Asia GP-led secondaries: A new normal for liquidity?

GP-led secondaries have become a more attractive, alternative, path to liquidity amid a challenging exit environment for sponsors during the past two years. While APAC markets still lag behind their Western counterparts in terms of utilising this type of transaction, recent completed transactions have been encouraging.

In BDA’s latest insight piece, we share our key thoughts on the Asian GP-Led secondaries landscape:

- Continuation Fund transactions, established in the US and Europe, are growing in Asia, with notable activity in Japan, India, China and SE Asia

- Market volatility and challenging exits are driving more sponsors to the secondaries market

- Secondary investors prioritise GP-alignment, growth and resilience; however macro-economic and political uncertainties, particularly in China, have lead to a pricing gap and a more cautious investment

- Secondary funds “dry powder” remains high and investors are focusing on well-performing assets, strong GP-alignment and recession resilience

Download the full report for more insights on the Asian GP-led secondaries

The private equity (PE) landscape in Vietnam is becoming increasingly attractive to global investors due to improvements in regulations, governance and corporate profiles. In the early 2000s and before, there was very limited PE activity in Vietnam, a market characterized by a shortage of private enterprises and unclear regulatory framework on private investments. It was not until the 2005 Enterprise Law came into effect that Vietnam first established a common legal framework for the establishment and management of both State Owned Enterprises (SOEs) and private enterprises, boosting investors’ confidence for investments in private companies.

Along with the rapid growth of Vietnam’s economy, PE activity has soared since the second half of the 2000s. This can be attributed to a number of factors:

- Integration with the global economy: Vietnam became a member of the World Trade Organization in 2007, committing to one of the world’s most progressive market access programs. This made Vietnam appear on more PE investors’ radar – in fact, some of the earliest notable transactions involving PE investors in Vietnam occurred in 2007, such as Temasek-Minh Phu and PENM Partners-Eurowindow. Since then, Vietnam has continued to participate in more free trade agreements to become an important node in the global economy.

- Development of the domestic stock exchanges: The launch and development of HOSE and HNX in the early 2000s provided additional comfort to institutional investors in their consideration to include Vietnam as a part of their mandate. As Vietnam gradually becomes one of the most closely watched frontier markets and is on track to reach emerging market status, the country has continued to draw attention from global PE investors.

- Easing of foreign ownership restrictions: There has been significant progress in unlocking market access for foreign investors since the early 2000s. Market access restrictions for specific sectors, once challenging to navigate in the past, are now clarified by the 2020 Law on Investment, which officially classifies restricted and conditional sectors in one consolidated source. Foreign ownership limits, once kept at 20%-30% for most sectors, now can be extended or have clear path to be extended to up to 100% for non-conditional, non-restricted business lines.

- Improvement in corporate profiles: In the earlier days, many private enterprises in Vietnam were small founder-owned, family-run businesses, which lacked both corporate governance of international standards and experience in working with foreign investors. Nowadays, sizable, well-managed private companies are more common – these firms will now consider investments from PE investors as a strategic option in their growth trajectory and have also become more educated in M&A processes.

- Regulatory landscape improvement: Local authorities have continuously provided clearer guidelines for M&A, as evidenced in various revisions of the Law on Enterprises, Law on Competition, and Law on Investment. For example, the latest 2020 Law on Investment has further addressed the ambiguity of existing regulations and clarified when M&A approval is required – a concern previously highlighted by many PE investors.

From the quiet days when there was only a handful of small value deals in the early 2000s, PE investors have been gradually playing a much bigger role in Vietnam’s M&A market. Larger deals involving PE investors have become more common – there were more than 30 deals valued at US$100m or higher over the last five years[1], while the top ten largest PE transactions of all time in Vietnam all occurred during this period. For Vietnamese businesses, PE funding brings in not only much needed capital for growth or additional liquidity for shareholders, but also important corporate governance guidelines and operational know-how of international standards for optimal value generation. Institutional presence among the cap table would also highlight the legitimacy and sustainability of the business models of local enterprises, which in turn enhance their attractiveness to more global investors.

| Date | Investor | Target | Sector | Value (US$m) | Stake |

| Jun-20 | KKR’s consortium | Vinhomes | Real Estate | 651 | 6% |

| Oct-18 | SK Investments | Masan Group | Consumer | 474 | 9% |

| Aug-18 | Hanwha Asset Management | Vingroup | Diversified | 403 | Undisc. |

| May-21 | Alibaba, BPEA | The CrownX | Consumer | 400 | 6% |

| Dec-18 | Warburg Pincus | Techcombank | Financial Services | 370 | 4% |

| Dec-21 | TPG, Temasek, ADIA | The CrownX | Consumer | 350 | 5% |

| Jul-19 | GIC, Softbank | VNPay | Technology | 300 | Undisc. |

| Jan-19 | GIC, Mizuho | Vietcombank | Financial Services | 264 | 3% |

| Jun-22 | Warburg Pincus | Novaland | Real Estate | 250 | Undisc. |

| Jul-21 | General Atlantic, Dragoneer | VNPay | Technology | 250 | Undisc. |

Emerging trends

1. Rising competition in dealmaking from global funds: In the earlier days, most PE transactions in Vietnam involved local funds given their advantages in familiarity with the investment landscape, with examples such as Indochina Capital-Hoang Quan (2006)[2], Mekong Capital-MobileWorld (2007)[3], and VinaCapital-PNJ (2008)[4]. Over time, more and more global PE firms have established local presence in Vietnam, with dedicated investment teams and network of advisors on the ground to start building their track record in the country. While local funds remain active in the market, global funds, with stronger financial capabilities, have been dominating the investment landscape – as evidenced in the list of top ten all-time largest PE transactions in Vietnam

2. Minority vs. control/buyout transactions: Minority transactions are still more popular for PE investors in Vietnam given the lack of onshore deal financing options commonly found in buyout transactions and risk aversion as most funds still have relatively short track record in the country. However, the market has witnessed several buyout transactions in the past, especially in the Healthcare and Education sectors such as CVC-Phuong Chau(2021)[5], BPEA-Vietnam USA Society English Centers (2019)[6], TPG-Vietnam Australia International School (2017)[7], and Navis-Hanoi French Hospital (2016)[8]. From our recent interactions with regional PEs, we understand that there is a growing appetite for control/buyout deals in Vietnam, driven by both record levels of dry powder and the maturation of the investment landscape.

3. Growing importance of ESG topics : ESG topics are no longer considered as a matter of compliance but have become opportunities to unlock value and present key selling points to potential investors. More investors have been appointing specialized ESG advisors for due diligence, while aligning with the target companies on having strong ESG values ingrained in corporate culture as part of deal negotiation and post-deal integration.

Looking ahead – Sectors to watch for PE activity in Vietnam

Consumer

- Although consumer confidence is temporarily impacted by the ongoing global macroeconomic turbulence, investors will continue to target Vietnam as one of the most attractive economies in the region.

Healthcare

- Rising income level and increased health awareness among Vietnamese people will propel demand for private hospital and clinics, in response to the lack of capacity within the national healthcare system.

Education:

- Before the emergence of Covid-19, investors showed significant interest in both local and international private schools.

Financial Services

- The shortage of financing and credit solutions among an underbanked population is expected to drive investments in Financial Services.

Logistics:

- Tailwinds from high growth in exports, a booming Internet economy, and supply chain shift from China will continue to propel growth in Vietnam’s logistics industry.

Technology

- Difficulties caused by the pandemic have accelerated progress in digitalization, driving growth in demand across all industries for technology-related services and digital solutions that help businesses improve functionality.

The PE market in Vietnam has changed drastically since the early 2000’s as we have experienced more favourable conditions. Going forward, we expect not only the number of deals to increase, but the size of deals in Vietnam to grow as PE investors seek opportunities.

[1] Source: Mergermarket

[2] https://vnexpress.net/indochina-capital-mua-cp-hoang-quan-2696691.html

[3] https://www.mekongcapital.com/our-investment/mobile-world/

[4] https://www.investegate.co.uk/vietnam-opp-fund-ltd/rns/investment/200805021205506730T/

[5] https://www.dealstreetasia.com/stories/cvc-capital-phuong-chau-hospital-307941

[6] https://www.globalprivatecapital.org/newsroom/bpea-acquires-majority-stake-in-vus/

[7] https://www.vas.edu.vn/en/news/he-thong-truong-dan-lap-quoc-te-viet-uc-co-nha-dua-tu-chien-luoc-moi

[8] https://www.naviscapital.com/wp-content/uploads/2016/06/Navis-Press-Release-30-June-2016-Acquisition-of-Hanoi-French-Hospital.pdf

[9] https://en.vietnamplus.vn/over-70-of-vietnamese-population-use-internet/231833.vnp

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

Solar energy in ASEAN presents a compelling investment opportunity for both financial and strategic investors. This is a result of the recent (and potentially continuing) advances in technology and levelized cost of energy (“LCOE”) and the expected regulatory developments.

Energy demand in the ASEAN region:

- Back in 2018, Singapore’s Prime Minister Lee Hsien Loong stated, “ASEAN will become the fourth-largest economy in the world by 2030, after the US, China, and the European Union”

- This step change means the associated evolution in energy demand in ASEAN has global implications

- From 2012 to 2021, the region’s growth in power demand actually outpaced that of GDP by a factor of 1.2x

- This trend is set to continue, with regional electricity demand growth expected to surpass global average power growth by 1.5x from 2022 to 2031

Investment opportunities:

- ASEAN countries have laid out clear renewable energy capacity targets to reach the goals set out in the Paris Agreement and the associated Nationally Determined Contributions (“NDCs”)

- By 2025, these nations aim to have 23% of their primary energy supplied by renewable energy

- To meet this objective, annual investments in the ASEAN renewables sector are expected to at least double from current levels

- Thanks to regulatory developments and the falling relative LCOE, solar is emerging as the predominant renewable technology for ASEAN

- BDA expects private sector investment and corporate activity to accelerate and support the sector’s already rapid growth

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

China’s private equity (“PE”) industry faced strong headwinds in 2022 due to factors including a slowing economy, Covid-19 restrictions, increased regulatory scrutiny, and higher prevailing interest rates globally which weighed on public market valuations. PE exits and fundraising had been challenging during the past year.

However, the China market underwent a dramatic change in recent months as the country’s Zero-Covid policy was relaxed and borders were reopened. The Chinese government implemented measures to boost the economy and private sector investments. This report provides our perspectives on how these changes may impact PE activities and China M&A market in 2023.

The key takeaways in this report are:

- The unwinding of Zero-Covid policies will benefit sectors such as consumer, tourism, and property. China’s growth story will be back in focus and investor confidence in the Chinese economy will likely revive. Looking ahead, consumer & retail, manufacturing, energy & resources, life science & healthcare, and logistics & supply chain industries will likely attract the most attention

- China M&A market involving Financial Sponsors will be dominated by China GP’s investments in domestic targets. We also expect to see an increase in GP outbound investments in 2023 to diversify their portfolio outside of China

- Trade sales and IPOs were difficult in 2022, leading to delays in portfolio company exits and fundraising for PEs. In 2023, we expect to see a greater number of portfolio company exits, with more quality assets coming to the market. We expect tightened regulations and the long backlog for public listings will continue to pose difficulties for IPO exits, and mean trade sale will be a more prominent exit route for PEs in 2023

- PEs will likely focus on returning capital to LPs through portfolio company exits in 2023. We expect that fundraising will remain relatively subdued this year, followed by more fundraising activity from 2024 onwards as PEs complete more exits – and need to replenish their capital for new investments

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

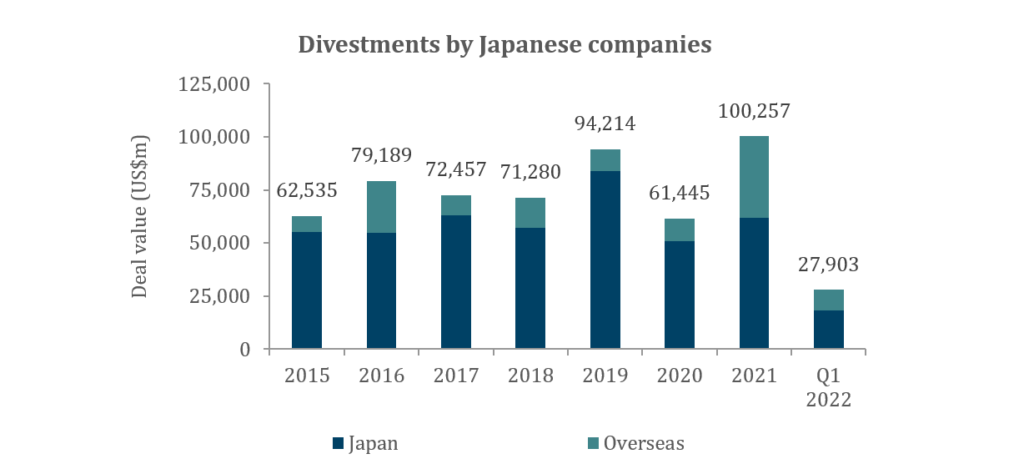

In the last few years, several trends have gained traction in Japan’s M&A market. The trends had already begun to take hold before COVID, which did not slow their development. In our latest insight, we take a closer look at three of the most significant trends, which are interrelated and are driving one another: 1) divestments by Japanese companies; 2) the ever-increasing activity of PE funds; and 3) the growing influence of activist funds.

Key takeaways:

Japanese companies are increasingly willing to divest non-core subsidiaries and assets, driven by changing perceptions about corporate divestments

- This has been led by large-cap companies so far, but smaller companies are expected to join as they also begin to appreciate the benefits

Divestments by Japanese companies are proving to be fruitful targets for PE funds, who are aggressively entering Japan market and raising record levels of capital

- Many corporate carveouts in Japan over the last few years have seen PE funds emerge as the successful acquirer

Another set of investment funds, activist investors, have stepped up their activity in Japan, embarking on campaigns against large companies to pressure them to increase corporate value

- A common demand of activist campaigns is the divestment of non-core assets, which feeds into the first trend, thus continuing the cycle

Source: Dealogic

Download the full report

Download the full report in Japanese

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

There has been a distinct focus on ESG and sustainability in Asian private equity deal activity in the first half of 2022, with implications for new investments, portfolio management and exits. We have seen this trend accelerate as we advise on a series of such transactions this year.

Asian sponsors are evaluating deals through an ESG lens

Western sponsors have thus far largely led the way on ESG considerations in M&A, with their APAC counterparts lagging behind. According to a recent Bain[1] survey, only 65% of APAC sponsors expect their LPs to scrutinise ESG issues over the next three years, compared to 96% and 80% for North America and Europe respectively.

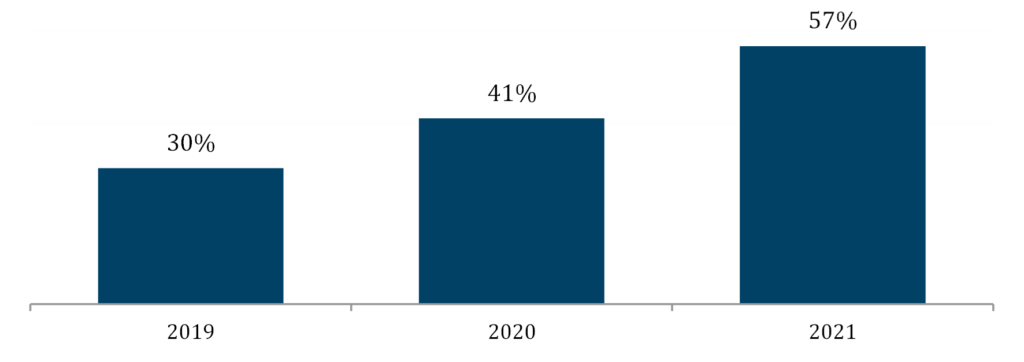

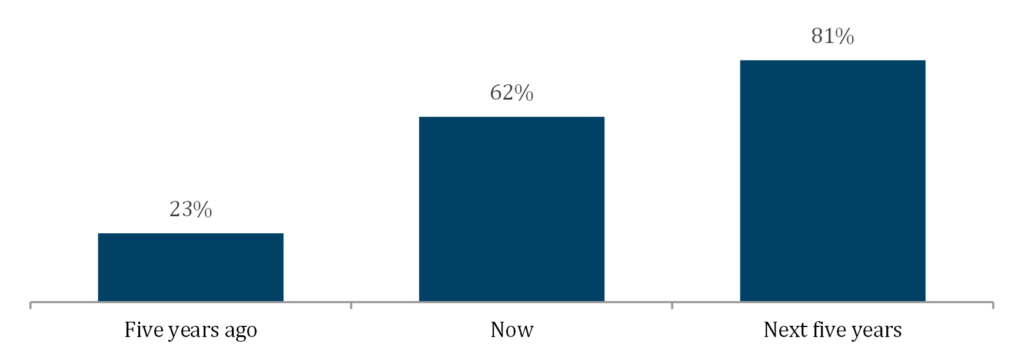

However, the ESG agenda in Asian business is now picking up significant momentum. The survey[2] also found 57% of Asian GPs plan to materially increase their ESG efforts over the next three to five years, up from 30% in 2019. This goes beyond just compliance and regulatory reporting, with more and more funds adopting an explicit – and exclusive – focus on new investments that will have both a positive impact and generate higher financial returns.

These twin goals are no longer seen as contradictory, rather, self-reinforcing. In a McKinsey Global Survey[3], C-suite leaders indicated they would be prepared to pay a 10% premium to acquire a company with a positive ESG track record versus a company without one. Furthermore, the consensus was that ESG programmes created value over the short and long term.

PE funds are proactively issuing ESG/sustainability related reports (i.e. EQT, Partners Group, Carlyle, and Permira, all with a major presence in Asia) which have started to disclose ESG measurements at the fund and portfolio company level, including scope 1 and 2 carbon emissions, energy consumption, diversity and inclusion metrics, corruption, etc. Those that have set up an ESG reporting framework and roadmap for each portfolio company across the investment lifecycle will be better placed for a successful exit.

Asian GPs: increasing their focus on ESG / Sustainability

Asian GPs: % of assets evaluated with ESG due diligence

Source: Bain Asia-Pacific Private Equity Report 2022

Deal types

Robust and high ESG standard gives an investment opportunity a competitive edge, without which will greatly hinder financial sponsors’ deal appetite, whether deploying dedicated “impact-labelled” funds or generalist capital. We have witnessed exceptional demand for ESG-oriented business models in 2022 such as: validation of supply chains and workforce conditions, responsible electronic waste recycling and a range of renewable energy plays. Conversely, the manufacturing of consumer items that lack a sustainability narrative find it harder to navigate the investment committee stage. Investment committees are also putting greater focus on ESG at the M&A decision making stage and more are avoiding certain end markets with a high carbon intensity.

“BDA is building a solid track record in sustainable infrastructure and services in Asia, and globally for Asian clients.”

Lars Freitag, Managing Director and Head of Sustainability: Services & Infrastructure, BDA Partners

Renewable Energy

E-waste Recycling & IT Asset Disposition

ESG & Supply Chain Services

Exit implications for PEs

ESG is now front and centre in both M&A due diligence and the value creation playbook.

For M&A due diligence, the role ESG plays can vary from a simple red flag checklist to a dedicated ESG vendor due diligence report (with comparisons to market competitors, emissions calculations etc.) or even a full-scope ESG value creation assessment. Red flag reports are rapidly becoming the norm in Asia, but the latter two are less common due to on-going challenges such as insufficient data for benchmarking (making it too difficult to correlate to value) or lack of expertise (to effectively analyse the data). There is no “one-size-fits-all” approach to ESG due diligence and should be assessed on each specific transaction, sector, client, etc. as different businesses will present different ESG issues to be considered.

“We are finding that, when presented with an acquisition opportunity, sponsors are asking ‘How does this business make the world a better place?’ Without a convincing answer to potential investors in our marketing materials and due diligence, any sellside process is more at risk, even in Asia.”

Paul DiGiacomo, Managing Partner and Head of Financial Sponsor Coverage, BDA Partners

Aided by such references as Principles for Responsible Investment (“PRI”), Sustainability Accounting Standards Board (“SASB”) and UN’s Sustainable Development Goals (“SDG”), sponsors are encouraging Asian portfolio companies to not only implement action plans to improve ESG performance and reporting, but also ensure that such steps generate robust and quantifiable data to increase accountability. The clear expectation is that being ready to present sustainability KPIs will pave the way for a smoother and more remunerative exit.

One example is the Baring Private Equity Asia (“BPEA”) stewardship of HCP, the Shanghai-headquartered packaging company serving the global cosmetics market. Since its acquisition in 2016, BPEA drove a transformation of HCP’s ESG and sustainability capabilities, including developing refillable packages and use of sustainability-certified manufacturing facilities.This greatly facilitated the onward sale to Carlyle, which was announced in May and should close in Q32022.

“ESG considerations are being tracked and monitored by management and shareholders, and are quickly becoming an important value creation strategy in Asia, including for building brand equity.”

Mark Webster, Partner and Head of Services, BDA Partners

Who is doing what: selected PE Sponsors’ ESG moves in Asia

- Baring Private Equity Asia, the regional PE powerhouse that set up a US$3.2bn ESG loan for APAC investment in 2021 – and has pioneered the implementation of ESG measures across its portfolio including HCP, sale to Carlyle announced (May 2022)

- Goldman Sachs’ portfolio company LRQA acquired Hong Kong-headquartered ELEVATE, the supply chain verification and worker engagement platform (from EQT – May 2022*)

- Navis capitalised on the circular economy thematic, exiting Singapore HQ TES, the electronic waste recycler and IT Asset Disposition service provider, to SK ecoplant of Korea (April 2022*)

- Serendipity Capital’s portfolio company Pollination, the climate change advisory and alternative investment platform, attracted US$50m in Series B capital from ANZ (January 2022*)

- StonePeak leading infrastructure specialist that targets assets globally, including dedicated capital for Asia, announced industry-leading ESG commitments alongside measurable and reportable plans to achieve them, including rigourous sustainability targets and the introduction of related performance incentives (March 2022)

- Temasek and BlackRock created Decarbonization Partners, a US$600m partnership focusing on late-stage venture capital and early-stage growth funds for decarbonisation in 2021. In June 2022, Temasek announced the launch of GenZero, a green investment firm with an initial $5b pledge, a testimony of its commitment to halve the net carbon emissions of its portfolio by 2030 using 2010 as a base and achieve net zero by 2050.

* BDA transaction

[1] Bain Asia-Pacific Private Equity Report 2022

[2] Ibid

[3] www.mckinsey.com/business-functions/sustainability/our-insights/the-esg-premium-new-perspectives-on-value-and-performance, February 2020.

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

BDA Partners hosted our inaugural China Growth Capital Conference on April 26th – 28th. 20 presenting companies from consumer, health, services and technology sectors gave presentations to growth capital investors in over 200 virtual one-on-one meetings.

Anthony Siu, Partner and Co-Head of Shanghai, said: “Our 3-day virtual conference was a big success. It was BDA’s first growth capital conference and it attracted over 300 investors from 150 PE firms to participate in our conference. The attendees included blue-chip global and China USD funds as well as China RMB funds. We also received strong support from Founders and CEOs of high-growth companies in China to present at our conference. These companies represent industries which are at the forefront of China’s economic development including digital health, in-vitro diagnostics, premium healthcare services, lifestyle & wellness and fintech. The strong turnout reflects investor appetite for high-quality companies set to benefit from China’s rapid transformation toward an advanced economy. It also demonstrates ample private market liquidity seeking mid to late stage opportunities in China. We are very pleased to be the partner of choice for our clients in bringing private capital and exciting growth opportunities together.”

We look forward to our next BDA China Growth Capital Conference in 2023, and also the annual BDA PE Conference in late 2022. Please contact us at gcc@bdapartners.com or pe-conference@bdapartners.com if you would like to learn more about either conference, and the benefits of both presenting and attending.

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

The BDA Private Equity Conference is an annual convene where blue-chip private equity investors meet outstanding private companies. It is a unique platform for outstanding private companies in the chemicals, consumer & retail, healthcare, industrials, services and technology sectors to build their profiles and network with leading PE investors. It is also an exclusive opportunity for PE investors to hear introductory presentations by company founders or senior management, and to have one-to-one individualized access to them. This provides early exposure to companies that may explore a transaction in the medium term.

BDA PE Conference 2021

BDA Partners hosted the 3rd annual BDA Private Equity Conference from November 30th to December 2nd, 2021.

32 leading Asian private companies from the Consumer, Education, Healthcare, Industrials, Services and Technology sectors gave presentations and participated in one-to-one meetings with more than 250 Asian & global private equity investors.

Paul DiGiacomo, Managing Partner and Head of the Financial Sponsors Group at BDA, said: “The BDA PE Conference has proven to be a valuable platform for both the private equity community and blue-chip private companies in Asia. We provide investors with unique access to high-quality private companies, and company founders and senior management can begin to develop relationships with investors and get invaluable early market feedback. We’re pleased that the community continues to find the conference to be useful and rewarding, and we expect to introduce additional opportunities for investors and private companies to network and interact in 2022.”

We look forward to hosting the 2022 BDA PE Conference in the second half of 2022. Further details will be shared in due course.

Please contact pe-conference@bdapartners.com if you would like to learn more about the 2021 conference, or to attend in 2022. Please contact pdigiacomo@bdapartners.com to discuss the benefits of presenting at the 2022 conference.

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes. BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese government-owned bank with US$150bn of assets.

US securities transactions are performed by BDA Partners’ affiliate, BDA Advisors Inc., a broker-dealer registered with the Securities and Exchange Commission (SEC). BDA Advisors Inc. is a member of the Financial Industry Regulatory Authority (FINRA) and SIPC. In the UK, BDA Partners is authorised and regulated by the Financial Conduct Authority (FCA). In Hong Kong, BDA Partners (HK) Ltd. is licensed and regulated by the Securities & Futures Commission (SFC) to conduct Type 1 and Type 4 regulated activities to professional investors. www.bdapartners.com

We spoke with Howard Lee, Partner and Head of Seoul at BDA Partners, who discussed the outlook of the M&A activities in South Korea, the impressive growth of the Korean private equity market and the role of a great financial advisor.

- What are the latest trends in the M&A inbound and outbound market in South Korea?

Inbound acquisitions of Korean assets by foreign investors have been inactive over the past year. It is largely related to the impact of Covid-19 on overseas buyers. For example, when I talked to potential buyers in the US or China about Korean assets, the general feedback was, under the Covid situation, we were unable to organize ourselves to seriously look at the asset. The Korean inbound market will be more active when the Covid situation improves globally during 2021.

Also, overseas acquisitions by Korean companies in the US and European market have not been particularly active over the last decade. Only few top conglomerates in Korea, like Samsung, LG and SK, tend to execute such M&A transactions. In general, most Korean companies tend to take a conservative stance when it comes to allocating considerable resources for cross-border M&A transactions. The problem resides in their limited exposure to cross-border M&A as well as in post transaction steps such as PMI (Post-Merger Integration). Thus, in order to penetrate overseas market through M&A strategy, it is important that they approach and confront the deal confidently but with proper preparation. Secondly, out of those major conglomerates, their hands are tied up by regulations. So, even though they would intend to go out looking at M&A opportunities, there are sometimes issues at the corporate level or sometimes at the level of key individuals.

- What are the key factors to the rising presence of financial sponsors in the Korean market?

Korean financial sponsors are quite capable, in terms of sourcing capital and executing transactions. Most Korean financial sponsors are supported by large limited partners such as the National Pension Service, the largest public pension fund in South Korea. As private equity funds continue growing in Korea, they are pressured to invest capital and make investments. Moreover, the Korean private equity market is relatively mature compared to other Asian countries and the private equity professionals are very capable and intelligent, exerting high level of professionalism in sourcing high quality assets and undertaking extensive due diligence.

The growth of Korean private equity has quite a unique story. In Korea, conglomerates divest certain affiliates every year. However, for various cultural reasons, transaction between corporates in Korea is very rare. For example, if Samsung sells one of its affiliates to LG, it would be considered exactly a kind of betrayal to employees. So, rather than directly selling the affiliate to another corporate, they would likely have an indirect discussion and sell it first to a private equity fund. A few years later under private equity ownership, the fund would then sell the asset to another conglomerate. This is a pretty typical process in Korea, and that is why financial sponsors are very active in acquiring assets, without many challenges divesting to corporates a few years later.

- Korean M&A market is expected to face an unprecedented boom in 2021. What are your views for the Korea M&A market in 2021?

The expected booming M&A activities in 2021 will be largely driven by the pent-up in transactions. Many private equity funds had good assets ready to be divested in 2020 but the M&A process was disrupted by Covid-19. These funds are now looking to resume these M&A processes in 2021. We will likely see a number of large assets come to the market in 2021. In the case of corporates, their outbound investments in the US, Japan and European markets have also been put on hold because of Covid. As we were seeing the light at the end of the tunnel by the end of 2020, these activities are also likely to resume during 2021.

As far as my knowledge goes, the market has already begun its process to rejuvenate M&A activities. A number of advisors/bankers are already in the process of developing deals and we can soon expect the market to be flooded with deals.

- How have chaebols (large local conglomerates) changed over the last few years and what do you expect going forward?

In my perspective, each chaebol has been focusing on building up their internal taskforce in 2020 looking to identify and resolve potential in-house issues related to liquidity, financial performance, etc. As a result, there were no significant transactions in 2020, other than SK Hynix’s acquisition of Intel’s NAND memory business for US$10bn.

For the past few years, chaebols were not active about overseas M&A. However, they now realize the future depends on their capabilities in AI, semiconductor, data, platform business, etc. As evidenced by Hyundai Motors’ recent investment in a global robotics company in the US, I think that these kinds of investment and acquisition by chaebols will be flourishing going forward.

- What are the most attractive sectors in Korea for M&A over the next five years and why?

One of the most attractive sectors in M&A over the next five years will be the industrials sector as it needs to be consolidated or restructured. Large industrials companies in Korea such as Samsung, LG and SK will need to complete some consolidation or restructuring, whether it is acquiring a competitor or exiting this sector soon in preparation for the ESG era. Based on the expected market dynamics as mentioned above, there will be a myriad of acquisition opportunities of legacy business under the consolidation or ESG preparation.

In addition, other attractive sector to look out for is the tech-driven industry which Korean chaebols and conglomerates are focusing on at the moment. Businesses related to AI, data, cloud computing, semiconductor are the ones that the conglomerates not only have strong fundamental on but also heavily investing in as well.

- How do you think the role of M&A financial advisory will evolve under such fierce competition?

Over the past decade, I think the top five or six conglomerates in Korea accounted for more than 80% of the fees paid to M&A financial advisors. That is because those conglomerates have sizable revenues and there are many M&A deals being sourced from them. In recent years, the private equity sector has been growing fast, contributing more and more to the financial advisory business across Korea.

Therefore, an advisor needs to focus on these two client types, and be able to deliver what they require. Corporate clients value the advisory firm’s network in both domestic and global markets. Private equity clients tend to look at each individual banker, their capabilities and track record for instance. So, I think M&A financial advisory needs to be built up in these two ways. Any advisory firm that is successful in building extensive local and global networks, and continuing to hire great professionals, will end up in a better position compared to the competition.

Another perspective here is the M&A financial advisory firms need to act like a bridge between corporates and private equity funds. If we build up a private pipeline between the two, we can arrange the one-on-one deal between private fund and corporate.

BDA has an edge in our unparalleled local Korean and global networks, extended experience in sell-side process, and seamless execution by the global team of professional bankers. Going forward, BDA Seoul will keep hiring highly competent people and delivering bigger transactions.

In this light, BDA Seoul is currently in discussion with a U.S. law firm to help Korean corporates elevate their knowledge of rules and practices to be considered when acquiring U.S. publicly-listed companies and will hold a session in March where all M&A staffs from most of major corporates in Korea will be invited. I believe this will greatly improve our reputation in the Korean market and strengthen our relationship with the potential clients.

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes. BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese government-owned bank with US$150bn of assets.

US securities transactions are performed by BDA Partners’ affiliate, BDA Advisors Inc., a broker-dealer registered with the Securities and Exchange Commission (SEC). BDA Advisors Inc. is a member of the Financial Industry Regulatory Authority (FINRA) and SIPC. In the UK, BDA Partners is authorised and regulated by the Financial Conduct Authority (FCA). In Hong Kong, BDA Partners (HK) Ltd. is licensed and regulated by the Securities & Futures Commission (SFC) to conduct Type 1 and Type 4 regulated activities to professional investors. www.bdapartners.com

Originally published as an op-ed in the Barron’s

In the 1990s, financiers used to mock “the FILTH”: British bankers or business people who “fail in London, try Hong Kong.” If you couldn’t make it anywhere else, you could still make it om the shores of the fragrant harbor whose ever-rising tide floated all boats. Hong Kong was the Manhattan, Las Vegas, and Los Angeles of Asia, all rolled into one—money, nightclubs, fast cars, world-class restaurants, stock-market booms, beaches, yachts, and dodgy go-go bars. It was a boomtown because it was the gateway to China. This was the staging post for the greatest gold rush of the 20th century: the reawakening of the Chinese dragon. Despite the recent crackdown on civil liberties, Hong Kong is far from turning into a financial backwater. As long as opportunity still exists, it will continue to attract foreign investors who feel more at home there than on the mainland.

Expats have long preferred Hong Kong to Shanghai or Beijing. The city boasts better schools, hospitals, and espresso bars. Google still works. Unlike on the mainland, business and society has felt free. While the British had never granted Hong Kong true democracy, the rule of law was clear. Private-equity firms enjoyed a fairly level playing field, taxes were low, the press was free, and the judiciary was independent. That’s why Britain fought so hard for the principle of “one country, two systems,” which was enshrined into law, for 50 years, when Hong Kong reverted to Chinese rule. China promised to give Hong Kong the democracy that Britain had denied its colony. Of course, the truth has emerged rather differently.

Suddenly, Hong Kong is out of fashion. Riots, the Covid-19 pandemic, and Chinese government repression have combined to scare away those same expats who made it their home. Six weeks ago, China imposed a broad national-security law on Hong Kong banning secession, subversion, and collusion with foreign countries. It’s already having a dramatic effect on the city’s media and politics. The new law eliminates civil rights that local residents have long exercised, and raises the specter of foreign business people being arrested for vaguely defined offenses and being deported to stand trial in China.

Beijing, far from liberalizing, is cracking down on dissent inside and outside its borders. The new security law explicitly applies beyond Hong Kong and covers non-Hong Kong residents, making this once freewheeling city dangerous for anyone viewed unfavorably by Beijing. Growing economic tensions between the U.S. and China have also led to tariff and nontariff barriers.

Last week, more than 200 police officers raided the head office of Apple Daily, the city’s most-read pro-democracy newspaper. Several managers were arrested, including the paper’s high-profile, millionaire owner, Jimmy Lai. Lai faces an array of charges, notably collusion with foreign countries, under the new law. He has a good relationship with the Trump administration and has testified before Congress in the past.

At the same time, China is trying to reassure the world that it should still do business with Hong Kong. For the foreseeable future, the city will still be the hub for inbound and outbound mainland investment. While Singapore has gained traction with private-equity professionals, boasting a transparent legal framework and increasingly broad tax treaty, Hong Kong is countering with incentives of its own. A new Limited Partnership Fund Bill hopes to establish Hong Kong as a prime Asian destination for private-equity and venture-capital funds. The legislation proposes Hong Kong as a domicile for private equity, venture capital, and real-estate funds and will attract private funds and family offices to Hong Kong. Domiciling in Hong Kong would give these firms direct access to the region and to Hong Kong’s robust capital markets. It will be a catalyst for growth in tech and financial services.

Officials have also announced plans to introduce a new carried-interest tax scheme, expected to be one of the world’s most liberal, intended to make the city a viable alternative to the Cayman Islands, especially for Asia-focused funds. The Hong Kong government is also planning to provide extensive tax concessions for private-equity funds’ “carried interest” performance fees. Singapore offers similar advantages, but Hong Kong is aiming to be even more generous to investors.

All of this will be attractive to investors as Hong Kong is still swimming in wealth. Tycoons have outperformed almost everyone else. With a population of only 7.5 million, the territory ranks seventh in the world with 96 billionaires and a combined wealth of $280 billion, according to Wealth-X’s Billionaire Census 2020. Of all world cities, only New York can boast more billionaires.

Hong Kong is clearly now part of the People’s Republic of China and, prompted by the government, mainland money is pouring in,but there’s little sign of foreign capital fleeing. Foreign investors who want to share in China’s economic growth have little choice but to use Hong Kong’s capital markets as their main vehicle. The Hong Kong dollar has held its trading band against the U.S. dollar. The stock market has seen heavy inflows from mainland institutions, and there are more and more “red-chip” companies, based in mainland China, but listed on the Hong Kong Stock Exchange. The Hang Seng Index fell sharply in the first quarter but has recovered 14% from its March low. The index is still 9% off its peak from two years ago, yet rumors of Hong Kong’s demise may be exaggerated, or just plain wrong.

Even though China has put a harness around the neck of its golden goose, Hong Kong’s economy is too precious to kill. Vietnam and Singapore are certainly benefiting from Hong Kong’s recent woes as expats move in and fund managers direct more money into those markets. Still, as long as Hong Kong’s financial advantages remain, Western professionals and investors may find themselves back in the gleaming office towers of Hong Kong Central quicker than they expect.

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 24 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese government-owned bank with US$150bn of assets.

US securities transactions are performed by BDA Partners’ affiliate, BDA Advisors Inc., a broker-dealer registered with the Securities and Exchange Commission (SEC). BDA Advisors Inc. is a member of the Financial Industry Regulatory Authority (FINRA) and SIPC. In the UK, BDA Partners is authorised and regulated by the Financial Conduct Authority (FCA). In Hong Kong, BDA Partners (HK) Ltd. is licensed and regulated by the Securities & Futures Commission (SFC) to conduct Type 1 and Type 4 regulated activities to professional investors. www.bdapartners.com