2021/01/27

China, the only major economy to grow in 2020, will gallop ahead at 8% in 2021, double the global rate

1. Pandemic? What Pandemic?

China’s Communist Party will mark its 100th birthday in July 2021 with typical pomp and ceremony. Celebrations will be cheered by an economy which shrugged off the effects of the Covid-19 pandemic remarkably quickly.

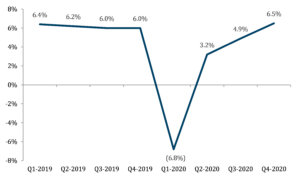

China recorded a sharp slowdown in Q1 2020, as the first country to be hit by Covid. China’s GDP dropped more in those three months than during the 2009 global financial crisis.

Beijing took the unprecedented step of locking down Wuhan a year ago, on 23rd January 2020. Economic activity and travel across the country ground to a virtual halt in the following months until the virus was stamped out. The Government tested repeatedly and widely for Covid, and on a scale other countries can only dream of: For example, in Qingdao, 12 cases in October 2020 resulted in nine million residents being tested in just five days. Unlike Western countries like the US, which focused stimulus efforts on lowering borrowing rates and handing out money to consumers, Beijing focused on restarting factories while keeping interest rates relatively high.

China’s factories came back online from April 2020, as the world’s manufacturing capacity was sputtering to a halt in the face of the devastating pandemic. China actually benefitted from the global slowdown, producing and exporting huge quantities of medical equipment, face masks and work-from-home electronics, such as laptops and monitors.

The Chinese economy roared back to life in Q2: year-on-year GDP went up by 3.2%.

China avoided consecutive quarters of negative growth, escaping the technical definition of recession. China was the only major country recording positive growth in Q2 2020.

China GDP continued to grow in Q3 2020, with year-on-year growth of 4.9%.

The pace has since accelerated. The Chinese economy grew 6.5% in Q4 2020, compared to a year ago. This was notably higher than pre-pandemic growth rates.

Chart 1 – China actual quarterly GDP growth % 2019 to 2020

Source: OECD

2. Thirty five years of growth

China’s economic miracle has lasted more than three decades. After recording 10% growth in 1987-88, China slowed in 1989-90, following violent repression of the pro-democracy protests in Tiananmen Square, Beijing, in June 1989. That led to a stark interruption of steady liberalization of the Chinese economy.

High growth rates returned quickly by 1991, and ran unabated until 2019. GDP grew by more than 9% per annum over those thirty years.

Of course, there have been significant hiccoughs along the way. The Chinese economy was already slowing dramatically before the outbreak of Covid, recording GDP growth of only 6% in 2019.

Going into 2020, The World Bank forecast 1%-2% growth for China; the IMF forecast 2%.

China’s eventual 2.3% growth in 2020 bucked the global trend. Other nations are still weighed down in the throes of the pandemic. All major global players except China, will record negative annual growth in 2020, according to IMF and the World Bank. And yet, the pandemic is apparently receding in the rearview mirror for China.

The World Bank estimates the US economy shrank by 3.6% in 2020, Japan shrank by 5.3%, and the Euro area shrank by a depressing 7.4%.

Chinese GDP per capita now exceeds US$10,000 for the first time in history, with almost no population growth at all.

Chart 2 – China actual GDP growth % 1985 to 2020 and forecast to 2025

Source: IMF

3. An aggressive President Xi

President Xi Jinping this week restated the importance of economic growth, highlighting “balance” in the Chinese economy, with strength in agriculture, more investment in infrastructure, and innovation in the tech sector.

President Xi reported reliable harvests and grain production for 17 years in a row, as well as breakthroughs in scientific explorations including the Tianwen-1 (Mars mission), Chang’e-5 (lunar probe), and Fendouzhe (manned deep-sea submersible). Development of the entire Hainan island, which is comparable in size to Taiwan, into the Hainan Free Trade Port, is proceeding at pace.

2021 will also mark the start of China’s 14th five-year plan, a closely watched road map covering 2021–25.

The World Bank is optimistic about China, predicting 2021 GDP growth of 7.9%, almost double the global growth projection of 4%.

Of course, outside observers are sceptical about the accuracy China’s reported figures, which are presented as part of President Xi’s nakedly political PR efforts. Nonetheless, BDA sees clear evidence of confidence and momentum, as Chinese private equity and IPO markets remain positive. It will be harder to achieve double digit growth, given the bigger base today, but there’s every reason to see that China will keep growing well.

Ignoring wide criticism of China’s maritime expansion, iron fisted rule over Hong Kong, and repression over the Uighurs in the northwest, Xi Jinping is asserting himself as aggressively as ever: “China will keep striving, marching ahead with courage, to create brighter glory”, he stated in his New Year’s address.

China’s ability to expand, even as the world fights to control Covid that has killed two million people, underscores the country’s success in taming Covid within its borders, and cements its unchallenged role as the dominant economy in Asia.

For now, the economic data reveal an economy still driven primarily by industrial production and investment rather than consumption. And yet, China consumer confidence is also recovering well.

4. China is unique

China’s growth makes it an outlier even among the greatest global economies. The World Bank expects the US economy to have contracted by 3.6% in 2020, and the Eurozone’s to have shrunk by 7.4%, reflected in global economic contraction of 4.3%.

This good momentum means that further recovery in China will likely have to take place without significant stimulus from the Government.

Provincial and local governments in China have some US$300bn in unspent stimulus money left over from 2020.

The export bonanza saw China ship 224 billion masks around the world from March to December 2020: 40 masks for every man, woman and child on the planet outside of China.

Domestic consumer demand may be sluggish in 2021, as wage growth is not yet back to pre-pandemic levels. That may explain Xi’s efforts to sound bullish, but the CCP under Xi tends to avoid sharp turns in policy.

China’s increasingly tense relationship with the US has caused China to pivot towards the EU, which was supported by both sides reaching an agreement on the EU-China Comprehensive Agreement on Investment in late 2020. Contrast this to the US, where in his final weeks in office, President Trump tightened restrictions on Chinese companies, to curb China’s tech sector dominance. This tension is worrying to financial markets. Wall Street is watching to see whether the incoming administration under President Biden will soften this stance at all.

Meanwhile, life continues relatively undimmed across China. People are going to restaurants again, particularly in affluent cities like Shanghai and Beijing. Service businesses like hotels and restaurants are performing well in the big coastal cities, but have not yet recovered in the inland provinces.

After its staggering success in taming the coronavirus, China has suffered renewed smaller outbreaks in the last month or so. The government mobilized quickly, building hospitals, imposing mass testing and putting 30 million people back under lockdown. The intrusive health checks will discourage consumers in the northeast from spending. Chinese families remain wary of big-ticket expenditures, new cars, or extensive home remodeling.

Retail sales growth stuttered in December, slowing to 4.6% from 5.0% the month before. The “Made in China” label has gained popularity, as people stuck in their homes cautiously redirect their spending. The consumer electronics sector has been especially resilient.

Beijing has ramped up its infrastructure spending. Every major city in China is now connected with high-speed rail, enough to span the continental US seven times. New lines were rapidly added last year to smaller cities. New expressways crisscrossed remote Western provinces. Construction companies turned on floodlights at many sites so that work could continue around the clock.

Despite reports to the contrary, China remains the workshop of the world. China’s exports grew 18.1% in December compared with the same month a year earlier, and 21.1% in November.

IPOs are booming as entrepreneurial companies go public at breakneck pace, across China. At BDA, we see M&A markets which are robust, and booming.

This explains why private equity and institutional investors are betting that China, which seemed like it might fall out of fashion in 2020, will continue to shine, and outperform the rest of the world.

Miraculously, China is approaching the Lunar New Year in rude health. 2021 will be the Year of the Ox, a fitting image for the Chinese economy.

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes. BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese government-owned bank with US$150bn of assets.

US securities transactions are performed by BDA Partners’ affiliate, BDA Advisors Inc., a broker-dealer registered with the Securities and Exchange Commission (SEC). BDA Advisors Inc. is a member of the Financial Industry Regulatory Authority (FINRA) and SIPC. In the UK, BDA Partners is authorised and regulated by the Financial Conduct Authority (FCA). In Hong Kong, BDA Partners (HK) Ltd. is licensed and regulated by the Securities & Futures Commission (SFC) to conduct Type 1 and Type 4 regulated activities to professional investors. www.bdapartners.com

Latest insights

2024/04/16

China Healthcare M&A outlook for 2024

In China’s dynamic healthcare market, M&A activities are booming...

2024/03/13

HealthTech sector landscape

The HealthTech industry has seen substantial expansion in recent years,...

2023/12/13

M&A trends and outlook for 2024

Jonathan Aiken, Partner and Head of London, discussed how a challenging...

2023/12/08

A regional perspective on Vietnam

BDA Partners Managing Partner Paul DiGiacomo was invited to be the keynote...