China Healthcare M&A outlook for 2024

In China’s dynamic healthcare market, M&A activities are booming due to an ageing population and increasing consumer health demands. The sector is seeing heavy domestic investments from Chinese firms and Government funds. PE firms are seizing M&A opportunities amid capital raising challenges. Chinese companies are also eyeing cross-border M&A for tech-driven healthcare targets. The market outlook indicates industry reshuffles, rising demands for elderly care and consumer health, and flexible growth strategies by multinational firms.

Investment trends highlight a focus on resilient segments, surging investment in out-of-pocket payment sectors and Chinese firms expanding globally, particularly across SE Asia and the Middle East. European healthcare companies remain attractive for Chinese investors; licensing deals are on the rise, led by Chinese pharma firms.

In our latest Insights piece, we summarise the predicted outlook of China healthcare M&A for 2024:

- Domestic strategics, Government-backed funds and RMB funds are investing heavily in China’s healthcare market

- There is an increasing difficulty for companies looking to raise capital in private or public markets, leading to M&A opportunities for large-cap PEs

- Support from the Chinese government to grow the private healthcare sector, including the development of private hospitals and elderly and home care services

- Narrowing valuation gap between IPO and trade sale facilitates more M&A deal completions

Download the full report for more Insights regarding the Chinese healthcare sector.

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services, Sustainability and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

As an increasing number of countries in Asia achieve an 80% vaccination rate, they are gradually removing COVID-19 social and border restrictions. BDA Partners is revisiting the fundamentals and attractiveness of the Asian healthcare services sector.

Healthcare services is the largest part of the healthcare industry in Asia. Its market size is expected to reach US$1.4tr by 2026[1], driven by a growing population, rising affluence, and a mounting disease burden.

Key takeaways:

- Demand for healthcare services in Asia will continue to rise — the segment is growing at a faster pace than the overall healthcare industry, although healthcare infrastructure has been under-invested historically

- Even as governments across Asia increase their budget allocation to healthcare, the private sector continues to play an important role, providing capital and improving the efficiency of the healthcare system

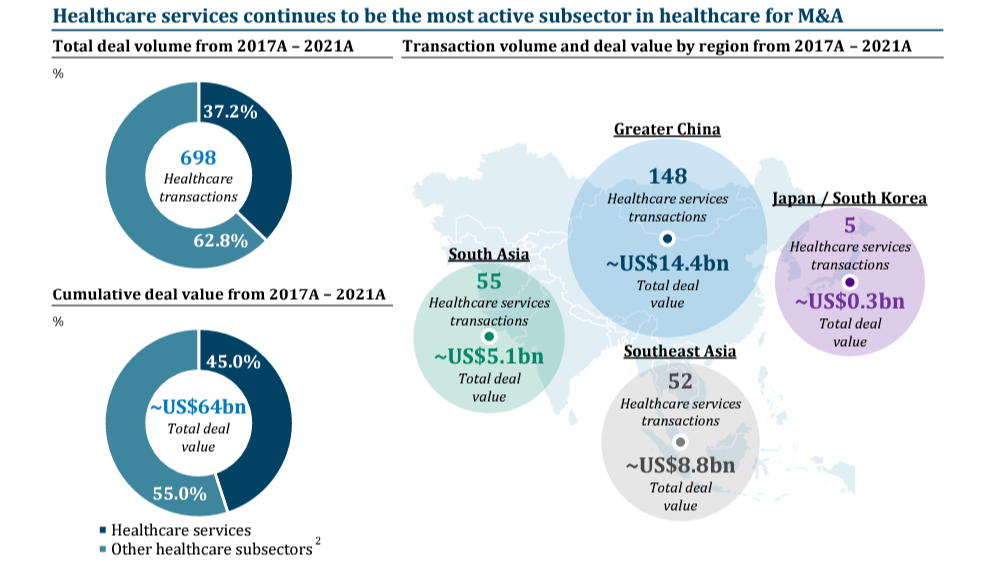

- Financial sponsors have been, and will continue to be, active buyers of quality hospitals and healthcare services assets. Sponsors have been involved in 25% of healthcare services transactions from 2017-2021

- The global dry powder of private equity funds reached a new record of US$1.8tr in February 2022, following a record year of fundraising

- Asian M&A activity in the next two to three years will be strong, driven by consolidation and bolt-on acquisitions by strategics in their core markets, and investments by financial sponsors into both platform and growth companies

In this piece, we examine post-COVID sector trends and M&A activities in SE Asia, Greater China, and India.

Sources: Mergermarket

Note: (2) Other healthcare subsectors include Medical Devices, Medical Equipment & Services, Biotechnology Research, Drug Development, Drug Manufacturing, Drug Supply, Handicap Aids and Basic Healthcare Supplies, etc.

Download the full report

Contact BDA health team

Andrew Huntley, Managing Partner, Global Head of Healthcare, London / Ho Chi Minh City: ahuntley@bdapartners.com

Anthony Siu, Partner, Co-Head of Shanghai: asiu@bdapartners.com

Sanjay Singh, Managing Director, Head of India, Co-Head of Asia Healthcare: ssingh@bdapartners.com

Claire Zhen, Director, Shanghai: czhen@bdapartners.com

Aditya Jaju, Vice President, Mumbai: ajaju@bdapartners.com

Yan Xia, Vice President, Singapore: xyan@bdapartners.com

Zhang Simeng, Vice President, Shanghai: szhang@bdapartners.com

[1] Fitch and Statista

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

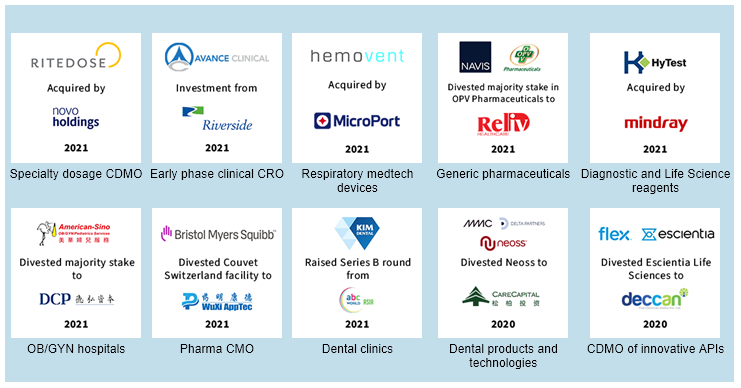

2021 was a phenomenal year for deal activity in the Healthcare sector. Strong M&A momentum continued across most Healthcare verticals despite, and sometimes because of, extended COVID-19 disruptions. BDA closed landmark transactions across sub-sectors including Pharma Services (CRO/CDMO), Specialty Generics, Healthcare Services, Diagnostics and Life Science Tools, and Medical Devices, which touched on specialty therapeutic areas such as respiratory, renal care, OB/GYN and dental.

It was a busy year for Asian players in healthcare. Among them, Chinese buyers emerged as some of the most active participants, driven by the desire to expand their capabilities to address unmet needs in the strongly growing Chinese market. With our deep sector knowledge and broad network, BDA delivered strong transaction outcomes for our corporate and private equity clients throughout the pandemic.

Enabling client success:

BDA’s senior Healthcare bankers give their predictions for the year ahead.

Andrew Huntley, Managing Partner and Global Head of Healthcare:

In 2022 I believe the 2021 Asian Healthcare M&A tally of US$139.6 billion(1) will grow further. COVID-19 impacts that disguised underlying EBITDA and created valuation and diligence frictions between buyer and seller should moderate. Specialty clinic chains, pharma services (CRO and CDMO), and diagnostic products and services will continue to attract M&A in Asia. Life science tools and technologies is a category for which I see a growing appetite where the region lags developed markets. So is home healthcare. I am waiting for an Asian leader in medical device CDMO to emerge and there are some interesting building blocks out there. Consolidation trends in China will play out; and we might see some multinational divestments of Chinese units in pharma and devices.

Sanjay Singh, Managing Director, Head of India and Co-Head Asia, Healthcare:

India continues to build innovative pharma research and development capabilities on top of its generics base. This is especially the case in pharma services where I see increasingly well positioned CDMO assets in both API (drug substance) and formulations (drug product) which serve global pharma sponsors not just generics customers. These will drive capital raising and M&A transactions, as will early signs of India nurturing some differentiated medical device innovators. Domestic formulation businesses will likely see consolidation as larger companies seek to expand their presence in chronic therapies. Digital health and Healthcare IT are, respectively, new and established exciting segments for investment and M&A.

Anthony Siu, Partner, Co-Head of Shanghai and Head of Financial Sponsor Coverage, China:

Private equity owners of Health assets are going to capitalise on the favourable sector trends to exit their investments, but they will also be very active acquirers, armed with ample dry powder of over US$650 billion Asia-wide. Healthcare regularly features in the top two priority sectors for Asian financial sponsors. China focused sponsors will continue to back or partner with strategic acquirers to drive both consolidation within China and outbound acquisitions in the West. On the capital markets side, growing uncertainties in public markets will increase the appeal of private capital raise rounds before IPO.

We look forward to delivering outstanding advisory services and great outcomes for our clients.

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

While there has been broad discussion on how businesses and markets have responded to the coronavirus outbreak and how they will adapt to a post COVID-19 world, arguably, no industry has received as much attention as clinical diagnostics. With the heightened focus on testing, terms such as antibody test and nasopharyngeal swap have jumped from medical journals to the front pages of newspapers the world over.

Thanks to previous experience with SARS, Asian IVD companies in many cases have led innovation in combating SARS-CoV-2. Regulators worldwide are closely studying the rapid response and mobilization of testing resources seen in China and Korea at the outset of the pandemic. However, even with the situation stabilizing in East Asia, companies in the region continue to innovate – developing more rapid point-of-care tests and antibody testing platforms, not to mention the urgent research into a possible vaccine being led by companies like CanSino and Shenzhen Geno-immune in China, Bharat Biotech in India, SK Biopharma in South Korea, and Takeda in Japan, to name only a few examples.

While the response to the pandemic has lifted the valuations of diagnostic tools and technologies companies globally, Asian companies have been trading, on average, at over 30x trailing EBITDA, led primarily by premium valuations achieved by Chinese diagnostic tools companies. We expect the spike in valuations will create opportunities in the space and accelerate consolidation efforts in the region, especially in China where the IVD market is less concentrated and the rise of import substitution in the diagnostic products space has attracted increased investment from both healthcare companies and firms in other industries looking to capitalize on the trend.

While year-to-date M&A activity has been muted across all industries, BDA and our partners William Blair continue to participate in deal activity in the diagnostics space, including the recently announced sale of FountainVest’s stake in Chinese IVD business Shanghai Kehua Bio-engineering in China and the sales of Stratos Genomics to Roche and of Exalenz to Meridian Biosciences in the US and Israel, respectively. We have also seen significant capital markets activity in the diagnostic tools and technology space so far this year.

In many ways, the coronavirus pandemic has accelerated a growth trend already taking place in Asia. Thanks to a focus on preventative care to reduce healthcare costs and the increasing prevalence of diagnostic testing, the Asian IVD industry had been poised to achieve double-digit growth over the next five years, even before the first cases of COVID-19 were reported.

While it could be argued that the impact from COVID-19 on the diagnostics space will be short-term, BDA has seen an interesting dynamic emerge where demand for more routine test kits, such as flu tests, have fallen due to COVID-19. We expect this will be temporary and not dampen mid-term demand. If anything, the pandemic has triggered increased spending on development that will spur further innovation for years to come.

Download the full report

Contact BDA healthcare team

- Andrew Huntley, Senior Managing Director, Asia/Europe: ahuntley@bdapartners.com

- Lei Gong, Managing Director, Shanghai: lgong@bdapartners.com

- Kumar Mahtani, Managing Director, Mumbai: kmahtani@bdapartners.com

- Peter Moreno, Vice President, New York: pmoreno@bdapartners.com

Related content

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 24 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese government-owned bank with US$150bn of assets.

US securities transactions are performed by BDA Partners’ affiliate, BDA Advisors Inc., a broker-dealer registered with the Securities and Exchange Commission (SEC). BDA Advisors Inc. is a member of the Financial Industry Regulatory Authority (FINRA) and SIPC. In the UK, BDA Partners is authorised and regulated by the Financial Conduct Authority (FCA). In Hong Kong, BDA Partners (HK) Ltd. is licensed and regulated by the Securities & Futures Commission (SFC) to conduct Type 1 and Type 4 regulated activities to professional investors. www.bdapartners.com

In the first trading week after the outbreak of the novel coronavirus (COVID-19), health sector performance in China’s capital market was remarkably strong. We look here at long-term impacts on the sector in China, and where the M&A and Private Equity opportunities may lie.

The BDA global Health Sector team has investigated these topics and would like to share our latest findings with you in our latest report.

Executive Summary:

- COVID-19‘s impact on the global economy is far beyond SARS, with almost 12x confirmed cases globally to date and stricter quarantine measures. While the epidemic in China shows signs of improvement, the outbreak has spread to other parts of the world. We expect the economy in China to rebound strongly in the second half of this year, but the extent of the recovery will depend on the impact of the outbreak on the global economy

- We expect the outbreak to have a positive effect on the healthcare sector development in China. While SARS’ impact on the sector was moderate, we believe COVID-19 will have a longer-term impact, with certain sub-sectors benefiting from favorable government policies and increased private and public health investments

- The preventative, diagnostic and therapeutic solutions for COVID-19 generate explosive short-term demand for related medical products. While the demand spike is temporary, we expect some medical products to experience a transformation to long-term increased demand

- COVID-19 has drastically raised people’s health awareness. It will raise both public and private health spending, and we expect the following subsectors to benefit, generating fundraising and buyout opportunities:

- Vaccines, medical robots, IVD, ICU equipment & devices, online medical consultation, home-based medical devices and OTC medicine

- Healthcare has been a hot spot for PE investments in recent years. We expect industry consolidation to accelerate, creating ample opportunities for both industry players and PE investors alike

- We believe that COVID-19 does not change the “principles” of cross-border M&A in China:

- Outbound deals focus on the acquisition of international brands, products and technology

- Inbound deals focus on entering and capturing markets with strong demand and growth potential

- Overall, COVID-19 outbreak is an opportunity rather than a crisis for capable private equity health investors, especially in certain sub-sectors

Contact BDA Healthcare team, China

- Andrew Huntley, Senior Managing Director, Global Head of Health Sector: ahuntley@bdapartners.com

- Lei Gong, Managing Director, Health Sector, Shanghai: lgong@bdapartners.com

- Anthony Siu, Managing Director, Financial Sponsor Coverage China, Shanghai: asiu@bdapartners.com

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 24 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese government-owned bank with US$150bn of assets.

US securities transactions are performed by BDA Partners’ affiliate, BDA Advisors Inc., a broker-dealer registered with the Securities and Exchange Commission (SEC). BDA Advisors Inc. is a member of the Financial Industry Regulatory Authority (FINRA) and SIPC. In the UK, BDA Partners is authorised and regulated by the Financial Conduct Authority (FCA). In Hong Kong, BDA Partners (HK) Ltd. is licensed and regulated by the Securities & Futures Commission (SFC) to conduct Type 1 and Type 4 regulated activities to professional investors. www.bdapartners.com