The luxury market in China is roaring again

As we approach the halfway point in 2023, it’s clear that the luxury goods market in China and Asia is thriving. This growth is fuelled by the opening of borders post-COVID and the region’s increasing affluence. Today, China alone accounts for over one-third of global luxury sales.

As consumers in the region spend more on retail, beauty, food, lifestyle, and luxury items than ever before, BDA sees opportunities for foreign investors and companies to reach an eager and widespread Asian market.

In our latest insights report, we discuss China’s economy and explore opportunities in other Asian markets. We also identify the subsectors in the consumer and retail space which we anticipate will shine.

The key takeaways in this report are:

- Asia’s luxury market continues to gain momentum, mainly driven by China

- In China, retail sales in March 2023 alone jumped 10.6% YOY, a speed unseen in two years

- The share price of some luxury companies have risen 10%-20% this year

- A rebound in the Chinese economy, the millennial generation, and changing consumer preferences support the trend

- Overall, Asian consumers are spending more on retail, beauty, food, lifestyle, and luxury items than ever before

- This increase in demand opens the door to opportunities for foreign investors and companies

- BDA has deep industry knowledge and extensive experience in advising clients on transactions in beauty & personal care, lifestyle & entertainment, mother & baby care, apparel & accessories, and the food and beverage industries

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

Solar energy in ASEAN presents a compelling investment opportunity for both financial and strategic investors. This is a result of the recent (and potentially continuing) advances in technology and levelized cost of energy (“LCOE”) and the expected regulatory developments.

Energy demand in the ASEAN region:

- Back in 2018, Singapore’s Prime Minister Lee Hsien Loong stated, “ASEAN will become the fourth-largest economy in the world by 2030, after the US, China, and the European Union”

- This step change means the associated evolution in energy demand in ASEAN has global implications

- From 2012 to 2021, the region’s growth in power demand actually outpaced that of GDP by a factor of 1.2x

- This trend is set to continue, with regional electricity demand growth expected to surpass global average power growth by 1.5x from 2022 to 2031

Investment opportunities:

- ASEAN countries have laid out clear renewable energy capacity targets to reach the goals set out in the Paris Agreement and the associated Nationally Determined Contributions (“NDCs”)

- By 2025, these nations aim to have 23% of their primary energy supplied by renewable energy

- To meet this objective, annual investments in the ASEAN renewables sector are expected to at least double from current levels

- Thanks to regulatory developments and the falling relative LCOE, solar is emerging as the predominant renewable technology for ASEAN

- BDA expects private sector investment and corporate activity to accelerate and support the sector’s already rapid growth

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

A rapidly expanding middle class with increased health awareness post-pandemic will continue to fuel demand for higher standards in all aspects of healthcare in Vietnam, making the country a favorite investment destination. At BDA Partners, we have seen strong interest from both financial sponsors and strategic investors to gain exposure to the sector, and we believe that there remains an abundance of M&A opportunities across various healthcare verticals.

Healthcare services – Key M&A volume driver

Historically, transactions involving private hospitals and clinics have driven deal volume in Vietnam, and this theme is expected to persist given favorable market dynamics. Vietnam’s aging population with increased health awareness and growing income level have created unmet demands for high quality healthcare services. On the supply side, the issue of overcrowding at public hospitals in major cities persist. According to the General Statistics Office[1], Vietnam has 3.1 hospital beds per 1,000 population in 2021, below WHO’s recommended level (5 beds per 1,000 population). This supply-demand imbalance implies significant headroom for the expansion of private healthcare in Vietnam, supported by government policies such as Decision No.20/NQ-TW 2017[2], which sets the target for private hospital beds to account for 10% and 15% of the total number of hospital beds in 2025 and 2030, respectively. As a result, private hospitals and clinics will continue to generate significant interest, especially as patient volume is recovering to pre-pandemic level, while surgeries, complex procedures, and other high-value medical services have been reintroduced.

Notable trends

- General hospitals attracting the most interest: The largest transaction in healthcare services in recent years was GIC’s US$204m investment in Vinmec in 2020. Other notable transactions include VinaCapital’s investment in Thu Cuc in 2020, Quadria Capital’s investment in FV Hospital in 2017, and Navis’s investment in Hanoi French Hospital in 2016. Both strategic and financial investors have been looking for sizable transactions involving private general hospitals in Vietnam, many of which boast strong profit margins, healthy cash flow, and high occupancy rates. Notably, assets in the upper-mid and premium segments with service quality comparable to international standards have the potential to capture demand from the growing number of Vietnamese patients who would otherwise be traveling abroad for treatment.

- Growing emphasis on specialty assets: Regional healthcare platforms are looking for bolt-on acquisitions to add more specialties to their networks, following Heliconia’s investment in the ophthalmology network Mat Sai Gon and TPG’s investment in Hung Viet Oncology Hospital in 2019. Specialty clinics have also started to gain traction, as evidenced by the successful capital raises of Kim Dental from ABC World (a transaction in which BDA served as the exclusive financial advisor to Kim Dental) and Nhi Dong 315, a pediatrics and maternity chain, both of which having extensive, fast-growing networks of locations in HCMC.

- New focus on Tier 2 / Tier 3 cities: Foreign investors have demonstrated increased appetite for assets outside major cities, as evidenced by CVC’s acquisition of a 60% stake in Phuong Chau, a network of four hospitals in the Mekong Delta region in 2022 and Kei Mei Kai’s acquisition of Binh Duong-based Hoan Hao Hospital in 2019. Vietnam’s rapid urbanization will create significant demand for high quality healthcare services in Tier 2 / Tier 3 cities, making hospitals / clinics in those regions compelling investment opportunities.

- Appetite for healthcare platforms: Investors are on the hunt to scoop up scaled healthcare operators with multiple facilities in Vietnam, which are more attractive from a growth and profitability improvement perspective compared to single-location assets.

Pharmaceuticals – Favorable market conditions propelling strategic M&A partnerships

With no foreign ownership limit for pharmaceutical manufacturing, many local manufacturers have formed partnerships with foreign investors, with examples such as Taisho-DHG, Aska-Hataphar, SK-Imexpharm, and Daewoong-Traphaco. Per Decree No. 54/2017/ND-CP[3], foreign-invested entities cannot directly participate in pharmaceutical distribution in Vietnam, while still being able to distribute their locally produced products. This regulation makes investments in local manufacturers the most efficient way for foreign players to gain exposure to Vietnam’s pharmaceutical market, which is projected to reach US$16.1bn by 2026 per BMI Research[4].

Going forward, as a defensive sector, pharmaceuticals will receive strong interest amidst current global macroeconomic turbulence. The industry is set to benefit from the government’s strategy to promote domestic manufacturing, which aims to increase the share of locally produced pharmaceuticals to 80%[5], in a market historically dominated by imports. To boost competitiveness, local manufacturers will find M&A with foreign strategic investors as a viable strategic option, enabling them to meet global standards through transfers of technology, corporate governance, and management expertise. Meanwhile, investors are targeting manufacturers in Vietnam to capture local market potential and export opportunities through contract manufacturing partnerships.

Others – Emerging verticals with headroom for growth

Healthtech

The decrease in direct interaction due to the pandemic has brought healthtech into the spotlight, given increased demand for virtual healthcare services. Remote medical examinations and digitalization of medical records have been among the key focuses of the Vietnamese government. Meanwhile, in the private sector, healthtech startups serving various verticals of the market such as telehealth (JioHealth, Med247, eDoctor), third party administration (Insmart, South Asia Services), and e-pharmacy (Medici, POC Pharma) have recently successfully raised funding from foreign investors, highlighting the prospect of the nascent healthtech segment in Vietnam. However, healthtech is still trailing other tech-related sectors such as payment or e-commerce in investments and development progress, and there is still ample room for investors to participate in the value creation process.

Diagnostics

The diagnostics market in Vietnam is still highly fragmented, with most players in the market being mom-and-pop labs with limited scale, low volume, and outdated technology. Thus, companies that can create scalable, modern, and tech-enabled networks of diagnostic services to capture market share will appeal to investors as good anchor assets for the creation of pathology platforms, similar to what happened in regional markets such as India and China. In addition to clinical diagnostics, genetic testing has also appeared on investors’ radar, with companies such as Genetica and Gene Solutions having completed their early funding rounds and Gentis being acquired by Eurofins.

Medical equipment

There are still few local manufacturers that meet international standards – more than 90 percent of medical equipment in Vietnam is imported, according to the Ministry of Health[6]. Nevertheless, the recent US$30m investment in 2022 by Eastbridge Partners in USM Healthcare, a local stent manufacturer, signifies that high quality assets in this space will still generate good traction. This sector will be an interesting one to watch, especially in the medical consumables segment (e.g., stents, sutures, etc.), which is more prevalent among local assets.

Looking ahead

From our recent interaction, healthcare regularly features among the key focuses of financial sponsors. Given favorable sector trends, financial sponsors are going to capitalize on and exit their investments, while also remaining as active investors due to accumulated dry powder and pent-up dealmaking demand after the pandemic. On the other hand, strategic investors will continue to closely monitor suitable opportunities to invest in synergistic assets in Vietnam. Investors with existing presence in Vietnam or in markets with similar levels of development will have an advantage through their deep understanding of market intricacies and strong operational know-how, to quickly integrate with potential targets.

In conclusion, we remain confident in the availability of M&A opportunities in Vietnam’s healthcare market going forward, especially now that Covid-related impacts that created valuation gaps and diligence challenges should no longer remain as obstacles. We look forward to a busy period ahead in 2023 with our ongoing live deals and strong pipeline of opportunities in the sector.

[2] https://thuvienphapluat.vn/van-ban/The-thao-Y-te/Nghi-quyet-20-NQ-TW-2017-tang-cuong-cong-tac-bao-ve-cham-soc-nang-cao-suc-khoe-nhan-dan-365599.aspx

[3] https://thuvienphapluat.vn/van-ban/The-thao-Y-te/Decree-54-2017-ND-CP-guidelines-for-implementation-of-the-Law-on-Pharmacy-356336.aspx

[4] https://gmp.com.vn/thi-truong-duoc-pham-viet-nam-2021:-trien-vong-han-che-va-nhung-xu-huong-n.html

[5] https://vietnamnews.vn/economy/772550/support-for-domestic-pharmaceutical-industry-to-rise-in-viet-nam.html

[6] https://www.vietnam-briefing.com/news/vietnams-medical-devices-industry-opportunities-for-european-businesses.html/

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

Huong Trinh, Partner and Head of Ho Chi Minh City at BDA Partners, shares insights on Vietnam F&B sector in M&A on VIR.

How do you see the trend of M&As in Vietnam’s F&B post-COVID? Do you see a slowdown in this area?

Post-Covid, we are still observing continuing interests from both strategic and financial investors, especially ones from Japan, Korea, and Southeast Asia for F&B companies in Vietnam. The total value of M&A transactions in Vietnam’s consumer sector reached US$1.2bn in 10M2022, an increase of nearly 40% yoy from US$871m in 10M2021. Meanwhile, it is worth noting that in recent months in 2H 2022, consumer confidence has been impacted by ongoing macro factors (e.g., surging inflation and interest rates). Nevertheless, going forward, we still expect a buoyant F&B market outlook, as Vietnam remains as one of the most attractive F&B markets in the region with robust market fundamentals and a strong socioeconomic backbone thanks to (i) a fast-growing market with 100 million consumers, propelled by robust economic growth and rising income, (ii) a young and dynamic population increasing propensity to spend, and (iii) rising demands for e-commerce and modern retail driven by rapid urbanization. These are the key factors driving M&A activities in the Vietnam’s F&B sector.

Filipino food company Jollibee Food Corporation is reportedly seeking to sell a minority stake in Vietnamese coffee chain Highlands Coffee. The sale could lead to an IPO launch for the coffee chain, which Jollibee has been considering for several years. What are the opportunities for foreign companies to conduct M&As in Vietnam’s F&B market? What are some major F&B deals in Vietnam in 2022?

We believe there remain many opportunities for foreign investors looking for potential targets for M&A of F&B companies in Vietnam, given the strong growth prospects. Strategic investors will be on the hunt for Vietnamese F&B companies to expand their product portfolio, manufacturing capacity and distribution network in the country. Such investments will also provide strategic investors quick access to a highly potential F&B market with 100 million consumers with rapidly growing disposable income. This attractive market outlook will also appeal to financial sponsors, especially ones with strong track record of operational expertise in the sector.

Additionally, in Vietnam, there is generally no restriction/limit on foreign ownership applicable to F&B companies. This opens various opportunities for foreign investors to penetrate Vietnam market via M&A, especially for those who prefer to seek controlling stakes in the target companies.

From our discussions with investors within our network, sub-segments in the F&B sector that we continue to see strong interests from foreign investors are food service, food ingredients and additives, and F&B retail. Vietnam F&B companies with (i) strong brand equity and awareness, (ii) extensive portfolio of staple products that are less directly affected by market fluctuations, (iii) nationwide distribution network, (iv) healthy financial performance, and (v) clearly defined business plans with attractive growth initiatives will present compelling investment opportunities for foreign investors.

Some remarkable F&B transactions in 2022 include:

- Masan Group’s acquisition of a majority stake in Phuc Long

- Swire Pacific’s acquisition of Coca-Cola bottling operations in Vietnam and Cambodia for c.US$1bn

- Golden Gate minority equity stake sale to a group of investors led by Temasek

- Navis invested over US$100mn in Dan-D Foods for the majority stake of the company.

- Pan Group has bought 39.9% stake in Bibica for US$22.6mn to increase its total ownership to 98.3%.

- Cool Japan Fund’s minority stake investment into Pizza 4P’s, following the successful divestment of Mekong Capital

Vietnam Dairy Products JSC (Vinamilk) and Kido Group JSC have just announced the suspension and dissolution of the joint venture Vibev. Could you comment on the dissolution of the F&B joint venture? What are challenges for F&B players to restructure their M&A strategies post-COVID?

The current regional and local macro situations may impact corporate considerations and decisions on business plans, including what should be the strategic focus for 2023 and onwards. These are also mentioned in Kido and Vinamilk’s statements regarding the dissolution of their JV. There are various aspects that F&B companies should carefully consider, so that their M&A activities (i) can be aligned with corporate strategies, and (ii) can add long-term synergistic value to the Company and stakeholders.

Some key challenges/considerations for F&B players regarding their M&A strategies include:

| Challenges | Mitigations and opportunities |

| For sellers | |

| How to align and balance the value from long-term M&A strategies with current business requirements | In some cases, shareholders or companies may have to choose between long-term strategic value and immediate capital needs. Nevertheless, F&B companies should always carefully consider such synergistic values that an investor may contribute to the development and expansion of the business (other than capital), when it comes to selecting the right strategic partner for M&A. Those values can be global best practices in corporate governance, know-hows in operations, network relationships or product portfolio expansion, etc. |

| Business performance can be impacted by macro factors (e.g., higher inflation and interest rates, which may impact valuation) | Valuation can be based on future performance or normalized current performance rather than current accounting performance. In such case, companies need to have a clear explanation for its performance during COVID period and a normalized level of performance. Companies with clearly defined business plans and well-established growth initiatives will be able to deliver more attractive growth stories and will be more likely to solicit better valuation/terms from investors. Companies should also keep in mind about the timing for M&A, so that investors may have sufficient time to understand and appreciate the business and growth potentials, before making an investment decision. Professional M&A sell-side advisors may help shareholders and the Company with fine-tuning the equity story and articulating growth prospects to potential investors to maximize value. |

| How to be well prepared to maximize value from M&A transactions | It can be time-consuming to prepare for an M&A transaction. To fully appreciate the business, investors will need to review an extensive level of company’s information, including historical and forecast financials, and detailed business plan. As such, companies should be well prepared in terms of available information that can be shared with investors before going to market for M&A. |

| For buyers | |

| How to identify and select the right targets for acquisition, and how to integrate long-term growth directions with M&A strategies amidst recent market fluctuations | Both strategic investors and financial sponsors should maintain a clear pipeline of potential targets in the wishlist and be prepared to have sufficient funding for prompt deployment when good opportunities become available (which usually involve strong competition). |

| Portfolio performance review and non-core business considerations | Companies should constantly review performance of portfolio companies and identify under-performing or non-core businesses for further action. This is to ensure that M&A activities actually bring value to the group business, and that most (if not all) investments align with the company’s strategic directions. Divestment of under-performing or non-core may be considered. |

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

Huong Trinh, Partner and Head of Ho Chi Minh City at BDA Partners, shares insights on the real estate and logistics market in M&A on DealStreetAsia.

“Accumulated dry powder and pent-up dealmaking lead to increased demand across all segments of the real estate market, with residential and industrial properties and projects attracting the most interest in 2022.”

“There is still ample headroom for development and investment opportunities in the segment, as Vietnam still needs to fill the demand of foreign corporations for the modernisation of industrial facilities to catch up with global standards and the introduction and integration of tech-enabled supply chain and logistics networks throughout the country,” said Trinh of BDA Partners.

In the short-term, M&A in real estate in Vietnam will be impacted by overall uncertainty in the macroeconomic environment and tightening of liquidity in the market, as the “easy money” period has come to a temporary halt, said Trinh of BDA Partners.

“Given tight liquidity available in the local banking and corporate bond system, we believe that there are opportunities for regional private credit funds, which have not been popular in Vietnam in the past, to penetrate the market,” she said.

Investors, Trinh went on, will require higher interest rates and more liquid assets to be used as collateral, reflecting the downgraded market outlook.

According to BDA Partners, foreign investors will continue to hunt for investments in both real estate projects and developers, driven by clear opportunities to capitalize on incumbent market potential in Vietnam’s fast-growing and transforming economy.

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

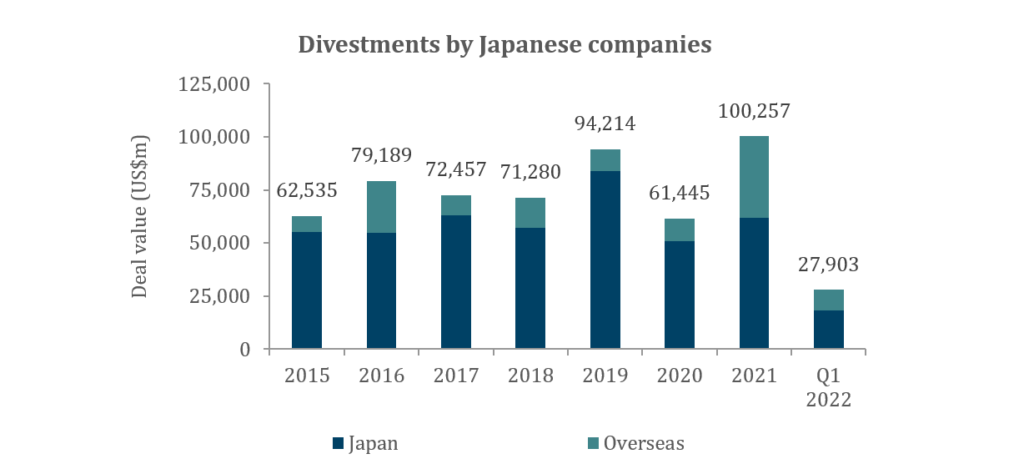

In the last few years, several trends have gained traction in Japan’s M&A market. The trends had already begun to take hold before COVID, which did not slow their development. In our latest insight, we take a closer look at three of the most significant trends, which are interrelated and are driving one another: 1) divestments by Japanese companies; 2) the ever-increasing activity of PE funds; and 3) the growing influence of activist funds.

Key takeaways:

Japanese companies are increasingly willing to divest non-core subsidiaries and assets, driven by changing perceptions about corporate divestments

- This has been led by large-cap companies so far, but smaller companies are expected to join as they also begin to appreciate the benefits

Divestments by Japanese companies are proving to be fruitful targets for PE funds, who are aggressively entering Japan market and raising record levels of capital

- Many corporate carveouts in Japan over the last few years have seen PE funds emerge as the successful acquirer

Another set of investment funds, activist investors, have stepped up their activity in Japan, embarking on campaigns against large companies to pressure them to increase corporate value

- A common demand of activist campaigns is the divestment of non-core assets, which feeds into the first trend, thus continuing the cycle

Source: Dealogic

Download the full report

Download the full report in Japanese

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com