China Healthcare M&A outlook for 2024

In China’s dynamic healthcare market, M&A activities are booming due to an ageing population and increasing consumer health demands. The sector is seeing heavy domestic investments from Chinese firms and Government funds. PE firms are seizing M&A opportunities amid capital raising challenges. Chinese companies are also eyeing cross-border M&A for tech-driven healthcare targets. The market outlook indicates industry reshuffles, rising demands for elderly care and consumer health, and flexible growth strategies by multinational firms.

Investment trends highlight a focus on resilient segments, surging investment in out-of-pocket payment sectors and Chinese firms expanding globally, particularly across SE Asia and the Middle East. European healthcare companies remain attractive for Chinese investors; licensing deals are on the rise, led by Chinese pharma firms.

In our latest Insights piece, we summarise the predicted outlook of China healthcare M&A for 2024:

- Domestic strategics, Government-backed funds and RMB funds are investing heavily in China’s healthcare market

- There is an increasing difficulty for companies looking to raise capital in private or public markets, leading to M&A opportunities for large-cap PEs

- Support from the Chinese government to grow the private healthcare sector, including the development of private hospitals and elderly and home care services

- Narrowing valuation gap between IPO and trade sale facilitates more M&A deal completions

Download the full report for more Insights regarding the Chinese healthcare sector.

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services, Sustainability and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

Anthony Siu, Partner and Co-Head of China at BDA Partners, was interviewed by Wancheng Hu, a reporter at South Reviews. The publication is a political and economics magazine published under the Guangzhou Daily Press Group in Southern China. The following is a translated version of the article published on June 5, 2023.

China’s outbound M&A volume dropped to its lowest point last year. According to PricewaterhouseCoopers, the total value of M&A transactions in China fell to US$485bn in 2022, representing an 80% decline from the peak in 2016, and is comparable to 2009 when investment activities plummeted in the wake of the global financial crisis.

The Covid-19 pandemic and increasing geopolitical tensions led to varying degrees of restrictions on capital flow. Combined with stringent national security reviews, China’s outbound M&A has suffered a dramatic slowdown in recent years.

As the pandemic came to an end in early 2023, investment activities gradually picked up again. China’s outbound investment policies have not changed significantly, and the central government’s focus remains on encouraging foreign direct investments in healthcare, technology, advanced manufacturing, energy, and resources.

In the first half of 2023, the M&A market is back on a recovery path, with domestic transactions dominating China’s M&A. Cross-border M&A will likely see a pick-up in the second half of 2023, with Asia Pacific and the Middle East becoming the preferred markets for Chinese acquirers.

Amid early signs of an increase in activities, China’s outbound M&A will face challenges as well as opportunities in the near term. The following are key factors to consider for China’s outbound M&A:

1. Impact of increasing regulations on cross-border M&A

BDA Partners specialises in cross-border M&A advisory and has been the top-ranked investment bank for cross-border M&A (enterprise value up to US$1bn) in Asia since 2016.

Mr. Siu moved to Shanghai from Hong Kong in 2008 and has been engaging in Chinese M&A advisory ever since. Having witnessed a long period of unprecedented growth of Chinese M&A, he was apprehensive about the recent downturn.

Siu said “For M&A practitioners, a lot has changed in recent years. The number of Chinese companies looking to engage in outbound M&A has shrunk significantly. The combined impact of the pandemic and the geopolitical tensions have led to a dramatic decline in M&A volume.”

While he believes that the pandemic impact is temporary, the geopolitical impact on cross-border M&A will be longer-lasting. In particular, the heavy regulatory scrutiny on China’s outbound M&A transactions is likely to stay for some time.

Among the affected regions, the US has been impacted the most. In January 2020, the US Treasury published new regulations based on the Foreign Investment Risk Review Modernization Act that significantly expanded the scope of the Committee on Foreign Investment in the United States (CFIUS).

“When a non-US company wants to acquire a US company, it needs to go through CFIUS review. The review will take a long time if the target’s industry is considered sensitive and involves national security concerns” said Siu, “although many transactions were not vetoed, they did not receive CFIUS approval and therefore were unable to close.”

In addition, countries that were previously considered to be open to foreign investments are moving toward increasingly stringent FDI reviews.

Germany, for instance, the country with the largest number of Chinese investments in the EU, had promulgated the Foreign Trade and Payments Act, imposing strict review measures for investments by non-EU countries and expanding the scope of mandatory filing obligations involving “critical infrastructure” and “critical technology.” Industry practitioners say that a large number of transactions were abandoned due to a slim chance of passing FDI or anti-monopoly review.

“Obtaining regulatory approval is a common concern for companies involved in cross-border M&A. If a Chinese state-owned enterprise (SOE) decides to conduct a transaction overseas, it requires approval from the State-owned Assets Supervision and Administration Commission (SASAC). Moreover, when the transaction amount exceeds US$300m, further approval is required from the China National Development and Reform Commission (NDRC). These approvals will typically take time to go through,” said Siu.

The aforementioned includes only the approval procedures required from the Chinese side, while each country has its own jurisdiction and approval procedures, which further complicates the closing of a transaction. A few high-profile cases involving SOE acquirers over the years include:

- In 2005, China National Offshore Oil Corporation (CNOOC) attempted to acquire Unocal Corporation in the US, but the transaction was blocked as it did not pass a national security review

- In 2009, Aluminum Corporation of China’s planned acquisition of Australia’s Rio Tinto was terminated because stakeholders reckoned that the terms were biased toward the buyer

- In 2020, Shandong Gold Mining’s acquisition of Canadian gold miner TMAC Resources was blocked by the regulatory authorities due to national security reasons

In addition to national security considerations, Chinese acquirers face increased scrutiny in areas such as information transparency, financing sources, and shareholding structure.

2. Where will the China capital go?

Despite some challenges, outbound M&A activities are showing signs of recovery.

Countries around the world are welcoming investments in industries that are deemed important to the country’s economic development. In addition, industries that have been hit hard by the pandemic, including transportation and logistics, tourism and hospitality, basic materials, and consumer goods, are recovering, giving acquirers renewed confidence in investing in the future upside of these industries.

Siu is bullish on the China outbound M&A market. The resumption of international air travel and the normalization of business activities will allow Chinese acquirers to become more active in engaging in outbound M&A activities. However, he believes that this wave of outbound M&A will be different from the past. Rather than focusing on the U.S. and Europe, Chinese acquirers will be shifting their focus to new markets such as Southeast Asia, the Middle East, and Africa.

“China today is playing a role similar to the US in the 1990s and early 2000s,” said Siu.

During those periods, US companies, facing a saturating domestic market, expanded their international footprint to high-growth emerging markets via M&A.

China is doing something similar now. In the past, the focus was on acquiring Western technologies and know-how to bring them to the Chinese market. This coming wave will be about investing in opportunities that allow Chinese acquirers to export self-developed technologies and products to the international markets. Instead of facing head-on competition in a crowded domestic market, they go abroad to look for new growth opportunities. Companies in the technology, media and telecom (TMT) space and the electric vehicle (EV) sector are among those industries with growth potential.

Southeast Asia, due to its close geographical proximity to China, has been a favourite destination for China’s outbound investments. Indonesia is one such example.

Indonesia has the world’s fourth-largest population with 274 million people and a young labour force. In 2022, investments made by Chinese companies in Indonesia reached US$8.2bn the second largest source of FDI in Indonesia. Today, Chinese investments are present in e-commerce, ride-hailing services, online food delivery, digital financial services, and online gaming sectors in Indonesia.

“Unlike trading and manufacturing companies that have gone to the West in the early days, Chinese high-tech and smart manufacturing companies looking to expand overseas now select Southeast Asia, the Middle East, and Africa as their priority markets to enter,” said Siu.

However, with benefits also come challenges. Just like many foreign companies find it difficult to adapt to the Chinese market, many Chinese companies that entered new markets have encountered challenges in working with local management, understanding the local culture, and dealing with workers that are not accustomed to long working hours.

The above are all common problems encountered by Chinese acquirers in outbound investments. Essentially, it is the lack of attention and effort paid to post-acquisition integration and understanding of cultural differences that hinder the acquirer’s success. For example, Chinese companies often lack experience in managing employees under a union-led workforce. If appointed Chinese executives attempt to impose a top-down culture, employees are likely to express dissatisfaction. Over time, a growing estrangement will develop between the local employees and the Chinese executives.

3. Focus on building up M&A expertise and acquiring talent

Having worked on M&A for over two decades, Siu has witnessed many successful acquisitions, while others failed and had to go through a difficult period of restructuring.

He observed that the issue faced by Chinese acquirers is usually caused by a breakdown in communication. When a Chinese acquirer becomes the controlling shareholder, the target’s management is often concerned about how the new owner will affect its corporate culture and management style, soft issues that are often overlooked by the Chinese acquirers. If these problems are not handled properly, the target’s management team will ultimately choose to leave.

These kinds of issues can often be mitigated if the acquirer has already established a presence in the target’s region, along with a team that understands the local system and culture. If the acquirer can understand the target company’s pain points, it can address these issues upfront more effectively, and the chance of a successful integration will increase.

Siu pointed out as an example a cross-border transaction that BDA and its strategic partner, William Blair, served as the sell-side advisors for Summa Equity, a Finnish private equity firm, on the sale of its portfolio company, HyTest, to China’s Mindray for €532m in 2021.

HyTest is a leading global supplier of in vitro diagnostic (IVD) raw materials, with in-house R&D and production capabilities for high-quality antigens and antibodies. This acquisition has helped Mindray broaden its international footprint and strengthen its value chain coverage while fulfilling the need for top-graded IVD upstream raw materials in China.

Simeng Zhang, Director at BDA Partners and the project lead for the sale of HyTest, stated “compared to other companies, Mindray has a professional in-house M&A team composed of talent with prior experience at accounting firms, law firms, and investment banks. Having this talent on the team made the due diligence, negotiation management, and decision-making process much smoother.”

She also mentioned that Mindray and HyTest had already established a good level of trust in prior business relationships. “In the past few years, more than half of HyTest’s revenue came from the China market, and with Mindray’s globalization strategy, the acquisition of HyTest became particularly attractive to Mindray.”

Though BDA Partners often takes on the role of a sell-side advisor, when the transaction involves a Chinese buyer, BDA Partners will also take the initiative to coordinate with the buyer to elaborate thoughts from the seller’s side, including management’s concerns on the transaction and key transaction terms.

Siu believes that the days of relying on the China growth story to win over the seller’s and target’s management are gone. Chinese acquirers should have a clear plan for globalising the target’s business beyond just China. “We are actively working with our clients to search for quality investment targets on a global scale to help them expand their international footprint,” said Siu.

The history of globalisation proved that successful M&A transactions can generate higher shareholder returns and help global players strengthen their competencies and maintain their market-leading position.

Being able to survive the pandemic will make a company stronger, while others facing challenges will become more open to being acquired. “For ambitious Chinese companies, now is a good time for M&A,” said Siu.

However, overseas competitors will not just sit back and wait. To grasp the opportunity and secure a meaningful position among global leaders, Chinese acquirers should further enhance their in-house M&A capabilities and attract talent with international experience and M&A expertise.

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

As we approach the halfway point in 2023, it’s clear that the luxury goods market in China and Asia is thriving. This growth is fuelled by the opening of borders post-COVID and the region’s increasing affluence. Today, China alone accounts for over one-third of global luxury sales.

As consumers in the region spend more on retail, beauty, food, lifestyle, and luxury items than ever before, BDA sees opportunities for foreign investors and companies to reach an eager and widespread Asian market.

In our latest insights report, we discuss China’s economy and explore opportunities in other Asian markets. We also identify the subsectors in the consumer and retail space which we anticipate will shine.

The key takeaways in this report are:

- Asia’s luxury market continues to gain momentum, mainly driven by China

- In China, retail sales in March 2023 alone jumped 10.6% YOY, a speed unseen in two years

- The share price of some luxury companies have risen 10%-20% this year

- A rebound in the Chinese economy, the millennial generation, and changing consumer preferences support the trend

- Overall, Asian consumers are spending more on retail, beauty, food, lifestyle, and luxury items than ever before

- This increase in demand opens the door to opportunities for foreign investors and companies

- BDA has deep industry knowledge and extensive experience in advising clients on transactions in beauty & personal care, lifestyle & entertainment, mother & baby care, apparel & accessories, and the food and beverage industries

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

China’s private equity (“PE”) industry faced strong headwinds in 2022 due to factors including a slowing economy, Covid-19 restrictions, increased regulatory scrutiny, and higher prevailing interest rates globally which weighed on public market valuations. PE exits and fundraising had been challenging during the past year.

However, the China market underwent a dramatic change in recent months as the country’s Zero-Covid policy was relaxed and borders were reopened. The Chinese government implemented measures to boost the economy and private sector investments. This report provides our perspectives on how these changes may impact PE activities and China M&A market in 2023.

The key takeaways in this report are:

- The unwinding of Zero-Covid policies will benefit sectors such as consumer, tourism, and property. China’s growth story will be back in focus and investor confidence in the Chinese economy will likely revive. Looking ahead, consumer & retail, manufacturing, energy & resources, life science & healthcare, and logistics & supply chain industries will likely attract the most attention

- China M&A market involving Financial Sponsors will be dominated by China GP’s investments in domestic targets. We also expect to see an increase in GP outbound investments in 2023 to diversify their portfolio outside of China

- Trade sales and IPOs were difficult in 2022, leading to delays in portfolio company exits and fundraising for PEs. In 2023, we expect to see a greater number of portfolio company exits, with more quality assets coming to the market. We expect tightened regulations and the long backlog for public listings will continue to pose difficulties for IPO exits, and mean trade sale will be a more prominent exit route for PEs in 2023

- PEs will likely focus on returning capital to LPs through portfolio company exits in 2023. We expect that fundraising will remain relatively subdued this year, followed by more fundraising activity from 2024 onwards as PEs complete more exits – and need to replenish their capital for new investments

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

BDA Partners hosted our inaugural China Growth Capital Conference on April 26th – 28th. 20 presenting companies from consumer, health, services and technology sectors gave presentations to growth capital investors in over 200 virtual one-on-one meetings.

Anthony Siu, Partner and Co-Head of Shanghai, said: “Our 3-day virtual conference was a big success. It was BDA’s first growth capital conference and it attracted over 300 investors from 150 PE firms to participate in our conference. The attendees included blue-chip global and China USD funds as well as China RMB funds. We also received strong support from Founders and CEOs of high-growth companies in China to present at our conference. These companies represent industries which are at the forefront of China’s economic development including digital health, in-vitro diagnostics, premium healthcare services, lifestyle & wellness and fintech. The strong turnout reflects investor appetite for high-quality companies set to benefit from China’s rapid transformation toward an advanced economy. It also demonstrates ample private market liquidity seeking mid to late stage opportunities in China. We are very pleased to be the partner of choice for our clients in bringing private capital and exciting growth opportunities together.”

We look forward to our next BDA China Growth Capital Conference in 2023, and also the annual BDA PE Conference in late 2022. Please contact us at gcc@bdapartners.com or pe-conference@bdapartners.com if you would like to learn more about either conference, and the benefits of both presenting and attending.

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

Since 2020 BDA has successfully advised on nearly 60 transactions, making us one of the most active M&A advisors in Asia. This level of experience underpins our ability to deliver successful outcomes for our clients under dynamic market conditions.

For over 20 years, our Hong Kong team has advised multinationals on strategic carve-outs and bolt-ons, guided entrepreneurs on divestments and capital raises, and supported financial sponsors on investments and portfolio company exits.

We continue to leverage this experience and insight to deliver value-optimising results for our clients who entrust us with their business.

The enclosed flyer provides a snapshot of our capabilities and our recent track record globally and in the Greater China region. Our experienced and dedicated team of Hong Kong-based bankers is ready to support your M&A ambitions. Should you wish to learn more about BDA, our expertise and how we can assist you, please reach out to one of our contacts below:

- Paul DiGiacomo, Managing Partner: pdigiacomo@bdapartners.com

- Simon Kavanagh, Partner: skavanagh@bdapartners.com

- Karen Cheung, Managing Director: kcheung@bdapartners.com

- Mireille Chan, Director: mchan@bdapartners.com

- Jakub Widzyk, Director: jwidzyk@bdapartners.com

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

A Q&A with Anthony Siu, Partner, Co-Head of Shanghai and Head of China Financial Sponsor Coverage, at BDA Partners, on the outlook for China M&A, private equity exits and outbound M&A activities

- 2020 was a record year for domestic Chinese M&A. Do you see this continuing in 2021?

Yes, I do see that trend of domestic Chinese M&A continuing, and even accelerating in 2021 and beyond. 2021 year-to-date domestic M&A has been on a record pace, with $80bn of deals announced and the busiest ever start to a year. This period saw three times the level of M&A deal value of the same period in 2020.

Covid-19 impacted the China M&A market heavily in the first half of 2020 but, since then, the market has rebounded significantly. Chinese buyers are focusing their M&A efforts domestically, largely due to geopolitical tensions, travel restrictions, and the severe impact of Covid-19 in Europe and the USA, along with shifting focus to domestic demand.

We see more domestic players speeding up their plan to expand in China. They are using this opportunity to consolidate in the domestic market, to accelerate growth, and to expand beyond their own regions to the whole country. Some national champions are emerging in certain sectors. With China aiming for more self-reliance and the economy still growing, I expect there will be further domestic M&A consolidation.

In terms of sectors, consumer and healthcare are the favorites for domestic buyers. As China is gearing towards consumer upgrade with higher disposable income, the consumer market will continue to grow. The large corporates would like to accelerate their channel network and market share expansion through acquisitions.

Healthcare is another area where we expect more domestic activities. The strategic players are looking at ways to expand their market share in a fast-growing but fragmented market. For example, in the healthcare services areas, we see a lot of M&A activities in hospitals, specialist clinics and rehabilitation centers.

- Do you think we will see Chinese family owner / founder business preferring IPO or trade sale exits in 2021?

I see both happening. The IPO market has been hot over the past year. The STAR Market has enabled smaller, high growth companies to list at attractive valuations. For founders who have no plans to retire or exit soon, or have high growth businesses that are tough to sell at an early stage, they will prefer the IPO route.

But for founders who have established businesses in traditional industries such as industrials and consumer & retail, trade sale can be a very attractive exit route for them. Strategic and private equity buyers are interested in market leaders with strong cash flows, and targets with these characteristics can attract strong interest.

- How do you see Covid-19 impacting PE owners’ timing and planning for exiting their investments?

Last year we saw PE sellers postponing their portfolio company exits due to adverse business environment. Looking ahead, we should see more PEs exiting their investments to clear the backlog. In the first half of this year, some PE firms are waiting to establish a clear path of recovery of the target’s financial and operating performance, and we expect trade sale exits to accelerate in the second half of the year.

- Do you see distressed / restructuring M&A opportunities in 2021? Domestic or overseas Chinese owned assets?

Not so much in China because the Covid-19 impact was short-lived. The over-leveraged situations for some enterprises happened before Covid-19 and they were forced to de-leverage. We saw a lot of these divestiture activities in the past 1-2 years.

Outside China, there may be more distressed and restructuring opportunities for companies that are looking for liquidity. With Chinese buyers being more active in outbound investments, we may see more deals done in overseas asset restructurings.

- China outbound M&A in 2020 was the lowest in the last decade. Do you see it bouncing back in 2021? If so, what sectors and countries will be attractive?

Since the beginning of this year, we have already seen early signs of recovery in outbound M&A. The Chinese players are becoming more active in outbound transactions into Europe and the rest of Asia such as Singapore and fast-growing countries like Vietnam; less so into the US because of the tensions between Washington and Beijing creating significant deal uncertainties. As the pandemic situation eases and borders re-open, we should see outbound deal volume picking up through the rest of the year.

I believe outbound investors will continue to favor sectors such as industrial and healthcare. Another sector that has benefited from the pandemic was transportation and logistics due to the boom of e-commerce.

- How do you see the geo-political relationship between China and the USA playing out under the new Biden Administration?

We have probably hit the lowest point of the China-USA relationship during the Trump Administration. I think the Biden Administration will take a firm but pragmatic approach to China, knowing that this is one of the most important strategic relationships to the US. US companies have significant investments in China, and they need to be protected. China is the biggest market in the world in many respects, and the US cannot afford to ignore that opportunity.

On the other hand, China will continue to open up. The government has already removed a lot of restrictions in foreign direct investments. Going forward, I expect that there will be a revival of US interest in investing in China.

- Will the new EU-China Agreement boost cross-border M&A in 2021?

The EU-China agreement primarily focuses on the China market opening up to the EU. It helps various sectors, for example, new energy, healthcare services, financial services; areas that were traditionally protected by the government. The EU companies will benefit from this agreement by China opening up these sectors more for EU investments. In terms of M&A, we expect to see more EU companies increasing their investments in China, through outright acquisitions or strategic investments. However, the recent sanctions row between the EU and China put the ratification of the agreement in doubt. I believe both sides will lose if the agreement falls through, and hope that they will find a way to avoid escalation and put the agreement back on the right path.

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes. BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese government-owned bank with US$150bn of assets.

US securities transactions are performed by BDA Partners’ affiliate, BDA Advisors Inc., a broker-dealer registered with the Securities and Exchange Commission (SEC). BDA Advisors Inc. is a member of the Financial Industry Regulatory Authority (FINRA) and SIPC. In the UK, BDA Partners is authorised and regulated by the Financial Conduct Authority (FCA). In Hong Kong, BDA Partners (HK) Ltd. is licensed and regulated by the Securities & Futures Commission (SFC) to conduct Type 1 and Type 4 regulated activities to professional investors. www.bdapartners.com

1. Pandemic? What Pandemic?

China’s Communist Party will mark its 100th birthday in July 2021 with typical pomp and ceremony. Celebrations will be cheered by an economy which shrugged off the effects of the Covid-19 pandemic remarkably quickly.

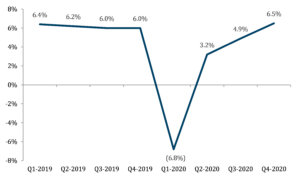

China recorded a sharp slowdown in Q1 2020, as the first country to be hit by Covid. China’s GDP dropped more in those three months than during the 2009 global financial crisis.

Beijing took the unprecedented step of locking down Wuhan a year ago, on 23rd January 2020. Economic activity and travel across the country ground to a virtual halt in the following months until the virus was stamped out. The Government tested repeatedly and widely for Covid, and on a scale other countries can only dream of: For example, in Qingdao, 12 cases in October 2020 resulted in nine million residents being tested in just five days. Unlike Western countries like the US, which focused stimulus efforts on lowering borrowing rates and handing out money to consumers, Beijing focused on restarting factories while keeping interest rates relatively high.

China’s factories came back online from April 2020, as the world’s manufacturing capacity was sputtering to a halt in the face of the devastating pandemic. China actually benefitted from the global slowdown, producing and exporting huge quantities of medical equipment, face masks and work-from-home electronics, such as laptops and monitors.

The Chinese economy roared back to life in Q2: year-on-year GDP went up by 3.2%.

China avoided consecutive quarters of negative growth, escaping the technical definition of recession. China was the only major country recording positive growth in Q2 2020.

China GDP continued to grow in Q3 2020, with year-on-year growth of 4.9%.

The pace has since accelerated. The Chinese economy grew 6.5% in Q4 2020, compared to a year ago. This was notably higher than pre-pandemic growth rates.

Chart 1 – China actual quarterly GDP growth % 2019 to 2020

Source: OECD

2. Thirty five years of growth

China’s economic miracle has lasted more than three decades. After recording 10% growth in 1987-88, China slowed in 1989-90, following violent repression of the pro-democracy protests in Tiananmen Square, Beijing, in June 1989. That led to a stark interruption of steady liberalization of the Chinese economy.

High growth rates returned quickly by 1991, and ran unabated until 2019. GDP grew by more than 9% per annum over those thirty years.

Of course, there have been significant hiccoughs along the way. The Chinese economy was already slowing dramatically before the outbreak of Covid, recording GDP growth of only 6% in 2019.

Going into 2020, The World Bank forecast 1%-2% growth for China; the IMF forecast 2%.

China’s eventual 2.3% growth in 2020 bucked the global trend. Other nations are still weighed down in the throes of the pandemic. All major global players except China, will record negative annual growth in 2020, according to IMF and the World Bank. And yet, the pandemic is apparently receding in the rearview mirror for China.

The World Bank estimates the US economy shrank by 3.6% in 2020, Japan shrank by 5.3%, and the Euro area shrank by a depressing 7.4%.

Chinese GDP per capita now exceeds US$10,000 for the first time in history, with almost no population growth at all.

Chart 2 – China actual GDP growth % 1985 to 2020 and forecast to 2025

Source: IMF

3. An aggressive President Xi

President Xi Jinping this week restated the importance of economic growth, highlighting “balance” in the Chinese economy, with strength in agriculture, more investment in infrastructure, and innovation in the tech sector.

President Xi reported reliable harvests and grain production for 17 years in a row, as well as breakthroughs in scientific explorations including the Tianwen-1 (Mars mission), Chang’e-5 (lunar probe), and Fendouzhe (manned deep-sea submersible). Development of the entire Hainan island, which is comparable in size to Taiwan, into the Hainan Free Trade Port, is proceeding at pace.

2021 will also mark the start of China’s 14th five-year plan, a closely watched road map covering 2021–25.

The World Bank is optimistic about China, predicting 2021 GDP growth of 7.9%, almost double the global growth projection of 4%.

Of course, outside observers are sceptical about the accuracy China’s reported figures, which are presented as part of President Xi’s nakedly political PR efforts. Nonetheless, BDA sees clear evidence of confidence and momentum, as Chinese private equity and IPO markets remain positive. It will be harder to achieve double digit growth, given the bigger base today, but there’s every reason to see that China will keep growing well.

Ignoring wide criticism of China’s maritime expansion, iron fisted rule over Hong Kong, and repression over the Uighurs in the northwest, Xi Jinping is asserting himself as aggressively as ever: “China will keep striving, marching ahead with courage, to create brighter glory”, he stated in his New Year’s address.

China’s ability to expand, even as the world fights to control Covid that has killed two million people, underscores the country’s success in taming Covid within its borders, and cements its unchallenged role as the dominant economy in Asia.

For now, the economic data reveal an economy still driven primarily by industrial production and investment rather than consumption. And yet, China consumer confidence is also recovering well.

4. China is unique

China’s growth makes it an outlier even among the greatest global economies. The World Bank expects the US economy to have contracted by 3.6% in 2020, and the Eurozone’s to have shrunk by 7.4%, reflected in global economic contraction of 4.3%.

This good momentum means that further recovery in China will likely have to take place without significant stimulus from the Government.

Provincial and local governments in China have some US$300bn in unspent stimulus money left over from 2020.

The export bonanza saw China ship 224 billion masks around the world from March to December 2020: 40 masks for every man, woman and child on the planet outside of China.

Domestic consumer demand may be sluggish in 2021, as wage growth is not yet back to pre-pandemic levels. That may explain Xi’s efforts to sound bullish, but the CCP under Xi tends to avoid sharp turns in policy.

China’s increasingly tense relationship with the US has caused China to pivot towards the EU, which was supported by both sides reaching an agreement on the EU-China Comprehensive Agreement on Investment in late 2020. Contrast this to the US, where in his final weeks in office, President Trump tightened restrictions on Chinese companies, to curb China’s tech sector dominance. This tension is worrying to financial markets. Wall Street is watching to see whether the incoming administration under President Biden will soften this stance at all.

Meanwhile, life continues relatively undimmed across China. People are going to restaurants again, particularly in affluent cities like Shanghai and Beijing. Service businesses like hotels and restaurants are performing well in the big coastal cities, but have not yet recovered in the inland provinces.

After its staggering success in taming the coronavirus, China has suffered renewed smaller outbreaks in the last month or so. The government mobilized quickly, building hospitals, imposing mass testing and putting 30 million people back under lockdown. The intrusive health checks will discourage consumers in the northeast from spending. Chinese families remain wary of big-ticket expenditures, new cars, or extensive home remodeling.

Retail sales growth stuttered in December, slowing to 4.6% from 5.0% the month before. The “Made in China” label has gained popularity, as people stuck in their homes cautiously redirect their spending. The consumer electronics sector has been especially resilient.

Beijing has ramped up its infrastructure spending. Every major city in China is now connected with high-speed rail, enough to span the continental US seven times. New lines were rapidly added last year to smaller cities. New expressways crisscrossed remote Western provinces. Construction companies turned on floodlights at many sites so that work could continue around the clock.

Despite reports to the contrary, China remains the workshop of the world. China’s exports grew 18.1% in December compared with the same month a year earlier, and 21.1% in November.

IPOs are booming as entrepreneurial companies go public at breakneck pace, across China. At BDA, we see M&A markets which are robust, and booming.

This explains why private equity and institutional investors are betting that China, which seemed like it might fall out of fashion in 2020, will continue to shine, and outperform the rest of the world.

Miraculously, China is approaching the Lunar New Year in rude health. 2021 will be the Year of the Ox, a fitting image for the Chinese economy.

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes. BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese government-owned bank with US$150bn of assets.

US securities transactions are performed by BDA Partners’ affiliate, BDA Advisors Inc., a broker-dealer registered with the Securities and Exchange Commission (SEC). BDA Advisors Inc. is a member of the Financial Industry Regulatory Authority (FINRA) and SIPC. In the UK, BDA Partners is authorised and regulated by the Financial Conduct Authority (FCA). In Hong Kong, BDA Partners (HK) Ltd. is licensed and regulated by the Securities & Futures Commission (SFC) to conduct Type 1 and Type 4 regulated activities to professional investors. www.bdapartners.com

Euan Rellie, Co-Founder and Senior Managing Director of BDA, in New York, recently joined a webinar International Business Briefing: What is the Future of the China Market, hosted by the US-China Business Council and Faegre Drinker.

Euan shared insights on M&A trends in China and Asia:

- China M&A Overview

- In 2019, China-related M&A transactions slumped significantly, reaching the lowest transaction value since 2013

- Major drivers were: Drop in outbound M&A (dropped 37% in value) and Drop in Private equity deals (dropped 22%)

- Outbound deals have been discouraged by increased scrutiny of CFIUS review in the US; national security review in Europe; Beijing’s controls on outbound capital flows

- Inbound transactions reached US$20bn in 2019, representing a 5.6% growth YoY

- China as a market for US companies: Large inbound acquisitions in China have always been rare; acquisitions by US companies have mostly been small/medium sized

- Impact of the trade war: Punitive actions against China will continue. Even if Trump loses in November, investors don’t expect a significant change in the US approach to China. The tone and tactics will change

- Developments during the pandemic: China becomes a refuge for US companies after overcoming COVID-19. China’s economy is slowly recovering, growing by 3.2% in Q2 2020 as retail and luxury sales experience a strong rebound. The recovery is unbalanced, which has widened the wealth gap

- Hong Kong isn’t over for foreign investors, despite the National Security Law: Hong Kong will remain the hub for inbound and outbound mainland investments

- China M&A going forward:

- In the short term, Chinese investors will be focused on domestic consolidation and less active in outbound M&A. Growth in inbound deals is expected, but a red-hot IPO market and high valuations in China could prevent this from growing fast

- In the medium/long term, we expect frequent sales of family-owned businesses. As China faces rising tension with the US, the PRC Government work to ease regulations on inbound M&A

If you want a copy of the slides, or would like to discuss any of these topics, please contact us.

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 24 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese government-owned bank with US$150bn of assets.

US securities transactions are performed by BDA Partners’ affiliate, BDA Advisors Inc., a broker-dealer registered with the Securities and Exchange Commission (SEC). BDA Advisors Inc. is a member of the Financial Industry Regulatory Authority (FINRA) and SIPC. In the UK, BDA Partners is authorised and regulated by the Financial Conduct Authority (FCA). In Hong Kong, BDA Partners (HK) Ltd. is licensed and regulated by the Securities & Futures Commission (SFC) to conduct Type 1 and Type 4 regulated activities to professional investors. www.bdapartners.com

In the first trading week after the outbreak of the novel coronavirus (COVID-19), health sector performance in China’s capital market was remarkably strong. We look here at long-term impacts on the sector in China, and where the M&A and Private Equity opportunities may lie.

The BDA global Health Sector team has investigated these topics and would like to share our latest findings with you in our latest report.

Executive Summary:

- COVID-19‘s impact on the global economy is far beyond SARS, with almost 12x confirmed cases globally to date and stricter quarantine measures. While the epidemic in China shows signs of improvement, the outbreak has spread to other parts of the world. We expect the economy in China to rebound strongly in the second half of this year, but the extent of the recovery will depend on the impact of the outbreak on the global economy

- We expect the outbreak to have a positive effect on the healthcare sector development in China. While SARS’ impact on the sector was moderate, we believe COVID-19 will have a longer-term impact, with certain sub-sectors benefiting from favorable government policies and increased private and public health investments

- The preventative, diagnostic and therapeutic solutions for COVID-19 generate explosive short-term demand for related medical products. While the demand spike is temporary, we expect some medical products to experience a transformation to long-term increased demand

- COVID-19 has drastically raised people’s health awareness. It will raise both public and private health spending, and we expect the following subsectors to benefit, generating fundraising and buyout opportunities:

- Vaccines, medical robots, IVD, ICU equipment & devices, online medical consultation, home-based medical devices and OTC medicine

- Healthcare has been a hot spot for PE investments in recent years. We expect industry consolidation to accelerate, creating ample opportunities for both industry players and PE investors alike

- We believe that COVID-19 does not change the “principles” of cross-border M&A in China:

- Outbound deals focus on the acquisition of international brands, products and technology

- Inbound deals focus on entering and capturing markets with strong demand and growth potential

- Overall, COVID-19 outbreak is an opportunity rather than a crisis for capable private equity health investors, especially in certain sub-sectors

Contact BDA Healthcare team, China

- Andrew Huntley, Senior Managing Director, Global Head of Health Sector: ahuntley@bdapartners.com

- Lei Gong, Managing Director, Health Sector, Shanghai: lgong@bdapartners.com

- Anthony Siu, Managing Director, Financial Sponsor Coverage China, Shanghai: asiu@bdapartners.com

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 24 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese government-owned bank with US$150bn of assets.

US securities transactions are performed by BDA Partners’ affiliate, BDA Advisors Inc., a broker-dealer registered with the Securities and Exchange Commission (SEC). BDA Advisors Inc. is a member of the Financial Industry Regulatory Authority (FINRA) and SIPC. In the UK, BDA Partners is authorised and regulated by the Financial Conduct Authority (FCA). In Hong Kong, BDA Partners (HK) Ltd. is licensed and regulated by the Securities & Futures Commission (SFC) to conduct Type 1 and Type 4 regulated activities to professional investors. www.bdapartners.com