Huong Trinh on VIR: Foreign groups locking eyes on F&B

Huong Trinh, Partner and Head of Ho Chi Minh City at BDA Partners, shares insights on Vietnam F&B sector in M&A on VIR.

How do you see the trend of M&As in Vietnam’s F&B post-COVID? Do you see a slowdown in this area?

Post-Covid, we are still observing continuing interests from both strategic and financial investors, especially ones from Japan, Korea, and Southeast Asia for F&B companies in Vietnam. The total value of M&A transactions in Vietnam’s consumer sector reached US$1.2bn in 10M2022, an increase of nearly 40% yoy from US$871m in 10M2021. Meanwhile, it is worth noting that in recent months in 2H 2022, consumer confidence has been impacted by ongoing macro factors (e.g., surging inflation and interest rates). Nevertheless, going forward, we still expect a buoyant F&B market outlook, as Vietnam remains as one of the most attractive F&B markets in the region with robust market fundamentals and a strong socioeconomic backbone thanks to (i) a fast-growing market with 100 million consumers, propelled by robust economic growth and rising income, (ii) a young and dynamic population increasing propensity to spend, and (iii) rising demands for e-commerce and modern retail driven by rapid urbanization. These are the key factors driving M&A activities in the Vietnam’s F&B sector.

Filipino food company Jollibee Food Corporation is reportedly seeking to sell a minority stake in Vietnamese coffee chain Highlands Coffee. The sale could lead to an IPO launch for the coffee chain, which Jollibee has been considering for several years. What are the opportunities for foreign companies to conduct M&As in Vietnam’s F&B market? What are some major F&B deals in Vietnam in 2022?

We believe there remain many opportunities for foreign investors looking for potential targets for M&A of F&B companies in Vietnam, given the strong growth prospects. Strategic investors will be on the hunt for Vietnamese F&B companies to expand their product portfolio, manufacturing capacity and distribution network in the country. Such investments will also provide strategic investors quick access to a highly potential F&B market with 100 million consumers with rapidly growing disposable income. This attractive market outlook will also appeal to financial sponsors, especially ones with strong track record of operational expertise in the sector.

Additionally, in Vietnam, there is generally no restriction/limit on foreign ownership applicable to F&B companies. This opens various opportunities for foreign investors to penetrate Vietnam market via M&A, especially for those who prefer to seek controlling stakes in the target companies.

From our discussions with investors within our network, sub-segments in the F&B sector that we continue to see strong interests from foreign investors are food service, food ingredients and additives, and F&B retail. Vietnam F&B companies with (i) strong brand equity and awareness, (ii) extensive portfolio of staple products that are less directly affected by market fluctuations, (iii) nationwide distribution network, (iv) healthy financial performance, and (v) clearly defined business plans with attractive growth initiatives will present compelling investment opportunities for foreign investors.

Some remarkable F&B transactions in 2022 include:

- Masan Group’s acquisition of a majority stake in Phuc Long

- Swire Pacific’s acquisition of Coca-Cola bottling operations in Vietnam and Cambodia for c.US$1bn

- Golden Gate minority equity stake sale to a group of investors led by Temasek

- Navis invested over US$100mn in Dan-D Foods for the majority stake of the company.

- Pan Group has bought 39.9% stake in Bibica for US$22.6mn to increase its total ownership to 98.3%.

- Cool Japan Fund’s minority stake investment into Pizza 4P’s, following the successful divestment of Mekong Capital

Vietnam Dairy Products JSC (Vinamilk) and Kido Group JSC have just announced the suspension and dissolution of the joint venture Vibev. Could you comment on the dissolution of the F&B joint venture? What are challenges for F&B players to restructure their M&A strategies post-COVID?

The current regional and local macro situations may impact corporate considerations and decisions on business plans, including what should be the strategic focus for 2023 and onwards. These are also mentioned in Kido and Vinamilk’s statements regarding the dissolution of their JV. There are various aspects that F&B companies should carefully consider, so that their M&A activities (i) can be aligned with corporate strategies, and (ii) can add long-term synergistic value to the Company and stakeholders.

Some key challenges/considerations for F&B players regarding their M&A strategies include:

| Challenges | Mitigations and opportunities |

| For sellers | |

| How to align and balance the value from long-term M&A strategies with current business requirements | In some cases, shareholders or companies may have to choose between long-term strategic value and immediate capital needs. Nevertheless, F&B companies should always carefully consider such synergistic values that an investor may contribute to the development and expansion of the business (other than capital), when it comes to selecting the right strategic partner for M&A. Those values can be global best practices in corporate governance, know-hows in operations, network relationships or product portfolio expansion, etc. |

| Business performance can be impacted by macro factors (e.g., higher inflation and interest rates, which may impact valuation) | Valuation can be based on future performance or normalized current performance rather than current accounting performance. In such case, companies need to have a clear explanation for its performance during COVID period and a normalized level of performance. Companies with clearly defined business plans and well-established growth initiatives will be able to deliver more attractive growth stories and will be more likely to solicit better valuation/terms from investors. Companies should also keep in mind about the timing for M&A, so that investors may have sufficient time to understand and appreciate the business and growth potentials, before making an investment decision. Professional M&A sell-side advisors may help shareholders and the Company with fine-tuning the equity story and articulating growth prospects to potential investors to maximize value. |

| How to be well prepared to maximize value from M&A transactions | It can be time-consuming to prepare for an M&A transaction. To fully appreciate the business, investors will need to review an extensive level of company’s information, including historical and forecast financials, and detailed business plan. As such, companies should be well prepared in terms of available information that can be shared with investors before going to market for M&A. |

| For buyers | |

| How to identify and select the right targets for acquisition, and how to integrate long-term growth directions with M&A strategies amidst recent market fluctuations | Both strategic investors and financial sponsors should maintain a clear pipeline of potential targets in the wishlist and be prepared to have sufficient funding for prompt deployment when good opportunities become available (which usually involve strong competition). |

| Portfolio performance review and non-core business considerations | Companies should constantly review performance of portfolio companies and identify under-performing or non-core businesses for further action. This is to ensure that M&A activities actually bring value to the group business, and that most (if not all) investments align with the company’s strategic directions. Divestment of under-performing or non-core may be considered. |

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

Huong Trinh, Partner and Head of Ho Chi Minh City at BDA Partners, shares insights on the real estate and logistics market in M&A on DealStreetAsia.

“Accumulated dry powder and pent-up dealmaking lead to increased demand across all segments of the real estate market, with residential and industrial properties and projects attracting the most interest in 2022.”

“There is still ample headroom for development and investment opportunities in the segment, as Vietnam still needs to fill the demand of foreign corporations for the modernisation of industrial facilities to catch up with global standards and the introduction and integration of tech-enabled supply chain and logistics networks throughout the country,” said Trinh of BDA Partners.

In the short-term, M&A in real estate in Vietnam will be impacted by overall uncertainty in the macroeconomic environment and tightening of liquidity in the market, as the “easy money” period has come to a temporary halt, said Trinh of BDA Partners.

“Given tight liquidity available in the local banking and corporate bond system, we believe that there are opportunities for regional private credit funds, which have not been popular in Vietnam in the past, to penetrate the market,” she said.

Investors, Trinh went on, will require higher interest rates and more liquid assets to be used as collateral, reflecting the downgraded market outlook.

According to BDA Partners, foreign investors will continue to hunt for investments in both real estate projects and developers, driven by clear opportunities to capitalize on incumbent market potential in Vietnam’s fast-growing and transforming economy.

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

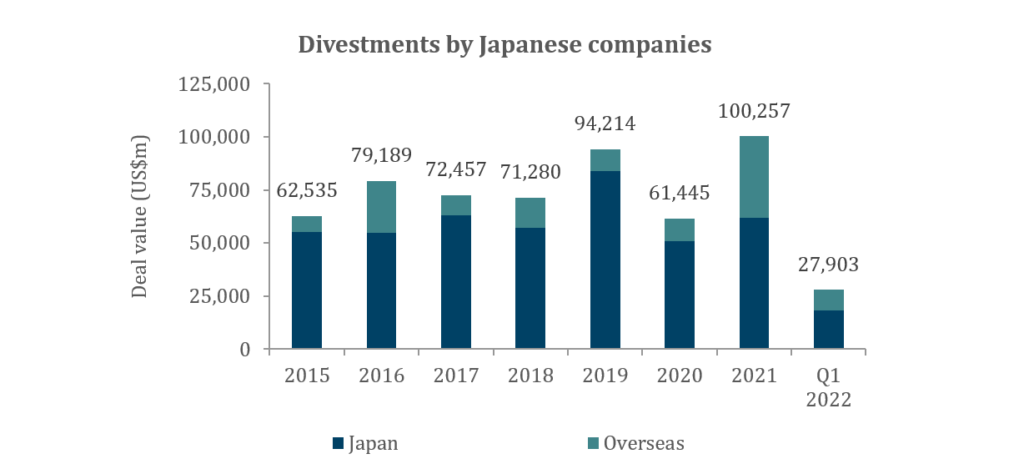

In the last few years, several trends have gained traction in Japan’s M&A market. The trends had already begun to take hold before COVID, which did not slow their development. In our latest insight, we take a closer look at three of the most significant trends, which are interrelated and are driving one another: 1) divestments by Japanese companies; 2) the ever-increasing activity of PE funds; and 3) the growing influence of activist funds.

Key takeaways:

Japanese companies are increasingly willing to divest non-core subsidiaries and assets, driven by changing perceptions about corporate divestments

- This has been led by large-cap companies so far, but smaller companies are expected to join as they also begin to appreciate the benefits

Divestments by Japanese companies are proving to be fruitful targets for PE funds, who are aggressively entering Japan market and raising record levels of capital

- Many corporate carveouts in Japan over the last few years have seen PE funds emerge as the successful acquirer

Another set of investment funds, activist investors, have stepped up their activity in Japan, embarking on campaigns against large companies to pressure them to increase corporate value

- A common demand of activist campaigns is the divestment of non-core assets, which feeds into the first trend, thus continuing the cycle

Source: Dealogic

Download the full report

Download the full report in Japanese

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com