Huong Trinh on VIR: M&A still in vogue despite economic headwinds

Huong Trinh, Partner and Head of Ho Chi Minh City at BDA Partners, shares her insights with Vietnam Investment Review.

With only three months of the year left, how has Vietnam’s M&A for 2023 fared so far?

Over the second and third quarters of 2023, a number of M&A transactions with deal size of over $100 million were announced. Some notable deals are the investment of up to $500 million into Masan Group Corporation led by Bain Capital, the $381 million acquisition of FV Hospital by Thomson Medical Group, and the investment into Xuyen A Hospital by Warburg Pincus. In addition, there are ongoing sizable M&A transactions across the consumer, healthcare and education sectors, which have received strong interest from both strategic and financial investors and are likely to reach the signing stage in the next six months. Even though the total deal volume in 2023 might be impacted, the average transaction value based on recent transactions has increased significantly. The healthy deal flow emphasizes investors’ confidence in the market’s long-term growth potential.

As local businesses are struggling amid a challenging economic outlook, do you see foreign investors stepping up their M&A transactions here?

Despite various macroeconomic challenges, Vietnam is expected to achieve a GDP growth rate of 5-6 per cent in 2023. The macroeconomic environment and consumer demand are expected to start to recover in the first half of 2024. Foreign investors, despite the market’s weakening performance in 2023, continue to source and monitor the investment opportunities in Vietnam. There has been a long-term view that Vietnam is one of the most attractive markets for investment in Southeast Asia thanks to its favourable demographics, resilience, as well as government efforts in improving the investment environment.

Inbound M&As remain vibrant in banking, healthcare, renewables and real estate. Why do these sectors remain a target?

Vietnam’s favourable demographics, stable socioeconomic environment, increasing disposable income, and improving investment environment remain key factors that underpin the inbound investments into the banking sector, such as the $1.5 billion acquisition of a 15 per cent stake in VPBank by Sumitomo Mitsui Banking Corporation, and the $850 million acquisition of 15 per cent stake in BIDV by KEB Hana Bank. Notable deals in the healthcare sector are the acquisition of FV Hospital by Thomson Medical Group, the investment into Xuyen A Hospital by Warburg Pincus, AIH by Raffles Medical Group as well as Singapore’s sovereign wealth fund GIC’s investment into Nhi Dong 315, a Vietnamese pediatric clinic operator. In the renewable energy sector, Vietnam witnessed the $165 million acquisition of a 49 per cent stake in Vietnam solar platform Solar NT from Super Energy Corporation by AC Energy Corporation, and the $108 million acquisition of a 35 per cent stake in Gia Lai Electricity by JERA. Regarding real estate sector, there is the $250 million investment into Novaland led by Warburg Pincus, along with the $650 million investment into Vinhomes by KKR. We expect that M&A activities in these sectors will continue to increase in the future.

Do you expect any shift in investor interest in emerging fields in Vietnam, such as electronics, semiconductors, and electric vehicles?

Yes, we have seen increasing interest in these areas as a result of Vietnam’s unique positioning – strategic location, skilled workforce, cost advantages, and stable socioeconomic environment. Following the supply chain diversification which started during the pandemic, and increasing global demand for these products, Vietnam continues to invest in infrastructure and technology to become a major industrial hub in Asia. The government has taken a proactive approach in developing these new sectors. In August 2023, the Ministry of Transport submitted its proposal on special incentives for electric vehicle (EV) producers and users to a deputy prime minister. These incentives included preferential special consumption tax, exemption of licence plate issuance fees, preferential import tariffs on equipment, production lines and components for the production and assembly of EVs and batteries, and a $1,000 incentive for each EV purchases. As for semiconductors, while it is not a new area as foreign players, Samsung, Amkor Technology, and Hana Micron have already established presence in Vietnam. Such moves have been in the spotlight recently, being a key topic of discussion at the Vietnam – US Summit in September 2023. The Vietnam – US comprehensive strategic partnership and the government support will help Vietnam’s semiconductor industry to develop further.

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services, Sustainability and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

BDA Partners Managing Partner Paul DiGiacomo was invited to be the keynote speaker at the VinaCapital Vietnam Investor Conference in Ho Chi Minh City in early October 2023. Having lived in Asia for 25 years and been active in Vietnam for the past 15 years, Paul has a unique perspective on the drivers and fundamentals of Vietnam’s investment landscape.

5 takeaways from the keynote speech

1. BDA is bullish on Vietnam

-

-

-

- 15+ years active in the market

- Team of 10 M&A bankers

- Investing opportunistically into early-stage opportunities through our partners’ fund

-

-

2. Vietnam has attractive investment fundamentals, supported by:

-

-

-

- A young and dynamic population

- An entrepreneurial and East Asian culture

- A stable socioeconomic and political structure

- Solidly moving up the manufacturing value chain to higher value added areas

-

-

3. External macroeconomic conditions that support Vietnam’s growth include:

-

-

-

- Strong FDI trends

- US/China decoupling and global supply chain reorganizations

- Increasingly strong US support for economic success

-

-

4. Risks to Vietnam’s growth are:

-

-

-

- Climate change and in particular rising sea levels

- The potential for deglobalization to proceed more aggressively

- Infrastructure insufficiency

-

-

5. The future is bright in Vietnam. By 2030 Vietnam will have:

-

-

-

- 36 million people in the middle class….

- …distributed across the country, with 25+ cites each having a middle-class population in excess of 250,000

- Much greater global supply chain integration in high valued-added products such as electronics and semiconductors

-

-

BDA Partners has been active in Vietnam for over 15 years. We received our first investment banking mandate in 2007 and established an office in Ho Chi Minh in 2011. We now have a team of 10 bankers on the ground working across multiple sectors.

Anthony Siu, Partner and Co-Head of China at BDA Partners, was interviewed by Wancheng Hu, a reporter at South Reviews. The publication is a political and economics magazine published under the Guangzhou Daily Press Group in Southern China. The following is a translated version of the article published on June 5, 2023.

China’s outbound M&A volume dropped to its lowest point last year. According to PricewaterhouseCoopers, the total value of M&A transactions in China fell to US$485bn in 2022, representing an 80% decline from the peak in 2016, and is comparable to 2009 when investment activities plummeted in the wake of the global financial crisis.

The Covid-19 pandemic and increasing geopolitical tensions led to varying degrees of restrictions on capital flow. Combined with stringent national security reviews, China’s outbound M&A has suffered a dramatic slowdown in recent years.

As the pandemic came to an end in early 2023, investment activities gradually picked up again. China’s outbound investment policies have not changed significantly, and the central government’s focus remains on encouraging foreign direct investments in healthcare, technology, advanced manufacturing, energy, and resources.

In the first half of 2023, the M&A market is back on a recovery path, with domestic transactions dominating China’s M&A. Cross-border M&A will likely see a pick-up in the second half of 2023, with Asia Pacific and the Middle East becoming the preferred markets for Chinese acquirers.

Amid early signs of an increase in activities, China’s outbound M&A will face challenges as well as opportunities in the near term. The following are key factors to consider for China’s outbound M&A:

1. Impact of increasing regulations on cross-border M&A

BDA Partners specialises in cross-border M&A advisory and has been the top-ranked investment bank for cross-border M&A (enterprise value up to US$1bn) in Asia since 2016.

Mr. Siu moved to Shanghai from Hong Kong in 2008 and has been engaging in Chinese M&A advisory ever since. Having witnessed a long period of unprecedented growth of Chinese M&A, he was apprehensive about the recent downturn.

Siu said “For M&A practitioners, a lot has changed in recent years. The number of Chinese companies looking to engage in outbound M&A has shrunk significantly. The combined impact of the pandemic and the geopolitical tensions have led to a dramatic decline in M&A volume.”

While he believes that the pandemic impact is temporary, the geopolitical impact on cross-border M&A will be longer-lasting. In particular, the heavy regulatory scrutiny on China’s outbound M&A transactions is likely to stay for some time.

Among the affected regions, the US has been impacted the most. In January 2020, the US Treasury published new regulations based on the Foreign Investment Risk Review Modernization Act that significantly expanded the scope of the Committee on Foreign Investment in the United States (CFIUS).

“When a non-US company wants to acquire a US company, it needs to go through CFIUS review. The review will take a long time if the target’s industry is considered sensitive and involves national security concerns” said Siu, “although many transactions were not vetoed, they did not receive CFIUS approval and therefore were unable to close.”

In addition, countries that were previously considered to be open to foreign investments are moving toward increasingly stringent FDI reviews.

Germany, for instance, the country with the largest number of Chinese investments in the EU, had promulgated the Foreign Trade and Payments Act, imposing strict review measures for investments by non-EU countries and expanding the scope of mandatory filing obligations involving “critical infrastructure” and “critical technology.” Industry practitioners say that a large number of transactions were abandoned due to a slim chance of passing FDI or anti-monopoly review.

“Obtaining regulatory approval is a common concern for companies involved in cross-border M&A. If a Chinese state-owned enterprise (SOE) decides to conduct a transaction overseas, it requires approval from the State-owned Assets Supervision and Administration Commission (SASAC). Moreover, when the transaction amount exceeds US$300m, further approval is required from the China National Development and Reform Commission (NDRC). These approvals will typically take time to go through,” said Siu.

The aforementioned includes only the approval procedures required from the Chinese side, while each country has its own jurisdiction and approval procedures, which further complicates the closing of a transaction. A few high-profile cases involving SOE acquirers over the years include:

- In 2005, China National Offshore Oil Corporation (CNOOC) attempted to acquire Unocal Corporation in the US, but the transaction was blocked as it did not pass a national security review

- In 2009, Aluminum Corporation of China’s planned acquisition of Australia’s Rio Tinto was terminated because stakeholders reckoned that the terms were biased toward the buyer

- In 2020, Shandong Gold Mining’s acquisition of Canadian gold miner TMAC Resources was blocked by the regulatory authorities due to national security reasons

In addition to national security considerations, Chinese acquirers face increased scrutiny in areas such as information transparency, financing sources, and shareholding structure.

2. Where will the China capital go?

Despite some challenges, outbound M&A activities are showing signs of recovery.

Countries around the world are welcoming investments in industries that are deemed important to the country’s economic development. In addition, industries that have been hit hard by the pandemic, including transportation and logistics, tourism and hospitality, basic materials, and consumer goods, are recovering, giving acquirers renewed confidence in investing in the future upside of these industries.

Siu is bullish on the China outbound M&A market. The resumption of international air travel and the normalization of business activities will allow Chinese acquirers to become more active in engaging in outbound M&A activities. However, he believes that this wave of outbound M&A will be different from the past. Rather than focusing on the U.S. and Europe, Chinese acquirers will be shifting their focus to new markets such as Southeast Asia, the Middle East, and Africa.

“China today is playing a role similar to the US in the 1990s and early 2000s,” said Siu.

During those periods, US companies, facing a saturating domestic market, expanded their international footprint to high-growth emerging markets via M&A.

China is doing something similar now. In the past, the focus was on acquiring Western technologies and know-how to bring them to the Chinese market. This coming wave will be about investing in opportunities that allow Chinese acquirers to export self-developed technologies and products to the international markets. Instead of facing head-on competition in a crowded domestic market, they go abroad to look for new growth opportunities. Companies in the technology, media and telecom (TMT) space and the electric vehicle (EV) sector are among those industries with growth potential.

Southeast Asia, due to its close geographical proximity to China, has been a favourite destination for China’s outbound investments. Indonesia is one such example.

Indonesia has the world’s fourth-largest population with 274 million people and a young labour force. In 2022, investments made by Chinese companies in Indonesia reached US$8.2bn the second largest source of FDI in Indonesia. Today, Chinese investments are present in e-commerce, ride-hailing services, online food delivery, digital financial services, and online gaming sectors in Indonesia.

“Unlike trading and manufacturing companies that have gone to the West in the early days, Chinese high-tech and smart manufacturing companies looking to expand overseas now select Southeast Asia, the Middle East, and Africa as their priority markets to enter,” said Siu.

However, with benefits also come challenges. Just like many foreign companies find it difficult to adapt to the Chinese market, many Chinese companies that entered new markets have encountered challenges in working with local management, understanding the local culture, and dealing with workers that are not accustomed to long working hours.

The above are all common problems encountered by Chinese acquirers in outbound investments. Essentially, it is the lack of attention and effort paid to post-acquisition integration and understanding of cultural differences that hinder the acquirer’s success. For example, Chinese companies often lack experience in managing employees under a union-led workforce. If appointed Chinese executives attempt to impose a top-down culture, employees are likely to express dissatisfaction. Over time, a growing estrangement will develop between the local employees and the Chinese executives.

3. Focus on building up M&A expertise and acquiring talent

Having worked on M&A for over two decades, Siu has witnessed many successful acquisitions, while others failed and had to go through a difficult period of restructuring.

He observed that the issue faced by Chinese acquirers is usually caused by a breakdown in communication. When a Chinese acquirer becomes the controlling shareholder, the target’s management is often concerned about how the new owner will affect its corporate culture and management style, soft issues that are often overlooked by the Chinese acquirers. If these problems are not handled properly, the target’s management team will ultimately choose to leave.

These kinds of issues can often be mitigated if the acquirer has already established a presence in the target’s region, along with a team that understands the local system and culture. If the acquirer can understand the target company’s pain points, it can address these issues upfront more effectively, and the chance of a successful integration will increase.

Siu pointed out as an example a cross-border transaction that BDA and its strategic partner, William Blair, served as the sell-side advisors for Summa Equity, a Finnish private equity firm, on the sale of its portfolio company, HyTest, to China’s Mindray for €532m in 2021.

HyTest is a leading global supplier of in vitro diagnostic (IVD) raw materials, with in-house R&D and production capabilities for high-quality antigens and antibodies. This acquisition has helped Mindray broaden its international footprint and strengthen its value chain coverage while fulfilling the need for top-graded IVD upstream raw materials in China.

Simeng Zhang, Director at BDA Partners and the project lead for the sale of HyTest, stated “compared to other companies, Mindray has a professional in-house M&A team composed of talent with prior experience at accounting firms, law firms, and investment banks. Having this talent on the team made the due diligence, negotiation management, and decision-making process much smoother.”

She also mentioned that Mindray and HyTest had already established a good level of trust in prior business relationships. “In the past few years, more than half of HyTest’s revenue came from the China market, and with Mindray’s globalization strategy, the acquisition of HyTest became particularly attractive to Mindray.”

Though BDA Partners often takes on the role of a sell-side advisor, when the transaction involves a Chinese buyer, BDA Partners will also take the initiative to coordinate with the buyer to elaborate thoughts from the seller’s side, including management’s concerns on the transaction and key transaction terms.

Siu believes that the days of relying on the China growth story to win over the seller’s and target’s management are gone. Chinese acquirers should have a clear plan for globalising the target’s business beyond just China. “We are actively working with our clients to search for quality investment targets on a global scale to help them expand their international footprint,” said Siu.

The history of globalisation proved that successful M&A transactions can generate higher shareholder returns and help global players strengthen their competencies and maintain their market-leading position.

Being able to survive the pandemic will make a company stronger, while others facing challenges will become more open to being acquired. “For ambitious Chinese companies, now is a good time for M&A,” said Siu.

However, overseas competitors will not just sit back and wait. To grasp the opportunity and secure a meaningful position among global leaders, Chinese acquirers should further enhance their in-house M&A capabilities and attract talent with international experience and M&A expertise.

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

Although COVID-19 did not completely hamper M&A deal flow in Vietnam, travel restrictions and a strict lockdown in the second half of 2021 posed major challenges for buyers and sellers alike. With the gradual unwinding of COVID-related restrictions and the resumption of international flights in October 2021, M&A activity has accelerated. The economy has recovered quickly and the outlook for dealmaking is positive.

Top 10 M&A transactions in Vietnam (October 2021 – August 2022)

| Date | Investor | Target | Deal size (US$m) | Stake |

| Oct-21 | SMBC Consumer Finance | FE Credit | 1,400 | 49% |

| Jul-22 | Swire Pacific | Coca-Cola Indochina | 1,015 | 100% |

| Dec-21 | TPG, Temasek, ADIA | The CrownX | 350 | 4% |

| Nov-21 | SK Holdings | The CrownX | 345 | 5% |

| Dec-21 | Mizuho | Momo | 200 | Undisclosed |

| Feb-22 | AC Energy | Super Energy’s nine solar plants | 165 | 49% |

| Oct-21 | UBS, Mirae, STIC | Tiki | 136 | Undisclosed |

| Apr-22 | Hana Financial Group | BIDV Securities | 118 | 35% |

| Aug-22 | Masan | Phuc Long | 155 | 34% |

| Apr-22 | Indorama Ventures | Ngoc Nghia Industry | 94 | 98% |

Source: Mergermarket

Key drivers propelling post-pandemic deal flow

Vietnam’s economic recovery has proven appealing to investors – it was one of the few countries that recorded two consecutive years of GDP growth in 2020 and 2021 during the height of COVID. According to the General Statistics Office, Vietnam achieved 2.58% GDP growth in 2021[1], despite experiencing one of the strictest lockdowns in the world during the second half of that year. Looking ahead, the Asian Development Bank is forecasting that Vietnam’s economic growth will recover to 6.5% in 2022[2]. In fact, GDP growth in Q2 2022 was 7.7%, the highest quarterly growth in the last ten years.[3]

Pent-up dealmaking demand is a key driver. Both strategic investors and financial sponsors have a large amount of capital to invest and are keen to identify new opportunities or revive discussions that were on hold. Industry leaders are actively looking for acquisitions to consolidate market share within their verticals, taking advantage perhaps of competitors weakened by COVID and slower to rebound. In addition, many companies are looking to position themselves for recovery in the post-pandemic economy and need new capital injections for internal transformation and further growth in order to remain competitive.

The resumption of international travel is also significant. In-person due diligence and site visits have facilitated many deals that were previously put on hold, especially for asset-heavy industries such as industrials, logistics, and healthcare. Since October 2021, BDA has met with numerous foreign investors who have expressed a strong interest in Vietnam. After a two-year hiatus, BDA organised its annual networking event in Ho Chi Minh City in May 2022 with over 200 participants – mainly investors and corporate shareholders – and all appreciated the opportunity to reconnect in person and discuss the future.

Trends expected to persist post COVID

Domestic investors had an advantage over their foreign counterparts during COVID given their local presence, and this led to an increase in domestic deal flow and volume. Although COVID-related border restrictions have now been lifted, BDA has seen local conglomerates continuing their acquisition spree in a market that has historically been dominated by foreign buyers. For example, in addition to its investment in Phuc Long, Masan also acquired a 25% stake in Trusting Social, a company engaged with credit scoring based on social data, for US$65m in April 2022. This was another transaction in which BDA acted as the exclusive advisor to the target company. Nova Group has been on an acquisition spree, expanding its ecosystem with a focus on Consumer businesses, having acquired and taken over the operations of major F&B establishments such as Jumbo Seafood, Sushi Tei, Crystal Jade, and PhinDeli.

From a deal negotiation perspective, BDA has observed several points that have become particularly important during deal negotiations. With material adverse change (“MAC”) clauses, buyers and sellers now need to acknowledge the risk of a significant downturn in the business as a result of COVID. MAC provisions typically exclude market-wide macroeconomic impact, but since COVID has different effects on different industries, the negotiation of specific triggers in MAC clauses needs to be scrutinised. Earn-outs have become more common by bridging valuation gaps under scenarios of temporary uncertainty, while also enabling sellers to share in the upside of long-term growth. Warranty and indemnity (“W&I”) insurance, a rare option in Vietnam deals in the past, is also being used more frequently, as both buyers and sellers appreciate the benefit of a smoother and faster signing and closing process.

During the height of domestic lockdown and border restrictions in 2021, virtual interaction was the only option in most cases for M&A transactions in Vietnam. We expect that for non-key discussions, virtual meetings will continue to be a common option in the future. However, for other key parts of the transaction process such as site visits and due diligence, which were supported by on-the-ground advisors and virtual tours during COVID, and especially for negotiations, in-person participation will still be preferred going forward.

Global slowdown in M&A in 2022 and beyond

Global M&A in H1 2022 is down 21% by value and 17% by volume compared H1 2021[4], partly due to the cooldown in SPAC-related transactions. Inflationary pressure across the supply chain, geopolitical tensions, and a rising interest rate environment have also contributed to the volatility that could become a recurring theme in the M&A market over the next year or so.

Inasmuch as businesses in Vietnam are not immune to these factors, we still believe that 2022 will remain another busy year for Vietnam’s M&A market. Investors have not shown any reduced appetite in dealmaking in Vietnam, as evidenced in their interest in BDA’s ongoing mandates. We believe that there are a lot of high-quality assets that have proven resilient against turbulence brought about by COVID that are now well-positioned for robust growth, and we look forward to a busy period ahead with a long list of current live deals and ongoing opportunities.

Tailwinds for future growth in M&A in Vietnam include:

- Strong socio-economic backbone: Vietnam will still benefit from steady economic growth, political stability, and a bourgeoning middle class population. Participation in multiple free trade agreements and open-market policies make Vietnam an attractive destination for foreign investment

- Rising importance as a manufacturing hub: More global corporations are expected to relocate to Vietnam, as the country has made significant progress in infrastructure development to catch up with international standards, with major investments from both public and private sectors. The US-China trade war and prolonged COVID restrictions in China have also led to more manufacturers moving operations to Vietnam

- Improving regulatory landscape: It is worth noting that with regards to M&A regulation and processes, local authorities have continuously been improving their turn-around time, while working towards clearer guidelines. For example, Decree 155/ND-CP guiding the implementation of the Law on Securities, which took effect in 2021, has provided additional clarification and detailed guidance with regard to the public tender offer process and foreign ownership limits

- Growing familiarity with M&A: Local businesses are becoming more professional with strong management teams and better corporate governance. Vietnamese companies are now more familiar with M&A concepts and are open to consider strategic partnerships with foreign investors, who can provide support through best practices in business operations and have extensive experience from global markets

Most attractive sectors in Vietnam for M&A

Consumer

- The Consumer sector will continue to be one of the main drivers of transaction volume

- Investors will target Vietnam as one of the fastest growing economies in the region, with its growing middle class and a young population with increasing income and propensity to spend

Healthcare

- In response to the lack of capacity within the national healthcare system, there has been an ongoing shift in demand towards private care

- Private hospitals will continue to attract interest from both strategic and financial investors, especially as patient volumes and occupancy rates are recovering to pre-COVID levels, while more profitable surgeries and procedures are reintroduced

Education

- Within private education, both local and international schools received significant interest from investors before COVID emerged

- We expect discussions regarding education assets will be restarted in the near future, as the businesses’ performance recover now that students of all levels have returned to the classrooms

Logistics

- Tailwinds from high growth in exports, a booming Internet economy, and supply chain shift from China will continue to propel growth in Vietnam’s logistics industry

- Assets in warehousing (especially smart logistics) and cold chain will generate strong interest from global investors

Financial Services

- An underbanked population with a shortage of financing and credit solutions will spur further investments in financial services

- The focus will be on consumer finance / fintech companies that provide solutions to enable access to non-bank credit for both individuals and micro, small, and medium businesses

Renewable Energy

- With a rapidly growing economy, Vietnam has been at risk of power shortages due to a lack of power infrastructure.

- Capital injections into the development of renewable energy could provide a suitable solution. Attractive feed-in-tariffs and untapped potential in solar and wind power capacity will make Vietnam an attractive destination for investors

[1] https://e.vnexpress.net/news/business/data-speaks/vietnam-finishes-2021-with-2-58-pct-gdp-growth-4409596.html

[2] https://www.adb.org/countries/viet-nam/economy

[3] https://baochinhphu.vn/gdp-quy-ii-2022-tang-truong-772-102220629090231152.htm

[4] https://www.allenovery.com/en-gb/global/news-and-insights/publications/global-ma-transactions-drop-over-20-percent-but-bright-spots-remain

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

The new Suga government has already been bold.

Japan’s fiscal response to the pandemic dwarfs the measures taken after the global financial crisis, and the earthquake and tsunami of 2011.

Now standing at more than 250% of GDP, Japan’s national debt is among the highest in the world, twice the average of other advanced economies. But it seems to be working.

Japan may finally be emerging from a prolonged slump, effectively a recession lasting three decades.

Japan’s population may be shrinking at a worrying pace, more than 1% per annum, but investors are thoroughly bullish, as if for the first time in living memory.

Private equity firms Bain, Carlyle and KKR are lining up to put serious capital to work in Japan. Interest rates remain low, which is helping to drive investor enthusiasm.

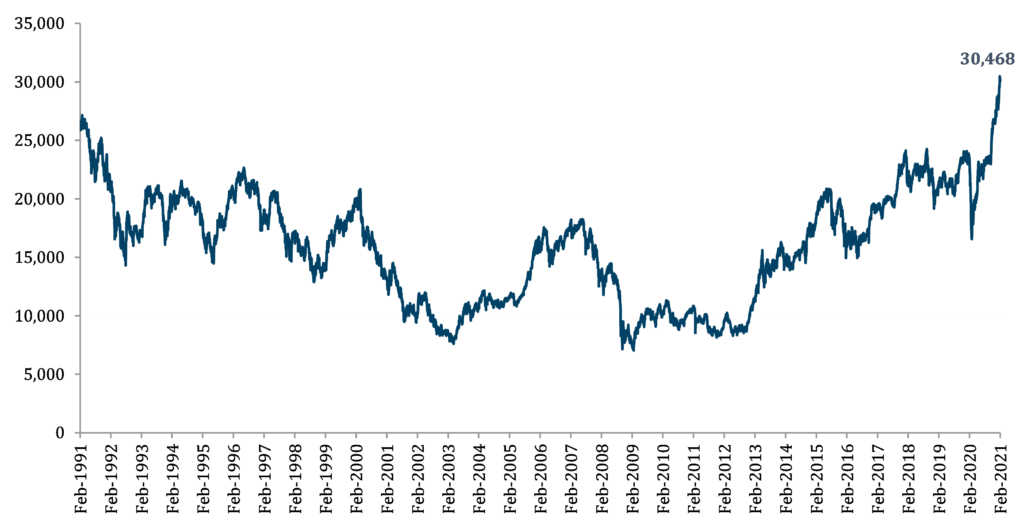

Last week, the Nikkei 225 rose above 30,000, a psychologically significant level last seen in 1991. Energy, Healthcare and Industrials have led the gains.

The Nikkei has risen 30% since November 2020, 9% since the beginning of the year, and 7% in the last two weeks. It is outperforming the US and European markets.

Nikkei 225 index 1991-2021

The TOPIX, which reflects a broader set of Japanese companies, also hit a 30-year high.

Japan’s Ministry of Health, Labour and Welfare has finally approved a Covid vaccine, months behind other major economies.

Still, signs that the pandemic is abating globally have caused optimism among Japanese analysts. Japanese companies are poised to rebound. Industrial customers and end consumers are both demonstrating renewed confidence.

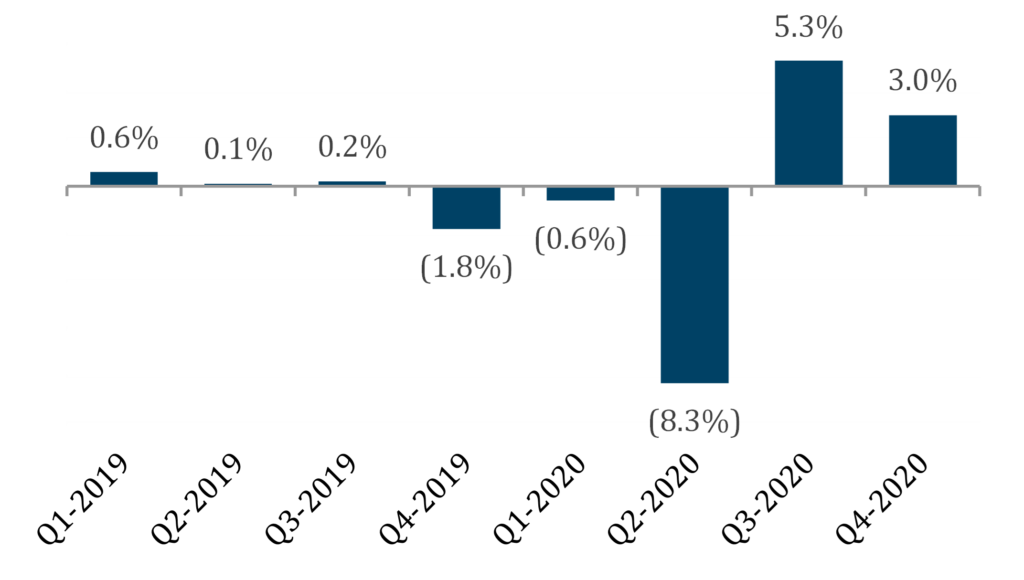

Japan’s economy performed surprisingly strongly in Q4 2020, recovering markedly from the slowdown earlier in the year. But this growth is still fragile and might be easily disrupted, analysts warn.

The second state of emergency, declared in January 2021 and extended in February, will dampen economic activity in Q1 2021, and tourism remains severely subdued.

Japan is the world’s third-largest economy behind the US and China. GDP rose 3.0% in Q4 2020, for a 12.7% annualized growth rate. The economy had also recovered by 5.3% in Q3 2020.

2019-2020 Japan Quarterly GDP growth

Exports and consumer spending have both surprised on the upside. Analysts say that consumers are demonstrating pent-up demand for Japanese goods which they did not buy in H1 2020.

Exports have been booming, especially capital goods and technology-sector goods and services.

Even before the pandemic, 2020 had begun inauspiciously, with a disastrous hike in the national consumption tax, a steep drop in trade with China, and an unusually damaging typhoon. The pandemic then arrived to cause the biggest drop in GDP since records began in 1955.

But the Government has managed the pandemic relatively well, allowing Japan to avoid the more profound economic damage that beset the US and Europe.

The Japanese population spent most of 2020 still able to travel domestically, eat out, and visit leisure facilities. The Government quickly brought in subsidies for domestic tourism, Covid notwithstanding.

Shinzo Abe resigned in August 2020, to manage his ulcerative colitis. Yoshihide Suga assumed office in September. Suga said his premiership will focus on continuing the goals of the Abe administration, including notably the Abenomics suite of economic policies.

Suga’s “third extra budget” in December 2020 supplements two earlier packages worth 11% of GDP. The year-end shot of fiscal caffeine was worth $708bn, including $385bn in direct fiscal spending and initiatives targeted at reducing carbon emissions, and boosting the adoption of digital technology.

The stimulus helped keep employment high, and companies in business. Bankruptcies actually dropped 6.5% in 2020, according to credit research company, Teikoku Databank.

Japan has been lamentably slow to start vaccinations. Regulators have finally approved the Pfizer-BioNTech vaccine. Frontline healthcare workers will receive their first doses this week, but it will be months before most citizens get shots.

And yet the pandemic’s effects have been much less severe in Japan, with fewer than 7,000 deaths to date.

The Government has begun encouraging activist investors to search for undervalued stocks, previously a taboo exercise. The weaker yen-dollar exchange rate, too, boosts the value of overseas holdings and makes exports more competitive.

The last time the Nikkei scaled these heights, Japan was in the throes of the bubble economy. The Bank of Japan throttled that speculative fever, which led to the infamous lost decade at the end of the twentieth century. Momentum has been stalled ever since.

Japan still has many hurdles to overcome. The economy relies on “old” companies. Productivity is stunted. Efforts to promote tourism died with the pandemic. Women remain undervalued in the economy, which becomes a more significant issue as the population shrinks – but also an opportunity, of course. As in other markets, inequality is growing in worrying ways, and the recovery looks K-shaped for now: steep for some, non-existent for others.

And yet: Japan is reforming, and reviving, and becoming fashionable among fund managers.

Prime Minister Suga has reasons to be cheerful. A month from now, Tokyo’s cherry trees will blossom. The symbolism should be potent this year: a chance to contemplate renewal and future happiness.

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes. BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese government-owned bank with US$150bn of assets.

US securities transactions are performed by BDA Partners’ affiliate, BDA Advisors Inc., a broker-dealer registered with the Securities and Exchange Commission (SEC). BDA Advisors Inc. is a member of the Financial Industry Regulatory Authority (FINRA) and SIPC. In the UK, BDA Partners is authorised and regulated by the Financial Conduct Authority (FCA). In Hong Kong, BDA Partners (HK) Ltd. is licensed and regulated by the Securities & Futures Commission (SFC) to conduct Type 1 and Type 4 regulated activities to professional investors. www.bdapartners.com

1. Pandemic? What Pandemic?

China’s Communist Party will mark its 100th birthday in July 2021 with typical pomp and ceremony. Celebrations will be cheered by an economy which shrugged off the effects of the Covid-19 pandemic remarkably quickly.

China recorded a sharp slowdown in Q1 2020, as the first country to be hit by Covid. China’s GDP dropped more in those three months than during the 2009 global financial crisis.

Beijing took the unprecedented step of locking down Wuhan a year ago, on 23rd January 2020. Economic activity and travel across the country ground to a virtual halt in the following months until the virus was stamped out. The Government tested repeatedly and widely for Covid, and on a scale other countries can only dream of: For example, in Qingdao, 12 cases in October 2020 resulted in nine million residents being tested in just five days. Unlike Western countries like the US, which focused stimulus efforts on lowering borrowing rates and handing out money to consumers, Beijing focused on restarting factories while keeping interest rates relatively high.

China’s factories came back online from April 2020, as the world’s manufacturing capacity was sputtering to a halt in the face of the devastating pandemic. China actually benefitted from the global slowdown, producing and exporting huge quantities of medical equipment, face masks and work-from-home electronics, such as laptops and monitors.

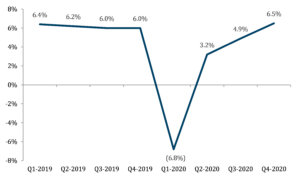

The Chinese economy roared back to life in Q2: year-on-year GDP went up by 3.2%.

China avoided consecutive quarters of negative growth, escaping the technical definition of recession. China was the only major country recording positive growth in Q2 2020.

China GDP continued to grow in Q3 2020, with year-on-year growth of 4.9%.

The pace has since accelerated. The Chinese economy grew 6.5% in Q4 2020, compared to a year ago. This was notably higher than pre-pandemic growth rates.

Chart 1 – China actual quarterly GDP growth % 2019 to 2020

Source: OECD

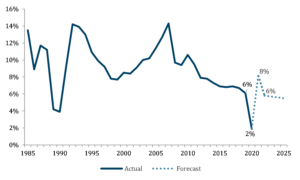

2. Thirty five years of growth

China’s economic miracle has lasted more than three decades. After recording 10% growth in 1987-88, China slowed in 1989-90, following violent repression of the pro-democracy protests in Tiananmen Square, Beijing, in June 1989. That led to a stark interruption of steady liberalization of the Chinese economy.

High growth rates returned quickly by 1991, and ran unabated until 2019. GDP grew by more than 9% per annum over those thirty years.

Of course, there have been significant hiccoughs along the way. The Chinese economy was already slowing dramatically before the outbreak of Covid, recording GDP growth of only 6% in 2019.

Going into 2020, The World Bank forecast 1%-2% growth for China; the IMF forecast 2%.

China’s eventual 2.3% growth in 2020 bucked the global trend. Other nations are still weighed down in the throes of the pandemic. All major global players except China, will record negative annual growth in 2020, according to IMF and the World Bank. And yet, the pandemic is apparently receding in the rearview mirror for China.

The World Bank estimates the US economy shrank by 3.6% in 2020, Japan shrank by 5.3%, and the Euro area shrank by a depressing 7.4%.

Chinese GDP per capita now exceeds US$10,000 for the first time in history, with almost no population growth at all.

Chart 2 – China actual GDP growth % 1985 to 2020 and forecast to 2025

Source: IMF

3. An aggressive President Xi

President Xi Jinping this week restated the importance of economic growth, highlighting “balance” in the Chinese economy, with strength in agriculture, more investment in infrastructure, and innovation in the tech sector.

President Xi reported reliable harvests and grain production for 17 years in a row, as well as breakthroughs in scientific explorations including the Tianwen-1 (Mars mission), Chang’e-5 (lunar probe), and Fendouzhe (manned deep-sea submersible). Development of the entire Hainan island, which is comparable in size to Taiwan, into the Hainan Free Trade Port, is proceeding at pace.

2021 will also mark the start of China’s 14th five-year plan, a closely watched road map covering 2021–25.

The World Bank is optimistic about China, predicting 2021 GDP growth of 7.9%, almost double the global growth projection of 4%.

Of course, outside observers are sceptical about the accuracy China’s reported figures, which are presented as part of President Xi’s nakedly political PR efforts. Nonetheless, BDA sees clear evidence of confidence and momentum, as Chinese private equity and IPO markets remain positive. It will be harder to achieve double digit growth, given the bigger base today, but there’s every reason to see that China will keep growing well.

Ignoring wide criticism of China’s maritime expansion, iron fisted rule over Hong Kong, and repression over the Uighurs in the northwest, Xi Jinping is asserting himself as aggressively as ever: “China will keep striving, marching ahead with courage, to create brighter glory”, he stated in his New Year’s address.

China’s ability to expand, even as the world fights to control Covid that has killed two million people, underscores the country’s success in taming Covid within its borders, and cements its unchallenged role as the dominant economy in Asia.

For now, the economic data reveal an economy still driven primarily by industrial production and investment rather than consumption. And yet, China consumer confidence is also recovering well.

4. China is unique

China’s growth makes it an outlier even among the greatest global economies. The World Bank expects the US economy to have contracted by 3.6% in 2020, and the Eurozone’s to have shrunk by 7.4%, reflected in global economic contraction of 4.3%.

This good momentum means that further recovery in China will likely have to take place without significant stimulus from the Government.

Provincial and local governments in China have some US$300bn in unspent stimulus money left over from 2020.

The export bonanza saw China ship 224 billion masks around the world from March to December 2020: 40 masks for every man, woman and child on the planet outside of China.

Domestic consumer demand may be sluggish in 2021, as wage growth is not yet back to pre-pandemic levels. That may explain Xi’s efforts to sound bullish, but the CCP under Xi tends to avoid sharp turns in policy.

China’s increasingly tense relationship with the US has caused China to pivot towards the EU, which was supported by both sides reaching an agreement on the EU-China Comprehensive Agreement on Investment in late 2020. Contrast this to the US, where in his final weeks in office, President Trump tightened restrictions on Chinese companies, to curb China’s tech sector dominance. This tension is worrying to financial markets. Wall Street is watching to see whether the incoming administration under President Biden will soften this stance at all.

Meanwhile, life continues relatively undimmed across China. People are going to restaurants again, particularly in affluent cities like Shanghai and Beijing. Service businesses like hotels and restaurants are performing well in the big coastal cities, but have not yet recovered in the inland provinces.

After its staggering success in taming the coronavirus, China has suffered renewed smaller outbreaks in the last month or so. The government mobilized quickly, building hospitals, imposing mass testing and putting 30 million people back under lockdown. The intrusive health checks will discourage consumers in the northeast from spending. Chinese families remain wary of big-ticket expenditures, new cars, or extensive home remodeling.

Retail sales growth stuttered in December, slowing to 4.6% from 5.0% the month before. The “Made in China” label has gained popularity, as people stuck in their homes cautiously redirect their spending. The consumer electronics sector has been especially resilient.

Beijing has ramped up its infrastructure spending. Every major city in China is now connected with high-speed rail, enough to span the continental US seven times. New lines were rapidly added last year to smaller cities. New expressways crisscrossed remote Western provinces. Construction companies turned on floodlights at many sites so that work could continue around the clock.

Despite reports to the contrary, China remains the workshop of the world. China’s exports grew 18.1% in December compared with the same month a year earlier, and 21.1% in November.

IPOs are booming as entrepreneurial companies go public at breakneck pace, across China. At BDA, we see M&A markets which are robust, and booming.

This explains why private equity and institutional investors are betting that China, which seemed like it might fall out of fashion in 2020, will continue to shine, and outperform the rest of the world.

Miraculously, China is approaching the Lunar New Year in rude health. 2021 will be the Year of the Ox, a fitting image for the Chinese economy.

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes. BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese government-owned bank with US$150bn of assets.

US securities transactions are performed by BDA Partners’ affiliate, BDA Advisors Inc., a broker-dealer registered with the Securities and Exchange Commission (SEC). BDA Advisors Inc. is a member of the Financial Industry Regulatory Authority (FINRA) and SIPC. In the UK, BDA Partners is authorised and regulated by the Financial Conduct Authority (FCA). In Hong Kong, BDA Partners (HK) Ltd. is licensed and regulated by the Securities & Futures Commission (SFC) to conduct Type 1 and Type 4 regulated activities to professional investors. www.bdapartners.com