange Commission (SEC). BDA Advisors Inc. is a member of the Financial Industry Regulatory Authority (FINRA) and SIPC. In the UK, BDA Partners is authorized and regulated by the Financial Conduct Authority (FCA). In Hong Kong, BDA Partners (HK) Ltd is licensed and regulated by the Securities & Futures Commission (SFC) to conduct Type 1 and Type 4 regulated activities to professional investors. www.bdapartners.com

BDA Partners’ Ho Chi Minh City team spoke with DealStreetAsia about healthcare investing in Vietnam. The interview examines why venture-backed healthtech platforms have struggled post-pandemic and why private equity interest in traditional healthcare assets remains strong.

Key perspectives from BDA Partners:

- “The shift is towards hybrid models where digital serves as an access point but must be integrated with physical infrastructure to deliver sustainable value. Pure-play telemedicine has not found a strong product market fit in Vietnam’s context,” said Huong Trinh, Partner and Head of Ho Chi Minh City at BDA Partners

- “In contrast to venture-backed startups, PE investors are targeting operators with real assets and recurring revenue. They see value in consolidation and operational improvement plays rather than in subsidising user acquisition for unproven digital models,” Trinh explained

- “These ambiguities create a regulatory risk premium. As such, investors might apply a discount on valuations to account for compliance uncertainty,” added Trinh

- “Financial sustainability has become a central investment criterion. Investors look for startups with a clear path to profitability and proven unit economics at their current scale,” said Yen Pham, Vice President of BDA Vietnam

- “The unifying theme across these opportunities is the appeal of healthcare models that combine a physical footprint, insurance reimbursement, and solid unit economics. In contrast, pure-play digital health ventures are expected to remain niche in the near term, pending greater regulatory clarity and more mature payment infrastructure,” Trinh concluded

Read the full article on DealStreetAsia here.

About BDA

BDA Partners is the global investment banking advisor. We are a premium provider of Asia-related advice to sophisticated clients globally, with 30 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services, Sustainability and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes. BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese government-owned bank with US$150bn of assets.

US securities transactions are performed by BDA Partners’ affiliate, BDA Advisors Inc, a broker-dealer registered with the Securities and Exchange Commission (SEC). BDA Advisors Inc. is a member of the Financial Industry Regulatory Authority (FINRA) and SIPC. In the UK, BDA Partners is authorized and regulated by the Financial Conduct Authority (FCA). In Hong Kong, BDA Partners (HK) Ltd is licensed and regulated by the Securities & Futures Commission (SFC) to conduct Type 1 and Type 4 regulated activities to professional investors. www.bdapartners.com

Demand across Southeast Asia is moving rapidly up the value chain—from basic liquid milk toward yogurt, cheese, and functional dairy—driven by urbanization, a rising middle class, and growing preference for premium and health-oriented products.

The region’s dairy market is valued at approximately US$34bn in 2025 and is projected to reach US$46bn by 2030, growing at ~6% CAGR. Consumption remains relatively low—20–30 liters per capita in markets such as Indonesia and Vietnam versus 100+ liters in more mature economies—leaving significant room for growth.

The industry continues to move up the value curve as consumers shift beyond liquid milk into yogurt, cheese, and functional dairy. Investors are backing brands with strong local relevance, integrated supply chains, and clear premiumization potential. Since 2023, both strategic players and private equity funds have accelerated investment—supporting domestic champions, upgrading processing technology, and building regional platforms. Value-added categories are expanding the fastest and delivering stronger margins, setting the stage for sustained deal momentum.

Looking ahead, investors should monitor opportunities that balance growth with supply-chain resilience. Emerging local leaders are scaling quickly—and are becoming increasingly attractive acquisition targets.

Please read our full report here.

BDA is here to help.

About BDA

BDA Partners is the global investment banking advisor. We are a premium provider of Asia-related advice to sophisticated clients globally, with 30 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services, Sustainability and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes. BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese government-owned bank with US$150bn of assets.

US securities transactions are performed by BDA Partners’ affiliate, BDA Advisors Inc, a broker-dealer registered with the Securities and Exchange Commission (SEC). BDA Advisors Inc. is a member of the Financial Industry Regulatory Authority (FINRA) and SIPC. In the UK, BDA Partners is authorized and regulated by the Financial Conduct Authority (FCA). In Hong Kong, BDA Partners (HK) Ltd is licensed and regulated by the Securities & Futures Commission (SFC) to conduct Type 1 and Type 4 regulated activities to professional investors. www.bdapartners.com

One billion people worldwide will celebrate Diwali next week.

Diwali, also known as Deepavali and the Hindu “Festival of Lights,” is one of India’s most widely celebrated holidays. It overlaps with other harvest rituals and festivals. The dates for the holiday vary each year; they follow the lunar calendar. Diwali originated in India, 2,500 years ago. The festival, which expands to the Indian diaspora, is observed for up to five days.

Different religious traditions in India each fit their religious themes and narratives into Diwali. Some Hindus, for example, believe Diwali to be the return of Lord Rama, an avatar of Vishnu, from 14 years of exile. Other Hindus believe it to be the celebration of the killing of the asura (demon) Narakasura by Lord Krishna, another avatar of Vishnu.

Some Hindus see Diwali as a chance to worship and celebrate the Hindu goddess of wealth, Lakshmi. For others, Diwali is the victory of knowledge over ignorance.

Diwali celebrations for Sikhs commemorate the release of Guru Hargobind, imprisoned in 1617 and released in 1619.

Jains also celebrate Diwali. They do it in remembrance of the day Lord Mahavira, revered as one of the great teachers of the religion, who attained Nirvana or enlightenment.

In each of these Indic traditions, we find that Diwali holds some sort of significance and a reason for celebration, often a representation of hope and the victory of goodness.

To honor someone, you may place a garland of flowers around them, such as the statues of deities in the temples.

Diwali occurs on the night of a new moon, adding to the importance of lights during Diwali. In the darkness of night, roads and paths in India are lined with oil lamps illuminating the way to temples where gods and goddesses are honored among lights.

People will also clean their homes and ensure every room is lit with lamps the night of Diwali. Believers report that the goddess Lakshmi visits well-lit homes.

BDA Partners hosted a panel discussion and networking reception for senior energy sector executives, in New York on 10th September, alongside Development Bank of Japan, and Norton Rose Fulbright.

We connected leading Japanese corporates across the value chain, from oil and gas energy, energy services, and renewables, with counterparts in the US. We’re focused on the surge of outbound investment interest from Japan.

We convened the most ambitious investors and US industry players. The agenda focused on the impact of the ‘One Big Beautiful Bill Act’ (OBBBA) on energy investment in the US.

The conference featured a welcome address by Shingo Kobayashi, Managing Executive Officer of DBJ, and a keynote speech by Todd Alexander, Partner at NRF, on the implications of OBBBA for the US energy sector. We followed with panel discussions, moderated by Euan Rellie of BDA and Paul Sankey of Sankey Research, addressing renewable energy and oil & gas investment trends.

Senior representatives attended from: Aggreko, AIP, Captona, CFS Energy, Chevron, Chugoku Electric, Eneos Power, Excelsior Energy Capital, Fuyo General Lease, Generate Capital, Gevo, Harbert, Hess Corp, HOG Resources, Idemitsu Kosan, Invenergy, JAPEX, Jetro, Kansai Electric, KDB, Kingston Capital, Kyuden International, Marubeni, MicroEra Power, Mitsubishi, MOL Americas, NRG Transition, Nano Nuclear, Nishimatsu, Northern Star Generation, Osaka Gas, Primergy Solar, RWE Clean Energy, Sankey Research, Shizuoka Gas, Sionic Energy, Silverpeak, TEPCO, and Tokyo Electric.

Key takeaways include:

- The future of energy will not be defined by renewables or oil & gas alone, but by a pragmatic mix of both, highlighting the need for flexible investment strategies to balance sustainability with energy security and economic viability

- Japanese appetite for US energy is driven by confidence in US demand and market resilience, rather than short-term policy catalysts like OBBBA, signalling a long-term commitment to the sector

- Japan’s energy companies are looking abroad, reflecting demographics, limited domestic growth, and the need to secure stable, diversified energy supplies

- Japanese investors are highly sought-after partners, valued for their patience, flexibility, and reliability. They are increasingly aligning with US deal timelines and valuations, while offering long term capital and a collaborative strategic approach

Euan Rellie, Managing Partner, BDA Partners, said: “This event was a big success. BDA, DBJ and Norton Rose have resolved to make it an annual conference, going forward. We’re already working on multiple potential transactions as a result of these conversations in New York. I’m grateful to everyone who participated, and excited for what’s to come”.

About BDA

BDA Partners is the global investment banking advisor. We are a premium provider of Asia-related advice to sophisticated clients globally, with 30 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services, Sustainability and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes. BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese government-owned bank with US$150bn of assets.

US securities transactions are performed by BDA Partners’ affiliate, BDA Advisors Inc, a broker-dealer registered with the Securities and Exchange Commission (SEC). BDA Advisors Inc. is a member of the Financial Industry Regulatory Authority (FINRA) and SIPC. In the UK, BDA Partners is authorized and regulated by the Financial Conduct Authority (FCA). In Hong Kong, BDA Partners (HK) Ltd is licensed and regulated by the Securities & Futures Commission (SFC) to conduct Type 1 and Type 4 regulated activities to professional investors. www.bdapartners.com

Asian food has exploded from niche to mainstream, transforming North America’s dining and grocery landscape.

Once confined to small “ethnic aisles” or family-run eateries, the category is now a US$37bn market growing at over 5% annually, outpacing the broader food sector. Immigration, cultural influence, and Gen Z’s appetite for global flavors are fueling the shift—turning dumplings, ramen, and kimchi into everyday staples.

North America’s retail shelves and restaurants are proof of this momentum. H Mart has become a US$2bn powerhouse, Jollibee has crossed 100 locations, and mochi ice cream has gone from novelty to freezer-aisle must-have. Asian corporates like CJ, Ajinomoto, and Pulmuone are planting factories on US soil, while private equity has piled in—reshaping family-run businesses into billion-dollar platforms through modernization, consolidation, and brand building.

What was once “ethnic” is now essential. Underrepresented cuisines—Filipino, Vietnamese, Indian—are set to drive the next wave, with health, wellness, and fusion formats pushing boundaries. For strategics and sponsors alike, Asian food has moved from novelty to necessity, cementing itself as the next strategic growth engine.

BDA is actively tracking the best investment and acquisition targets in this fast-growing sector. Our cross-border expertise and track record in food and beverage M&A position us to help clients capture this transformation.

SE Asia’s international K-12 sector is booming – expanding nearly twice as fast as the rest of Asia – and quickly becoming a global magnet for investors.

In our latest insight piece, we explore why global education groups and private equity investors are doubling down on the region’s resilient and high-growth K-12 space, where opportunity remains vast and attractive.

Key highlights:

- Surging growth: SE Asia’s international K-12 campus growth has been outpacing the rest of Asia by ~2x from 2020-2025, fueled by both expat and rising local demand

- Massive market: Over 110 million students aged 5 to 19 across 5 dynamic economies – with significant TAM expansion driven by policy liberalization and demographic shifts

- Attractive economics: Mature K-12 platforms deliver 20–30% EBITDA margins, with high visibility from prepaid fees and long student lifecycles

- Fragmented field: Scaled operators control just ~5% of the region’s 2,000+ international campuses – creating ample headroom for roll-ups and platform building

- Favorable tailwinds: SE Asia offers investor-friendly regulations, stable pricing, and a policy environment that supports long-term private sector participation

Download the full report to explore market deep-dives, valuation trends, and the leading consolidators shaping the region’s educational future.

About BDA

BDA Partners is the global investment banking advisor. We are a premium provider of Asia-related advice to sophisticated clients globally, with 30 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services, Sustainability and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes. BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese government-owned bank with US$150bn of assets.

US securities transactions are performed by BDA Partners’ affiliate, BDA Advisors Inc, a broker-dealer registered with the Securities and Exchange Commission (SEC). BDA Advisors Inc. is a member of the Financial Industry Regulatory Authority (FINRA) and SIPC. In the UK, BDA Partners is authorized and regulated by the Financial Conduct Authority (FCA). In Hong Kong, BDA Partners (HK) Ltd is licensed and regulated by the Securities & Futures Commission (SFC) to conduct Type 1 and Type 4 regulated activities to professional investors. www.bdapartners.com

Euan Rellie, Managing Partner and Chairman of Consumer & Retail, BDA Partners, was recently quoted by Octus on the current state of M&A activity in the luxury fashion market.

“Buyers are paying for a profit stream that is subdued at the moment,” said Euan Rellie. “Because of the down market, there is opportunistic M&A at lower price points, which you could ironically call bargain shopping.”

When reflecting on today’s buyer-friendly M&A environment, some sources evoked memories of the 2008 great financial crisis, surmising that deals struck in that period realized some of the healthiest returns of the last decade.

“Private equity activity during the GFC was rewarded with some of the best-performing exits five years later,” purports Rellie. “It’s a buyer’s market and sellers will need to be realistic in price. But we think this is a great time to buy – and the trade war won’t last forever.”

Rellie noted that billion-dollar M&A deals in the luxury sector have been abnormally subdued over the past several years. In a pre-pandemic landscape, there were typically two to three such deals every year originating in either Europe or the United States.

However, the recent tariff hikes cast a bright light on underperforming brands that drag on portfolios, which could put pressure on strategics to begin divestitures, Rellie said.

Likely targets:

- Ami Paris – Sequoia Capital China acquired the French designer brand in 2021, and recent reports note the company is looking for a buyer. It was first founded by designer Alexandre Mattiussi in 2011.

- Brunello Cucinelli – Italy-based Brunello Cucinelli SpA pursued an IPO in late 2023 on the Euronext Milan stock exchange under the ticker BC.MI. Its consistent performance and vertical integration has garnered attention as a valuable acquisition target, despite Cucinelli voicing a preference for independence. As of June 4, the company was trading at €106.20.

- Burberry – Spurred by performance challenges, the company was rumored last year to be targeted by luxury brand Moncler for an acquisition, though the rumors were ultimately debunked. Burberry Group plc trades on the London Stock Exchange under the ticker BRBY.L and as of June 4 was trading at £10.93 per share.

- Dolce & Gabbana – Co-founders Domenico Dolce and Stefano Gabbana are 67 and 62 years old, respectively, and have no successors in the ownership lineup. Last year, the pair told the media the company would prefer a minority investor rather than an IPO.

- Giorgio Armani – Infamous founder and designer Giorgio Armani, who turns 91 in July, told the media in 2024 that he plans to retire in the next “two or three years.”

- Guess? Inc. – In March, publicly listed Guess? Inc., which trades on the NYSE under the ticker GES, announced it received a nonbinding acquisition offer from WHP Global for $13 per share. However, no deal was announced. As of June 4, GES was trading at $11.07 per share, down from $23.06 on June 4, 2024.

- Jimmy Choo – Carpi Holdings acquired the luxury shoe designer in 2017 from Labelux, a division of JAB Holdings. In March, Capri sold Versace to Prada, and Jimmy Choo is widely reported to be next on the chopping block.

- Only The Brave – Diesel founder Renzo Rosso, owner of the Italian holding company OTB Group, told media in 2024 that IPO plans have been postponed until 2026. In addition to Diesel, OTB owns fashion brands Maison Margiela, Marni, Jil Sander and Viktor & Rolf.

- The Row – Founded by celebrity sisters Ashley and Mary-Kate Olsen in 2006, the company reportedly received investments last year from family offices affiliated with Chanel and L’Oréal, valuing The Row at about $1 billion.

- Valentino – Founded in 1960 by Valentino Garavani, luxury strategic Kering (in partnership with Qatari investment fund Mayhoola) acquired a 30% stake in the company in 2023 for a cash consideration of €1.7 billion. In the announcement, Kering notes it has the option to acquire 100% of Valentino no later than 2028.

Jeff Acton, Partner and Head of BDA’s Tokyo office, was recently interviewed by Worldfolio on how BDA Partners has established itself as the leading cross-border M&A advisor to private equity clients in Japan.

In the interview, Jeff discusses the firm’s long-standing presence in Japan, its track record advising on complex international transactions, and the role BDA plays in bridging Japanese sellers with global buyers. He also highlights the growing activity and opportunities within Japan’s private equity market, as well as the cultural and strategic nuances that define successful cross-border deals.

“We have been in Japan for a long time. We understand the domestic environment, the expectations and the needs of local clients. At the same time, we’re a global firm – so we can translate those needs into an international context and connect Japanese sellers with the right global buyers,” Jeff explains.

With 30 years of experience globally, BDA continues to deliver trusted, independent advice to clients navigating Japan-related cross-border M&A.

Read the full interview on Worldfolio here.