Corporate divestments, PE investments and activist campaigns: a virtuous circle for Japan

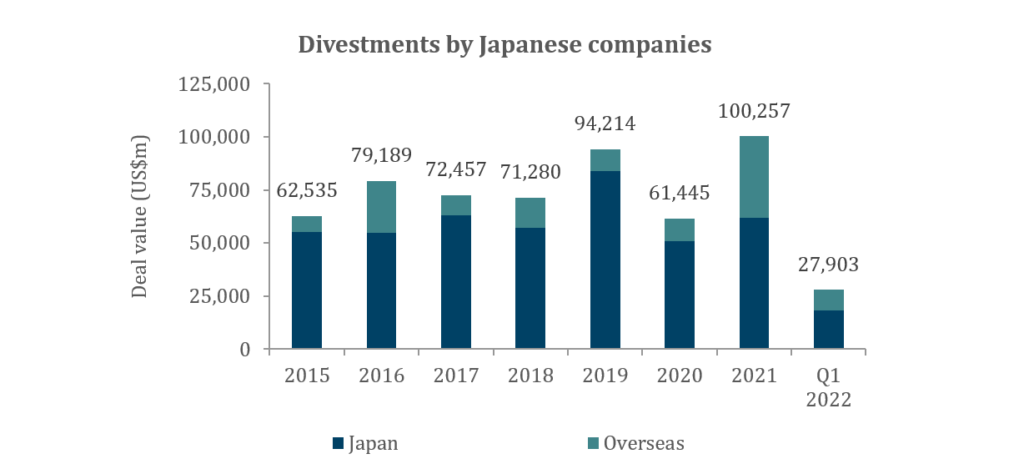

In the last few years, several trends have gained traction in Japan’s M&A market. The trends had already begun to take hold before COVID, which did not slow their development. In our latest insight, we take a closer look at three of the most significant trends, which are interrelated and are driving one another: 1) divestments by Japanese companies; 2) the ever-increasing activity of PE funds; and 3) the growing influence of activist funds.

Key takeaways:

Japanese companies are increasingly willing to divest non-core subsidiaries and assets, driven by changing perceptions about corporate divestments

- This has been led by large-cap companies so far, but smaller companies are expected to join as they also begin to appreciate the benefits

Divestments by Japanese companies are proving to be fruitful targets for PE funds, who are aggressively entering Japan market and raising record levels of capital

- Many corporate carveouts in Japan over the last few years have seen PE funds emerge as the successful acquirer

Another set of investment funds, activist investors, have stepped up their activity in Japan, embarking on campaigns against large companies to pressure them to increase corporate value

- A common demand of activist campaigns is the divestment of non-core assets, which feeds into the first trend, thus continuing the cycle

Source: Dealogic

Download the full report

Download the full report in Japanese

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

As an increasing number of countries in Asia achieve an 80% vaccination rate, they are gradually removing COVID-19 social and border restrictions. BDA Partners is revisiting the fundamentals and attractiveness of the Asian healthcare services sector.

Healthcare services is the largest part of the healthcare industry in Asia. Its market size is expected to reach US$1.4tr by 2026[1], driven by a growing population, rising affluence, and a mounting disease burden.

Key takeaways:

- Demand for healthcare services in Asia will continue to rise — the segment is growing at a faster pace than the overall healthcare industry, although healthcare infrastructure has been under-invested historically

- Even as governments across Asia increase their budget allocation to healthcare, the private sector continues to play an important role, providing capital and improving the efficiency of the healthcare system

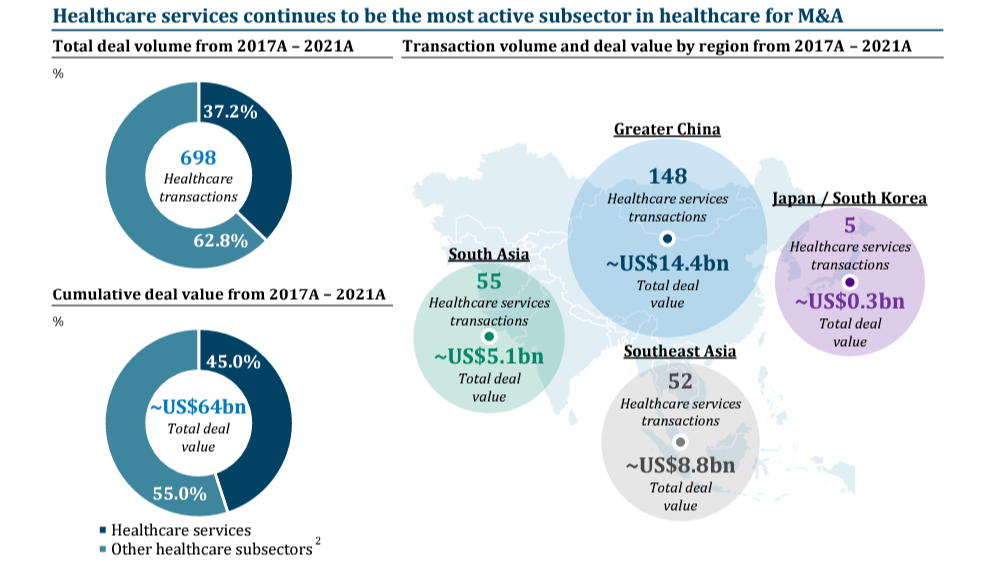

- Financial sponsors have been, and will continue to be, active buyers of quality hospitals and healthcare services assets. Sponsors have been involved in 25% of healthcare services transactions from 2017-2021

- The global dry powder of private equity funds reached a new record of US$1.8tr in February 2022, following a record year of fundraising

- Asian M&A activity in the next two to three years will be strong, driven by consolidation and bolt-on acquisitions by strategics in their core markets, and investments by financial sponsors into both platform and growth companies

In this piece, we examine post-COVID sector trends and M&A activities in SE Asia, Greater China, and India.

Sources: Mergermarket

Note: (2) Other healthcare subsectors include Medical Devices, Medical Equipment & Services, Biotechnology Research, Drug Development, Drug Manufacturing, Drug Supply, Handicap Aids and Basic Healthcare Supplies, etc.

Download the full report

Contact BDA health team

Andrew Huntley, Managing Partner, Global Head of Healthcare, London / Ho Chi Minh City: ahuntley@bdapartners.com

Anthony Siu, Partner, Co-Head of Shanghai: asiu@bdapartners.com

Sanjay Singh, Managing Director, Head of India, Co-Head of Asia Healthcare: ssingh@bdapartners.com

Claire Zhen, Director, Shanghai: czhen@bdapartners.com

Aditya Jaju, Vice President, Mumbai: ajaju@bdapartners.com

Yan Xia, Vice President, Singapore: xyan@bdapartners.com

Zhang Simeng, Vice President, Shanghai: szhang@bdapartners.com

[1] Fitch and Statista

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

There has been a distinct focus on ESG and sustainability in Asian private equity deal activity in the first half of 2022, with implications for new investments, portfolio management and exits. We have seen this trend accelerate as we advise on a series of such transactions this year.

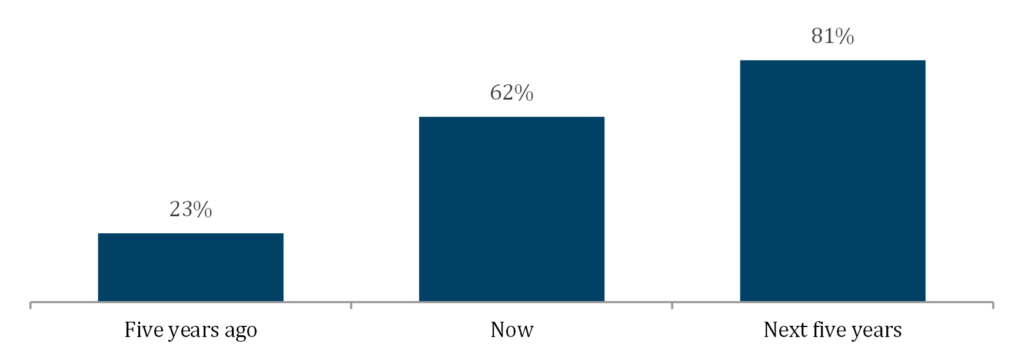

Asian sponsors are evaluating deals through an ESG lens

Western sponsors have thus far largely led the way on ESG considerations in M&A, with their APAC counterparts lagging behind. According to a recent Bain[1] survey, only 65% of APAC sponsors expect their LPs to scrutinise ESG issues over the next three years, compared to 96% and 80% for North America and Europe respectively.

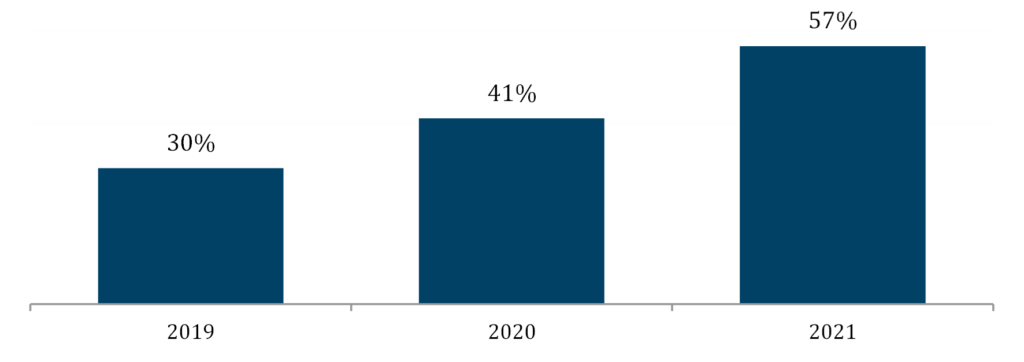

However, the ESG agenda in Asian business is now picking up significant momentum. The survey[2] also found 57% of Asian GPs plan to materially increase their ESG efforts over the next three to five years, up from 30% in 2019. This goes beyond just compliance and regulatory reporting, with more and more funds adopting an explicit – and exclusive – focus on new investments that will have both a positive impact and generate higher financial returns.

These twin goals are no longer seen as contradictory, rather, self-reinforcing. In a McKinsey Global Survey[3], C-suite leaders indicated they would be prepared to pay a 10% premium to acquire a company with a positive ESG track record versus a company without one. Furthermore, the consensus was that ESG programmes created value over the short and long term.

PE funds are proactively issuing ESG/sustainability related reports (i.e. EQT, Partners Group, Carlyle, and Permira, all with a major presence in Asia) which have started to disclose ESG measurements at the fund and portfolio company level, including scope 1 and 2 carbon emissions, energy consumption, diversity and inclusion metrics, corruption, etc. Those that have set up an ESG reporting framework and roadmap for each portfolio company across the investment lifecycle will be better placed for a successful exit.

Asian GPs: increasing their focus on ESG / Sustainability

Asian GPs: % of assets evaluated with ESG due diligence

Source: Bain Asia-Pacific Private Equity Report 2022

Deal types

Robust and high ESG standard gives an investment opportunity a competitive edge, without which will greatly hinder financial sponsors’ deal appetite, whether deploying dedicated “impact-labelled” funds or generalist capital. We have witnessed exceptional demand for ESG-oriented business models in 2022 such as: validation of supply chains and workforce conditions, responsible electronic waste recycling and a range of renewable energy plays. Conversely, the manufacturing of consumer items that lack a sustainability narrative find it harder to navigate the investment committee stage. Investment committees are also putting greater focus on ESG at the M&A decision making stage and more are avoiding certain end markets with a high carbon intensity.

“BDA is building a solid track record in sustainable infrastructure and services in Asia, and globally for Asian clients.”

Lars Freitag, Managing Director and Head of Sustainability: Services & Infrastructure, BDA Partners

Renewable Energy

E-waste Recycling & IT Asset Disposition

ESG & Supply Chain Services

Exit implications for PEs

ESG is now front and centre in both M&A due diligence and the value creation playbook.

For M&A due diligence, the role ESG plays can vary from a simple red flag checklist to a dedicated ESG vendor due diligence report (with comparisons to market competitors, emissions calculations etc.) or even a full-scope ESG value creation assessment. Red flag reports are rapidly becoming the norm in Asia, but the latter two are less common due to on-going challenges such as insufficient data for benchmarking (making it too difficult to correlate to value) or lack of expertise (to effectively analyse the data). There is no “one-size-fits-all” approach to ESG due diligence and should be assessed on each specific transaction, sector, client, etc. as different businesses will present different ESG issues to be considered.

“We are finding that, when presented with an acquisition opportunity, sponsors are asking ‘How does this business make the world a better place?’ Without a convincing answer to potential investors in our marketing materials and due diligence, any sellside process is more at risk, even in Asia.”

Paul DiGiacomo, Managing Partner and Head of Financial Sponsor Coverage, BDA Partners

Aided by such references as Principles for Responsible Investment (“PRI”), Sustainability Accounting Standards Board (“SASB”) and UN’s Sustainable Development Goals (“SDG”), sponsors are encouraging Asian portfolio companies to not only implement action plans to improve ESG performance and reporting, but also ensure that such steps generate robust and quantifiable data to increase accountability. The clear expectation is that being ready to present sustainability KPIs will pave the way for a smoother and more remunerative exit.

One example is the Baring Private Equity Asia (“BPEA”) stewardship of HCP, the Shanghai-headquartered packaging company serving the global cosmetics market. Since its acquisition in 2016, BPEA drove a transformation of HCP’s ESG and sustainability capabilities, including developing refillable packages and use of sustainability-certified manufacturing facilities.This greatly facilitated the onward sale to Carlyle, which was announced in May and should close in Q32022.

“ESG considerations are being tracked and monitored by management and shareholders, and are quickly becoming an important value creation strategy in Asia, including for building brand equity.”

Mark Webster, Partner and Head of Services, BDA Partners

Who is doing what: selected PE Sponsors’ ESG moves in Asia

- Baring Private Equity Asia, the regional PE powerhouse that set up a US$3.2bn ESG loan for APAC investment in 2021 – and has pioneered the implementation of ESG measures across its portfolio including HCP, sale to Carlyle announced (May 2022)

- Goldman Sachs’ portfolio company LRQA acquired Hong Kong-headquartered ELEVATE, the supply chain verification and worker engagement platform (from EQT – May 2022*)

- Navis capitalised on the circular economy thematic, exiting Singapore HQ TES, the electronic waste recycler and IT Asset Disposition service provider, to SK ecoplant of Korea (April 2022*)

- Serendipity Capital’s portfolio company Pollination, the climate change advisory and alternative investment platform, attracted US$50m in Series B capital from ANZ (January 2022*)

- StonePeak leading infrastructure specialist that targets assets globally, including dedicated capital for Asia, announced industry-leading ESG commitments alongside measurable and reportable plans to achieve them, including rigourous sustainability targets and the introduction of related performance incentives (March 2022)

- Temasek and BlackRock created Decarbonization Partners, a US$600m partnership focusing on late-stage venture capital and early-stage growth funds for decarbonisation in 2021. In June 2022, Temasek announced the launch of GenZero, a green investment firm with an initial $5b pledge, a testimony of its commitment to halve the net carbon emissions of its portfolio by 2030 using 2010 as a base and achieve net zero by 2050.

* BDA transaction

[1] Bain Asia-Pacific Private Equity Report 2022

[2] Ibid

[3] www.mckinsey.com/business-functions/sustainability/our-insights/the-esg-premium-new-perspectives-on-value-and-performance, February 2020.

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

BDA Partners hosted our inaugural China Growth Capital Conference on April 26th – 28th. 20 presenting companies from consumer, health, services and technology sectors gave presentations to growth capital investors in over 200 virtual one-on-one meetings.

Anthony Siu, Partner and Co-Head of Shanghai, said: “Our 3-day virtual conference was a big success. It was BDA’s first growth capital conference and it attracted over 300 investors from 150 PE firms to participate in our conference. The attendees included blue-chip global and China USD funds as well as China RMB funds. We also received strong support from Founders and CEOs of high-growth companies in China to present at our conference. These companies represent industries which are at the forefront of China’s economic development including digital health, in-vitro diagnostics, premium healthcare services, lifestyle & wellness and fintech. The strong turnout reflects investor appetite for high-quality companies set to benefit from China’s rapid transformation toward an advanced economy. It also demonstrates ample private market liquidity seeking mid to late stage opportunities in China. We are very pleased to be the partner of choice for our clients in bringing private capital and exciting growth opportunities together.”

We look forward to our next BDA China Growth Capital Conference in 2023, and also the annual BDA PE Conference in late 2022. Please contact us at gcc@bdapartners.com or pe-conference@bdapartners.com if you would like to learn more about either conference, and the benefits of both presenting and attending.

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

Since 2020 BDA has successfully advised on nearly 60 transactions, making us one of the most active M&A advisors in Asia. This level of experience underpins our ability to deliver successful outcomes for our clients under dynamic market conditions.

For over 20 years, our Hong Kong team has advised multinationals on strategic carve-outs and bolt-ons, guided entrepreneurs on divestments and capital raises, and supported financial sponsors on investments and portfolio company exits.

We continue to leverage this experience and insight to deliver value-optimising results for our clients who entrust us with their business.

The enclosed flyer provides a snapshot of our capabilities and our recent track record globally and in the Greater China region. Our experienced and dedicated team of Hong Kong-based bankers is ready to support your M&A ambitions. Should you wish to learn more about BDA, our expertise and how we can assist you, please reach out to one of our contacts below:

- Paul DiGiacomo, Managing Partner: pdigiacomo@bdapartners.com

- Simon Kavanagh, Partner: skavanagh@bdapartners.com

- Karen Cheung, Managing Director: kcheung@bdapartners.com

- Mireille Chan, Director: mchan@bdapartners.com

- Jakub Widzyk, Director: jwidzyk@bdapartners.com

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

The article was originally published on April 2022 issue of Vietnam Economic Times

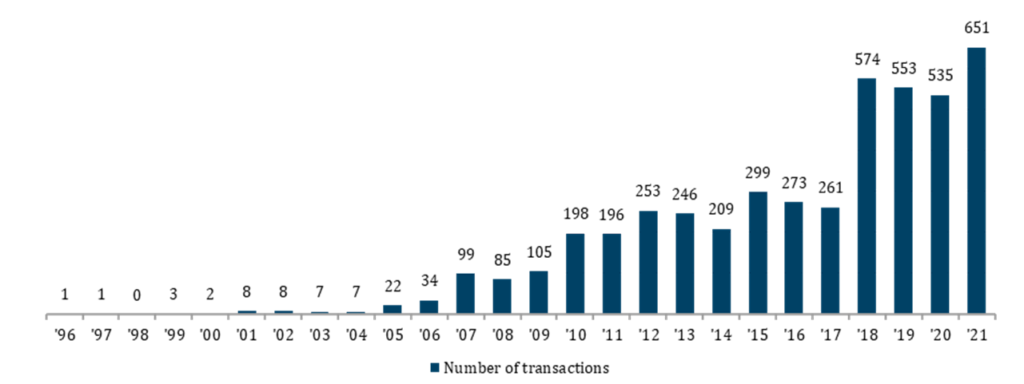

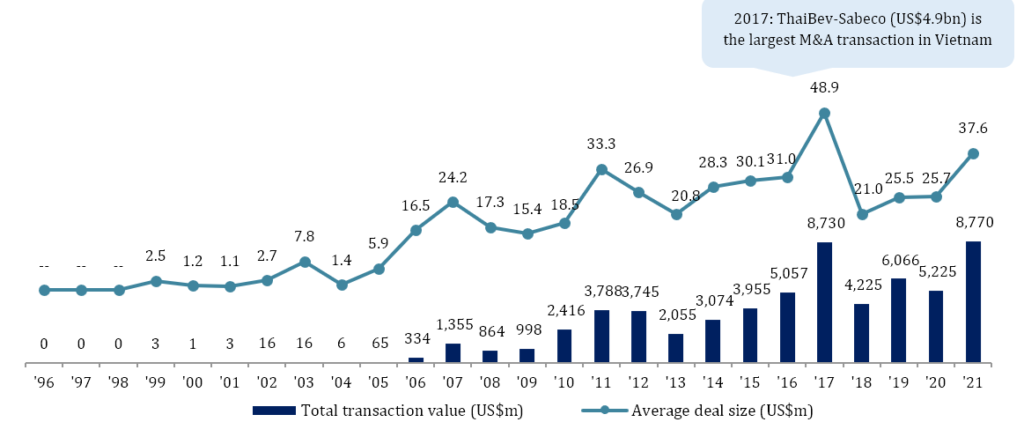

Over the last 25 years, Vietnam has transformed from a low-income country into one of the fastest-growing economies in the world, with GDP per capita increasing nearly ten-fold from 1996 to 2021[1], supported by a strong socio-economic backbone of a young population and a rapidly-growing middle class. Along with economic growth, merger and acquisition (M&A) activities in Vietnam have also soared, driven by progress in equitization and market liberalization, as evidenced by supportive market regulations for foreign investors. From the quiet days of a handful of small value deals in the late 1990s, Vietnam’s M&A market has been recording over 500 deals each year recently. Larger deals have become more common, with 62 valued at $100 million or more over the last five years. Although challenges remain, the outlook for M&A activities in Vietnam is bright, especially as border restrictions have been relaxed and the country is heading towards post-pandemic recovery.

Source: Capital IQ

Source: Capital IQ

The emergence of a new M&A market (1996-2004)

Vietnam’s new market economy was gradually developing in the 1990s, after extensive socio-economic reforms brought about by “Doi Moi” policies since 1986. In 1995, Vietnam became a member of ASEAN as part of efforts to rejoin the global economy and attract foreign investment. The early days of M&A activities in Vietnam in the late 1990s to early 2000s were relatively quiet, with no apparent trend, as its economy was still largely dominated by State-owned enterprises (SOEs). There were fewer than ten transactions each year in this period, more than 90% of which were under $5 million.

Top buyer countries: In addition to domestic investors, investors from Denmark and the US were most active, followed by those from developed countries in Asia such as Japan and South Korea. The top position held by Denmark was primarily driven by Carlsberg’s acquisition of Hue Brewery in 2003, with the addition of several small-scale projects in Industrials and Information Technology backed by IFU, the Denmark-based development fund.

Top sectors: Consumer and Financial Services dominated in deal value, driven by (i) Vietnam’s gradual emergence from low-income status at the turn of the 21st century, and (ii) the Vietnamese Government’s plan to revamp its nascent banking system with foreign investment.

Booming M&A activities due to market liberalization (2005-2013)

From only a handful of deals a year from 1996 to 2004, M&A activities in Vietnam skyrocketed to over 150 deals on average a year in the 2005-2013 period. Deal value and number of deals fell briefly from 2007 to 2009 due to the impact of the global financial recession, before rebounding in later years and peaking in 2011 and 2012 with a number of high-value deals. Transaction size significantly improved, with 90 transactions having over $50 million in value.

M&A activities in Vietnam increased significantly in this period due to:

- An influx of foreign capital into SOEs: Major examples are investments by major Japanese banks such as Mizuho and Sumitomo in Vietcombank and Eximbank

- A strengthened regulatory framework, as the 2005 Enterprise Law came into effect

- Open market access for foreign investors: Vietnam became a member of the WTO in 2007, committing to one of the world’s most progressive market access programs

Top buyer countries: Domestic investors took the top spot with a number of sizeable transactions and many smaller ones (90% of domestic deals were under $10 million). The largest deals from domestic investors had two notable trends:

- M&As in Financial Services, with top deals such as SHB’s $168 million acquisition of Habubank and Eximbank’s acquisition of a 9.6% stake in Sacombank for $100 million in 2012

- Local conglomerates’ expansion strategies, with top deals such as Masan’s acquisition of (i) an 85% stake in Nui Phao Mining for $100 million in 2010, and (ii) a 40% stake in Vietnamese-French Cattle Feed (Proconco) for $96 million in 2012

Among foreign investors, buyers from Japan, France, the US, and Singapore were among the most active, with eleven transactions surpassing the $100 million mark.

Top sectors: Financial Services overtook Consumer to be the top area of focus for M&As and foreign investments, driven by market consolidation and the restructuring of Vietnam’s banking system. Industrials remained in the top 3, attracting M&A activities from foreign investors due to Vietnam’s potential in natural resources and low labor costs.

Record-breaking deal flow (2014-2021)

In the 2014-2021 period, annual average deal count increased more than three-fold to over 450. Transaction size also significantly improved, with 196 transactions having over $50 million in value; more than double the figure in the 2005-2013 period. 2017 was a record-breaking year in terms of transaction value, driven by ThaiBev’s acquisition of a 53.6% stake in Sabeco in 2017 for $4.9 billion; the largest deal in Vietnam to date. Overall, transaction value was on an upwards trend, peaking at $8.7 billion in 2017 before declining to $6 billion in 2019 as the US-China trade war sparked recession concerns, and $5.2 billion in 2020 due to the impact of Covid-19. However, M&A activities recovered strongly in 2021, with a record year seen in deal volume (651) and value ($8.8 billion), in line with global M&A trends and due to the unleashing of accumulated capital and pent-up deal-making demand. With economic optimism remaining high, especially given new open border policies, 2021 set a solid background for supercharged growth in M&As in 2022 and beyond.

Key drivers for record-breaking deal flows in this period include:

- Favorable regulation and market access for foreign investors:

- The 2015 Law on Enterprises and Law on Investment allows foreign investors to own up to 100% of equity in listed companies in Vietnam, except for ones constrained by:

- Foreign ownership restrictions, as set out in commitments to international treaties

- Conditional lines of business

- Voluntary limits imposed by shareholders

- The 2015 Law on Enterprises and Law on Investment allows foreign investors to own up to 100% of equity in listed companies in Vietnam, except for ones constrained by:

- Vietnam’s participation in major free trade agreements such as the EU-Vietnam Free Trade Agreement and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership

Top buyer countries:

- Thai and South Korean buyers showed an appetite for large-sized deals, as evidenced by ThaiBev’s acquisition of a 53.6% stake in Sabeco for $4.9 billion in 2017 and the SK Group’s acquisition of a 6.1% stake in Vingroup for $1 billion in 2019

- Singaporean and Japanese investors were more attracted to small and medium-sized transactions, with only 5% of transactions having over $100 million in value

- Deal flow involving domestic buyers, though no longer remaining at the top position, was still significant in volume, although 90% of transactions were under $10 million in value. Major deals with domestic buyers included Vingroup’s acquisition of a 96.5% stake in the Bao Lai JSC, a white marble mining company, for $119.8 million, and Masan’s acquisition of a majority stake in Phuc Long for over $100 million

Top sectors:

- Information Technology emerged among the top 5, driven by private equity and venture capital investors betting on Vietnam’s dynamic internet economy, with the internet penetration rate doubling from 35% in 2011 to 70% in 2021 (according to the World Bank)

- Deal flow and volume in Infrastructure, Government & Utilities was driven by transactions involving renewable energy. The largest deals included Chaleun Sekong’s $99 million acquisition of the Hoang Anh Gia Lai Hydropower Plant JSC and Banpu’s $66 million acquisition of the Mui Dinh Wind Farm

Although Real Estate M&A transactions (asset / project / land bank transfer) were not considered for M&A statistics here, it is worth noting that Real Estate also saw a boom in transaction numbers and value in the period, driven by rapid urbanization in Vietnam. There were 79 deals totaling $1.7 billion from domestic buyers and 178 deals totaling $4.4 billion from foreign investors.

Future outlook

Recent outbreaks of Covid-19 might put a temporary halt on progress in economic growth but will not reverse ongoing progress in socio-political changes in Vietnam, which will set a solid foundation for the next 25 years. Vietnam will continue to enjoy (i) a bourgeoning middle class with increasing spending power, (ii) a young population with a high urbanization rate, and (iii) stable political standing. As Covid-related restrictions have been relaxed, Vietnam’s economy is expected to strongly recover as the fastest-growing economy in ASEAN, with 6.6% growth in 2022, followed by the Philippines (6.3%) and Malaysia (6.0%). Since 2019, factory relocations from China or other parts of Southeast Asia have been driving an influx of foreign capital; a trend expected to persist in the next 25 years as Vietnam cements its strategic importance as a manufacturing hub in the region. Market liberalization will also continue to serve as the backbone for Vietnam’s economy, with government policies focusing on free trade agreements.

Expected trends

Environmental, social, and governance (ESG) criteria will become more deeply integrated into Vietnam’s M&A market.

Private equity investors have become more active in Vietnam in recent years. Recent examples of large deals involving private equity investors include KKR’s $650 million investment in Vinhomes in 2020, $400 million investment led by Alibaba Group and Baring Private Equity Asia (BPEA) and $350 million investment by a consortium of TPG, Temasek, and the Abu Dhabi Investment Authority in The CrownXin 2021. More and more global and regional private equity firms have established a local presence in Vietnam, with dedicated investment teams and networks of advisors on the ground.

Asia-Pacific investors will continue to rank higher in deal volume compared to their European and North American counterparts.

Buyout transactions have become more common, especially due to the impact of the pandemic, which led to the consolidation of small and medium-sized players into respective market leaders. Local conglomerates such as Vingroup, Masan, and the Nova Group have all been active in acquiring targets across different industries both within and beyond their core capabilities, such as education, technology, and F&B, etc., and are expected to accelerate their expansion strategies through acquisitions in the future. Foreign investors, on the other hand, have been increasingly active in pursuing buyout transactions in Vietnamese businesses, as seen in the Stark Corporation’s acquisition of ThiPha Cable and Dovina in 2020 and SCG Packaging’s acquisition of Duy Tan Plastics in 2021, for both of which BDA served as sellside advisor. Financial sponsors have also been active in buyouts of Vietnamese companies, as evidenced in acquisitions of majority stakes in Vietnam USA Society English Centers (VUS) and Vietnam Australia International School by BPEA and TPG, respectively.

Sectors of focus include consumer, healthcare, industrials, IT/technology, and renewableeEnergy.

In conclusion, we remain confident in the availability of opportunities in Vietnam’s M&A market going forward, especially now that social distancing restrictions have been lifted and borders are expected to be fully open this year. We at BDA in Ho Chi Minh City have seen strong interest from investors looking for sizable transactions, as foreign investors interested in Vietnam have accumulated a lot of dry powder since 2020 and are ready to revive deals that were put on hold or cancelled. Meanwhile, we are also observing strong demand for growth capital and exits from both founder-backed and private equity-owned companies, as evidenced by current live deals and strong pipelines of opportunities for 2022 and beyond.

[1] Source: International Monetary Fund

[2] Excluding transactions with undisclosed value

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

In recent years, moderating GDP growth, fierce competition from local players, rising geopolitical tensions, major regulatory changes, and management constraints stemming from the COVID pandemic have led many MNCs to consider taking a step back from China.

Since 2017, multinational corporations (“MNCs”) have realized nearly US$100bn from divestitures of PRC-based assets, with ~90% of transactions concluded with Chinese buyers. Today, the appetite of PRC corporates/sponsors for quality China operations is at an all-time high, and a well-run process can deliver strong returns for an asset with diminishing strategic value.

In our latest Insights, Unlocking Value with Strategic Corporate Divestments in China, we examine the recent expansion of MNC divestments in the PRC and discuss how on-the-ground insights and careful process management can optimize value in such a situation.

Click to download: Unlocking Value with Strategic Corporate Divestments in China

BDA is highly experienced in corporate exits, both in China and across Asia. For a further discussion please reach out to one of our contacts below:

- Jeffrey Wang, Partner, Shanghai: jwang@bdapartners.com

- Anthony Siu, Partner, Shanghai: asiu@bdapartners.com

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

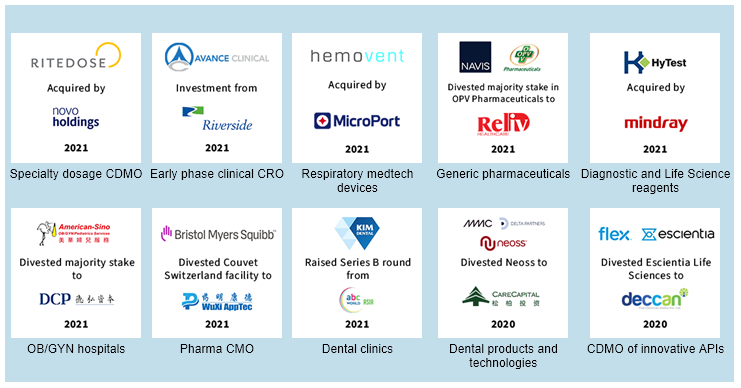

2021 was a phenomenal year for deal activity in the Healthcare sector. Strong M&A momentum continued across most Healthcare verticals despite, and sometimes because of, extended COVID-19 disruptions. BDA closed landmark transactions across sub-sectors including Pharma Services (CRO/CDMO), Specialty Generics, Healthcare Services, Diagnostics and Life Science Tools, and Medical Devices, which touched on specialty therapeutic areas such as respiratory, renal care, OB/GYN and dental.

It was a busy year for Asian players in healthcare. Among them, Chinese buyers emerged as some of the most active participants, driven by the desire to expand their capabilities to address unmet needs in the strongly growing Chinese market. With our deep sector knowledge and broad network, BDA delivered strong transaction outcomes for our corporate and private equity clients throughout the pandemic.

Enabling client success:

BDA’s senior Healthcare bankers give their predictions for the year ahead.

Andrew Huntley, Managing Partner and Global Head of Healthcare:

In 2022 I believe the 2021 Asian Healthcare M&A tally of US$139.6 billion(1) will grow further. COVID-19 impacts that disguised underlying EBITDA and created valuation and diligence frictions between buyer and seller should moderate. Specialty clinic chains, pharma services (CRO and CDMO), and diagnostic products and services will continue to attract M&A in Asia. Life science tools and technologies is a category for which I see a growing appetite where the region lags developed markets. So is home healthcare. I am waiting for an Asian leader in medical device CDMO to emerge and there are some interesting building blocks out there. Consolidation trends in China will play out; and we might see some multinational divestments of Chinese units in pharma and devices.

Sanjay Singh, Managing Director, Head of India and Co-Head Asia, Healthcare:

India continues to build innovative pharma research and development capabilities on top of its generics base. This is especially the case in pharma services where I see increasingly well positioned CDMO assets in both API (drug substance) and formulations (drug product) which serve global pharma sponsors not just generics customers. These will drive capital raising and M&A transactions, as will early signs of India nurturing some differentiated medical device innovators. Domestic formulation businesses will likely see consolidation as larger companies seek to expand their presence in chronic therapies. Digital health and Healthcare IT are, respectively, new and established exciting segments for investment and M&A.

Anthony Siu, Partner, Co-Head of Shanghai and Head of Financial Sponsor Coverage, China:

Private equity owners of Health assets are going to capitalise on the favourable sector trends to exit their investments, but they will also be very active acquirers, armed with ample dry powder of over US$650 billion Asia-wide. Healthcare regularly features in the top two priority sectors for Asian financial sponsors. China focused sponsors will continue to back or partner with strategic acquirers to drive both consolidation within China and outbound acquisitions in the West. On the capital markets side, growing uncertainties in public markets will increase the appeal of private capital raise rounds before IPO.

We look forward to delivering outstanding advisory services and great outcomes for our clients.

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

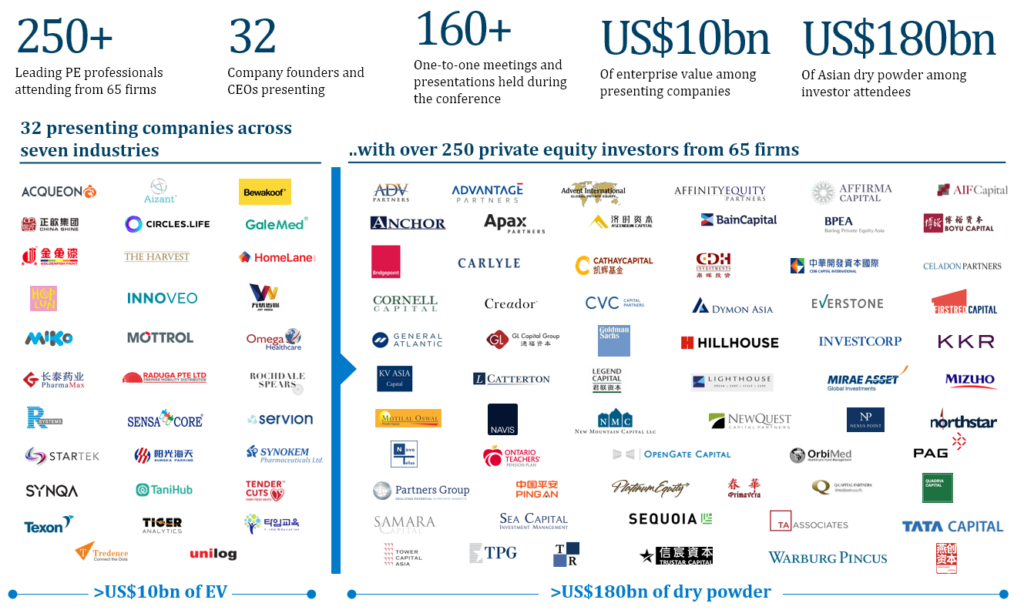

The BDA Private Equity Conference is an annual convene where blue-chip private equity investors meet outstanding private companies. It is a unique platform for outstanding private companies in the chemicals, consumer & retail, healthcare, industrials, services and technology sectors to build their profiles and network with leading PE investors. It is also an exclusive opportunity for PE investors to hear introductory presentations by company founders or senior management, and to have one-to-one individualized access to them. This provides early exposure to companies that may explore a transaction in the medium term.

BDA PE Conference 2021

BDA Partners hosted the 3rd annual BDA Private Equity Conference from November 30th to December 2nd, 2021.

32 leading Asian private companies from the Consumer, Education, Healthcare, Industrials, Services and Technology sectors gave presentations and participated in one-to-one meetings with more than 250 Asian & global private equity investors.

Paul DiGiacomo, Managing Partner and Head of the Financial Sponsors Group at BDA, said: “The BDA PE Conference has proven to be a valuable platform for both the private equity community and blue-chip private companies in Asia. We provide investors with unique access to high-quality private companies, and company founders and senior management can begin to develop relationships with investors and get invaluable early market feedback. We’re pleased that the community continues to find the conference to be useful and rewarding, and we expect to introduce additional opportunities for investors and private companies to network and interact in 2022.”

We look forward to hosting the 2022 BDA PE Conference in the second half of 2022. Further details will be shared in due course.

Please contact pe-conference@bdapartners.com if you would like to learn more about the 2021 conference, or to attend in 2022. Please contact pdigiacomo@bdapartners.com to discuss the benefits of presenting at the 2022 conference.

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes. BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese government-owned bank with US$150bn of assets.

US securities transactions are performed by BDA Partners’ affiliate, BDA Advisors Inc., a broker-dealer registered with the Securities and Exchange Commission (SEC). BDA Advisors Inc. is a member of the Financial Industry Regulatory Authority (FINRA) and SIPC. In the UK, BDA Partners is authorised and regulated by the Financial Conduct Authority (FCA). In Hong Kong, BDA Partners (HK) Ltd. is licensed and regulated by the Securities & Futures Commission (SFC) to conduct Type 1 and Type 4 regulated activities to professional investors. www.bdapartners.com

The article was originally published in the September 2021 issue of Vietnam Economic Times

Huong Trinh

Managing Director, Head of Ho Chi Minh, BDA Partners

Despite Vietnam experiencing its fourth wave of Covid-19, merger and acquisition (M&A) activities will continue to remain strong. Since the beginning of this year, we at BDA Ho Chi Minh City have seen strong interest from large regional PEs (private equity firms) looking for sizable transactions. We are also observing strong demand for growth capital and exits from both founder-backed and private equity-owned companies, evidenced by numerous current live deals and strong pipelines/opportunities for 2021.

Vietnam’s macroeconomic fundamentals remain strong. In the International Monetary Fund (IMF)’s revised forecast released in July, the country is still on track to remain the fastest-growing economy in Southeast Asia this year, with projected growth of 6.5 percent. Vietnam also has one of the fastest-growing middle-class populations, with rising discretionary spending power, leading to high pent-up demand for goods and services that will contribute to economic recovery as the country opens up again later this year.

Key industries predicted to grow strongly

In general, Vietnam’s economy has remained resilient and maintained good momentum for growth across industries despite the recent surge of Covid-19. In addition to consumer and retail which has always been one of the most active sectors in Vietnam and is expected to rebound strongly in 2022 thanks to the recovery of consumer confidence, the following sectors have been attracting a lot of interest.

We believe that IT & Technology and especially the internet-related segment will achieve the strongest growth in Vietnam, and that there will be a strong pipeline of opportunities for the sector in 2021 and upcoming years. Difficulties caused by the pandemic have driven growth in demand across all industries for technology-related services and digital solutions that help businesses function normally. In a post-pandemic world, there will be a continued push for swift digitalization, and M&As will be the fastest way for businesses to achieve this goal. Also, Vietnam’s internet economy has been growing rapidly during Covid-19, and we expect this trend to continue as there have been long-term changes to consumer habits and dynamics. The pandemic, for all its negative impacts on health, society, and economy, is propelling the growth of e-commerce and digital finance in Vietnam, paving the way for the country to fulfill its digital potential. According to the Ministry of Industry and Trade, Vietnam’s e-commerce market grew 18 percent year-on-year in 2020 to $11.8 billion, while traffic on e-commerce platforms was 150 percent higher than in 2019.

Pharmaceuticals is an industry that has attracted a lot of interest from foreign investors in recent years, with notable transactions including Taisho’s acquisition of a majority stake in DHG Pharma and SK’s recent investment in Imexpharm. According to BMI Research, Vietnam’s pharmaceutical industry could reach $7.7 billion in 2021 and $16.1 billion in 2026. A growing middle class, urbanization, and a young population are driving domestic demand for all aspects of healthcare, including expenditures on pharmaceuticals. As a defensive sector, pharmaceuticals will continue to achieve strong growth as Vietnam transitions out of the pandemic period. The industry is set to benefit greatly from the government’s national strategy to promote domestic manufacturing. To compete with imports, M&As with foreign strategic investors will continue to be crucial for local manufacturers, enabling them to meet global pharmaceutical standards through transfers of technology, R&D, and management expertise.

Renewable energy has also become an interesting sector for M&A activity in Vietnam over recent years, and we expect deal flow to resume as the country gradually opens up. With a rapidly growing economy, Vietnam has been at risk of power shortages as demand exceeds supply due to a lack of power infrastructure, and capital injections into the development of renewable energy could provide a good solution. Vietnam became the largest solar energy market in Southeast Asia in 2019, attracting foreign investors in mega plants in Binh Phuoc, Tay Ninh, and Ninh Thuan provinces, given the more attractive feed-in-tariff schemes compared to other countries in the region. Buyers have also been active with acquisitions of onshore and offshore wind farms in the central highlands and central coastal regions, which boast huge potential given their ample wind resources.

In Vietnam’s real estate market, M&A remains the quickest solution for foreign developers to enter the country and for local developers to expand their land portfolio. An increase in real estate M&A activity is expected this year, as various projects will be approved thanks to new improvements in the Law on Investment, after lengthy delays in the review process in previous years. Investors have accumulated a lot of capital, which is waiting to be deployed as the economy recovers, while owners struggling from the impact of the pandemic are willing to sell at lower valuations. Within the sector, industrial real estate has seen more activity in 2021, as multinational companies continue to shift their manufacturing bases from China to Vietnam despite the ongoing pandemic. Meanwhile, deal flow in residential real estate is expected to recover in the latter half of the year, as postponed transactions are resumed when travel restrictions are loosened.

Manufacturing, one of the sectors temporarily hit by Covid-19, will also provide opportunities to buyers who are confident of a strong economic recovery. Vietnam has been emerging as a manufacturing hub in the region given its low labor costs, its strategic location and many seaports nationwide, and its increasing participation in free trade agreements. For these reasons, its manufacturing sector will remain attractive to foreign investors, especially given ongoing China-US trade tensions, resulting in the relocation of manufacturing hubs from China to Vietnam. Domestically, there could also be a pickup in M&A activity, as we might see a trend in the consolidation of struggling small and medium-sized players into respective market leaders. Demand for growth capital from businesses looking for internal transformation and rebuilding post-pandemic will also present opportunities for investors looking for high-quality assets at attractive valuations.

Common risks and opportunities

Some of the common risks include uncertainty in the legal framework, especially new laws that came into effect recently, quality of information, as some companies still do not apply best practices in bookkeeping, an unfamiliarity among Vietnamese sellers with M&As and the basic concepts and processes involved, and cultural differences during deal negotiation and post-deal integration.

M&A transactions in Vietnam are largely governed by the Law on Enterprises, the Law on Investment, and the Law on Competition. Recent changes in these laws have posed additional challenges to potential buyers. For example, under the new Law on Competition, a substantially higher percentage of M&A deals are subject to merger control filing requirements, and the evaluation process could potentially add months of uncertainty to the timeline of a deal. Quality of information is also a common issue for foreign buyers, as target companies do not always have an organized information system that meets their requirements.

The current postponement of inbound international flights due to the pandemic also makes it difficult for buyers to conduct in-depth due diligence through site visits and face-to-face meetings. Additionally, foreign buyers might be unfamiliar with cultural differences in corporate governance practices in Vietnam. Many target companies are founder-owned, family-run businesses, which may not yet see the value-added of foreign strategic and financial partners or be open to international corporate governance standards. Last but not least, Vietnamese sellers lack knowledge in terms of how the M&A process works and is structured, which will create uncertainties.

Despite the existing drawbacks, it is important to acknowledge that compared to a decade ago, the perception of M&As in Vietnam has changed dramatically among government agencies, business owners, and investors/buyers and in a positive way. Authorities are continuously improving their turn-around times and responsiveness, while working toward new guidelines for M&A transactions, with the new Law on Enterprises, Law on Investment, and Law on Securities having come into effect on January 1, 2021. Shareholders are now more open to adding M&A as a strategic option in their growth trajectory and are becoming more educated in terms of M&A processes and key concepts. We see that sellers are taking a much more structured approach for large domestic deals or cross-border deals by engaging relevant advisors, who will help mitigate risks for foreign buyers by working with them through a transparent process. As BDA has a local team in Vietnam, we have been fortunate and pleased to be trusted by many local business owners and have given them advice and helped them run structured deal processes along the way.

We remain confident in the availability of opportunities in Vietnam’s M&A market. From a macro level value creation process perspective, Vietnam will continue to enjoy: (i) stable, unparalleled economic growth compared to other Southeast Asia countries, especially amid Covid-19; (ii) an influx of advantages from recent free trade agreements; and (iii) a strong government push to equitize State-owned enterprises. From a micro-level perspective, Vietnamese companies are becoming more professional with stronger management teams and better corporate governance. They are more open to foreign investors as they see the different values that both strategic and financial investors can bring.

Anticipated M&A deals and volume in next six months

Companies looking to position themselves for recovery in the post-pandemic economy will need new capital injections for internal transformation and further growth to remain competitive, and they will be eager to restart conversations with buyers for deals that were put on hold or lost. Within businesses in industries such as F&B, manufacturing, and industrials that have been negatively affected by the pandemic, there are still a lot of sizable and high-quality assets in the market. This environment will create opportunities for an increase in deal flow linked to dislocation, as sellers are more willing to close deals at a lower valuation in exchange for immediate access to growth capital. Until travel restrictions are loosened, local investors will have an advantage over foreign counterparts in such transactions, given their presence in Vietnam and their ability to run quicker processes and provide liquidity to businesses in need. We also expect to see a consolidation trend in M&A transactions, as market conditions have become challenging for small and medium-sized enterprises (SMEs).

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes. BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese government-owned bank with US$150bn of assets.

US securities transactions are performed by BDA Partners’ affiliate, BDA Advisors Inc., a broker-dealer registered with the Securities and Exchange Commission (SEC). BDA Advisors Inc. is a member of the Financial Industry Regulatory Authority (FINRA) and SIPC. In the UK, BDA Partners is authorised and regulated by the Financial Conduct Authority (FCA). In Hong Kong, BDA Partners (HK) Ltd. is licensed and regulated by the Securities & Futures Commission (SFC) to conduct Type 1 and Type 4 regulated activities to professional investors. www.bdapartners.com