25 January 2022

2022 – the year ahead in healthcare

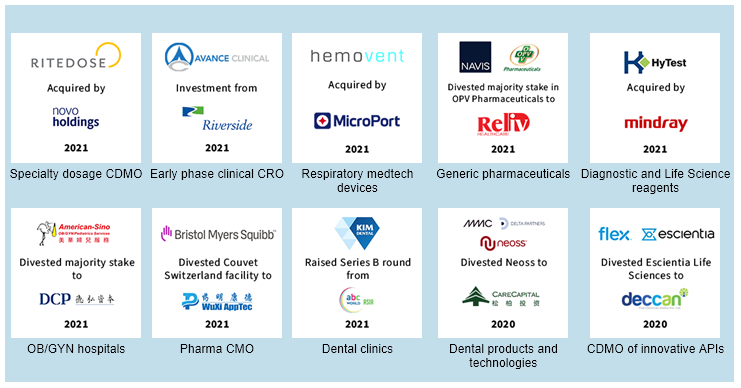

2021 was a phenomenal year for deal activity in the Healthcare sector. Strong M&A momentum continued across most Healthcare verticals despite, and sometimes because of, extended COVID-19 disruptions. BDA closed landmark transactions across sub-sectors including Pharma Services (CRO/CDMO), Specialty Generics, Healthcare Services, Diagnostics and Life Science Tools, and Medical Devices, which touched on specialty therapeutic areas such as respiratory, renal care, OB/GYN and dental.

It was a busy year for Asian players in healthcare. Among them, Chinese buyers emerged as some of the most active participants, driven by the desire to expand their capabilities to address unmet needs in the strongly growing Chinese market. With our deep sector knowledge and broad network, BDA delivered strong transaction outcomes for our corporate and private equity clients throughout the pandemic.

Enabling client success:

BDA’s senior Healthcare bankers give their predictions for the year ahead.

Andrew Huntley, Managing Partner and Global Head of Healthcare:

In 2022 I believe the 2021 Asian Healthcare M&A tally of US$139.6 billion(1) will grow further. COVID-19 impacts that disguised underlying EBITDA and created valuation and diligence frictions between buyer and seller should moderate. Specialty clinic chains, pharma services (CRO and CDMO), and diagnostic products and services will continue to attract M&A in Asia. Life science tools and technologies is a category for which I see a growing appetite where the region lags developed markets. So is home healthcare. I am waiting for an Asian leader in medical device CDMO to emerge and there are some interesting building blocks out there. Consolidation trends in China will play out; and we might see some multinational divestments of Chinese units in pharma and devices.

Sanjay Singh, Managing Director, Head of India and Co-Head Asia, Healthcare:

India continues to build innovative pharma research and development capabilities on top of its generics base. This is especially the case in pharma services where I see increasingly well positioned CDMO assets in both API (drug substance) and formulations (drug product) which serve global pharma sponsors not just generics customers. These will drive capital raising and M&A transactions, as will early signs of India nurturing some differentiated medical device innovators. Domestic formulation businesses will likely see consolidation as larger companies seek to expand their presence in chronic therapies. Digital health and Healthcare IT are, respectively, new and established exciting segments for investment and M&A.

Anthony Siu, Partner, Co-Head of Shanghai and Head of Financial Sponsor Coverage, China:

Private equity owners of Health assets are going to capitalise on the favourable sector trends to exit their investments, but they will also be very active acquirers, armed with ample dry powder of over US$650 billion Asia-wide. Healthcare regularly features in the top two priority sectors for Asian financial sponsors. China focused sponsors will continue to back or partner with strategic acquirers to drive both consolidation within China and outbound acquisitions in the West. On the capital markets side, growing uncertainties in public markets will increase the appeal of private capital raise rounds before IPO.

We look forward to delivering outstanding advisory services and great outcomes for our clients.

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

Latest insights

11 June 2025

Private credit could fuel bargain M&A deals as luxury fashion empires...

Euan Rellie, Managing Partner and Chairman of Consumer & Retail, BDA...

6 June 2025

Jeff Acton speaks to Worldfolio on how BDA became the leading cross-border...

Jeff Acton, Partner and Head of BDA’s Tokyo office, was recently interviewed...

30 April 2025

A volatile world: how are Trump’s tariffs impacting cross-border M&A?...

President Trump’s tariffs have injected new risk and complexity into...

25 April 2025

BDA’s Jeff Acton quoted in Bloomberg on Japan’s overseas M&A...

Bloomberg has featured commentary from BDA Partners in its latest article...