21 July 2022

Asian healthcare services: Time to look beyond COVID-19

As an increasing number of countries in Asia achieve an 80% vaccination rate, they are gradually removing COVID-19 social and border restrictions. BDA Partners is revisiting the fundamentals and attractiveness of the Asian healthcare services sector.

Healthcare services is the largest part of the healthcare industry in Asia. Its market size is expected to reach US$1.4tr by 2026[1], driven by a growing population, rising affluence, and a mounting disease burden.

Key takeaways:

- Demand for healthcare services in Asia will continue to rise — the segment is growing at a faster pace than the overall healthcare industry, although healthcare infrastructure has been under-invested historically

- Even as governments across Asia increase their budget allocation to healthcare, the private sector continues to play an important role, providing capital and improving the efficiency of the healthcare system

- Financial sponsors have been, and will continue to be, active buyers of quality hospitals and healthcare services assets. Sponsors have been involved in 25% of healthcare services transactions from 2017-2021

- The global dry powder of private equity funds reached a new record of US$1.8tr in February 2022, following a record year of fundraising

- Asian M&A activity in the next two to three years will be strong, driven by consolidation and bolt-on acquisitions by strategics in their core markets, and investments by financial sponsors into both platform and growth companies

In this piece, we examine post-COVID sector trends and M&A activities in SE Asia, Greater China, and India.

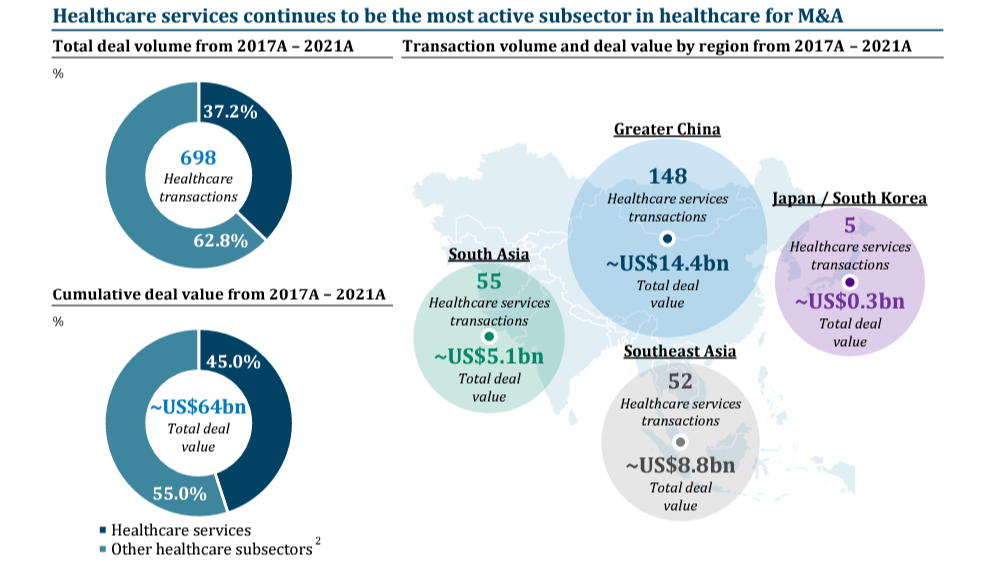

Sources: Mergermarket

Note: (2) Other healthcare subsectors include Medical Devices, Medical Equipment & Services, Biotechnology Research, Drug Development, Drug Manufacturing, Drug Supply, Handicap Aids and Basic Healthcare Supplies, etc.

Download the full report

Contact BDA health team

Andrew Huntley, Managing Partner, Global Head of Healthcare, London / Ho Chi Minh City: ahuntley@bdapartners.com

Anthony Siu, Partner, Co-Head of Shanghai: asiu@bdapartners.com

Sanjay Singh, Managing Director, Head of India, Co-Head of Asia Healthcare: ssingh@bdapartners.com

Claire Zhen, Director, Shanghai: czhen@bdapartners.com

Aditya Jaju, Vice President, Mumbai: ajaju@bdapartners.com

Yan Xia, Vice President, Singapore: xyan@bdapartners.com

Zhang Simeng, Vice President, Shanghai: szhang@bdapartners.com

[1] Fitch and Statista

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

Latest insights

11 June 2025

Private credit could fuel bargain M&A deals as luxury fashion empires...

Euan Rellie, Managing Partner and Chairman of Consumer & Retail, BDA...

6 June 2025

Jeff Acton speaks to Worldfolio on how BDA became the leading cross-border...

Jeff Acton, Partner and Head of BDA’s Tokyo office, was recently interviewed...

30 April 2025

A volatile world: how are Trump’s tariffs impacting cross-border M&A?...

President Trump’s tariffs have injected new risk and complexity into...

25 April 2025

BDA’s Jeff Acton quoted in Bloomberg on Japan’s overseas M&A...

Bloomberg has featured commentary from BDA Partners in its latest article...