The beauty sector is growing and glowing in Asia

North Asian countries already comprise the world’s largest markets for beauty and personal care products. China, Korea and Japan together represent 35% of the global market, with above average growth. China skyrocketed to become the industry leader in this region, but has witnessed a troubling market hangover in the last 12 months.

Asia Pacific’s luxury beauty segment – especially China – face the challenge of justifying high prices to increasingly sophisticated and discerning consumers, against a backdrop of economic uncertainty and rising quality and quantity of brands at more accessible price points. At the same time, younger women – and men – are spending more each year.

North America makes up 25% of the global market, while Europe makes up 20%. And those regions are increasingly looking to Asia for innovation and growth.

Asian beauty brands have recovered from the pandemic, and are jostling to find new, compelling ways to connect with consumers. Beauty influencers and DTC brands are both driving and adapting to buyer preferences.

In the past, people would buy beauty brands landed in China purely because they were ‘Made in France’ or ‘Made in Switzerland’. Suddenly now, Asian consumers are rediscovering and appreciating their own rich cultural backgrounds and ancient beauty practices.

This swelling national pride has encouraged new Chinese domestic labels to engage in premium-isation, to offer more interesting propositions, drawing on home advantage. Compared to international peers, they have innovated faster and shown themselves to be adaptable and responsive to local consumer trends. International brands are finding it increasingly hard to grow market share, unless they speak to local preferences.

L’Oréal remains the leading global beauty products company, with US$40bn in global sales, double the size of second-place Unilever. Rounding out the top five are Estée Lauder, P&G and the Japanese giant: Shiseido. All of these are fighting to find growth across Asia, although Estée’s big bets on China have mostly misfired.

Once the domain of Western beauty leaders, the cosmetics industry across Asia is now booming, at least outside China, blending Eastern and Western elements. Rising disposable income and evolving lifestyles drive this growth, marking the beauty industry as one of the most radiant and lucrative consumer segments.

BDA’s latest Insight report shows that:

- Skincare continues to be a dominant force in Asia

- Indian beauty is experiencing rapid growth, projected to reach US$33bn by 2027, with a CAGR of over 6%

- Thailand’s beauty industry is growing and bifurcating, with both mass and premium brands performing well

- Prominent Asian beauty companies are pursuing ambitious regional expansion across India, Thailand and Vietnam, accelerating expansion into secondary Asia Pacific markets

Younger emerging Western beauty leaders such as Kylie Cosmetics and Fenty Beauty are debuting in India, China and SE Asia to widen their consumer base.

The market is evolving and shifting fast. BDA is carefully monitoring these market dynamics, working on multiple transactions in the space. We’ve closed a number of exciting beauty transactions. We’re seeing strong dealflow. Let us know if we can help you.

Underpinned by continued digitalisation, rapid adoption of localised, cloud-native mission-critical Software, attractive demographics and other market tailwinds, Asian Software is set to outpace Global Software growth, reaching ~20% share of the Global Software market by 2028.

In our latest insight piece, we summarise our key observations on the Asian Software landscape:

- Scaled Software companies have proven operating leverage, and demonstrated accelerating cash flow generating ability

- Emerging technologies such as AI are expected to drive continued expenditure on Software

- Software founders and management teams are increasingly tracking non-traditional SaaS-oriented metrics to meet the needs of savvy investors

- Many traditional non-Software companies have become Software companies as they undertake such strategic M&As to remain relevant and competitive

- Emergence of local champions driven by the heterogeneous nature of the Asian markets, with differing stages of development and diverse languages and cultures

Download the full report for more insights regarding Software in Asia.

One of the most promising shifts for decarbonisation is the introduction of “Cooling-as-a-Service” or “CaaS”. With temperatures rising globally, temperature cooling has never been as important but comes with a significant environmental footprint. Outsourcing cooling to a third party directly incentivises these service providers to provide service as efficiently and environmentally friendly as possible and design a better, less carbon-intensive cooling infrastructure.

- The carbon footprint of the “built environment” already represents ~26% of global CO2 emissions and will continue to become more significant without fundamental change

- The CaaS model allows the service provider to assume full responsibility for the design and investment ownership required for the cooling installation and related equipment, associated energy and water consumption, and it’s operation, maintenance and optimisation

- The service provider is accountable for achieving specific metrics while charging at a fixed price

- The client is only responsible for ensuring a consistent supply of electricity and water to the equipment

- The CaaS provider is therefore directly incentivised to install and/or run the equipment in the most efficient way possible

Download the full report for more insight regarding CaaS and its potential impact on decarbonisation

Sources: United Nations, Global Change Data Lab, IEA, The Economist

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services, Sustainability and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

Huong Trinh, Partner and Head of Ho Chi Minh City at BDA Partners, shares her insights with Vietnam Investment Review.

With only three months of the year left, how has Vietnam’s M&A for 2023 fared so far?

Over the second and third quarters of 2023, a number of M&A transactions with deal size of over $100 million were announced. Some notable deals are the investment of up to $500 million into Masan Group Corporation led by Bain Capital, the $381 million acquisition of FV Hospital by Thomson Medical Group, and the investment into Xuyen A Hospital by Warburg Pincus. In addition, there are ongoing sizable M&A transactions across the consumer, healthcare and education sectors, which have received strong interest from both strategic and financial investors and are likely to reach the signing stage in the next six months. Even though the total deal volume in 2023 might be impacted, the average transaction value based on recent transactions has increased significantly. The healthy deal flow emphasizes investors’ confidence in the market’s long-term growth potential.

As local businesses are struggling amid a challenging economic outlook, do you see foreign investors stepping up their M&A transactions here?

Despite various macroeconomic challenges, Vietnam is expected to achieve a GDP growth rate of 5-6 per cent in 2023. The macroeconomic environment and consumer demand are expected to start to recover in the first half of 2024. Foreign investors, despite the market’s weakening performance in 2023, continue to source and monitor the investment opportunities in Vietnam. There has been a long-term view that Vietnam is one of the most attractive markets for investment in Southeast Asia thanks to its favourable demographics, resilience, as well as government efforts in improving the investment environment.

Inbound M&As remain vibrant in banking, healthcare, renewables and real estate. Why do these sectors remain a target?

Vietnam’s favourable demographics, stable socioeconomic environment, increasing disposable income, and improving investment environment remain key factors that underpin the inbound investments into the banking sector, such as the $1.5 billion acquisition of a 15 per cent stake in VPBank by Sumitomo Mitsui Banking Corporation, and the $850 million acquisition of 15 per cent stake in BIDV by KEB Hana Bank. Notable deals in the healthcare sector are the acquisition of FV Hospital by Thomson Medical Group, the investment into Xuyen A Hospital by Warburg Pincus, AIH by Raffles Medical Group as well as Singapore’s sovereign wealth fund GIC’s investment into Nhi Dong 315, a Vietnamese pediatric clinic operator. In the renewable energy sector, Vietnam witnessed the $165 million acquisition of a 49 per cent stake in Vietnam solar platform Solar NT from Super Energy Corporation by AC Energy Corporation, and the $108 million acquisition of a 35 per cent stake in Gia Lai Electricity by JERA. Regarding real estate sector, there is the $250 million investment into Novaland led by Warburg Pincus, along with the $650 million investment into Vinhomes by KKR. We expect that M&A activities in these sectors will continue to increase in the future.

Do you expect any shift in investor interest in emerging fields in Vietnam, such as electronics, semiconductors, and electric vehicles?

Yes, we have seen increasing interest in these areas as a result of Vietnam’s unique positioning – strategic location, skilled workforce, cost advantages, and stable socioeconomic environment. Following the supply chain diversification which started during the pandemic, and increasing global demand for these products, Vietnam continues to invest in infrastructure and technology to become a major industrial hub in Asia. The government has taken a proactive approach in developing these new sectors. In August 2023, the Ministry of Transport submitted its proposal on special incentives for electric vehicle (EV) producers and users to a deputy prime minister. These incentives included preferential special consumption tax, exemption of licence plate issuance fees, preferential import tariffs on equipment, production lines and components for the production and assembly of EVs and batteries, and a $1,000 incentive for each EV purchases. As for semiconductors, while it is not a new area as foreign players, Samsung, Amkor Technology, and Hana Micron have already established presence in Vietnam. Such moves have been in the spotlight recently, being a key topic of discussion at the Vietnam – US Summit in September 2023. The Vietnam – US comprehensive strategic partnership and the government support will help Vietnam’s semiconductor industry to develop further.

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services, Sustainability and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

BDA Partners Managing Partner Paul DiGiacomo was invited to be the keynote speaker at the VinaCapital Vietnam Investor Conference in Ho Chi Minh City in early October 2023. Having lived in Asia for 25 years and been active in Vietnam for the past 15 years, Paul has a unique perspective on the drivers and fundamentals of Vietnam’s investment landscape.

5 takeaways from the keynote speech

1. BDA is bullish on Vietnam

-

-

-

- 15+ years active in the market

- Team of 10 M&A bankers

- Investing opportunistically into early-stage opportunities through our partners’ fund

-

-

2. Vietnam has attractive investment fundamentals, supported by:

-

-

-

- A young and dynamic population

- An entrepreneurial and East Asian culture

- A stable socioeconomic and political structure

- Solidly moving up the manufacturing value chain to higher value added areas

-

-

3. External macroeconomic conditions that support Vietnam’s growth include:

-

-

-

- Strong FDI trends

- US/China decoupling and global supply chain reorganizations

- Increasingly strong US support for economic success

-

-

4. Risks to Vietnam’s growth are:

-

-

-

- Climate change and in particular rising sea levels

- The potential for deglobalization to proceed more aggressively

- Infrastructure insufficiency

-

-

5. The future is bright in Vietnam. By 2030 Vietnam will have:

-

-

-

- 36 million people in the middle class….

- …distributed across the country, with 25+ cites each having a middle-class population in excess of 250,000

- Much greater global supply chain integration in high valued-added products such as electronics and semiconductors

-

-

BDA Partners has been active in Vietnam for over 15 years. We received our first investment banking mandate in 2007 and established an office in Ho Chi Minh in 2011. We now have a team of 10 bankers on the ground working across multiple sectors.

Anthony Siu, Partner and Co-Head of China at BDA Partners, was interviewed by Wancheng Hu, a reporter at South Reviews. The publication is a political and economics magazine published under the Guangzhou Daily Press Group in Southern China. The following is a translated version of the article published on June 5, 2023.

China’s outbound M&A volume dropped to its lowest point last year. According to PricewaterhouseCoopers, the total value of M&A transactions in China fell to US$485bn in 2022, representing an 80% decline from the peak in 2016, and is comparable to 2009 when investment activities plummeted in the wake of the global financial crisis.

The Covid-19 pandemic and increasing geopolitical tensions led to varying degrees of restrictions on capital flow. Combined with stringent national security reviews, China’s outbound M&A has suffered a dramatic slowdown in recent years.

As the pandemic came to an end in early 2023, investment activities gradually picked up again. China’s outbound investment policies have not changed significantly, and the central government’s focus remains on encouraging foreign direct investments in healthcare, technology, advanced manufacturing, energy, and resources.

In the first half of 2023, the M&A market is back on a recovery path, with domestic transactions dominating China’s M&A. Cross-border M&A will likely see a pick-up in the second half of 2023, with Asia Pacific and the Middle East becoming the preferred markets for Chinese acquirers.

Amid early signs of an increase in activities, China’s outbound M&A will face challenges as well as opportunities in the near term. The following are key factors to consider for China’s outbound M&A:

1. Impact of increasing regulations on cross-border M&A

BDA Partners specialises in cross-border M&A advisory and has been the top-ranked investment bank for cross-border M&A (enterprise value up to US$1bn) in Asia since 2016.

Mr. Siu moved to Shanghai from Hong Kong in 2008 and has been engaging in Chinese M&A advisory ever since. Having witnessed a long period of unprecedented growth of Chinese M&A, he was apprehensive about the recent downturn.

Siu said “For M&A practitioners, a lot has changed in recent years. The number of Chinese companies looking to engage in outbound M&A has shrunk significantly. The combined impact of the pandemic and the geopolitical tensions have led to a dramatic decline in M&A volume.”

While he believes that the pandemic impact is temporary, the geopolitical impact on cross-border M&A will be longer-lasting. In particular, the heavy regulatory scrutiny on China’s outbound M&A transactions is likely to stay for some time.

Among the affected regions, the US has been impacted the most. In January 2020, the US Treasury published new regulations based on the Foreign Investment Risk Review Modernization Act that significantly expanded the scope of the Committee on Foreign Investment in the United States (CFIUS).

“When a non-US company wants to acquire a US company, it needs to go through CFIUS review. The review will take a long time if the target’s industry is considered sensitive and involves national security concerns” said Siu, “although many transactions were not vetoed, they did not receive CFIUS approval and therefore were unable to close.”

In addition, countries that were previously considered to be open to foreign investments are moving toward increasingly stringent FDI reviews.

Germany, for instance, the country with the largest number of Chinese investments in the EU, had promulgated the Foreign Trade and Payments Act, imposing strict review measures for investments by non-EU countries and expanding the scope of mandatory filing obligations involving “critical infrastructure” and “critical technology.” Industry practitioners say that a large number of transactions were abandoned due to a slim chance of passing FDI or anti-monopoly review.

“Obtaining regulatory approval is a common concern for companies involved in cross-border M&A. If a Chinese state-owned enterprise (SOE) decides to conduct a transaction overseas, it requires approval from the State-owned Assets Supervision and Administration Commission (SASAC). Moreover, when the transaction amount exceeds US$300m, further approval is required from the China National Development and Reform Commission (NDRC). These approvals will typically take time to go through,” said Siu.

The aforementioned includes only the approval procedures required from the Chinese side, while each country has its own jurisdiction and approval procedures, which further complicates the closing of a transaction. A few high-profile cases involving SOE acquirers over the years include:

- In 2005, China National Offshore Oil Corporation (CNOOC) attempted to acquire Unocal Corporation in the US, but the transaction was blocked as it did not pass a national security review

- In 2009, Aluminum Corporation of China’s planned acquisition of Australia’s Rio Tinto was terminated because stakeholders reckoned that the terms were biased toward the buyer

- In 2020, Shandong Gold Mining’s acquisition of Canadian gold miner TMAC Resources was blocked by the regulatory authorities due to national security reasons

In addition to national security considerations, Chinese acquirers face increased scrutiny in areas such as information transparency, financing sources, and shareholding structure.

2. Where will the China capital go?

Despite some challenges, outbound M&A activities are showing signs of recovery.

Countries around the world are welcoming investments in industries that are deemed important to the country’s economic development. In addition, industries that have been hit hard by the pandemic, including transportation and logistics, tourism and hospitality, basic materials, and consumer goods, are recovering, giving acquirers renewed confidence in investing in the future upside of these industries.

Siu is bullish on the China outbound M&A market. The resumption of international air travel and the normalization of business activities will allow Chinese acquirers to become more active in engaging in outbound M&A activities. However, he believes that this wave of outbound M&A will be different from the past. Rather than focusing on the U.S. and Europe, Chinese acquirers will be shifting their focus to new markets such as Southeast Asia, the Middle East, and Africa.

“China today is playing a role similar to the US in the 1990s and early 2000s,” said Siu.

During those periods, US companies, facing a saturating domestic market, expanded their international footprint to high-growth emerging markets via M&A.

China is doing something similar now. In the past, the focus was on acquiring Western technologies and know-how to bring them to the Chinese market. This coming wave will be about investing in opportunities that allow Chinese acquirers to export self-developed technologies and products to the international markets. Instead of facing head-on competition in a crowded domestic market, they go abroad to look for new growth opportunities. Companies in the technology, media and telecom (TMT) space and the electric vehicle (EV) sector are among those industries with growth potential.

Southeast Asia, due to its close geographical proximity to China, has been a favourite destination for China’s outbound investments. Indonesia is one such example.

Indonesia has the world’s fourth-largest population with 274 million people and a young labour force. In 2022, investments made by Chinese companies in Indonesia reached US$8.2bn the second largest source of FDI in Indonesia. Today, Chinese investments are present in e-commerce, ride-hailing services, online food delivery, digital financial services, and online gaming sectors in Indonesia.

“Unlike trading and manufacturing companies that have gone to the West in the early days, Chinese high-tech and smart manufacturing companies looking to expand overseas now select Southeast Asia, the Middle East, and Africa as their priority markets to enter,” said Siu.

However, with benefits also come challenges. Just like many foreign companies find it difficult to adapt to the Chinese market, many Chinese companies that entered new markets have encountered challenges in working with local management, understanding the local culture, and dealing with workers that are not accustomed to long working hours.

The above are all common problems encountered by Chinese acquirers in outbound investments. Essentially, it is the lack of attention and effort paid to post-acquisition integration and understanding of cultural differences that hinder the acquirer’s success. For example, Chinese companies often lack experience in managing employees under a union-led workforce. If appointed Chinese executives attempt to impose a top-down culture, employees are likely to express dissatisfaction. Over time, a growing estrangement will develop between the local employees and the Chinese executives.

3. Focus on building up M&A expertise and acquiring talent

Having worked on M&A for over two decades, Siu has witnessed many successful acquisitions, while others failed and had to go through a difficult period of restructuring.

He observed that the issue faced by Chinese acquirers is usually caused by a breakdown in communication. When a Chinese acquirer becomes the controlling shareholder, the target’s management is often concerned about how the new owner will affect its corporate culture and management style, soft issues that are often overlooked by the Chinese acquirers. If these problems are not handled properly, the target’s management team will ultimately choose to leave.

These kinds of issues can often be mitigated if the acquirer has already established a presence in the target’s region, along with a team that understands the local system and culture. If the acquirer can understand the target company’s pain points, it can address these issues upfront more effectively, and the chance of a successful integration will increase.

Siu pointed out as an example a cross-border transaction that BDA and its strategic partner, William Blair, served as the sell-side advisors for Summa Equity, a Finnish private equity firm, on the sale of its portfolio company, HyTest, to China’s Mindray for €532m in 2021.

HyTest is a leading global supplier of in vitro diagnostic (IVD) raw materials, with in-house R&D and production capabilities for high-quality antigens and antibodies. This acquisition has helped Mindray broaden its international footprint and strengthen its value chain coverage while fulfilling the need for top-graded IVD upstream raw materials in China.

Simeng Zhang, Director at BDA Partners and the project lead for the sale of HyTest, stated “compared to other companies, Mindray has a professional in-house M&A team composed of talent with prior experience at accounting firms, law firms, and investment banks. Having this talent on the team made the due diligence, negotiation management, and decision-making process much smoother.”

She also mentioned that Mindray and HyTest had already established a good level of trust in prior business relationships. “In the past few years, more than half of HyTest’s revenue came from the China market, and with Mindray’s globalization strategy, the acquisition of HyTest became particularly attractive to Mindray.”

Though BDA Partners often takes on the role of a sell-side advisor, when the transaction involves a Chinese buyer, BDA Partners will also take the initiative to coordinate with the buyer to elaborate thoughts from the seller’s side, including management’s concerns on the transaction and key transaction terms.

Siu believes that the days of relying on the China growth story to win over the seller’s and target’s management are gone. Chinese acquirers should have a clear plan for globalising the target’s business beyond just China. “We are actively working with our clients to search for quality investment targets on a global scale to help them expand their international footprint,” said Siu.

The history of globalisation proved that successful M&A transactions can generate higher shareholder returns and help global players strengthen their competencies and maintain their market-leading position.

Being able to survive the pandemic will make a company stronger, while others facing challenges will become more open to being acquired. “For ambitious Chinese companies, now is a good time for M&A,” said Siu.

However, overseas competitors will not just sit back and wait. To grasp the opportunity and secure a meaningful position among global leaders, Chinese acquirers should further enhance their in-house M&A capabilities and attract talent with international experience and M&A expertise.

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

The private equity (PE) landscape in Vietnam is becoming increasingly attractive to global investors due to improvements in regulations, governance and corporate profiles. In the early 2000s and before, there was very limited PE activity in Vietnam, a market characterized by a shortage of private enterprises and unclear regulatory framework on private investments. It was not until the 2005 Enterprise Law came into effect that Vietnam first established a common legal framework for the establishment and management of both State Owned Enterprises (SOEs) and private enterprises, boosting investors’ confidence for investments in private companies.

Along with the rapid growth of Vietnam’s economy, PE activity has soared since the second half of the 2000s. This can be attributed to a number of factors:

- Integration with the global economy: Vietnam became a member of the World Trade Organization in 2007, committing to one of the world’s most progressive market access programs. This made Vietnam appear on more PE investors’ radar – in fact, some of the earliest notable transactions involving PE investors in Vietnam occurred in 2007, such as Temasek-Minh Phu and PENM Partners-Eurowindow. Since then, Vietnam has continued to participate in more free trade agreements to become an important node in the global economy.

- Development of the domestic stock exchanges: The launch and development of HOSE and HNX in the early 2000s provided additional comfort to institutional investors in their consideration to include Vietnam as a part of their mandate. As Vietnam gradually becomes one of the most closely watched frontier markets and is on track to reach emerging market status, the country has continued to draw attention from global PE investors.

- Easing of foreign ownership restrictions: There has been significant progress in unlocking market access for foreign investors since the early 2000s. Market access restrictions for specific sectors, once challenging to navigate in the past, are now clarified by the 2020 Law on Investment, which officially classifies restricted and conditional sectors in one consolidated source. Foreign ownership limits, once kept at 20%-30% for most sectors, now can be extended or have clear path to be extended to up to 100% for non-conditional, non-restricted business lines.

- Improvement in corporate profiles: In the earlier days, many private enterprises in Vietnam were small founder-owned, family-run businesses, which lacked both corporate governance of international standards and experience in working with foreign investors. Nowadays, sizable, well-managed private companies are more common – these firms will now consider investments from PE investors as a strategic option in their growth trajectory and have also become more educated in M&A processes.

- Regulatory landscape improvement: Local authorities have continuously provided clearer guidelines for M&A, as evidenced in various revisions of the Law on Enterprises, Law on Competition, and Law on Investment. For example, the latest 2020 Law on Investment has further addressed the ambiguity of existing regulations and clarified when M&A approval is required – a concern previously highlighted by many PE investors.

From the quiet days when there was only a handful of small value deals in the early 2000s, PE investors have been gradually playing a much bigger role in Vietnam’s M&A market. Larger deals involving PE investors have become more common – there were more than 30 deals valued at US$100m or higher over the last five years[1], while the top ten largest PE transactions of all time in Vietnam all occurred during this period. For Vietnamese businesses, PE funding brings in not only much needed capital for growth or additional liquidity for shareholders, but also important corporate governance guidelines and operational know-how of international standards for optimal value generation. Institutional presence among the cap table would also highlight the legitimacy and sustainability of the business models of local enterprises, which in turn enhance their attractiveness to more global investors.

| Date | Investor | Target | Sector | Value (US$m) | Stake |

| Jun-20 | KKR’s consortium | Vinhomes | Real Estate | 651 | 6% |

| Oct-18 | SK Investments | Masan Group | Consumer | 474 | 9% |

| Aug-18 | Hanwha Asset Management | Vingroup | Diversified | 403 | Undisc. |

| May-21 | Alibaba, BPEA | The CrownX | Consumer | 400 | 6% |

| Dec-18 | Warburg Pincus | Techcombank | Financial Services | 370 | 4% |

| Dec-21 | TPG, Temasek, ADIA | The CrownX | Consumer | 350 | 5% |

| Jul-19 | GIC, Softbank | VNPay | Technology | 300 | Undisc. |

| Jan-19 | GIC, Mizuho | Vietcombank | Financial Services | 264 | 3% |

| Jun-22 | Warburg Pincus | Novaland | Real Estate | 250 | Undisc. |

| Jul-21 | General Atlantic, Dragoneer | VNPay | Technology | 250 | Undisc. |

Emerging trends

1. Rising competition in dealmaking from global funds: In the earlier days, most PE transactions in Vietnam involved local funds given their advantages in familiarity with the investment landscape, with examples such as Indochina Capital-Hoang Quan (2006)[2], Mekong Capital-MobileWorld (2007)[3], and VinaCapital-PNJ (2008)[4]. Over time, more and more global PE firms have established local presence in Vietnam, with dedicated investment teams and network of advisors on the ground to start building their track record in the country. While local funds remain active in the market, global funds, with stronger financial capabilities, have been dominating the investment landscape – as evidenced in the list of top ten all-time largest PE transactions in Vietnam

2. Minority vs. control/buyout transactions: Minority transactions are still more popular for PE investors in Vietnam given the lack of onshore deal financing options commonly found in buyout transactions and risk aversion as most funds still have relatively short track record in the country. However, the market has witnessed several buyout transactions in the past, especially in the Healthcare and Education sectors such as CVC-Phuong Chau(2021)[5], BPEA-Vietnam USA Society English Centers (2019)[6], TPG-Vietnam Australia International School (2017)[7], and Navis-Hanoi French Hospital (2016)[8]. From our recent interactions with regional PEs, we understand that there is a growing appetite for control/buyout deals in Vietnam, driven by both record levels of dry powder and the maturation of the investment landscape.

3. Growing importance of ESG topics : ESG topics are no longer considered as a matter of compliance but have become opportunities to unlock value and present key selling points to potential investors. More investors have been appointing specialized ESG advisors for due diligence, while aligning with the target companies on having strong ESG values ingrained in corporate culture as part of deal negotiation and post-deal integration.

Looking ahead – Sectors to watch for PE activity in Vietnam

Consumer

- Although consumer confidence is temporarily impacted by the ongoing global macroeconomic turbulence, investors will continue to target Vietnam as one of the most attractive economies in the region.

Healthcare

- Rising income level and increased health awareness among Vietnamese people will propel demand for private hospital and clinics, in response to the lack of capacity within the national healthcare system.

Education:

- Before the emergence of Covid-19, investors showed significant interest in both local and international private schools.

Financial Services

- The shortage of financing and credit solutions among an underbanked population is expected to drive investments in Financial Services.

Logistics:

- Tailwinds from high growth in exports, a booming Internet economy, and supply chain shift from China will continue to propel growth in Vietnam’s logistics industry.

Technology

- Difficulties caused by the pandemic have accelerated progress in digitalization, driving growth in demand across all industries for technology-related services and digital solutions that help businesses improve functionality.

The PE market in Vietnam has changed drastically since the early 2000’s as we have experienced more favourable conditions. Going forward, we expect not only the number of deals to increase, but the size of deals in Vietnam to grow as PE investors seek opportunities.

[1] Source: Mergermarket

[2] https://vnexpress.net/indochina-capital-mua-cp-hoang-quan-2696691.html

[3] https://www.mekongcapital.com/our-investment/mobile-world/

[4] https://www.investegate.co.uk/vietnam-opp-fund-ltd/rns/investment/200805021205506730T/

[5] https://www.dealstreetasia.com/stories/cvc-capital-phuong-chau-hospital-307941

[6] https://www.globalprivatecapital.org/newsroom/bpea-acquires-majority-stake-in-vus/

[7] https://www.vas.edu.vn/en/news/he-thong-truong-dan-lap-quoc-te-viet-uc-co-nha-dua-tu-chien-luoc-moi

[8] https://www.naviscapital.com/wp-content/uploads/2016/06/Navis-Press-Release-30-June-2016-Acquisition-of-Hanoi-French-Hospital.pdf

[9] https://en.vietnamplus.vn/over-70-of-vietnamese-population-use-internet/231833.vnp

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

As we approach the halfway point in 2023, it’s clear that the luxury goods market in China and Asia is thriving. This growth is fuelled by the opening of borders post-COVID and the region’s increasing affluence. Today, China alone accounts for over one-third of global luxury sales.

As consumers in the region spend more on retail, beauty, food, lifestyle, and luxury items than ever before, BDA sees opportunities for foreign investors and companies to reach an eager and widespread Asian market.

In our latest insights report, we discuss China’s economy and explore opportunities in other Asian markets. We also identify the subsectors in the consumer and retail space which we anticipate will shine.

The key takeaways in this report are:

- Asia’s luxury market continues to gain momentum, mainly driven by China

- In China, retail sales in March 2023 alone jumped 10.6% YOY, a speed unseen in two years

- The share price of some luxury companies have risen 10%-20% this year

- A rebound in the Chinese economy, the millennial generation, and changing consumer preferences support the trend

- Overall, Asian consumers are spending more on retail, beauty, food, lifestyle, and luxury items than ever before

- This increase in demand opens the door to opportunities for foreign investors and companies

- BDA has deep industry knowledge and extensive experience in advising clients on transactions in beauty & personal care, lifestyle & entertainment, mother & baby care, apparel & accessories, and the food and beverage industries

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

China’s private equity (“PE”) industry faced strong headwinds in 2022 due to factors including a slowing economy, Covid-19 restrictions, increased regulatory scrutiny, and higher prevailing interest rates globally which weighed on public market valuations. PE exits and fundraising had been challenging during the past year.

However, the China market underwent a dramatic change in recent months as the country’s Zero-Covid policy was relaxed and borders were reopened. The Chinese government implemented measures to boost the economy and private sector investments. This report provides our perspectives on how these changes may impact PE activities and China M&A market in 2023.

The key takeaways in this report are:

- The unwinding of Zero-Covid policies will benefit sectors such as consumer, tourism, and property. China’s growth story will be back in focus and investor confidence in the Chinese economy will likely revive. Looking ahead, consumer & retail, manufacturing, energy & resources, life science & healthcare, and logistics & supply chain industries will likely attract the most attention

- China M&A market involving Financial Sponsors will be dominated by China GP’s investments in domestic targets. We also expect to see an increase in GP outbound investments in 2023 to diversify their portfolio outside of China

- Trade sales and IPOs were difficult in 2022, leading to delays in portfolio company exits and fundraising for PEs. In 2023, we expect to see a greater number of portfolio company exits, with more quality assets coming to the market. We expect tightened regulations and the long backlog for public listings will continue to pose difficulties for IPO exits, and mean trade sale will be a more prominent exit route for PEs in 2023

- PEs will likely focus on returning capital to LPs through portfolio company exits in 2023. We expect that fundraising will remain relatively subdued this year, followed by more fundraising activity from 2024 onwards as PEs complete more exits – and need to replenish their capital for new investments

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

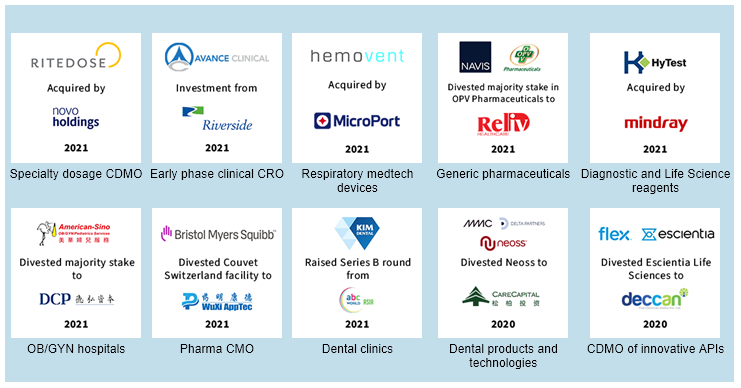

2021 was a phenomenal year for deal activity in the Healthcare sector. Strong M&A momentum continued across most Healthcare verticals despite, and sometimes because of, extended COVID-19 disruptions. BDA closed landmark transactions across sub-sectors including Pharma Services (CRO/CDMO), Specialty Generics, Healthcare Services, Diagnostics and Life Science Tools, and Medical Devices, which touched on specialty therapeutic areas such as respiratory, renal care, OB/GYN and dental.

It was a busy year for Asian players in healthcare. Among them, Chinese buyers emerged as some of the most active participants, driven by the desire to expand their capabilities to address unmet needs in the strongly growing Chinese market. With our deep sector knowledge and broad network, BDA delivered strong transaction outcomes for our corporate and private equity clients throughout the pandemic.

Enabling client success:

BDA’s senior Healthcare bankers give their predictions for the year ahead.

Andrew Huntley, Managing Partner and Global Head of Healthcare:

In 2022 I believe the 2021 Asian Healthcare M&A tally of US$139.6 billion(1) will grow further. COVID-19 impacts that disguised underlying EBITDA and created valuation and diligence frictions between buyer and seller should moderate. Specialty clinic chains, pharma services (CRO and CDMO), and diagnostic products and services will continue to attract M&A in Asia. Life science tools and technologies is a category for which I see a growing appetite where the region lags developed markets. So is home healthcare. I am waiting for an Asian leader in medical device CDMO to emerge and there are some interesting building blocks out there. Consolidation trends in China will play out; and we might see some multinational divestments of Chinese units in pharma and devices.

Sanjay Singh, Managing Director, Head of India and Co-Head Asia, Healthcare:

India continues to build innovative pharma research and development capabilities on top of its generics base. This is especially the case in pharma services where I see increasingly well positioned CDMO assets in both API (drug substance) and formulations (drug product) which serve global pharma sponsors not just generics customers. These will drive capital raising and M&A transactions, as will early signs of India nurturing some differentiated medical device innovators. Domestic formulation businesses will likely see consolidation as larger companies seek to expand their presence in chronic therapies. Digital health and Healthcare IT are, respectively, new and established exciting segments for investment and M&A.

Anthony Siu, Partner, Co-Head of Shanghai and Head of Financial Sponsor Coverage, China:

Private equity owners of Health assets are going to capitalise on the favourable sector trends to exit their investments, but they will also be very active acquirers, armed with ample dry powder of over US$650 billion Asia-wide. Healthcare regularly features in the top two priority sectors for Asian financial sponsors. China focused sponsors will continue to back or partner with strategic acquirers to drive both consolidation within China and outbound acquisitions in the West. On the capital markets side, growing uncertainties in public markets will increase the appeal of private capital raise rounds before IPO.

We look forward to delivering outstanding advisory services and great outcomes for our clients.

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com